Most of the crises experienced over the last 15 years, beginning with the Persian Gulf crisis of 1990, were related to problems outside the United States.

There was a flight of safety into U. S. Treasury bonds by some domestic investors, but also by international ones. This, in turn, tended to strengthen the U.S. dollar in times of crisis. However, with the Fed again embarking on a massive money printing operation would foreign investors still consider the U. S. dollar and U. S. bonds to be safe? I doubt it.

Under such circumstances a far more likely outcome would be a rapid sell-off of the dollar and, along with it, selling off U. S. bonds. In the wake of massive selling of bonds by foreign investors, interest rates would likely rise and a further loss of confidence in the dollar would follow.

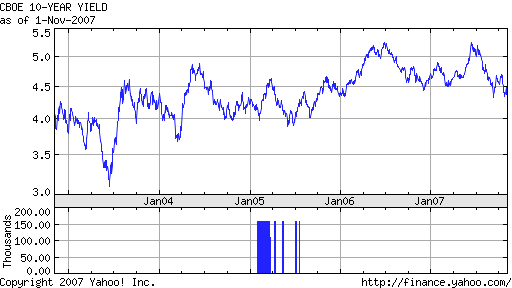

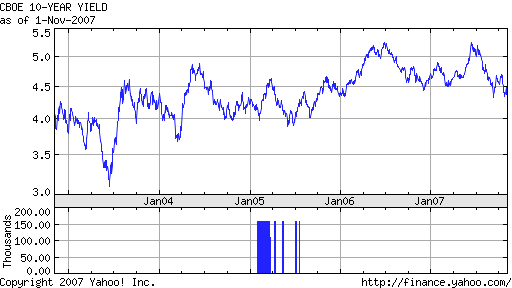

However, with the Fed again embarking on a massive money printing operation would foreign investors still consider the U. S. dollar and U. S. bonds to be safe? I doubt it. M3 has increased substantially over the past five years but the 10-year is yielding just under 4.5% today. When is all this printing of money going to be reflected in the bond market?

Under such circumstances a far more likely outcome would be a rapid sell-off of the dollar and, along with it, selling off U. S. bonds

Sounds like these circumstances have already happened. If bonds haven't sold off yet, when will they? It looks like we need to be a lot more patient than you are suggesting.