For money volocity charts for U.S., click the following link:

Posted on 09/14/2009 7:04:22 AM PDT by TigerLikesRooster

Guest Post: The Boom Before The Bust

Submitted by Tyler Durden on 09/13/2009 21:29 -0500

Submitted by The Pragmatic Capitalist

We're at a truly fascinating crossroads in modern economic times. Financial theory as we have come to know it will be changed forever based the recent actions of Ben Bernanke and global central bankers. Millions of textbooks will be rewritten in the coming 10 years and careers will either flourish or die on the back of the actions of these bankers. Those in favor of Bernanke's legendary helicopter drop are celebrating a 6 month rally in equities, but a vital piece of the recovery puzzle remains missing. While Bernanke and Co. fire up the printing presses, and the banks sell the recovery hook line and sinker to the investing public, we continue to see very weak consumer trends.

As we sit on the one year anniversary of the demise of Lehman Brothers it's most appropriate to ask what we have achieved over the last few months and years in regards to policy action. Many say we avoided the second great depression and praise Bernanke for his innovative and swift actions. Others (myself included) believe we have simply kicked the can down the road and foresee an end to Bernanke's career that very much mirrors Mr. Greenspan's. As we noted back in August, Bernanke's real report card is less than impressive:

4 million lost jobs

4.6 percentage point surge in the unemployment rate

20% decline in the S&P 500

30% plunge in house values

A 3.5% reduction in real GDP per capita

11% decline in the trade-weighed dollar

109 failed banks (almost matching the total from the prior 13 years combined)

(Excerpt) Read more at zerohedge.com ...

For money volocity charts for U.S., click the following link:

Ping!

We now carry ZERO unsecured debt. Other than our mortgate which is over 50% paid off, we're debt free.

L

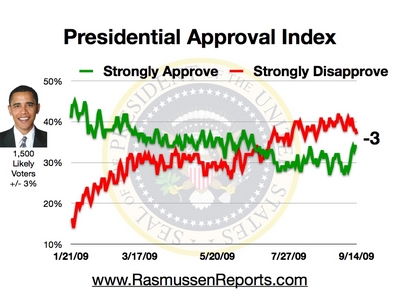

Follow the red line and the long term trend over the past 8 months.

To me the Obama policy is like mortgaging everything you own and buying lotto tickets.

They have to get the green line up by doing some quick lying whit the assistance of the puppets in the MSM.

The sheeple have no idea whatsoever why lies ahead in the very near future.

Cash and gold are king now with precious metals and land to hold there value.

Have you notice they have to lie about his approval numbers going back up just before Congress works on and votes on the HealthCare Reform plan.... Coincidence ?

Not coincidence. They have to get the #s up quick. So they along with the MSM will go on a lying campaign.

[Follow the red line and the long term trend over the past 8 months.]

The red disapproval line has barely budged despite all Obama, all the time speeches, and the stronly approve at 35% is just telling us what we knew, that 35% of Americans are marxists dolts. We’ll see where the last 25% breaks as the economy continues to dive.

Good for you!

I thank God we got hooked on Dave Ramsey a few months before the market tanked. I haven’t seen his name come up as a reason consumers are deleveraging so furiously—I’m sure it’s not all him, but darn, he’s gotta be having an impact!

We are John Galt.

4 million lost jobs

4.6 percentage point surge in the unemployment rate

20% decline in the S&P 500

30% plunge in house values

A 3.5% reduction in real GDP per capita

11% decline in the trade-weighed dollar

109 failed banks (almost matching the total from the prior 13 years combine

And yet the MSM feels the DEMS are doing a Grrrreat job!

Sep 13, 2009 - 04:48 PM

By: Graham_Summers

In case you have not heard the news, China has announced that it will be instructing its state-owned enterprises to potentially default on their derivatives contracts. As I have written extensively in the past, the derivatives market is a massive time bomb just waiting to go off. China’s latest move may be the match that lights the fuse.

[snip]

I am not saying any of this to be “scary” or “doom and gloom.” But things are coming to a head in a very REAL way on the global stage. And it is not looking good at all. This financial crisis is nowhere near over. If anything we’re at the end of the beginning. Many, many more banks will go under. We can and will see a lot more volatility in the bond and currency markets (a bear market in bonds would be a nightmare we haven’t seen in 30 odd years). And stocks (already overbought and propped up via manipulation and accounting gimmicks) are primed to take a full-scale nosedive.

My Personal Message: BE PREPARED

In light of this, and on a more personal note, I am suggesting you prepare for the WORST if you are in the US. This means stockpiling food, and having enough cash on hand to survive an economic shutdown if it happens. We came close to such an event last fall (the story was not widely spread but banks in US and UK considered shutting down ATMs and having a holiday).

I can tell you that I personally have stockpiled food (3 months’ worth) and am telling my family and friends to do the same. After all, what’s the worst that could come from doing this? If I’m totally wrong and everything gets better, you simply eat the food just like you would anyway.

But if I am right, and things do get MESSY, then stockpiling now means you’ve got food on the table later. Again, we have the making of several black swan events that could push an already weak economy into SERIOUS trouble.

[snip]

The key is unsecured. When my son needed a lap top for school we researched it, shopped around, got the best price. We could have paid cash for it. But Dell was offering 10 month interest free loan. Why not take advantage of it? I calculated how much per month it would take to pay it off, set up an automatic payment in my bank’s bill paying web site. And it’s secured by cash, which I could use at any time to pay it all off if I choose. I don’t see any downside to this arrangement.

“Clan Lurker paid off every single credit card we have this month. Every one.”

Great news Lurker! I am right behind you. Another 3 months and we will be paid off too! $46k in credit card debt paid off in 19 months!

I got an extra job and we cut expenses to the bone. Stopped using the cards and started making huge payments. It feels great! It’s become like a video game. Logging and making payments that are 20-30 times the minimum due is fun. Like zapping aliens. Here VISA TAKE THAT! Then they keep calling and raising my limit and lowering the rates, but I am not falling in to that trap again!

No more.

ABC, CBS, MSNBC and FOX were interviewing guests to talk up the economy early this morning. These no-nothing 'experts' are acting like 0-clones, spouting nonsense. One dizzy woman who looked to be still wet behind the ears said on ABC News, "I think the worst is over. There is a major turn around coming . . .

The sad truth is 0 believes he can stimulate the U.S. economy with Bovine Squat. A sad state of affairs, indeed.

His brain-dead, criminal advisers are telling him lies he wants to hear. And 0 repeats those lies endlessly.

My advice to all here is to not turn on the television media. All the national channels are spouting outright lies and propaganda. The news media are trying to lure in millions of suckers to fleece. The oligarchs who run this nation are greedy beyond belief.

Fox has joined the others: You saw it for yourselves this weekend. Every network under estimated the turn out for the DC Tea Party. ABC, with offices in the White House, was the worst. They reported only '60,000 to 70,000 protesters' showed up in DC. Anybody with half a brain had to understand that was a bald faced lie.

Use alternative news sources like this . . .

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.