Skip to comments.

From Too Big to Fail to Too Big to Care (Financial)

PrudentBear.com ^

| January 24, 2008

| Fred Sheehan

Posted on 01/24/2008 8:42:19 AM PST by Travis McGee

Alan Greenspan’s confirmation hearing as Fed chairman has been addressed in two previous Whiskey & Gunpowder contributions (May 21, 2007 Help Wanted: A Leading Contrarian Indicator and July 20, 2007 Alan, We Hardly Knew Ye). The spotlight was on Greenspan. This time, the prophetic warnings of Senator Proxmire receive attention. The chairman of the Committee on Banking, Housing, and Urban Development expressed several concerns, the greatest of which was the trend towards the concentration in banking. In extracts below, Proxmire makes it plain he expects Greenspan will abet these tendencies. And while the chairman’s statements and questions are directed to Greenspan, he speaks with the frustration of a man who sees danger ahead but finds little acknowledgement among his fellow legislators.

Whatever Proxmire’s motivations, we find the paradoxical situation of a politician lecturing the future Federal Reserve chairman that interest-rate competition is preferable to government regulation of banking, and, after Greenspan’s term expires, a television comedian grilling Greenspan on why he rigged interest rates in a market distorted by the government’s “benevolent hand.”

Greenspan’s confirmation hearing was in July 1987. This was during the great deregulation of banking. Initiatives included the emancipation of the savings and loan industry, authorization for commercial banks to cross state lines, to offer home mortgages, to enter the brokerage business, to underwrite securities and to change themselves into conglomerates offering all of the above services and more. The pressure to grow also pushed from the other end – investment banks that ran brokerages, brokerages that became investment banks, and so on.

Towards the end of the hearing Proxmire declaimed the trend: “It seems to me that banking in this country and finance in this country is likely to move very sharply… in the direction of concentration…. I think most senators, if they thought very long about it, might be very concerned too. And I think the American people would be concerned too.”

A coincident development was the socialization of risk, unwritten (at least in legislation), but gradually understood by all: the “too-big-to-fail” doctrine. The government bailout of Continental Illinois in 1984 made it plain that the federal government would not allow one of the largest banks in the country to suffer insolvency. In March 2007, Henry Kaufman described a consequence: “Therefore, market discipline falls unevenly: it falls more heavily on smaller institutions, which in turn motivates them to merge into larger entities protected by the too-big-to-fail umbrella.”

In 1986, Kaufman wrote an important book, Interest Rates, the Markets, and the New Financial World. As is often the case with books published well ahead of their time, nobody read it. Then managing director and chief economist at Salomon Brothers, Kaufman saw that banks would augment their balance sheets and profits by securitizing mortgages, consumer credit and commercial property. Financial derivatives were young. He expected these markets would explode.

Proxmire was concerned with Greenspan’s lobbying efforts. Among other ventures, a top project was Sears’ attempt to offer banking services. Proxmire addressed the candidate: “[Y]ou think, if we erected Chinese walls, you can still merge banking and commerce. And that shocks this Senator, and I think it should shock many others. You, in my judgment, favor an increased concentration of banking…” (Aside from the larger issue, Proxmire had other concerns. In Greenspan’s full disclosure of relationships before the hearing, he listed such directorships as Alcoa and J.P. Morgan. He did not include either Sears or Lincoln Savings & Loan. Greenspan’s distinguished the two by slipping them in the side pocket of “advocacy projects.” Cutting through the euphemism, he was paid by each to lobby for banking de-regulation.)

Proxmire tutored Greenspan on the beauty of markets: “[The] chairman of the Federal Reserve Board [is] the country’s leading bank regulator. The Fed, as we know, regulates a large number of State member banks [and] bank holding companies that control an increasing proportion of all the commercial banking in our country. You take this position at a time when there’s a headlong drive towards bank concentration….A couple of weeks ago, the second and third largest banks in Wisconsin, also interest rate competitors, announced their intention to merge and form a bank that will be far larger than its nearest competition in Milwaukee and throughout Wisconsin.”

The italics are mine. Greenspan’s term was marked by government distortion of asset markets and the economy by consistently setting the short-term interest rate at a level that encouraged speculation, borrowing, and bubbles at the expense of long-term capital investment. It requires courage for a Fed chairman to resist the temptation of low interest rates.

