Skip to comments.

From bust to bounty (Tens of billions of barrels of oil in ND and Mont)

Twincities.com ^

| 12/09/2007

| LESLIE BROOKS SUZUKAMO

Posted on 12/09/2007 7:05:16 AM PST by saganite

The oil industry has known for decades that there was oil in North Dakota's Bakken Formation. But until recently, few thought it was worth chasing.

The Bakken, an immense blanket of rock that covers about 200,000 square miles, stretching from Saskatchewan to straddle western North Dakota and eastern Montana, has long frustrated efforts to extract its oil.

The oil was two miles down and trapped in tightly packed horizontal layers of shale that were easy to miss with conventional drilling.

By 1999, when oil prices were low, the industry had largely given up on North Dakota, recalls Ron Ness, president of the North Dakota Petroleum Council: For the first time since the discovery of its oil in 1951, no oil rigs were drilling new wells anywhere in the state. "It was devastating," he said.

Fast forward to 2007. On the day before Thanksgiving, Ness counted 54 rigs in the field, almost half of them clustered around Parshall, a farming community of about 1,000 people 60 miles southwest of Minot.

The turnabout is due to a combination of factors: new discoveries, new technology that puts previously unattainable oil within reach and high oil prices that make the search for oil economically worthwhile.

The new curiosity about North Dakota oil was sparked last year, when an oil exploration company, Houston-based EOG Resources, revealed that a well it had drilled into an oil-rich layer of shale below Parshall is expected to produce 700,000 barrels of oil.

Now rigs are arriving almost weekly, and farmers with the right pieces of land can become millionaires just by selling their mineral rights and collecting royalties. A year from now, if a study by the U.S. Geological Survey pans out, the state could see even more activity. Intrigued by the drilling around Parshall, the USGS is going to try next year to recalculate the oil potential of a geological formation called the Williston Basin, which includes the Bakken Formation below it.

The USGS wants to check out an estimate by the late Denver-based USGS geochemist Leigh Price, who wrote in 1999 that the Bakken's shale potentially contained 413 billion barrels of oil. By comparison, Alaska's North Slope, the nation's largest oil resource, holds between 50 billion and 70 billion barrels of oil.

Price died before the paper could be reviewed by fellow scientists and published, but his estimate has created quite a buzz in the industry.

"It's mind-boggling," said Lynn Helms, director of the North Dakota Department of Mineral Resources.

The Bakken's oil would appear to dwarf that of Alaska, but Alaskan oil is much easier to get out of the ground. Federal geologists estimate that about 30 percent to 50 percent of the Alaskan oil is recoverable, or a mean of about 26 billion barrels.

The Bakken's shale is so tight that only 1 percent to 3 percent of it may be recoverable using present-day technology, Helms said. That would come to about 4.1 billion to 12.3 billion barrels.

By comparison, ANWR, the Alaska National Wildlife Reserve, holds about 10.4 billion barrels of technically recoverable crude, according to USGS estimates.

"The Bakken is one of the worst rock (formations) on the planet," Helms said.

Still, with North Dakota crude fetching $78 a barrel lately, there could be serious money to be made.

It's that potential that is driving the renewed interest in North Dakota, with Parshall at its center. "This is probably one of the top two or three oil plays in the U.S. today," said Ness.

Wayzata-based Northern Oil and Gas is just one of several oil exploration companies hoping to cash in on Parshall's potential. The startup says it is one of the largest holders of mineral rights in the area, after EOG. In a joint venture with Austin, Texas-based Brigham Exploration, Northern Oil drilled its first well in Parshall last month.

Michael Reger, Northern Oil's CEO, grew up in an oil-industry family in Billings, Mont. By this time next year, he predicts, the wheat and grazing land around Parshall will have a well every few miles. Each well needs a whole 640-acre section because the pipe has to extend nearly a mile or more from the starting hole to make it efficient.

Horizontal drilling technology has made it possible to recover oil from the tight shale of the Bakken Formation, which has been estimated to contain 413 billion barrels of oil. By comparison, Alaska's North Slope, the nation s largest oil resource, holds between 50 billion and 70 billion barrels. (JOHN DOMAN, Pioneer Press)drilling, introduced about a dozen years ago, has given the oil industry a way to finally extract oil from the Bakken's shale and other places where it was once almost impossible.

As the drill reaches the sedimentary rock roughly 9,000 feet below the surface, it begins a gradual 90-degree turn into the layer for another mile, exposing more pipe to the shale for greater collection.

In the last few years, drillers added fracture technology to horizontal drilling. In fracture technology, mud is forced into the drilled hole under immense pressures to "frack" or break up the shale further. The deeper cracks allow more oil to flow to the pipe.

The advent of horizontal technology made drilling the Bakken practical, but it was the rise in crude oil prices that made it attractive. When North Dakota's oil industry tanked back in the 1990s, prices for its native crude fell to as low as $3 a barrel.

This year, honey-colored North Dakota crude hit an all-time high of $88.68 a barrel on Nov. 23, the day after Thanksgiving, Helms said.

"The technology and the high commodity prices met at the right time," Ness said.

In 2005, before the Parshall wells had even been drilled, the state's $4 billion oil industry was contributing $280 million in taxes and throwing off another $280 million in royalties and lease payments, according to the petroleum association.

The association expects that the increased activity in the state will spur the oil industry to hire 12,000 more people, from roughnecks to geologists to truck drivers, over the next four years.

Annual salaries for the industry average about $60,000, about double the state's average, Ness said.

And although North Dakotans tend to avoid displays of extravagance, anecdotes of sudden oil wealth are starting to trickle in. "In Mountrail County, you're making millionaires out of farmers and ranchers there on a monthly basis," Ness said. "It's going to change the economy of the area for a significant time ahead."

Of course, not every county is a Mountrail and not every farmer a millionaire. The results from Dunn and Divide counties, where similar exploration efforts are underway, so far aren't as rosy as in Mountrail, he said.

And because the Bakken oil isn't easy to reach, it will take decades to realize the full potential of the formation.

"Getting it out is a problem - we've just barely figured out how to do that, so recovery is going to be very, very slow," said Helms of the state's mineral resources department.

The bustle of activity has piqued the interest of Mountrail County residents.

John O'Neill, 52, is the rig manager for Nabors Building, which is drilling a well for Northern Oil and Gas and Brigham Exploration. He is from Williston, but said his wife grew up three miles from the site and her family owns 14 quarter-acres nearby.

"So I'm really curious what this is going to do," he said, nodding to the drilling rig.

Maybe his in-laws are sitting on valuable mineral rights, he said. If so, he joked, maybe his wife won't need him anymore. He gives a hearty laugh.

"Everybody's pretty excited," O'Neill said. "But a lot of them don't know what to think."

TOPICS: Business/Economy; News/Current Events; US: Montana; US: North Dakota

KEYWORDS: bakken; blackgold; drilling; energy; montana; northdakota; oil; texastea

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-97 next last

To: Smokin' Joe

Thanks. Most informative and by your description much more promising than I had believed. I wish someone with your sort of knowledge had written the article.

61

posted on

12/09/2007 6:17:49 PM PST

by

R W Reactionairy

("Everyone is entitled to their own opinion ... but not to their own facts" Daniel Patrick Moynihan)

To: R W Reactionairy

Thanks!

There are not many writers out there with close to 30 years doing wellsite geology or who have examined nearly 100 miles of this formation, one 30 ft. sample at a time.

Most journalists butcher technical articles, anyway.

It only makes me wonder how bad the ones are which cover areas out of my expertise.

62

posted on

12/09/2007 6:52:02 PM PST

by

Smokin' Joe

(How often God must weep at humans' folly.)

To: Cobra64

A lot of that oil (in the older CA fields) is still there: The easy barrels (first 25%-30%) have been pulled out, but the rest of the rock “refills” from untapped zones back to the pumped regions and you can begin begin pumping/fracturing/pressurizing & sucking it out again after several years.

If they let you drill at all, that is.

63

posted on

12/09/2007 7:01:12 PM PST

by

Robert A Cook PE

(I can only donate monthly, but Hillary's ABBCNNBCBS continue to lie every day!)

To: saganite

The most optimistic estimates for the Bakken are over 400 BILLION barrels.

64

posted on

12/09/2007 7:05:29 PM PST

by

stboz

To: Smokin' Joe

It only makes me wonder how bad the ones are which cover areas out of my expertise.

Anytime I have been close to a story I have been amazed at the inaccuracies in the press. I’m generally happy if they get the generalities right.

65

posted on

12/09/2007 7:08:36 PM PST

by

saganite

To: Combat_Liberalism

Germany’s synfuel project was based upon coal so far as I recall...... South Africa has also done a lot in this area. It’s more expensive than getting it from the ground (if you have the oilfields to drill), but with the current price of oil maybe synfuel diesel from coal will become a big thing. Is anyone in the USA trying to do this yet?

66

posted on

12/09/2007 7:15:11 PM PST

by

Enchante

(Democrat terror-fighting motto: "BLEAT - CHEAT - RETREAT - DEFEAT - REPEAT")

To: stboz

Actually, the most optimistic estimates by a geoligist named Price put it at 500 billion barrels with 50% of that being recoverable. Others are more conservative in their estimates. A USGS survey is due next year which could help clarify it.

67

posted on

12/09/2007 7:21:40 PM PST

by

saganite

To: saganite

I work for an agchem company and we have locations in North Dakota and eastern Montana. We can’t begin to hire truck drivers to deliver our products.....everyboy’s gone to the oil patch.

68

posted on

12/09/2007 7:30:50 PM PST

by

stboz

Comment #69 Removed by Moderator

To: Baynative

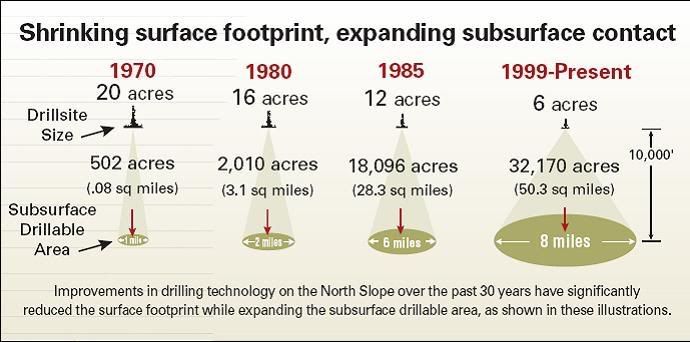

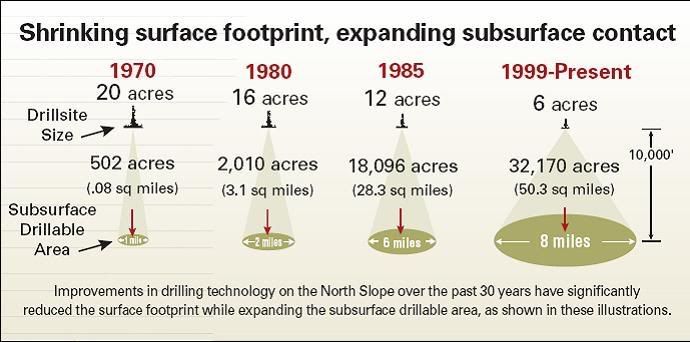

If it's proven safe and clean that a six sq. mile area can be drained from one production pad, what would that mean to their fight to keep ANWR off limits? A lot bigger area than that is already in production on the Alaskan North Slope. This isn't a theory. It is existing production sites in the Alpine Area on the Western North Slope.

http://www.conocophillipsalaska.com/ArcticEnergy.pdf

BP is going to be able to reach 8 miles horizontally with the new drill rig they are having built for the North Slope.

30 STRONG: UERD for offshore development

http://www.petroleumnews.com/pnads/48009602.shtml

...But Liberty drilling will likely achieve world records for extended reach drilling, with horizontal departures from the wellheads of up to 44,000 feet or more.

“Drilling studies support departures of 34,000 to 44,000 feet,” BP has said...

70

posted on

12/10/2007 9:29:35 AM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

I think I remember reading some time ago that the oil companies were planning to drill in the Beaufort Sea and tap the oil in ANWAR this way until they were shut down with new requirements to prove they will never spill a drop of oil. Does that ring a bell?

71

posted on

12/10/2007 10:05:04 AM PST

by

saganite

To: saganite

Shell has been doing some drilling in the Beaufort Sea including offshore of ANWR this past year. There have been protests and delays from complaints concerning the whales.

72

posted on

12/10/2007 10:08:34 AM PST

by

thackney

(life is fragile, handle with prayer)

To: Smokin' Joe

73

posted on

12/10/2007 11:12:28 AM PST

by

CPT Clay

(Drill ANWR, Personal Accounts NOW , Vote Hunter in the Primary)

To: thackney

Conoco announced $1 billion of exploration in Alaska for next year, and a whole lot more elsewhwere.

74

posted on

12/10/2007 11:13:49 AM PST

by

RightWhale

(anti-razors are pro-life)

To: saganite

A true miracle - high oil prices and new technologies converge!!!!

75

posted on

12/10/2007 11:19:04 AM PST

by

ZULU

(Non nobis, non nobis Domine, sed nomini tuo da gloriam. God, guts and guns made America great.)

To: Baynative

Their fight is not based on facts, nor is it based on anything approaching common sense.

Unfortunately, unlike here, ANWR has no crowd of indigenous residents who can come to the meeting and tell those people to go home, back to wherever they live, and leave us alone.

More unfortunately, this allows the "activists" to claim to "speak for the environment", not to mention all the wee beasties and plants.

When the "Buffalo Commons" bunch came through here, they were politiely treated, but their ideas recieved the well-deserved derision they should have. And they went back to New Jersey with their grand plan for the Northern Prairie of herding people into town and letting the rest go to seed.

They even tried to make a dozen or so small parcels of land into Designated Wilderness Area, an idea which failed when a few of us marked the areas on the map and saw that it made a continuous strip through part of Southwestern North Dakota, one which would have shut down oil drilling and ranching in a much larger area.

Of course, the legal descriptions of those parcels as presented did not strike a note, at least until one realized that parcel 9 abuts parcel 1, and so on, which inspired the map.

It isn't just ANWR, and it isn't just oil.

76

posted on

12/10/2007 11:22:51 AM PST

by

Smokin' Joe

(How often God must weep at humans' folly.)

To: stboz

If anyone here does not have a job, they don't want one. Everyone is short handed, especially retail and fast food.

Housing is short, too, but there are a lot of places up for sale (and yes, the local market is inflated compared to a few years ago--but not out of line with national averages.)

77

posted on

12/10/2007 11:27:13 AM PST

by

Smokin' Joe

(How often God must weep at humans' folly.)

To: saganite

...they were shut down with new requirements to prove they will never spill a drop of oil.Now go look at your average paved parking space and tell me that is reasonable.

78

posted on

12/10/2007 11:30:26 AM PST

by

Smokin' Joe

(How often God must weep at humans' folly.)

To: thackney

Nice diagram, but 502 acres is 0.8 square miles, not .08 (640 acres to the secion)

79

posted on

12/10/2007 11:32:12 AM PST

by

Smokin' Joe

(How often God must weep at humans' folly.)

To: Smokin' Joe

Well, I was exaggerating a bit but my driveway is a class one oil spill if that criteria is used. ;^)

80

posted on

12/10/2007 11:33:19 AM PST

by

saganite

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-97 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson