Posted on 04/29/2008 4:06:51 PM PDT by kellynla

Crude oil prices and the value of the dollar have been marching in different directions for months. But that may shift if the Federal Reserve signals on Wednesday that its rate-cutting campaign has come to a close.

One factor that has sent the dollar down and oil up recently has been the Federal Reserve's months-long round of rate cuts. In an attempt to stimulate the ailing U.S. economy, the central bank has cut rates by three percentage points since September. But the rate cuts are also inflationary, weakening the dollar and sending oil prices higher.

"The weak dollar is a major detriment to the price of oil," said Stephen Schork, publisher of the energy industry newsletter The Schork Report. "It's keeping prices artificially high."

Since this time last year, the dollar has plummeted over 10% against global currencies, and oil has climbed about 80%. As the dollar continues to depreciate in value, investors have bought oil futures as a hedge against inflation.

Also, oil is priced in dollars worldwide, so a falling dollar provides less incentive for oil-exporting countries to increase output, or for foreign consumers to cut back on oil use.

As a result, oil traders will be closely watching the Fed on Wednesday. Though most economists have forecast a quarter of a percentage point cut to its key funds rate, many economists are also predicting the Fed will hint that it will keep rates steady, or even raise rates in future meetings, to protect against inflation.

"All of us are hoping for a 25-point cut with a statement that that's it," said MF Global energy analyst John Kilduff. "Some of us wouldn't mind if there's no cut."

Whispers that the current round of rate cuts is coming to an end may send crude prices lower.

(Excerpt) Read more at money.cnn.com ...

ping

I’ve been saying that the FED needs to stop and reverse course on rate cuts for a month now.

it ain’t rocket science...

quit printing money and quit cutting the rates...

and these guys at the Fed are supposed to be smart. LOL

of course, it would be nice if congress would start paying down the debt & passed a...gasp...Balanced Budget for a change!

Just a what-if to cover the impending Fed decision.

It seems to this poor, dumb, high-school ed-u-mi-cated trucker that as long as we buy such vast quantities of oil from foreign suppliers, instead of tapping our own vast oil reserves(Anwar, Oil shale, coal-to-oil, off-shore {west coast, gulf coast and east coast} liquid petroleum, etc, etc) our dollar, and the American economy as a whole will be help hostage to the whims and vagaries of the speculative nature of the world oil market.

[So, since I hate “critics who whine w/o coming up any solution, let me try this out for size]

Perhaps, if we were willing to set a floor for what we pay for oil, in order to assure a profit to those companies that would be developing the necessary oil shale recovery methods, as well coal-to-oil technology.

For example, say, set $50/bbl for the minimum price of crude oil to the refiners. Any oil which cost more that $50/bbl to buy, would not be effected. BUT if oil on the world market fell below $50/bbl, then any incoming oil from foreign sources would have a tariff attached to it to bring its price up to $50/bbl. Domestically produced oil, from any source would be immune to this tariff.

The purpose of this tariff would be to protect our fledgling oil shale and coal-to-oil producers from having OPEC flood the market with oil, as they did in the mid 1980’s and drive the new domestic producers out of business.

The benefits of this would be as follows. 1-As we produce more oil in this country, our dollar will get less weak, as less dollars will go overseas to buy oil. 2- as we produce more domestically, we become less dependent on foreign producers. 3- once we prove we are serious about producing our own oil, the price for oil on the world market will decrease, as there will be more oil perceived to be available on the world market. 4- Our oil dollars will cease to go to foreign, semi-hostile countries who use our own dollars to hinder us, and aid our enemies.

I'm sure there are other benefits, as well as other pitfalls in this suggestion, but, as one American, I am getting sick and tired of our supposed “leaders” and pundits decrying the present (fully predictable) sad state of affairs in our economy, but not having the testicular fortitude to have any solutions beyond standing up and decrying that “ITS NOT MY FAULT!!!”

and the speculators had nothing to do with it... right???

and the speculators had nothing to do with it... right???

It didn't make sense to me.

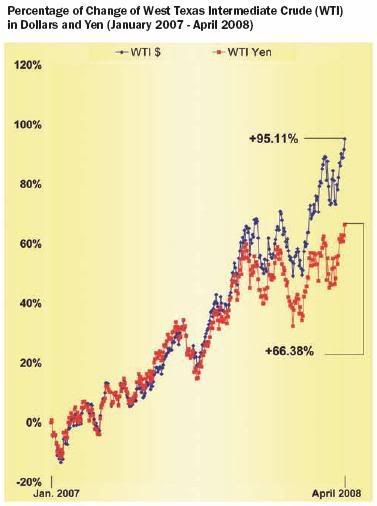

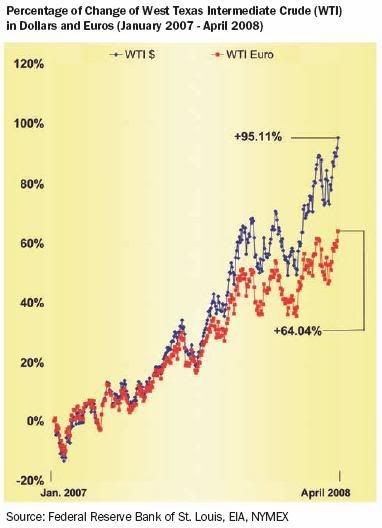

So do you think that the claim of a ten percent drop in the dollar wouldn't cause an eighty percent increase in the price of crude?

No, I believe a 10% drop in the dollar equals a 10% rise in commodities priced in dollars.

Your suggestion has some merit.

I have a question regarding the dollar being weakened by our flooding overseas markets with dollars. Does the same principle apply to other foreign trade (not just oil)? We have a lot of dollars flooding into China to buy cheap Chinese goods, and we do not sell near as much to them as we buy.

“Perhaps, if we were willing to set a floor for what we pay for oil, in order to assure a profit to those companies that would be developing the necessary oil shale recovery methods, as well coal-to-oil technology.”

Great idea.

And I bet none of our presidential contenders would even consider it. . . .

The article provides an explanation.

Also, oil is priced in dollars worldwide, so a falling dollar provides less incentive for oil-exporting countries to increase output, or for foreign consumers to cut back on oil use.

That would only be true if the price for oil in dollars was unchanged. That certainly has not been true. The price for oil has risen faster than the dollar has dropped.

or for foreign consumers to cut back on oil use.

If, as they claim, it was only the price in dollars rising, it would have no impact on those starting with another currency. For example, the rise in oil price in dollars would be offset by the rise in Yen to dollar exchange.

OK then.

Burst away!

So a 10% decline in the dollar has led to an 80% increase in the cost of oil.

MMmmmmK.

Now, obviously, if you are talking about the trade imbalance between Sri Lanka and the US in shirts. That, being such a small part of the overall market, has a correspondingly small effect. But when you get into the 10’s and hundreds of billions of dollars, then effect is not only measurable, but also painful.

The solution, as I see it is to make the US better at providing its own resources, and making the business climate more favorable then exists in other countries. (can any one say “Fair Tax”?? Yep, I knew you could)

(and what is truly a shame, is the the gov’t school, indoctrinated sheeple will be leading the charge because most of them seem to think they have the constitutional right to “buy” oil at a price that still allows them to have enough left over for their Cable, sports, and whatever else they ‘want/need’.)

Pogo was right. “We has met the enemy, and he is us.”

I was wondering the same thing.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.