Posted on 11/20/2007 4:40:40 AM PST by DeaconBenjamin

The dollar fell to a record low against the euro on Tuesday as rumours swept the currencies markets that the Federal Reserve was set to deliver an emergency cut in US interest rates.

Traders said the talk was that that the Fed would cut interest rates when it released its new growth forecasts and the minutes from its October meeting at 19.00GMT.

The dollar fell 0.9 per cent to an all-time low of $1.4797 against the euro, dropped 0.7 per cent to $2.0640 against the pound and lost 0.8 per cent to SFr1.1070 against the Swiss franc.

Neil Mellor at Bank of New York Mellon dismissed the speculation, however.

“The Fed will want to keep its options open,” he sad. “By introducing an emergency rate cut, it would send the wrong message out to the market and seriously undermine its credibility.”

Indeed, David Woo at Barclays Capital said the likelihood was that Fed’s economic projections would be more upbeat than expected.

“With the market relatively confident about the prospects for a rate cut in December, the risk is these expectations will be disappointed somewhat, which would be positive for the dollar,” he said.

Meanwhile, stability on Asian equity markets put pressure on the yen as a pick-up in risk appetite saw the yen give back Monday’s gains.

Analysts said heightened risk appetite had prompted renewed demand for carry trades, in which the low-yielding yen is sold to finance the purchase of higher-yielding, riskier assets elsewhere.

The yen fell 0.3 per cent to Y110.10 against the dollar, lost 1.1 per cent to Y162.88 against the euro and dropped 1.1 per cent to Y227.29 against the pound.

However, Derek Halpenny at Bank of Tokyo-Mitsubishi said yen sell-offs were becoming less convincing by the day and he doubted the return of risk appetite would be prolonged.

He said the key signal of impending trouble for the financial markets in August was the sudden loss of liquidity in the money markets that triggered a spike in short-term money market rates.

“The very same development is now taking place again,” he said. “With financial markets in stress again, the scope for yen weakness looks limited.”

When Paul Volker got us out of Jimmy Carter's mess our trade deficits were very small, most oil we used was domestic and there wasn't as much personal debt, governmental debt and money owed to foreigners. The United States had much better underlying health. Much much more of what you bought week to week was made in USA from tools, to clothing, to food

Why are you so paranoid about the "big boys"? Were you fired from a big WS firm or something? Every time you answer one of my posts you ignore 90% of it when I mention a big WS firm and go on a rant that sounds more like class warfare than anything else.

Maybe the reason they haven't bought futures today is because they were so wrong in their call a month ago. They were advising their clients that the RSI's on foreign currencies were out of control high and should be sold. So far they have been enormously wrong.

And, no, they haven't been able to manipulate the currency market to steal money from you.

Or maybe it’s just history’s big wheel coming around. Grand super cycles and all that.

Exactly.

Almost prophetic isn’t it?

The Japanese markets are liquid; just how liquid ask anyone who has placed an out-of-whack order and got hammered immediately. Mizuho is probably the most famous case in recent years (they mistakenly offered to sell 610,000 shares for 1 yen rather than 1 share for 610,000 yen! --- I think it ended costing them some $300 million), but there are others.

Why we love the Mizuho Securities 40 billion Yen data entry error

Alright! I can see the OPEC demanding trades in yen at the Central Japan Commodity Exchange.

yitbos

You were the one who stated that the dollar is oversold, not me. If it is then it is an opportunity. If it is not then it is not. No I am not paranoid, and I don't think that the "big boys" can push currency markets around, and that is the whole point. The dollar isn't "oversold," in my view, but rather all that paper we have pushed out over the years is now coming home. If there is a lot more out there, then we are not at a market bottom, and the decline will continue.

You think my ire is focused on Wall Street. You are dead wrong. I am focused on the Fed. I think that what they have done is a scandal, and has been for a long time. I am amazed how many folks, big banks, are taking big losses.

A lot of folks here, you seem to be included, keep telling us everything is ok, and then another bank, Freddie Mac, even Swiss Re, anounces multi-$B writeoffs.

But, the Fed doesn't do this stuff all by itself and Wall Street is a part of the system. People have been making a lot of money doing a lot of irresponsible things for an awfully long time. And most of them don't even understand where their money came from. They think they earned it. Now, I admit that making a lot of money through investments is hard because you can make mistakes and there are people out to get you, and markets can go against you. But at the end of the day, when people add up their gains across the city, how much of that is earned the old fashioned way, and how much of it just came off the printing press?

When it comes through investment in the engines of commerce, it is earned. When it comes off the printing press, it came out of my pocket.

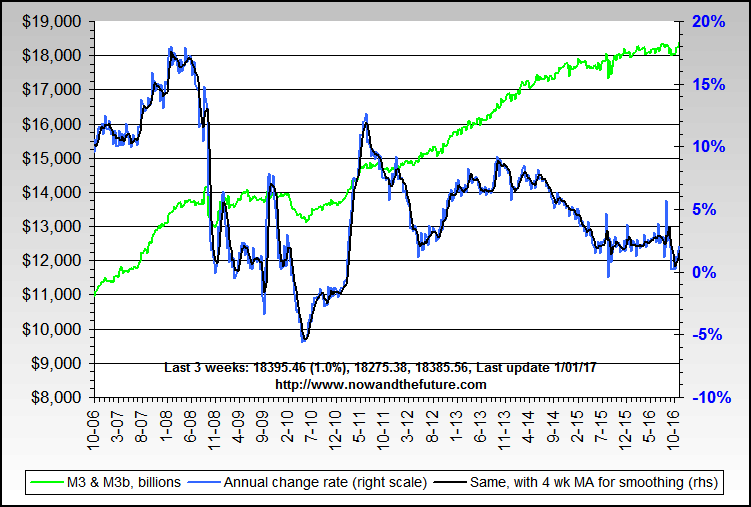

The plot of M3 above shows that there has been an awful lot of printing, which is a simple enough explanation for why the US$ is falling.

