Skip to comments.

Budget Deficit Drops to $250 Billion

AP ^

| October 6, 2006

| ANDREW TAYLOR

Posted on 10/06/2006 10:19:40 AM PDT by West Coast Conservative

The federal budget estimate for the fiscal year just completed dropped to $250 billion, congressional estimators said Friday, as the economy continues to fuel impressive tax revenues.

The Congressional Budget Office's latest estimate is $10 billion below CBO predictions issued in August and well below a July White House prediction of $296 billion.

The improving deficit picture _ Bush predicted a $423 billion deficit in his February budget _ has been driven by better-than-expected tax receipts, especially from corporate profits, CBO said.

TOPICS: Breaking News; Business/Economy; Government; News/Current Events

KEYWORDS: 47; bush; deficit; itstheeconomy; legacy; socialistsnightmare; success; taxes; thebusheconomy

Navigation: use the links below to view more comments.

first previous 1-20 ... 81-100, 101-120, 121-140 ... 221-224 next last

To: West Coast Conservative

No I'm not a liberal spy, but we should be excited when we have a surplus. A 250 billion deficit is still a deficit, and a bad one at that.

The GOP needs to curb the spending bigtime.

No this isn't IBTZ or anything like that, I'm just sick of the excitment of a 250 billion deficit when the bums in Congress should be cutting back on spending.

101

posted on

10/07/2006 12:05:50 AM PDT

by

Dengar01

(Go White Sox!)

To: sappy; FreeReign; stultorum; groanup; CharlesWayneCT; Rembrandt; Dengar01

according the dems, we did have a surplus when BJ was in office, which of course is NONSENSE. Looking at the total federal debt, that's true. Likewise, it's nonsense that Bush has cut the deficit to $250 billion. The following table shows the federal debt over the past decade as given by the Treasury Department:

TOTAL FEDERAL DEBT (billions of dollars)

Intra-

Fiscal Debt Held Gov't Total

Year End by Public Change Holdings Change Debt Change

---------- --------- -------- --------- -------- --------- --------

9/29/2006 4843.1 241.9 3663.9 332.4 8507.0 574.3

9/30/2005 4601.2 293.9 3331.5 259.8 7932.7 553.7

9/30/2004 4307.3 383.3 3071.7 212.6 7379.1 595.8

9/30/2003 3924.1 370.9 2859.1 184.1 6783.2 555.0

9/30/2002 3553.2 213.9 2675.1 206.9 6228.2 420.8

9/28/2001 3339.3 -66.0 2468.2 199.3 5807.5 133.3

9/28/2000 3405.3 -230.8 2268.9 248.7 5674.2 17.9

9/30/1999 3636.1 -97.8 2020.2 227.8 5656.3 130.1

9/30/1998 3733.9 -55.8 1792.3 168.9 5526.2 113.0

9/30/1997 3789.7 1623.5 5413.1

Source: U.S. Department of the Treasury, Bureau of the Public Debt,

online at http://www.publicdebt.treas.gov/opd/opdpdodt.htm

As can be seen in the last column, the total debt increased $574 billion in the fiscal year that just ended, over $20 billion MORE than it increased during the prior fiscal year. According to the third column, the debt borrowed from the public did increase $242 billion, $52 billion less than last year. However, the government borrowed over $72 billion more from Social Security and other trust funds, increasing the total borrowing by over $20 billion. So while it's true that entitlements represent a large problem in the future, Social Security and some other trust fund surpluses are currently masking our true deficit. Hence, the true deficit problem is not getting better and is currently caused by the general fund, not by entitlements.

Comment #103 Removed by Moderator

To: Dengar01

A 250 billion budget deficit for an economy of our size is nothing.

104

posted on

10/07/2006 5:19:15 AM PDT

by

Darkwolf377

(Republican, atheist, pro-life)

To: West Coast Conservative

105

posted on

10/07/2006 5:38:55 AM PDT

by

avacado

To: LASVEGASBRETT

Bush is insecure??

You must be stoned. AN insecure man would not be doing what he is doing in the WOT. Enduring the stones of the left, the insanity of the Euro people.

YOu may be contemptuous of his attempt to the the Pres of all the people, to not indulge in the kind of rhetoric that the left indulges in, but I believe, in the long run, it will pay off.

But this president is in no way insecure.

To: RacerF150; West Coast Conservative

To: West Coast Conservative

Lowering taxes has been the #1 CAUSE of this effect.

To: West Coast Conservative

" The good news was that job gains for both July and August turned out to bigger than previously estimated, taking some of the bite out of September's figures.

The report also showed that job growth during the 12 months ending in March may have been 45 percent higher than previously reported.

The Labor Department said payrolls for the 12 months that ended in March 2006 will be revised upwards by a whopping 810,000 jobs, the biggest revision since 1991. "

109

posted on

10/07/2006 8:12:24 AM PDT

by

george76

(Ward Churchill : Fake Indian, Fake Scholarship, and Fake Art)

To: West Coast Conservative

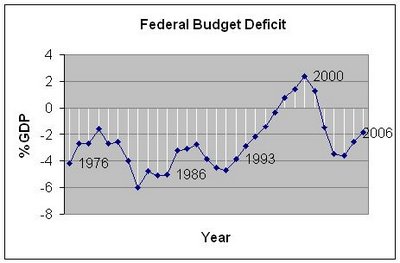

We are now well below the the average budget deficit over the last 30 years, which is 2.6%. And look at that trend over the last 3 years. It's better than anyone predicted as recently as 6 months ago. You can see that we had a surplus during the Clinton years, but everyone agrees that it was an illusion due in large part to the stock market bubble that finally burst shortly after Bush took office. The end of that speculative market, the attacks of 9/11, and the subsequent wars in Afghanistan and Iraq all took their toll on the federal budget. Viewed in that light, it is simply amazing that the deficit is as small as it is now.

Update on the Federal Budget Deficit

110

posted on

10/07/2006 8:24:00 AM PDT

by

bnelson44

(Proud parent of a tanker! (Charlie Mike, son))

To: SDGOP

Deficit = too much government spending

Surplus = too much taxation

111

posted on

10/07/2006 8:25:03 AM PDT

by

Toby06

To: bnelson44

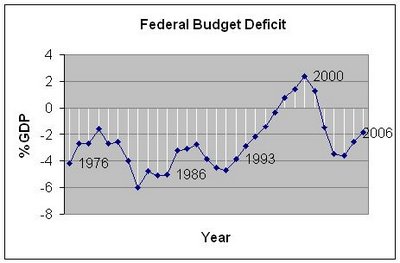

Oh, and here is another trend you've probably heard about:

This graph shows the Dow Jones Industrial Average from 1997 up to today. The market peaked in the year 2000, but then the bubble popped. As you can see, though, the market has been on its way back for a while now, so much so that it is in record-setting territory once again.

Let's see, GDP growth is strong, productivity is way up, unemployment is low, family incomes are rising, inflation is down, the stock market is up, and the federal deficit is down. Yet polls show that we are about to put more Democrats into both the House and the Senate. That should fix all of these economic problems, real quick.

Update on the Federal Budget Deficit

112

posted on

10/07/2006 8:33:00 AM PDT

by

bnelson44

(Proud parent of a tanker! (Charlie Mike, son))

To: OldFriend

"Much like the klinton kool aid drinkers, there are republicans who will never admit they've been wrong about our President."

They never were Republicans. Some may have been Rinos for awhile.

113

posted on

10/07/2006 8:44:31 AM PDT

by

Grampa Dave

(There's a dwindling market for Marxist Homosexual Lunatic wet dreams posing as journalism)

To: stultorum

The deficit was $568 billion in 2004, but masked by raiding SS surplus and postal service surpluses such that the publicized off-budget number was $412.7 billion.

The on-budget deficit for this year (the deficit before raiding SS surpluses) will be closer to $430 billion when they release those numbers. Mark my words.

Of course, that $430B would still look good compared to how things would look if the government had to report like every corporation does.

To: dinoparty

I call BS...

Nothing like raiding SS just so you can publish numbers at $250B when they should be more like $430B...

To: West Coast Conservative

This will be the lowest the budget fall unless the GOP retains both houses of congress

2% of GDP is better than any years of the 1970s and 1980s and 1990s up to 1997.

Where it not for the spending spluge we would ahve a balanced budget even with the tax cuts and 3% annual spending increases, including all the 911 spending

To: stultorum

It depends on how you count it - using either the off-budget numbers ($250B for the year just ended), 2000 came in at about a $90B surplus. Using on-budget numbers ( about $430B for the year just ended), there was an even greater surplus in 2000. So no, there was no huge deficit using either of these numbers - there were large surpluses.

However, if you use accounting methods like any large corporation, yes, there was a deficit (accounting for future benefits earned in the current year).

To: CharlesWayneCT

Not using on-budget or off-budget methods (off-budget is the scam they use to claim *only* a $250B deficit). Using those methods, there was a large surplus.

However, 2001 had unexpected challenges... But with a good economy, there is NO excuse for an on-budget deficit of $430B like we just racked up.

To: stultorum

Total on-budget deficits, FY 93-00: $1.004 trillion

Total on-budget deficits, FY 01-06: $2.380 trillion (approx, pending final 06 numbers, using $430B for 06 as an estimate)

So in aggregate, in 6 years of W, we have racked up 2.38 times as much debt as we did in 8 years of Clinton. $1.004 trillion is terrible. $2.380 trillion is horrific.

There is no fiscal conservative voice in DC.

To: Rembrandt

GW is NOWHERE near balancing the budget. He has about $430 Billion to go to achieve that.

Navigation: use the links below to view more comments.

first previous 1-20 ... 81-100, 101-120, 121-140 ... 221-224 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson