Posted on 01/29/2009 10:24:20 PM PST by Tempest

But do the math, and you can begin to understand how really botched this bailout has been. Since October, the government has deposited $165 billion into the accounts of the nation's eight largest banks. Yet those same financial firms are now worth $418 billion less than they were four months ago, and the Congressional Budget Office estimates that the government's preferred shares are worth at least $20 billion less. In Wall Street terms, that's throwing good money after bad. All told, the government's annualized rate of return on its investment in the nation's largest banks is -1,096%. That's well beyond Bernie Madoff territory; he topped out at a mere -100%. (See pictures of the demise of Bernie Madoff.)

(Excerpt) Read more at time.com ...

why would I read or believe TIME?

anyway, why is the government bailing out failing industries while taxing the successful ones to death?

They probably do, but if the nation's eight largest banks all fail, we're looking at marshal law as a best case scenario.

You’re right don’t read Time, you could just clasp your hands over you ears and go lalalala.

P.S. - if the gov’t doesn’t tax you to death how else can they rescue the banks? Although I’m curious which companies have been forced to file bankruptcy recently due to their tax burden? They couldn’t get a write off for their losses for some strange reason?. . .

Some will die, but not all of them. you can’t die from playing possum.

There now we can good little Obamites

The easiest thing for everyone would have been to let all of the banks that were going to fail, fail.

Sure there would have been some deep pain for a few months, but the failed banks would have been quickly replaced by new banks that would be lending to worthy people and companies today.

Instead, we tried to save them via TARP, and at a VERY high cost. Those banks are still failing. Hopefully we will cut our losses now and let them go, and resist the temptation of TARP II.

If the congress and Hussein come back with TARP II there should be a mutiny by the American people.

hehe yeah, it’s 1:50 in the am

I’m in total agreement with the mutiny. But I cringe, knowing that the little bank sycophants will be spreading their vague air of fear to whomever is naive enough to listen to them.

If the big banks would have found that they wasn't going to get a bailout, I wonder if they would have found a way to make some tough choices and survive on their own. We will never know....

The banks did make tough choices. they laid off thousannds of employees while recieving billions of dollars.

You see how tough the execs have it. This is why they need private jets...

time to bed for you... ;-)

I don't think it is entirely the banks' fault.

The economy expands as debt through loans is created, the GOVERNMENT forced the banks to make risky loans to meet the goals of the CRA and underwrote those loans with Fannie Maee and Freddie Mac guarantees. 0bama even sued banks to force them to make those loans.

If the loans default en masse the whole house of cards comes down an "money" evaporates, because it never really existed in the first place, it was just an obligation that someone has now defaulted on.

When the economy collapses as it has done, the wealth just shrinks, it's not a zero sum game where someone wins as someone else loses, the money just disappears because there is no trust or faith to back it.

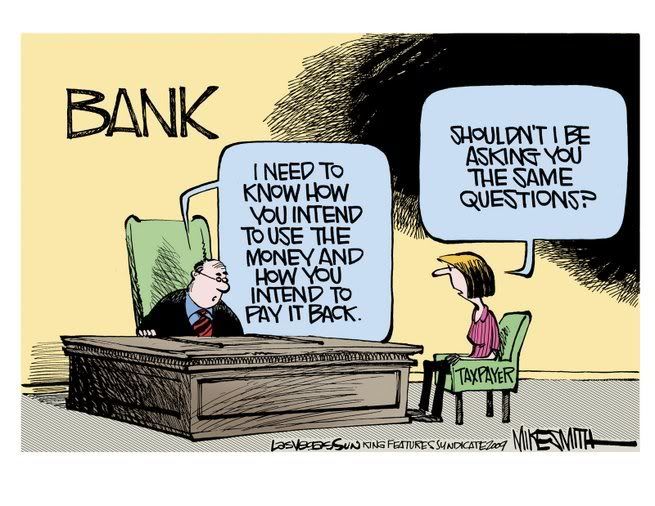

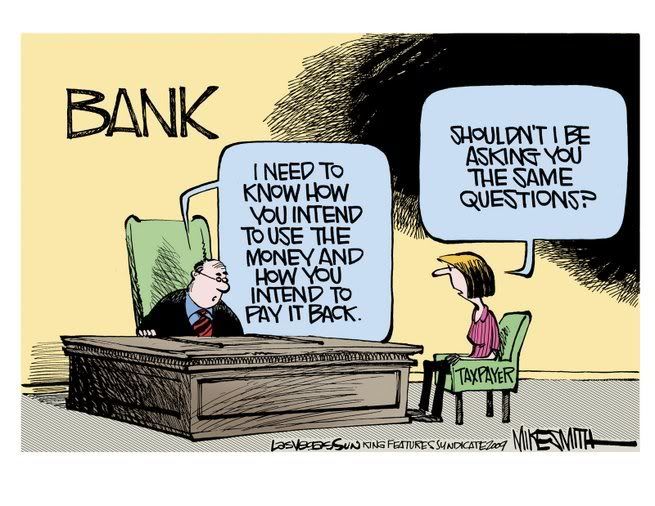

I love that cartoon. We’re trying to refinance our house and you’d think we’ve robbed banks in the past with an 800 credit score. Meanwhile, the government can’t give banks money fast enough with no strings attached. This household says use the money to start new banks that can start over and let the old ones fail.

"The wavelike movement affecting the economic system, the recurrence of periods of boom which are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."

Our idiotic leaders appear to be choosing Option 2.

Governments don’t do well with strong independent people or companies. People like that don’t need government. They also provide a model for others to copy. Next thing you know, everyone is finding a way to become independent. Then, what good is the government? What would it and all the government people do except collect taxes, and pay themselves to sit in building three or four days a week?

Therefore it is important that government do its real work of hunting down productive people and industries and making them cripples, dependent and broke. This is not easy because people are resilient and keep finding new ways to be independent, therefore the government needs new ways to pull them back into its control.

Not if they are taken over and sold in pieces to healthy smaller banks. The feds have been making it worse by forcing the weak biggest banks together, only concentrating the mess. The shareholders of these banks need to be wiped out, and the the boards and managements of the more conservative smaller banks need to maintain a grip on their better practices. The underwater home mortgage holders need to be wiped out too. That’s the other recourse that will put some cap on the ever-increasing losses to the government—though the Feds are about to do the opposite and force more of the homeowners’ losses into the banking system.

The 1907 financial panic of mostly crooked, over debted, delusional banks in New York led to the 1913 Federal Reserve Bureaucracy Act. The original panic, handled in J.P Morgans library, lasted four weeks and cost the taxpayer nothing. Which the banks then being private business what businesses did they have taking other peoples money.

Now with the Federal Reserve Bureaucracy and Money Centralization in Washington Act, panics last for years, if not decades and citizens bail out private banks.

It’s nice to be amongst the elite. Public debt and private profit.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.