Posted on 04/19/2006 12:56:38 PM PDT by 1rudeboy

One year ago, the chorus of the consensus told America that the dollar’s exchange rate was due to fall in 2005. Under relentless assault from cheap Chinese imports and facing a record trade deficit, the dollar had nowhere to go but down. The influential Economist magazine went so far as to say, “[t]he deficit is unsustainable: sooner or later it will need to shrink, and that will involve a cheaper dollar.” Politicians and pundits predicted economic trauma at the hands of outsourcing. Time has proven them wrong. What the U.S. needed then and needs now is to stick to the reliable keys to growth: low tax rates, deregulation, limited government, and especially free trade.

A Dollar – Deficit Link?

The U.S. economy did set two records last year. First, 2005 saw a new record trade gap. Imports to the U.S. exceeded exports by $724 billion, or 5.8 percent of GDP. Second, more Americans were employed than ever before in history, arguing against those who preached doom and gloom.

The data continue to support our contention of last May that the trade deficit is not the signal to watch: “This is all wrong... Many economists and the weight of history suggest that the trade deficit, a symptom of investment capital inflows, is a sign of national economic strength.”[1] Additionally, two papers published last spring pointed out the lack of a historical relationship between currency values and trade deficits.[2] Indeed, despite the widening trade gap, the dollar gained value against other currencies.

The January 5, 2006, Economist admits that the dollar pessimists “were all wrong.” Yet the conventional wisdom of “trade hawks” is again resurgent, arguing that trade deficits are unsustainable and the dollar cannot hold. Last week, the government reported the third deepest trade gap on record, with imports outweighing exports by $65.7 billion. Current exchange rates, however, appear normal compared with exchange rates over the last few decades.

Unless Congress moves from protectionist rhetoric to protectionist legislation, there is no reason to expect the dollar to slide significantly. Trade flows are the “tail of the dog,” as Fed Chairman Ben Bernanke once explained. From time to time the dollar does fall when the world’s investors lose confidence in the superiority of America’s institutions and markets. Sadly, congressional hostility to the U.A.E. port deal was a bipartisan embarrassment and isn’t likely to reassure the world that America is as free and fair as it proclaims. Equally troubling is the Schumer-Graham proposal in the U.S. Senate to place trade barriers on imports from China.

The Chinese Invasion

According to the last week’s data from the Department of Commerce, the U.S. trade deficit with China was $13.8 billion in February. In 2005, the U.S. trade deficit with China grew by 25 percent to $202 billion. That amounts to nearly twice the $103 billion bilateral deficit in 2002. The ratio of imports to exports with China is now 5 to 1, perfect for the “Chinese invasion” storyline. The U.S.-China deficit’s growth probably won’t continue, but not because it can’t. Consider these points:

We should cheer the triumph of capitalism and its alleviation of poverty within China, as well as its benefits for American consumers and shareholders. The only point of debate is whether American workers’ wages are suffering due to trade with China, but there is no clear evidence of wages “racing to the bottom.” Instead, China is experiencing a severe labor shortage that is driving wages up rapidly in a “race to the top”—the level of free-market workers.

The real dangers to America are not free trade or China’s currency. That’s not to say there aren’t smart policies that should be taken to curb abuses of fair trade, rather that protectionism and currency haggling aren’t part of the smart mix. The real danger is that Congress will try to fix what is not broken and adopt a mercantilist policy of import limitation. Congress would do well to stick to the reliable keys to growth spelled out in The Heritage Foundation’s Index of Economic Freedom: strong property rights, low tax rates, low regulation, limited government, and especially free trade.

Tim Kane, Ph.D., is Director of, Marc Miles, Ph.D., is Senior Fellow in, and Anthony Kim is Research Associate in, the Center for International Trade and Economics at The Heritage Foundation.

[1] Tim Kane, “The Brutal Price of a Dollar,” Heritage Foundation Backgrounder No. 1855, May 31, 2005, at http://www.heritage.org/Research/TradeandForeignAid/bg1855.cfm.

[2] See Ibid. and Tim Kane and Marc Miles, “Trade Deficits, Dollars, and China: Wrong Lessons Make Dangerous Policy,” Heritage Foundation WebMemo No. 743, May 12, 2005, at http://www.heritage.org/Research/Economy/wm743.cfm.

[3] A.B. Bernard, J.B. Jensen, and P.K. Schott, "Importers, Exporters and Multinationals: A Portrait of the Firms in the U.S. that Trade Goods," NBER Working Paper No. 11404, June 2005.

Thank goodness your mother government has such a loyal comrade as you working for her.

Thank you for saying what you want, but your recommendation really surprises me. By canceling my buy order for Chinese stock, I'll be making the trade deficit bigger and I'll be allowing foreigners to increase their ownership of America. I can't believe you suddenly stopped caring about the out-of-control trade deficit and the tragic foreign takeover of the United States' interests. You've got to be keeping something from me because my hunch is that you do care.

Also, please let me know how you plan to defend your recommendation to snowsislander.

This country needs more people who understand the danger of our trade deficit and actively work to reduce it, unlike you.

Thank God Americans are...

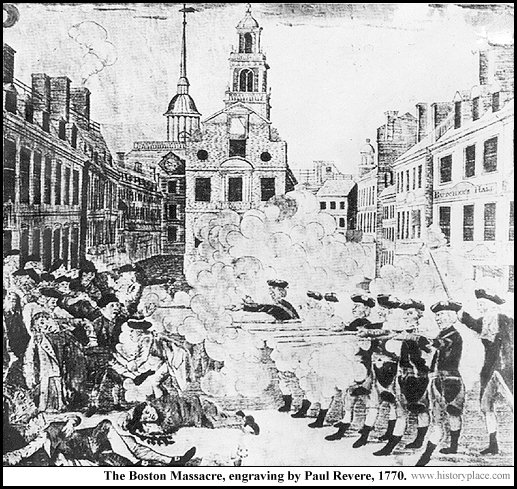

Horrors! A mob of tin-foilers interfere in righteous trade!

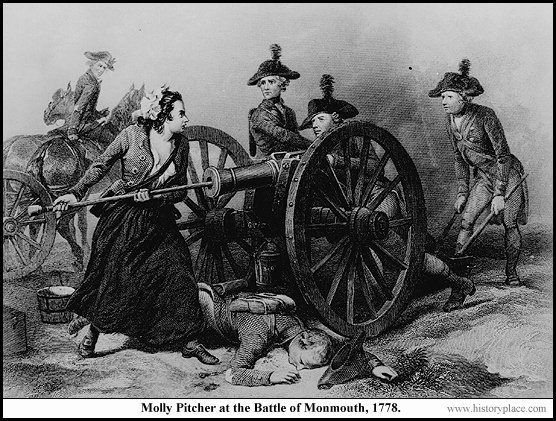

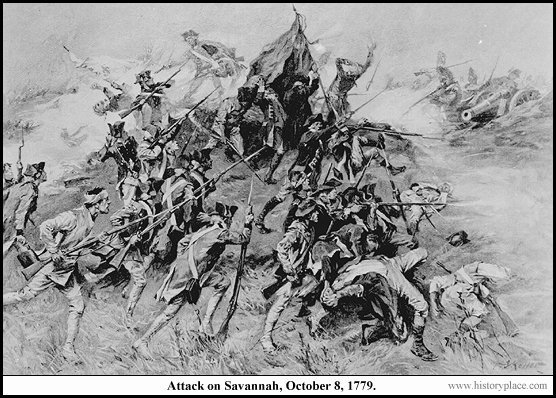

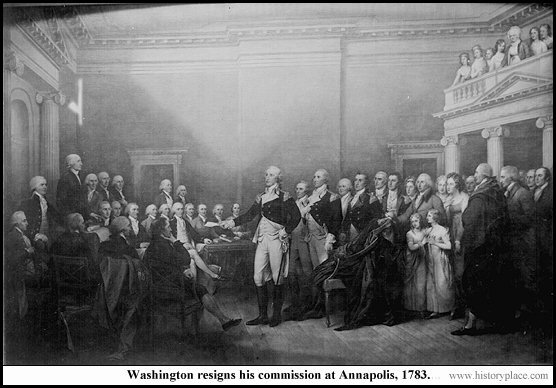

Signing of Declaration of Independence

Each man above knew he had a British noose fitted for his neck if he were captured. Can you even fathom that courage? Taking on the mightiest Empire at its zenith? Their principles of liberty vastly transcend your pale and feeble comprehension of economic freedom. Do you still fail to recognize how important our NATION is?

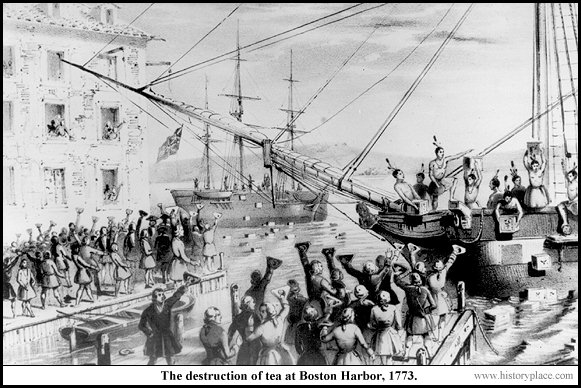

No "Beanies" here:

Or here.

Or here.

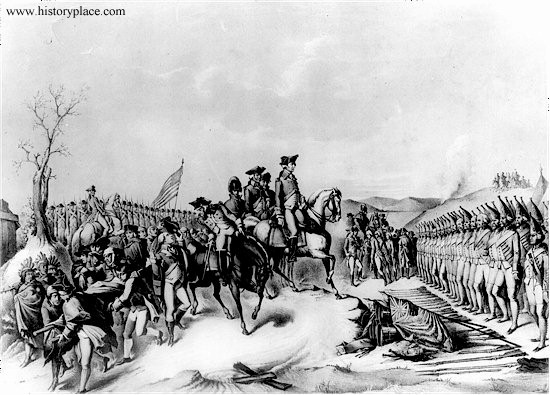

http://www.historyplace.com/unitedstates/revolution/revgfx/steuben.jpg">

http://www.historyplace.com/unitedstates/revolution/revgfx/steuben.jpg">

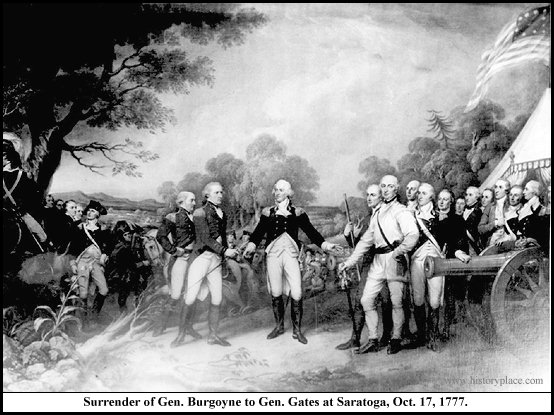

Or here:

Or here:

Or here:

I don't expect you to understand, let alone appreciate any of this, since not a drop of American blood runs in your veins...

but suffice it to say...Americans value nothing more highly than our independence.

Especially from you types. That is why we band together as a nation to better optimize that independence...and our nation which preserves it.

Rooiight. I've been keeping from you that your theoretical construct is in fact a mistake. Sorry. My bad.

Beautiful.

"It is not our duty to leave wealth to our children, but it is our duty to leave liberty to them. We have counted the cost of this contest, and we find nothing so dreadful as voluntary slavery."

--John Dickinson

"The United States may command all that I have, except my integrity."

--Robert Morris

Isn't it interesting, however, how there is one little smidgeon of your cartoon book that is in fact prophetic and warns us implicitly against your free trade Global Government World Order.

Just as you celebrate Thomas Friedman's "The World Is Flat" look what happens to you...

The faux Free Trade 'Fellow-travellers' try to silence dissent from their political-economic dogma.

Yes, you are on the road to serfdom. But you are putting the chains on all by yourself for your future Chi-Comm masters...

Hedge, you can't possibly be happy with the fact that foreigners own more of America than we do of them ---and that this is the cause of our out-of-control trade deficit. There's still time. We can reverse this horrible trend if you just tell me to buy a Chinese company.

This will reduce the relative foreign control of the US, and it will give the Chinese money to buy US goods. It will also get 1rudeboy off my back --but I won't until you say it's ok. Tell me when.

Is that the new globalist creed? Instead of Buy American, Buy Communist?

Are you saying that you honestly don't believe that money spent on Chinese stocks is used by the Chinese to buy US made goods?

I am truly surprised that anyone can refer to Friedrich Hayek, even indirectly, as "Orwellian." More so when he illustrates the potential Orwellian consequence of what you yourself believe. I am laughing too hard to continue.

Moreover, who the hell is Thomas Friedman, and why should I care? Milton Friedman, certainly.

I honestly believe the official reports that we have a five-to-one trade deficit with them. They already have a pile of lollipallooza to "buy US made goods." Since they are a communist nation however, that regards the US as their "main enemy" they don't behave economically rationally in your world.

Not everything is about best economic interests. Or certainly short-run economics. They are very loathe to buy anything from the U.S. unless they absolutely have to...or if it happens to reinforce their subjugation of the U.S. as a third world colony we sell them raw materials. They sell us finished goods.

At least that's what I've been told, when it is explained to me that that 2.5 billion dollar Samsung semiconductor plant in Austin, Texas is a drag on our economy.

I'm asking-- I don't know.

The only way the Commies can buy US products is if they have dollars. The only way they can get dollars (baring giving them the money) is buy selling us either their products or assets (like company stocks shares).

Tell me if I'm wrong, but my hunch is that you want the Chicoms to buy US products. Fine with me too. Let's get them some dollars so they can buy US goods. So we can either buy Chinese goods at Wall-mart (increasing the out-of-control trade deficit) or we can buy Chinese stocks (reducing it).

Make a choice. Paul did, and he chose foreigners owning more of America than vise versa. Your turn.

Because he is the New York Times liberal columnist who you so faithfully echo! Virtually every argument. To a "T". He is your unacknowledged Free Trade champion!

His euphoric over-the-top descriptive hyperbole has finally inspired a number of rather amusing poems by some of more skeptical mindset:

The first, by John M. Ford:

Much have I travell'd on the feet of gold, And many tumbled walls and maidens seen, Round many horny Africs have I been Which bards like bosoms in their welkins hold, Oft of a spare expanse had I been told That fence-swung Homer looked on as demesne; Yet never did I breathe its mountains clean Till I heard Friedman speak out uncontrolled, Then felt I like some Cousteau of the skies When a new bubble undermines his ken, Or sack-like Falstaff, when with precast eyes He stared at echoes—and his fellow men Harked back in multitudes like single spies Silent, past their peak in Darien.

The second from James D. Macdonald:

Much have I travell'd in a chartered jet And munched betimes upon a Cinnabon; Upon my iPod listened to Don Juan Which I downloaded from the wireless 'Net. I did not understand the 'Nineties lore Of Windows systems and of Pizza Hut, How one was opened and the other shut, Till I heard Friedman speak in metaphor. Then felt I like a steroid in a vein: Jose Canseco on a level field, Whose random thoughts of glory and of pain Were like an ice-cream sundae all congealed. The moral is, when put by words in train, That which does not exist can't be revealed. On first looking into Friedman's Flathead

This becomes interesting. If it continues, Friedman may conceivably hope to someday outdo Gene Steinberg as one of the Muses of Eloquent Indignation.

Only time will tell.

Addendum: Jonathan Vos Post has weighed in:

I met a traveller from the New York Times Who said: 'Two vast and Lexus legs of stone Stand in Bangalore. Near their paradigms Half sunk, a shattered visage lies, whose frown, And open Windows, and sneer of the Berlin Wall, Tell that its sculptor often ate at Pizza Hut Which yet survive, stamped on this Lilliput, T.I. that mocked them as ephemeral. And on the plinth by this Michelangelo— “My name is Friedmandias, king of the IPO: Look on my prose, ye Mighty, and despair!” Nothing coherent stays. Round the decay Of that steroidal wreck, boundless and bare The level playing fields stretch far away.' Friedmandias

Until he understands the basics, discussing the trade deficit with him is a waste of effort. He even thinks that China's $1.8 trillion GDP is more impressive than our $13 trillion GDP. The public school he dropped out of must have had a weak math department.

Finally, and this is a serious question: have you actually read T. Friedman's book? I have not. If you have not read it yourself, then you need a big dose of STFU.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.