You know, I actually have some respect for groanup. I think he is trying to explain away some things that are clear to anyone who looks and that just don’t seem to be going away. He is a bit condescending, talks too quickly and listens not enough, but for the most part I think he knows what he is talking about and I am learning from the argument with him. You on the other hand are like a sniveling little brat cheering on the schoolyard bully. You haven’t said an intelligent thing in about 300 posts.

Like I said, all we have had from you for 300 posts is sniveling BS. I know you think me an idiot, but if you don’t post something intelligent all of the spectators around here are going to think you an idiot too.

When the Fed buys Treasuries from a Primary Dealer, they pay cash. How can you claim they're charging a preferential rate? Only someone who is too stupid to know the difference between a purchase and a loan would say that.

I guess the spectators now see that you are a moron. So whine some more, you're better at that then discussing Fed policy.

If you do see a counter-trend rally in the dollar, it won’t be because the dollar is gaining in absolute value, but rather that it is temporarily falling more slowly than the Euro or the Yen.

Since all the central banks are inflating massively to avoid a deflationary collapse, all currencies have a decline in real terms baked in (though they will all fall at different rates).

Federal Funds

* Federal funds, or fed funds, are unsecured loans of reserve balances at Federal Reserve Banks that depository institutions make to one another. The rate at which these transactions occur is called the fed funds rate.

* The most common duration or term for fed funds transaction is overnight, though longer-term deals are arranged.

* The Federal Open Market Committee (FOMC) sets a target level for the fed funds rate, which is its primary tool for implementing monetary policy.

Fed Funds Transactions Redistribute Bank Reserves Fed funds are unsecured loans of reserve balances at Federal Reserve Banks between depository institutions. Banks keep reserve balances at the Federal Reserve Banks to meet their reserve requirements and to clear financial transactions. Transactions in the fed funds market enable depository institutions with reserve balances in excess of reserve requirements to lend them, or “sell” as it is called by market participants, to institutions with reserve deficiencies. Fed funds transactions neither increase nor decrease total bank reserves. Instead, they redistribute bank reserves and enable otherwise idle funds to yield a return. Technical details on fed funds are described in Regulation D.

Participants in the fed funds market include commercial banks, thrift institutions, agencies and branches of foreign banks in the United States, federal agencies, and government securities dealers. Many relatively small institutions that accumulate reserves in excess of their requirements lend reserves overnight to money center and large regional banks, and to foreign banks operating in the United States. Federal agencies also lend idle funds in the fed funds market.

Other financial institutions serve as intermediaries in the market by borrowing and lending funds on the same day, usually channeling funds from relatively small to large depository institutions. Several broker firms that neither borrow nor lend funds arrange transactions between lenders and borrowers in order to earn commissions.

Fed Funds Transactions Fed funds transactions can be initiated by either a funds lender or a funds borrower. An institution seeking to lend fed funds identifies a borrower directly, through an existing banking relationship, or indirectly, through a fed funds broker. The most commonly used method to transfer funds between depository institutions is for the lending institution to authorize its district Federal Reserve Bank to debit its reserve account and to credit the reserve account of the borrowing institution.

The most common type of fed funds transaction is a very short-run loan between two financial institutions; some transactions, however, have longer-term maturities. Most overnight loans are booked without a contract. The borrowing and lending institutions exchange verbal agreements based on various considerations, particularly their experience in doing business together, and limit the size of transactions to established credit lines in order to minimize the lender's exposure to default risk. Such arrangements facilitate speedy processing at the lowest possible transaction cost.

Overnight fed funds transactions under a continuing contract are renewed automatically until termination by either the lender or the borrower. This type of agreement is used most frequently by correspondent banks that borrow overnight fed funds from a respondent bank. Correspondent banks are typically larger institutions that provide services, such as managing funds, to smaller, respondent banks. Unless notified by the respondent to the contrary, the correspondent will continually roll the inter-bank deposit into fed funds, creating a longer-term instrument of open maturity.

Fed Funds in Monetary Policy By facilitating the transfer of the most liquid funds among depository institutions, the fed funds market plays a major role in the execution of monetary policy. The interest rate on fed funds, the fed funds rate, is sensitive to Federal Reserve open market operations that influence the supply of reserves in the banking system. In fact, the directive for implementation of U.S. monetary policy from the FOMC to the Federal Reserve Bank of New York states that the trading desk should “create conditions in reserve markets” that will encourage fed funds to trade at a particular level. Fed open market operations change the supply of reserve balances in the system, and by affecting the supply of balances, the Fed can create upward or downward pressure on the fed funds rate.

In formulating monetary policy, the Federal Reserve sets a target level for the fed funds rate, and the Fed's announcements of changes in monetary policy specify the changes in the Fed's target for that rate. It is important to note that the fed funds rate is determined by market participants, and is not actually "set" by the Fed.

Movements in the fed funds rate have important implications for the loan and investment policies of all financial institutions, especially for commercial bank decisions concerning loans to businesses, individuals and foreign institutions. Financial managers compare the fed funds rate with yields on other investments before choosing the combinations of maturities of financial assets in which they will invest or the term over which they will borrow. Interest rates paid on other short-term financial securities—commercial paper and Treasury bills, for example—often move up or down roughly in parallel with the funds rate. Yields on long-term assets—corporate bonds and Treasury notes, for example—are determined in part by expectations for the fed funds rate in the future.

August 2007

You are the one who is confusing treasury purchases, repos, and federal funds transactions and throwing up a cloud of dust.

Thanks for proving my point.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.