Proxmire questioned the candidate’s resolve: “[Former Federal Reserve chairmen] resisted the pleading of Congress for a more expansive, stimulative monetary policy. If Congress pays any attention at all to monetary policy, it is to call for a more expansive policy. If interest rates are too high, it’s the Fed’s fault. If they are low, the administration and Congress will fall all over themselves claiming credit, especially when an election approaches…. You have to find it in you to deny the President the easy money policy he and his party want. You have to say nix to the Congress, too. As usual the only voice you will hear from Congress will be a steady chant to ease up on the money supply…. Are you the man who can say no to the administration and to the Congress?”

The banking committee chairman continued to address financial concentration: “As chairman of the Federal Reserve you play the key role in approval or disapproval of these massive bank mergers…. I would feel much better about this appointment if there was somewhere in your record an indication of your awareness of the dangers to our economy of excessive financial concentration. Maybe you can reassure us that you understand that banking should be separated from commerce and the unique multiplicity of banking in this country is an immense source of strength for our small businesses and that you can’t have competition without having a large number of banks, as many banks as possible competing in every banking market. Do you have a conviction that regulators, no matter how able, cannot do the job as effectively and efficiently as competition? I hope as chairman you can show us this.” (Italics added.)

Proxmire was looking in the wrong place for conviction. He probably knew this, since he described Greenspan elsewhere as a “get along, go along” guy. Over the course of Greenspan’s term at the Fed, banks merged and expanded until they were no longer banks. They take deposits, make loans, trade for their own accounts, manage hedge funds, serve as brokers for competing hedge funds, offer mortgages, securitize mortgages, sell securitized mortgages, (e.g., CDOs, CBOs, CMBS), then sell credit derivatives to protect the buyer against bankruptcy of the securitized mortgage.

Kaufman foresaw the abstraction of matter. Derivatives grew fancier, more profitable and detached themselves from economic purpose: in a world that produces a $50 trillion Gross Domestic Product; derivatives, mostly created from within the banking system, now top $500 trillion. Financing exceeds economic output by at least a factor of ten – for what purpose?

The financial system does serve an economic function of its own: additional finance is needed to grow the real economy (e.g., that of manufacturing automobiles, selling flowers). Credit expanded faster than production. This impaired the ability of those living in the real economy to service debt (most obviously now in California, where the median house price exceeded $500,000 at the peak with a median income of $60,000).

Overindulgence is an age-old problem that rehabilitates itself in a recession, but the expedient route of faster financing beckoned. Too-low interest rates fueled the factories of finance with more energy than that expended at Ford’s River Rouge plant. The banks produced billion-dollar derivative instruments and sold them to hedge funds. Hedge funds produced more and sold them to banks. Generally, no capital was required to back these promises.

No money existed the moment before the transaction; yet, the security was immediately integrated into the bouillabaisse of stocks, bonds and cash savings. Physical objects were turned into tradable currency – houses, power boats, facelifts, coffins and David Bowie. Finance was mimicking installation art; Alan Greenspan admitted to Congress he no longer knew what money was; money had grown more abstract than Greenspan’s syntax; if exhibited at the Whitney Museum Biennial, the chairman, stuffed and seated at the FOMC conference table, would win the blue ribbon for coherent symbolism.

The imprimatur of the Fed chairman went a long way to relieving concerns of derivative activity. Congress held hearings during the 1994 derivatives maelstrom. George Soros appeared before the House Banking Committee and stated: “There are so many [derivatives], and some of them are so esoteric, that the risks involved may not be properly understood even by the most sophisticated investors, and I’m supposed to be one of them.” After Congress completed its study, Alan Greenspan dismissed it as unnecessary. He described the risk of derivatives as “negligible.” Congress chose to believe the testimony of Greenspan and ignore Soros.

Whatever ran through Greenspan’s mind (it is not clear if Greenspan understood the consequences of his actions), the Federal Reserve, as the leading bank regulator, held an institutional bias towards expanding the derivatives markets: commoditized and securitized loans relieved banks of default risk on their balance sheets. Given the Fed’s regulatory responsibility, this must have been a welcome development. Citicorp might be a poor judge of consumer credit, but it could sell its receivables into the marketplace. The financial institutions were growing larger; derivatives were very profitable and a means to reduce risk at banks; the risks to the financial system mounted. Today, five commercial banks hold over $160 trillion of derivatives with a comparatively microscopic capital allotment. With banks now forced to take the odious derivatives back on their balance sheets, the only clear beneficiaries to all this maneuvering are those who collected fees.

The Fed chairman was ever vigilant in assuring all that derivatives reduced risk.

In May 2003: “Derivatives have permitted financial risks to be unbundled in ways that have facilitated both their measurement and their management…. As a result, not only have individual financial institutions become less vulnerable to shocks from underlying risk factors, but also the financial system as a whole has become more resilient.”

In April 2005: “[L]enders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers…. These improvements have led to rapid growth in subprime mortgage lending.”

In May 2005: “The use of a growing array of derivatives and the related application of more-sophisticated approaches to measuring and managing risk are key factors underpinning the greater resilience of our largest financial institutions.”

Henry Kaufman viewed the development differently: “[I]nstitutions with aggressive [derivative] models will get the business and garner the profits. Senior managers will find it more difficult to resist increasing pressures to compete using riskier models, especially if doing so would cause the earnings and stock process to lag behind those of institutions deploying riskier models. Ongoing financial intermediation and balance-sheet leveraging also will continue to support riskier modeling on the near horizon.”

In March 2007, before all hell broke loose, Kaufman viewed the preferable solution as impractical: “One [solution] is to let competitive forces discipline market participants. In this scenario, the managers who perform well will prosper, while those who do not will fail. But…[we] typically do not allow the process to follow through when it comes to very large financial institutions. The failure of behemoth financial conglomerates not only exacts enormous social costs, but also poses systemic risks for markets around the world.”

During the first quarter of 2007 (December 2006 through February 2007), the balance-sheet assets of Goldman Sachs, Lehman Brothers, Morgan Stanley, and Bear Stearns rose $237 billion – a 34% annualized growth rate. If sustained over a year, these banks would grow by $1 trillion, in an economy with a $13 trillion GDP. The leverage was enormous, as was that of the hedge funds they financed. The suspicion arises the behemoths have grown from too-big-to-fail to too-big-to-care. The Fed has lost control over the banks it failed to regulate and the credit-creating apparatus it no longer understands.

During Greenspan’s recent book tour promotion, the most enterprising interviewer was Jon Stewart on Comedy Central. Stewart, unencumbered with presumptions of how he should think and what he should not say, spoke much as the boy who asked why the emperor wore no clothes:

STEWART: Many people are free-market capitalists, and they always ask about free-market capitalism, and that is our economic theory. So why do we have a Fed? … [W]ouldn’t the market take care of interest rates and all that? Why do we have someone adjusting rates if we are in a free-market society?

GREENSPAN: You’re asking a very fundamental question.

STEWART: I am? Should I leave?”

Greenspan convinced his host to both stay and listen to an inaccurate Federal Reserve pep talk. (The former chairman seemed to think the Fed was founded in the 1930s). Stewart was not satisfied with the mumbo-jumbo:

STEWART: So, we’re not in a free market then.

GREENSPAN: No. No.

STEWART: There’s a… benevolent hand that touches us.

GREENSPAN: Absolutely. You’re quite correct.

Proxmire, Kaufman and Stewart alerted their audiences to government interference in the free market. (The Greenspan myth includes a commitment to laissez-faire economics, which is a wholly inaccurate characterization.) In the end, both Proxmire and Kaufman tacitly conceded defeat to the monster they saw so clearly, and that may devour us all. The Banking Committee chairman concluded: “[T]his nomination should result in a slam-bang debate in committee and the floor. It won’t, and it is startling, given what you have told us.”

At the end of his 2007 speech, Kaufman noted that decisive changes in economic thought only occur after collapse: “In light of this pattern, it seems unlikely that a new economic philosopher will come forth with an integrated economic and financial approach anytime soon. Today’s most influential economists have strong vested interests in preserving the integrity and reputation of their views. A lifetime of research and writing is at stake. It is very difficult for any of us to fundamentally alter our views, especially for those who have reached a leadership role.”

In other words, the former chairman of the Princeton economics department in unlikely to question the viability of his own institution. The comedian from Comedy Central at least planted the seeds for a new economic philosopher.

Frederick J. Sheehan is an investor in Boston who writes about the financial markets. A version of the following was originally published in the online newsletter, Whiskey and Gunpowder. "Greenspan's Bubbles," by Fred Sheehan and Bill Fleckenstein will be published by McGraw-Hill in January 2008."

TOPICS: Business/Economy

KEYWORDS: banks; derivatives; greenspan

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-49 next last

To: jedward

It’s difficult to remain cordial with traitors...especially FREETRAITORS.

21

posted on

01/24/2008 6:48:31 PM PST

by

nicmarlo

To: nicmarlo

It’s the clear as a bell shills that annoy the living crap out of me. It’s not hard to tell someone who is genuinly mis-guided, strongly supportive of a contrary view...and a shill. the latter sticks out like a sore...well, you know :)

22

posted on

01/24/2008 6:50:40 PM PST

by

jedward

To: jedward

It’s not hard to tell someone who is genuinly mis-guided, strongly supportive of a contrary view...and a shill. the latter sticks out like a sore... like a traitor....a SORE traitor who hates being exposed to what s/he actually IS.

23

posted on

01/24/2008 6:54:43 PM PST

by

nicmarlo

To: Toddsterpatriot

Nice little thread full of warm and fuzzy protectionists.

Do you think there is a debt supercycle and that we are nowhere close to the end of it? I do.

24

posted on

01/24/2008 7:10:58 PM PST

by

groanup

(Tell me your 10 favorite things about the IRS)

To: groanup

Nice little thread full of warm and fuzzy protectionists.If only we restricted trade, bad things wouldn't happen.

Do you think there is a debt supercycle and that we are nowhere close to the end of it? I do.

How long would the cycle be? When did it start?

25

posted on

01/24/2008 8:52:54 PM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

Stay tuned, we’ll find out in the next year or two, when it’s as obvious as a train wreck.

26

posted on

01/25/2008 5:44:24 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Travis McGee

Stay tuned, we’ll find out in the next year or two, Weren't you saying this a year or two ago?

27

posted on

01/25/2008 5:46:04 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

And look where we are now.

"I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future."

~~E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."

~~Irving Fisher PhD, leading U.S. economist , New York Times, October 17, 1929

"If recession should threaten serious consequences for business (as is not indicated at present) there is little doubt that the Federal Reserve System would take steps to ease the money market and so check the movement."

~~Harvard Economic Society, October 19, 1929

"This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan... that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years."

~~R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

28

posted on

01/25/2008 6:15:06 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Travis McGee

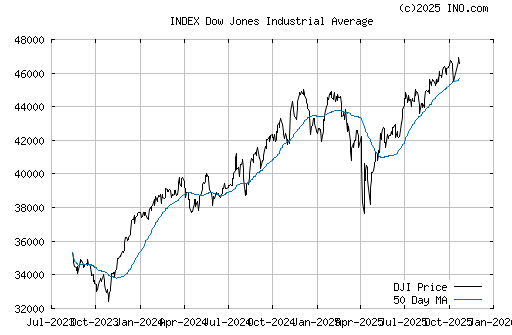

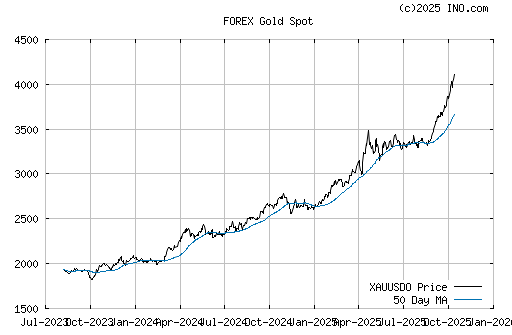

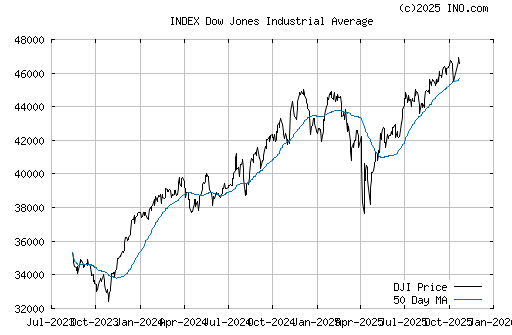

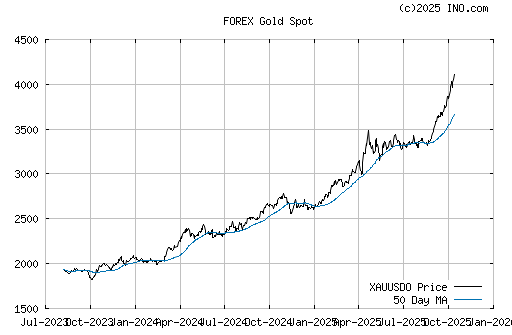

And these pretty charts have what exactly to do with my post #25?

29

posted on

01/25/2008 6:17:12 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

How long would the cycle be? When did it start? I believe it started after WWII. Prior to that, economic excesses were left to shake outs that severly restricted economic activity and produced depressions. Now, each time there is an excess monetary authorities step in and shore it up allowing for another leveraged cycle.

Take the 2000 deflationary blow off of the internet bubble. The Fed stepped in and reliquified the economy and created the excesses that caused the housing bubble. Even now the Fed isn't allowing the pain it should. Instead it is screaming "leverage, leverage" pushing the real showdown further down the road.

Am I crazy?

30

posted on

01/25/2008 6:22:46 AM PST

by

groanup

(Tell me your 10 favorite things about the IRS)

To: groanup

Now, each time there is an excess monetary authorities step in and shore it up allowing for another leveraged cycle.What about Volcker?

Am I crazy?

No.

31

posted on

01/25/2008 6:28:00 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

You asked about my outlooks 1 to 2 years ago. Connect the dots, genius.

Economic Geniuses Now:

“Derivatives have permitted financial risks to be unbundled in ways that have facilitated both their measurement and their management…. As a result, not only have individual financial institutions become less vulnerable to shocks from underlying risk factors, but also the financial system as a whole has become more resilient.”

~~Alan Greenspan, May 2003

"American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage."

~~Alan Greenspan, February 22, 2004

“The use of a growing array of derivatives and the related application of more-sophisticated approaches to measuring and managing risk are key factors underpinning the greater resilience of our largest financial institutions.”

~~Alan Greenspan, May 2005

"We're not about to go into a situation where (real estate) prices will go down. There is no evidence home prices are going to collapse."

~~Alan Greenspan, May 21, 2006

“The damage from the subprime market has been largely contained. Fortunately, the financial system and the economy are strong enough to weather this storm.”

Richard Fisher, Federal Reserve Bank of Dallas President, Apr 4, 2007

"All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system."

~~Fed Chairman Ben Bernanke, May 17, 2007

Economic Geniuses Then:

"I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future."

~~E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."

~~Irving Fisher PhD, leading U.S. economist , New York Times, October 17, 1929

"If recession should threaten serious consequences for business (as is not indicated at present) there is little doubt that the Federal Reserve System would take steps to ease the money market and so check the movement."

~~Harvard Economic Society, October 19, 1929

"This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan... that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years."

~~R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

32

posted on

01/25/2008 6:29:53 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Travis McGee

Wow, those quotes were just as interesting two years ago as they are now. LOL!

33

posted on

01/25/2008 6:36:22 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: groanup

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."~~Ludwig von Mises

"In the long run, we are all dead."

~~John Maynard Keynes, who had no children, and promoted defecit spending to push the day of reckoning far into the future. This was his famous response concerning what will happen in the long run if his theories were followed.

The future is now.

34

posted on

01/25/2008 6:36:34 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Toddsterpatriot

Yeah, it's all a big joke. Laugh it up, genius.

"In the long run we are all dead."

Great philosophy, if you are a childless gay hedonist like Keynes. Not so great for our children.

35

posted on

01/25/2008 6:37:56 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Toddsterpatriot

What about Volcker? He had no choice because inflation had been in the double digits. He then eased like crazy from, what, 20% down to 10%?

36

posted on

01/25/2008 6:40:20 AM PST

by

groanup

(Tell me your 10 favorite things about the IRS. Okay, 5. Okay, 1.)

To: Travis McGee

Much worse today than 2 years ago. LOL!

37

posted on

01/25/2008 6:40:30 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Travis McGee

Yeah, it's all a big joke. Laugh it up, genius. You said we were doomed two years ago. Or has it been longer? Are we doomed yet?

It's true, we will eventually have a recession. Does that mean you were right the whole time? Even if it's 5 years after your prediction? 7 years later? 10 years later?

38

posted on

01/25/2008 6:43:15 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

Those charts are meant to prove that all is well today?

Wow, I want some of what you’re smoking!

39

posted on

01/25/2008 6:43:48 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Travis McGee

Those charts are meant to prove that all is well today? No, they're meant to show you may not have proved your point in post #28.

40

posted on

01/25/2008 6:47:45 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-49 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson