Are we seeing a domino effect started by the toppling of the sub-prime mortgage lending market? Where will this one end?

States scrambling to convert action-rate bonds to fixed securities but funding sorces are in the tank on the sub-prime lending losses.

Again, where will this one end?

” Again, where will this one end? “

Hint: Start a crash study program on subsistence farming, and lay in a supply of trade goods....

This is just one line in a series of converging trends — it’s not gonna be pretty.....

where will this one end?

Look up stagflation.

Now the problem lies in the fact that your Government has taken to starting long term projects and funding them on cheap short term money (only to find out short term money is no longer cheap).

“Again, where will this one end?”

Nobody really knows. Billions of dollars that were invested in equity investments are disappearing. That sounds like deflation to me but I’m no expert.

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."~~Ludwig von Mises

"Credit expansion can bring about a temporary boom. But such a fictitious prosperity must end in a general depression of trade, a slump."~~Ludwig von Mises

"True, governments can reduce the rate of interest in the short run. They can issue additional paper money. They can open the way to credit expansion by the banks. They can thus create an artificial boom and the appearance of prosperity. But such a boom is bound to collapse soon or late and to bring about a depression."~~Ludwig von Mises

"Credit expansion is not a nostrum to make people happy. The boom it engenders must inevitably lead to a debacle and unhappiness."~~Ludwig von Mises

"What is needed for a sound expansion of production is additional capital goods, not money or fiduciary media. The credit boom is built on the sands of banknotes and deposits. It must collapse."~~Ludwig von Mises

"If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders."~~Ludwig von Mises

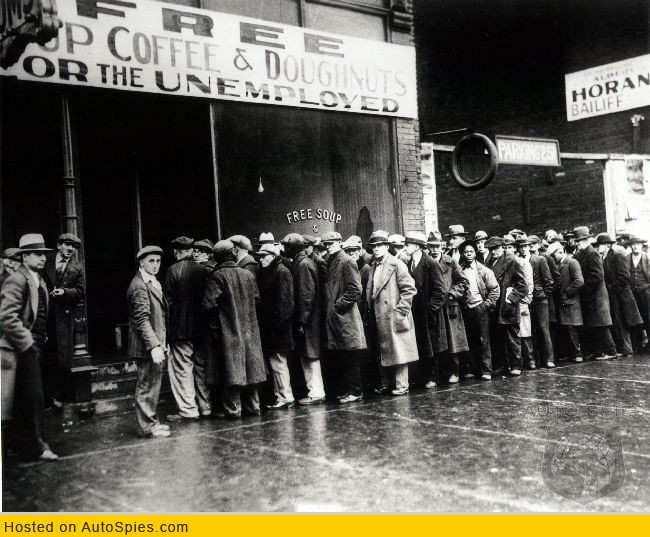

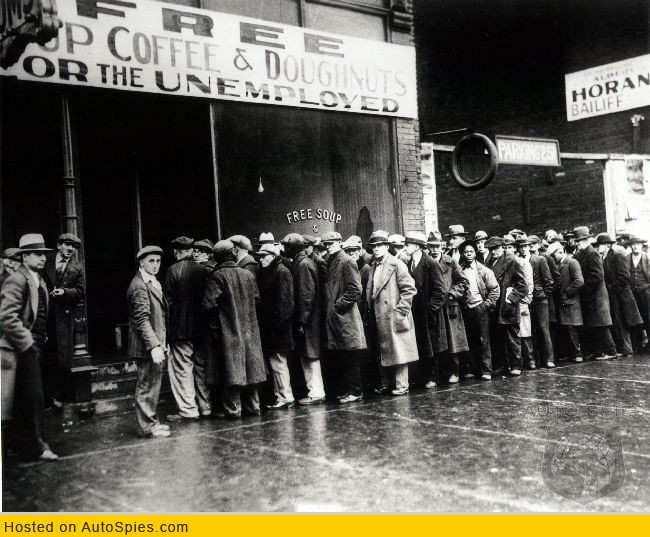

Ummm, I hope you like government cheese, powdered milk & eggs. You’ll have a nice side dish of enriched pasta with, rationed by the U.S. government. In 2008 you will see this quarter and next in deep recession. Stimulus will ehlp in the second two quarters with GDP slightly positive. By Q3 of 2009, expect to see multiple banks going bust. Wall Street will collapse along with many, many small businesses and dozens of larger businesses. Oil will be at $120 a barrel in 2008 and then decline in 2009, but the damage/fleecing of our financial & energy system by the greedy elites and speculators on the middle class will create a 12%+unemployment rate depression. This will likely last through 2010 and then a long-term recovery shall ensue.