To: mysterio

No, we should stop borrowing and devaluing our dollar. How about if the EU stops inflating the Euro.

It's all relative and the slide in the dollar has been a very good thing for the US manufacturing and exporting sector.

12 posted on

12/14/2007 11:31:51 AM PST by

Ditto

(Global Warming: The 21st Century's Snake Oil)

To: Ditto

Exactly and the Europeans are very unhappy about the disparity between their currency and ours because it is killing their sales to us.

To: Ditto

It's all relative and the slide in the dollar has been a very good thing for the US manufacturing and exporting sector.

Well, that's good. Because for the rest of us, it's been a nice little pay cut.

19 posted on

12/14/2007 11:42:13 AM PST by

mysterio

To: Ditto

You are right that it is all relative, but part of the reason for the deflation of the Dollar and the inflation of the Euro is simply competition. For the longest time, the Dollar was the only real hedge currency. Since the advent of the Euro (and let's face it, a currency backed by the productivity of multiple first world countries is going to be strong) there has been competition for hedge currencies. Considering we were the only good hedge currency for the longest time, it is a natural move that will balance out over time.

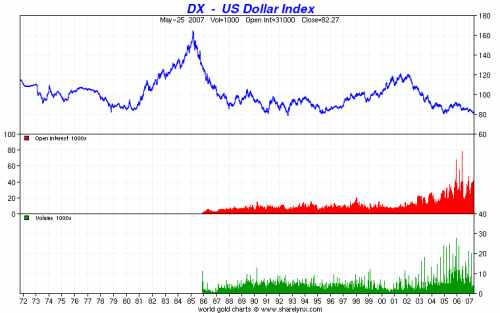

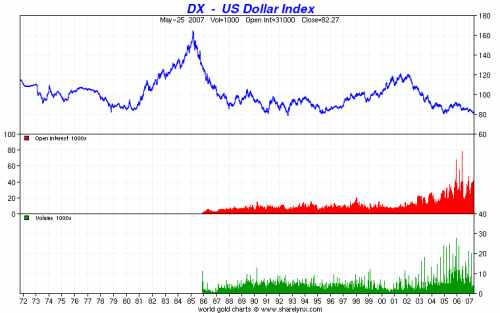

I would urge caution about jumping 'in bed' with doomsayers who point to the short term change a some sign of collapse. They are not much different than global warming followers who look at the short term data to try to describe long term issues. They always come out of the woodwork the days the dollar falls and ignore the long term.

This is a long term chart of real world Dollar valuation.

21 posted on

12/14/2007 11:46:46 AM PST by

mnehring

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson