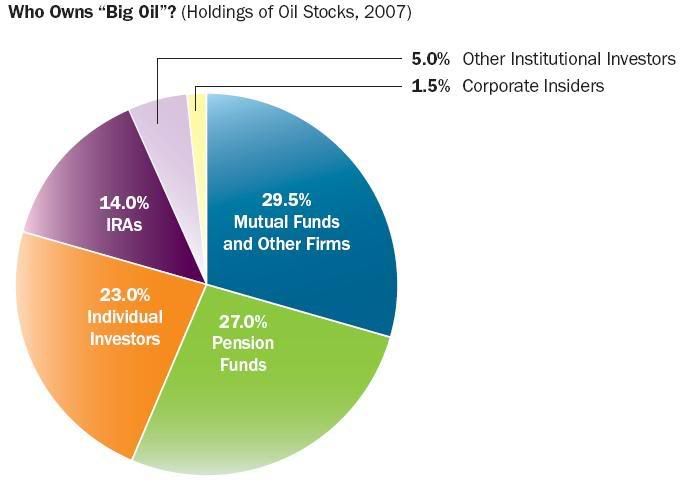

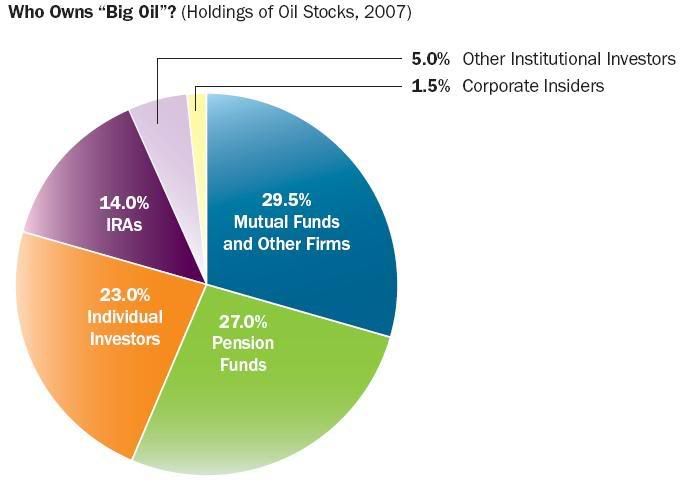

That would be anyone invested in a retirement, mutual fund, IRA or the stock market:

In other words, US!

Posted on 05/08/2008 8:25:56 AM PDT by yoe

Exxon Mobil recently posted the biggest-ever annual profit for a U.S. company at $40.6 billion dollars. Outrageous — they gasp — consumers are obviously being gouged by Big Oil.

Let’s look at the facts. First of all, just who is “Big Oil?” Exxon Mobil, Shell, BP, Chevron Texaco, Conoco Phillips? Wrong! It’s the government-controlled national oil companies of Saudi Arabia, Iran, Iraq, Venezuela, Libya, Algeria, Nigeria, Russia, Brazil, China, etc. In fact, the privately held Western oil companies that most people associate with “Big Oil” control less than 6 percent of the world’s reserves.

Do these companies set the price of oil? Absolutely not! Since 1973, the price has been controlled by a cartel of Oil Producing and Exporting Countries (OPEC) through imposed production limits. Prior to 1973, the price of oil was also controlled by a cartel that imposed production limits — namely, the Texas Railroad Commission.

With the exception of Saudi Arabia and war-torn Iraq, most OPEC countries are already producing at maximum capacity. Oil supply for 2007 was 85.5 million barrels per day compared to a demand of 85.8 million barrels per day. What do you think the price of oil will be when Saudi Arabia (which hasn’t discovered a new major oil field in over 30 years) no longer has spare capacity?

At current demand, we (as a world) are consuming more than a billion barrels of oil every 12 days. That means we need to be finding a billion-barrel field (which are classified as “giants”) every 12 days — and we are not. It’s even worse in that the fields which we are discovering are technically more difficult to produce — i.e., they produce at much slower rates — meaning that we really need to find a giant field every three to four days. Ten years from now, $90-a-barrel oil may be something we could only wish for. Most economists treat oil as a commodity — just show up at the window with enough money and they’ll make more. Unfortunately, oil is a finite resource.

But what about Exxon’s “enormous” profits? Exxon is a U.S. oil company, meaning that it pays enormous taxes to the U.S. government on its worldwide income. The same cannot be said for Total Elf Fina (a major oil company almost in the same league as Exxon that is based in France). Most foreign countries do not tax on worldwide income (at least none that I can think of). If we are to impose an additional tax burden on the U.S. oil companies, what incentive do they have to keep from packing their bags and relocating their base of operations to a more tax-friendly country?

But isn’t Exxon charging excessive prices at the pump? Shouldn’t it return those profits to the consumer in the form of lower pump prices? Exxon’s profit margin is a mere 10 cents on the dollar ($40.6 billion dollars profit on $404 billion dollars of revenue). The absolute numbers are big because Exxon is big.

There are a lot of companies in the U.S. with operating margins well in excess of 10 percent. For example, as an independent consultant, I made 73 cents profit on every dollar of revenue last year. Are my profits excessive? Should I be hauled before Congress to justify my profit margin?

By and large, the price at the pump is governed by the cost of refinery feedstock (crude oil), which is controlled by OPEC. The rest is governed by operating efficiencies and market forces.

What happens to the independent refiner if Exxon sells its refinery products at less than its cost of manufacture? The independents couldn’t compete, would scream bloody murder, and would haul Exxon before the courts for unfair trade practices. The same would apply to other integrated oil companies that might have a larger proportion than Exxon of their business in the downstream sector (refining and marketing) as opposed to the upstream sector (exploration and production).

Should the government force Exxon to subsidize the price at the pump? Just look at the exodus of private oil com-panies from Venezuela as a result of what Hugo Chavez is doing.

Lastly, ask yourself this question: “Who is Exxon?” Exxon is not this amorphous entity, but a business owned by its shareholders. So the next time you find yourself complaining about Exxon’s excessive profits, instead of complaining, buy its stock. And when you hear presidential candidates lambasting Big Oil in their plight to get elected, rest assured that you are at least better informed.

— Shaun Hoolahan, of 801 Rickards St. in Opportunity, was born and raised there. He received a bachelor’s degree in petroleum engineering from Montana Tech in 1982, a master’s degree in engineering management from the University of Alaska in 1987 and is a licensed/registered professional petroleum engineer who has worked on oil and gas developments around the globe. Retiring in 2005, he returned with his family to Opportunity and formed a consulting business. This article was written during a layover at the Frankfurt (Germany) International Airport.

So, after some research, it looks like the oil company makes about 30 cents per gallon in profit, and the government(Fed+State+Local) makes 62 cents per gallon, in California.

Oops! I meant to say 10 cents per dollar profit for the oil company. So with $4.00 gasoline, it’s 40 cents profit for the oil company, and 62 cents for the gubmint.

per dollar or per gallon for both?

10 cents per dollar for oil companies, and 62 cents per gallon for gubmint.

That would be anyone invested in a retirement, mutual fund, IRA or the stock market:

In other words, US!

What is outrageous is that the Saudies are making a 5000% profit on the oil they pump. THEY ARE ACCUMULATING OUR DOLLARS FASTER THAN WE CAN PRINT THEM! Soon they will be able to buy our entire country, just because we we too stupid to drill for our own oil.

& we have more oil under us than they do!

It's driven up the price of used cars, also. Anyone tried to buy a thousand dollar beater lately? They don't exist. Anything that runs is three grand. Demand is way up.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.