Unlikely.

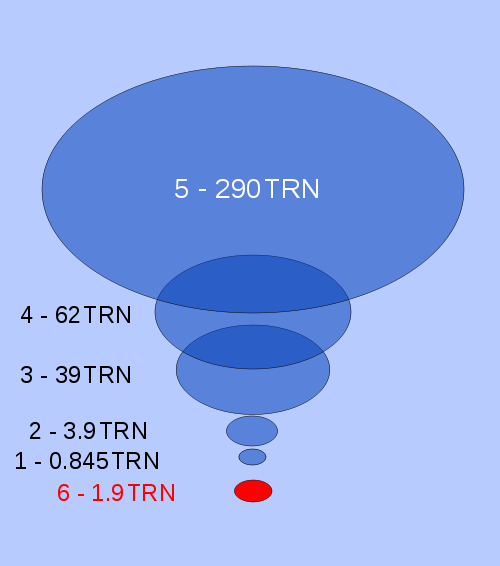

The great asset bubble during the Late-2000s recession.

The great asset bubble during the Late-2000s recession.

* 1 - Central banks gold reserves ($0.845 trillion)

* 2 - M0 (paper money) ($3.9 trillion)

* 3 - Traditional (fractional reserve) banking assets ($39 trillion)

* 4 - shadow banking assets ($62 trillion)

* 5 - other assets ($290 trillion)

* 6 - Bail-out money (early 2009) ($1.9 trillion)