I conceded that no government could reach the ideal goal of matching their full money supply (M3) by crunching only the numbers for the physical currency in circulation (only part of M1). But you don't deal with the reason the U.S. was forced off the gold standard:

"The US gold reserves had declined from a peak of 21,682 tonnes in 1948 to 15,821 tonnes by 1960. By the time Nixon closed the gold window, US reserves had dropped below 8,500 tonnes. Nixon could not risk any further depletion of US gold reserves."Source

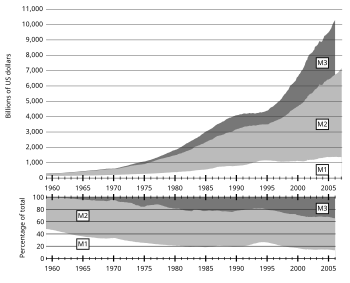

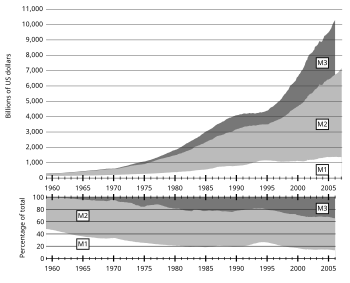

US gold reserves are even lower today and both the total money supply (M3) and currency in circulation has grown exponentially.

Source

In 1971, when Nixon was forced to take us off the good standard - due to demands at the gold window - M3 was less than just today's currency component of the M3 (about $700 billion) and M1 (currency and checking accounts together) was around $100 billion.

To see viable numbers for maintaining a gold standard look at 1960. Gold reserves were 15,821 tons and M3 was less than $100 billion. At $35/oz that was $18 billion gold reserves for total money supply (M3) of $100 billion or 18%.

With today's $10,000 billion of M3, 18% would be $1,800 billion dollars of gold reserve. At $735/oz that's 76,530 tons of gold reserve. And yet today our 8,200 ton gold reserve is even less than even 1971 - when Nixon was forced to abandon the gold standard.

How could the U.S. open the gold window without a further depletion of the reserve forcing it to either close it again or make massive purchases of gold and causing an extreme increase in the price of gold and an extreme devaluation of the dollar?

As for the stupidity of questioning Ron Paul's personal motives and financial ambitions... His investments in gold while advocating a return to the gold standard is either dishonest, if he expect gold to benefit from his position, OR stupid, if he expects it to suffer from that position.

For you to believe this conflict of interest should not be questioned is beyond stupidity.

****In 1971, when Nixon was forced to take us off the good standard - due to demands at the gold window - M3 was less than just today’s currency component of the M3 (about $700 billion) and M1 (currency and checking accounts together) was around $100 billion.

To see viable numbers for maintaining a gold standard look at 1960. Gold reserves were 15,821 tons and M3 was less than $100 billion. At $35/oz that was $18 billion gold reserves for total money supply (M3) of $100 billion or 18%.*****

Most banks, today, operate on a fractional reserve of 5% or less. It is a matter of confidence.

***With today’s $10,000 billion of M3, 18% would be $1,800 billion dollars of gold reserve. At $735/oz that’s 76,530 tons of gold reserve. And yet today our 8,200 ton gold reserve is even less than even 1971 - when Nixon was forced to abandon the gold standard.****

Nixon closed the gold window because several nations, mainly France, were trading in paper dollars for gold. LBJ and the Federal Reserve had a guns and butter policy during the 60’s, and we were flooding Europe with “Euro Dollars.”

****How could the U.S. open the gold window without a further depletion of the reserve forcing it to either close it again or make massive purchases of gold and causing an extreme increase in the price of gold and an extreme devaluation of the dollar?*****

You just have to look at the civil war period when we went off the gold standard. The US just printed enough dollars to get what they wanted and inflation was very high for the times. After the civil war, the US went back to the gold standard and there was a period of deflation. If there are too many dollars in circulation, people will turn them in for gold. If there are too few dollars in circulation, then people will turn in gold to get more dollars.

****As for the stupidity of questioning Ron Paul’s personal motives and financial ambitions... His investments in gold while advocating a return to the gold standard is either dishonest, if he expect gold to benefit from his position, OR stupid, if he expects it to suffer from that position.

For you to believe this conflict of interest should not be questioned is beyond stupidity.****

When people invest in stocks, it is because they expect the value of the stock to increase in future years. If we would return to a gold standard, the value of gold would be exactly the same 10 years from now as it is today. E.g. the value of gold, in US dollars, was the same from the early 1800’s until the early 1930’s.

We could also do a quasi gold standard, by just targeting our money supply to the price of gold. If the price of gold is increasing, we would print fewer dollars or take more dollars out of circulation. If the price of gold was decreasing, we would print more dollars. Using the price of gold to regulate our money supply would take the value of our currency out of the hands of whims of the head of the federal reserve.