Skip to comments.

Market Outlook: Stocks Could Struggle Amid 'Buyer's Fatigue' (no more sugar high?)

CNBC ^

| Patti Domm

| Patti Domm

Posted on 10/24/2009 6:43:46 AM PDT by TigerLikesRooster

Market Outlook: Stocks Could Struggle Amid 'Buyer's Fatigue'

Published: Friday, 23 Oct 2009 | 8:21 PM ET

By: Patti Domm

Executive Editor

Stocks could struggle in the week ahead as the market's 7-month rally shows signs of tiring.

There is another barrage of third quarter earnings reports, including names like ExxonMobil, Procter and Gamble, Aetna and Verizon. A trader at the New York Stock Exchange. Photo: Oliver Quillia for CNBC.com A trader at the New York Stock Exchange.

But investor focus should shift to economic news with the first look Thursday at third quarter GDP. The number is significant in that it should mark the end of the recession with the first quarter of growth since second quarter, 2008.

Economists expect a number of 3 percent or better, after the second quarter's decline of 0.7 percent.

(Excerpt) Read more at cnbc.com ...

TOPICS: Business/Economy; Extended News; News/Current Events

KEYWORDS: dollar; peaking; rally; stock

'Buyer's Fatigue' No recovery in real economy; rally in stock market offset by tanking dollar.

Marginal return of extra money pumped into system is now turning negative(-.)

To: TigerLikesRooster; PAR35; AndyJackson; Thane_Banquo; nicksaunt; MadLibDisease; happygrl; ...

2

posted on

10/24/2009 6:44:16 AM PDT

by

TigerLikesRooster

(LUV DIC -- L,U,V-shaped recession, Depression, Inflation, Collapse)

To: TigerLikesRooster

(no more brown sugar high?)Sorry, had to do that. :^)

3

posted on

10/24/2009 6:47:02 AM PDT

by

raybbr

(It's going to get a lot worse now that the anchor babies are voting!)

To: TigerLikesRooster

Nouriel Roubini: Big Crash Coming"There’s a huge bubble, because we have zero rates in the U.S., zero rates around the world and a huge carry trade. Everyone is borrowing at zero interest rates in dollars and getting a capital gain because the dollar is weakening, so they are borrowing at negative rates. And then they invest in risky assets: commodities, equities, credit. We’re creating a bigger bubble than before.'

"It’s going to go crashing down, in an ugly way. That’s the basics of the argument."

4

posted on

10/24/2009 6:47:07 AM PDT

by

blam

To: TigerLikesRooster

Keynesians in the 111th Congress hard at work;

http://www.marketoracle.co.uk/index.php?name=News&file=article&sid=14313

“Cheap money is a stimulant, also an intoxicant. If the dose is large enough, a substantial temporary effect can be brought about, but headaches follow. If the matter really were that simple, everybody could be an economist, and only the perversity of central banks would keep us from endless prosperity. Merchants and manufacturers will not be induced to increase borrowings, since interest on money borrowed is only one small factor in total costs.

But if merchants and manufacturers will not use cheap money, speculators will”. Benjamin Anderson, Chief Economist of Chase National Bank, New York Times, April 1930

