To: richalessi

History has shown that socialism fails because centrally planned economies cannot factor in all the variables to price things correctly, the way free markets can.

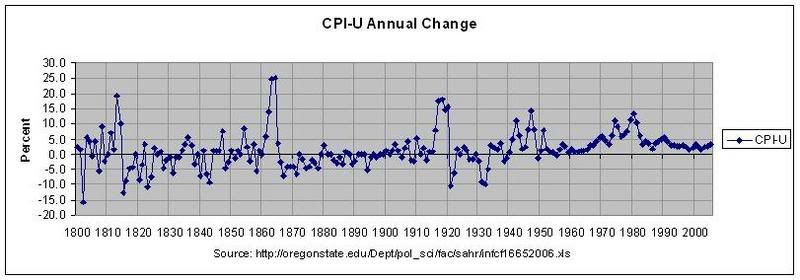

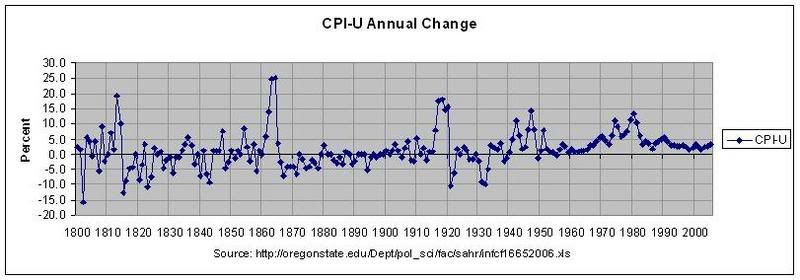

Yeah, just look at all that price stability we had under the gold standard. The Fed has done a pretty good job managing monetary policy through interest rates since 1982. That stability has helped create the environment for capital formation and innovation that has made our economy and net worth dramatically increase since.

In addition to its central planning gig, the fed’s other main job is to “sell” the $US by understating inflation. Core or Headline, it doesn’t matter, the published inflation rates are far below reality.

Is that why our the 10-year T-bill is yielding just 5%? Because inflation is so much higher than what's being reported? All those people who make money buying and selling bonds, who have access to so much information, are all, in reality, losing huge amounts of money because they don't know what the real rate of inflation is? But you do? Sorry. That horse doesn't ride.

46 posted on

07/19/2007 9:35:39 AM PDT by

Mase

(Save me from the people who would save me from myself!)

To: Mase

You didn’t answer my question. Do you think interest rates should be centrally managed or set by the free market?

I don’t know that commenting on tbond prices would be helpful. If you don’t think inflation is higher than 5%, you also are not likely to understand the reasons why bond rates are not higher (hint - if you want to “set” or “control” interest rates, you buy bonds to keep rates down. look at the balance sheet of the fed and see how their inventory of bonds has been piling up. they are printing money to buy these bonds - this will cause yet more inflation)

To: Mase

“Is that why our the 10-year T-bill is yielding just 5%? Because inflation is so much higher than what’s being reported? All those people who make money buying and selling bonds, who have access to so much information, are all, in reality, losing huge amounts of money because they don’t know what the real rate of inflation is? But you do? Sorry. That horse doesn’t ride.”

One more piece of advice for you:

Keep all your assets in cash, earning 5%. Check back with us in 5 years and see if you can purchase the same amount of energy, health care, food, higher education as you can today. You’ll then understand that central planners frequently hold “real” interest rates below the rate of inflation.

If you don’t want to wait 5 years to find out how poorly cash is holding up its purchasing power, do a thought experiment and roll back 5 years ago to 2002. If you had kept any amount of cash earning the sub-5% interest rates of the time, do you think you could buy the same amount of goods today?

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson