Some VERY scary graphs here

Here are some more:

Within months, the Second wave of foreclosures will start kicking in, while the FDIC Deposit Insurance will have dried up because the public does NOT want more Bailouts, as inflation starts to spike due to piles of HARD cash sitting in the Federal Reserves (and the Treasury needing to increase bond interest rates to attract 5- to 30-year-bond buyers)...

$300 Billion in Foreclosures since October; $1.4 Trillion between now and Fall 2012 ...

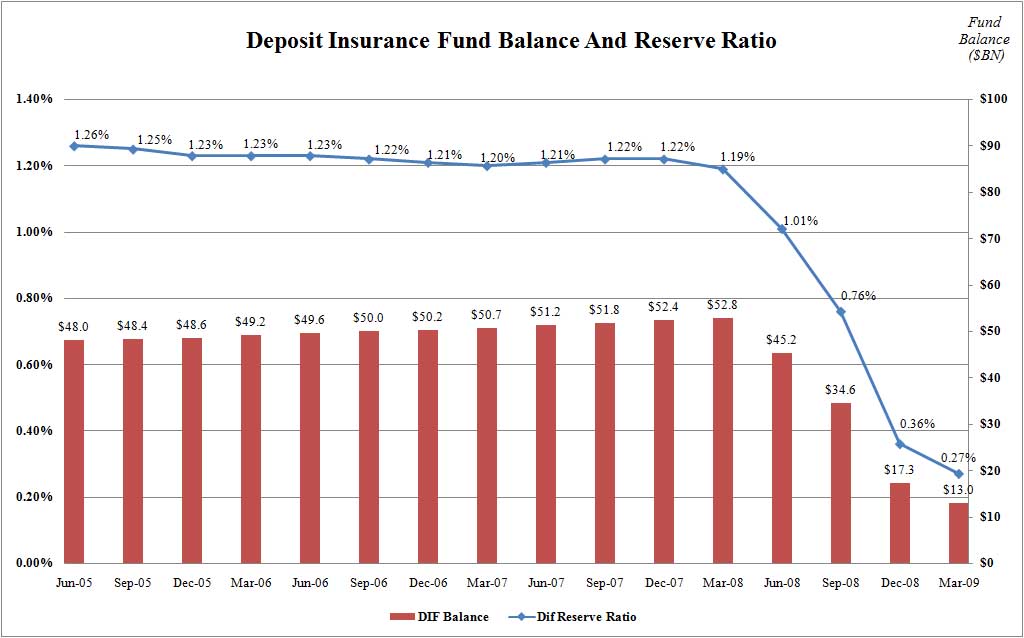

Most likely, the FDIC Deposit Insurance funds have dried up since Mar 09 -- it just hasn't been disclosed to the public yet...

The US Treasury is printing money like mad, and the public wants NO MORE BAILOUTs.