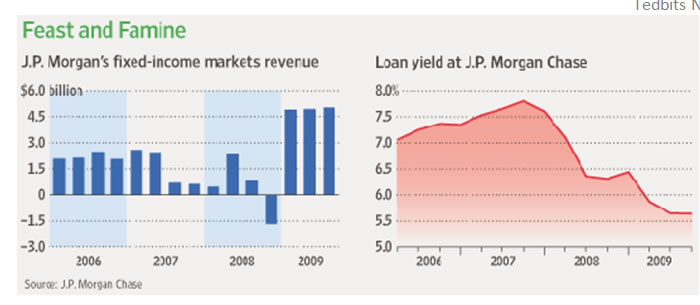

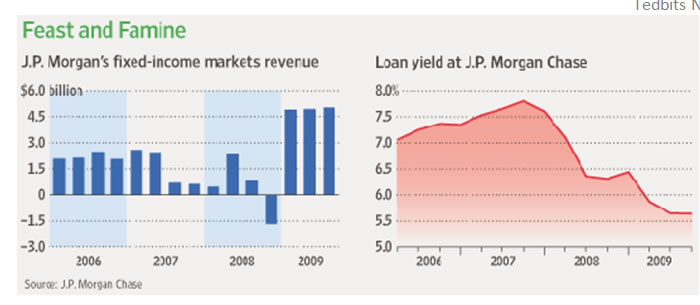

This could have been written YESTERDAY. Goldman, er…Government Sachs, JPMorgan Chase and Citigroup have now all reported earnings, and guess what? Profits and revenues from core banking activities are almost non-existent; profits now come from speculation using GOVERNMENT money at zero interest rates. The markets for securitized lending are closed so the banks can no longer pass consumer and small business lending to third-party INVESTORS. They must hold the loans on their books and for the most part they are REFUSING to do so. So, instead of lending to Main Street, the big banks are borrowing overnight from the Federal Reserve and buying Treasuries to absorb the huge budget deficits and put a bid into the bond market with a wink and a nod from the Central Bank. Take a look at the revenue streams from JPMorgan Chase.

5

posted on

10/24/2009 7:28:52 AM PDT

by

Son House

(OcarterCare by Congress will make all Americans = Wards of the State)

To: TigerLikesRooster

http://www.marketoracle.co.uk/index.php?name=News&file=article&sid=14313

Banks are hemorrhaging $300 billion per quarter in losses and covering them up with ACCOUNTING gimmicks, with the express help of the FDIC, the Treasury and regulators at the Federal Reserve. This graphic from David Rosenberg of www.gluskinsheff.com illustrates how M2, 3 and all lending to the private sector is in freefall:

And this is only the beginning since the BIG banks can no longer make money from banking because the mounting losses are daunting. They may not tell you and me about them, but they are fully aware that at some point, they WILL BE RESOLVED, and they need all those reserves they refuse to lend against to COVER THEM.

With the Debt-to-GDP ratio at over 350% (over a thousand percent if unfunded liabilities are added) and incomes PLUMMETING, defaults have only one way to go, so it is off to the printing press to cover the lender’s INDISCRETIONS.

6

posted on

10/24/2009 7:41:37 AM PDT

by

Son House

(OcarterCare by Congress will make all Americans = Wards of the State)

To: Son House

A pig flapping measly small wings before the gravity takes full charge.:-)

7

posted on

10/24/2009 7:47:01 AM PDT

by

TigerLikesRooster

(LUV DIC -- L,U,V-shaped recession, Depression, Inflation, Collapse)

To: TigerLikesRooster

A pig flapping measly small wings before the gravity takes full charge.:-)Well, it flew "better than we expected."

8

posted on

10/24/2009 8:01:03 AM PDT

by

NaughtiusMaximus

(As our six year old Balloon Boy says, "I think I gotta puke.")

To: NaughtiusMaximus

Yup.:-)

9

posted on

10/24/2009 8:09:05 AM PDT

by

TigerLikesRooster

(LUV DIC -- L,U,V-shaped recession, Depression, Inflation, Collapse)

To: TigerLikesRooster

The number [GDP] is significant in that it should mark the end of the recession with the first quarter of growth since second quarter, 2008.

I'm missing something. If GDP grew last quarter, why has nearly every company earnings report for last quarter shown declining revenue? Shouldn't a growing economy have revenues increasing at more than a handful of companies?

10

posted on

10/24/2009 11:13:32 AM PDT

by

javachip

(TARP - proof there is no situation so bad that government can't make it worse.)

To: javachip

If GDP grew last quarter, why has nearly every company earnings report for last quarter shown declining revenue? They haven't released the figure yet. All we have are predictions. I'm with you though, no one's revenue has increased...why expect a rise in GDP? (Keep in mind that the inordinate fed spending could raise GDP iself by 1%, so that might be what they are hoping for.)

11

posted on

10/24/2009 2:35:30 PM PDT

by

A.Hun

(Common sense is no longer common.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson