Skip to comments.

From Too Big to Fail to Too Big to Care (Financial)

PrudentBear.com ^

| January 24, 2008

| Fred Sheehan

Posted on 01/24/2008 8:42:19 AM PST by Travis McGee

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-49 next last

To: jedward

It’s difficult to remain cordial with traitors...especially FREETRAITORS.

21

posted on

01/24/2008 6:48:31 PM PST

by

nicmarlo

To: nicmarlo

It’s the clear as a bell shills that annoy the living crap out of me. It’s not hard to tell someone who is genuinly mis-guided, strongly supportive of a contrary view...and a shill. the latter sticks out like a sore...well, you know :)

22

posted on

01/24/2008 6:50:40 PM PST

by

jedward

To: jedward

It’s not hard to tell someone who is genuinly mis-guided, strongly supportive of a contrary view...and a shill. the latter sticks out like a sore... like a traitor....a SORE traitor who hates being exposed to what s/he actually IS.

23

posted on

01/24/2008 6:54:43 PM PST

by

nicmarlo

To: Toddsterpatriot

Nice little thread full of warm and fuzzy protectionists.

Do you think there is a debt supercycle and that we are nowhere close to the end of it? I do.

24

posted on

01/24/2008 7:10:58 PM PST

by

groanup

(Tell me your 10 favorite things about the IRS)

To: groanup

Nice little thread full of warm and fuzzy protectionists.If only we restricted trade, bad things wouldn't happen.

Do you think there is a debt supercycle and that we are nowhere close to the end of it? I do.

How long would the cycle be? When did it start?

25

posted on

01/24/2008 8:52:54 PM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

Stay tuned, we’ll find out in the next year or two, when it’s as obvious as a train wreck.

26

posted on

01/25/2008 5:44:24 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Travis McGee

Stay tuned, we’ll find out in the next year or two, Weren't you saying this a year or two ago?

27

posted on

01/25/2008 5:46:04 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

And look where we are now.

"I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future."

~~E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."

~~Irving Fisher PhD, leading U.S. economist , New York Times, October 17, 1929

"If recession should threaten serious consequences for business (as is not indicated at present) there is little doubt that the Federal Reserve System would take steps to ease the money market and so check the movement."

~~Harvard Economic Society, October 19, 1929

"This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan... that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years."

~~R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

28

posted on

01/25/2008 6:15:06 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Travis McGee

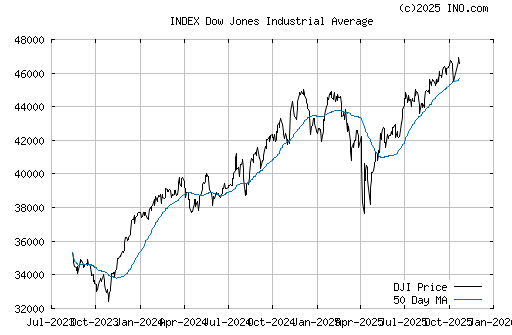

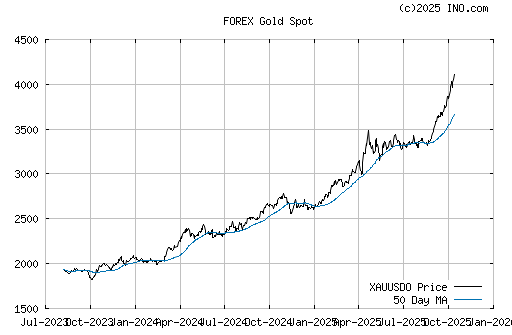

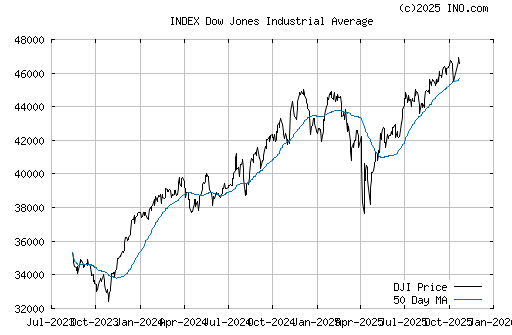

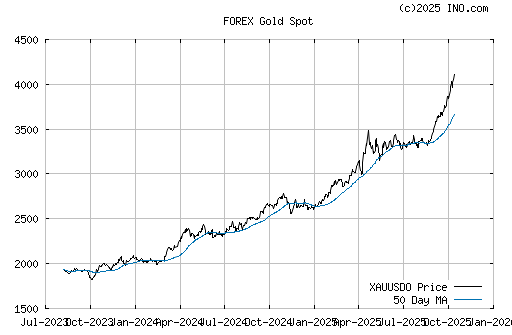

And these pretty charts have what exactly to do with my post #25?

29

posted on

01/25/2008 6:17:12 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

How long would the cycle be? When did it start? I believe it started after WWII. Prior to that, economic excesses were left to shake outs that severly restricted economic activity and produced depressions. Now, each time there is an excess monetary authorities step in and shore it up allowing for another leveraged cycle.

Take the 2000 deflationary blow off of the internet bubble. The Fed stepped in and reliquified the economy and created the excesses that caused the housing bubble. Even now the Fed isn't allowing the pain it should. Instead it is screaming "leverage, leverage" pushing the real showdown further down the road.

Am I crazy?

30

posted on

01/25/2008 6:22:46 AM PST

by

groanup

(Tell me your 10 favorite things about the IRS)

To: groanup

Now, each time there is an excess monetary authorities step in and shore it up allowing for another leveraged cycle.What about Volcker?

Am I crazy?

No.

31

posted on

01/25/2008 6:28:00 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

You asked about my outlooks 1 to 2 years ago. Connect the dots, genius.

Economic Geniuses Now:

“Derivatives have permitted financial risks to be unbundled in ways that have facilitated both their measurement and their management…. As a result, not only have individual financial institutions become less vulnerable to shocks from underlying risk factors, but also the financial system as a whole has become more resilient.”

~~Alan Greenspan, May 2003

"American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage."

~~Alan Greenspan, February 22, 2004

“The use of a growing array of derivatives and the related application of more-sophisticated approaches to measuring and managing risk are key factors underpinning the greater resilience of our largest financial institutions.”

~~Alan Greenspan, May 2005

"We're not about to go into a situation where (real estate) prices will go down. There is no evidence home prices are going to collapse."

~~Alan Greenspan, May 21, 2006

“The damage from the subprime market has been largely contained. Fortunately, the financial system and the economy are strong enough to weather this storm.”

Richard Fisher, Federal Reserve Bank of Dallas President, Apr 4, 2007

"All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system."

~~Fed Chairman Ben Bernanke, May 17, 2007

Economic Geniuses Then:

"I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future."

~~E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."

~~Irving Fisher PhD, leading U.S. economist , New York Times, October 17, 1929

"If recession should threaten serious consequences for business (as is not indicated at present) there is little doubt that the Federal Reserve System would take steps to ease the money market and so check the movement."

~~Harvard Economic Society, October 19, 1929

"This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan... that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years."

~~R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

32

posted on

01/25/2008 6:29:53 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Travis McGee

Wow, those quotes were just as interesting two years ago as they are now. LOL!

33

posted on

01/25/2008 6:36:22 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: groanup

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."~~Ludwig von Mises

"In the long run, we are all dead."

~~John Maynard Keynes, who had no children, and promoted defecit spending to push the day of reckoning far into the future. This was his famous response concerning what will happen in the long run if his theories were followed.

The future is now.

34

posted on

01/25/2008 6:36:34 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Toddsterpatriot

Yeah, it's all a big joke. Laugh it up, genius.

"In the long run we are all dead."

Great philosophy, if you are a childless gay hedonist like Keynes. Not so great for our children.

35

posted on

01/25/2008 6:37:56 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Toddsterpatriot

What about Volcker? He had no choice because inflation had been in the double digits. He then eased like crazy from, what, 20% down to 10%?

36

posted on

01/25/2008 6:40:20 AM PST

by

groanup

(Tell me your 10 favorite things about the IRS. Okay, 5. Okay, 1.)

To: Travis McGee

Much worse today than 2 years ago. LOL!

37

posted on

01/25/2008 6:40:30 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Travis McGee

Yeah, it's all a big joke. Laugh it up, genius. You said we were doomed two years ago. Or has it been longer? Are we doomed yet?

It's true, we will eventually have a recession. Does that mean you were right the whole time? Even if it's 5 years after your prediction? 7 years later? 10 years later?

38

posted on

01/25/2008 6:43:15 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

Those charts are meant to prove that all is well today?

Wow, I want some of what you’re smoking!

39

posted on

01/25/2008 6:43:48 AM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Travis McGee

Those charts are meant to prove that all is well today? No, they're meant to show you may not have proved your point in post #28.

40

posted on

01/25/2008 6:47:45 AM PST

by

Toddsterpatriot

(Why are protectionists so bad at math?)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-49 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson