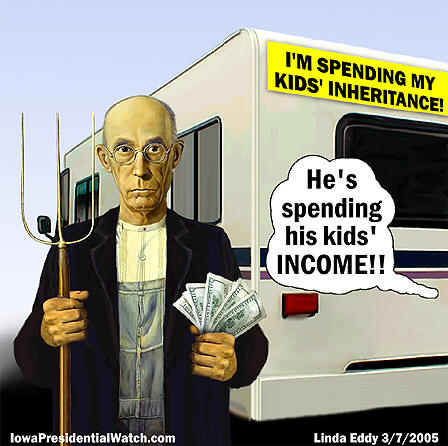

cartoon by FReeper IPWGOP (aka Linda Eddy)

click here for really large version

This is an email-able, copyright-ready graphic you can use in emails, on blogs, in flyers, on posters... anything that's noncommercial.

Three great lies about Social Security

Editorial by: Roger Wm. Hughes

There are three great lies about Social Security that are taken as truths.

The first great lie is that those who are currently receiving Social Security benefits are just drawing their own money out of the system. This is not true because the Social Security System has always been a pay-as-you-go system. The first retirees who received benefits in 1937 never paid into the system. It was those working at that time who paid for the retirees’ benefits. So too, today’s workers are paying for current retirees’ benefits.

Those who are currently receiving benefits must realize that their money is long gone – used as payments to the previous generation’s retirees.

The second great lie is that the money paid into Social Security has been stolen from the system. All surplus money received into the Social Security account (revenues in FICA taxation greater than the amount of money due to current retirees) is accounted for in special treasury bonds. They earn interest, and the U.S. government will have to start paying off those bonds in 2018. It is estimated that in 2018 revenues from FICA taxation will not equal the expenditures to baby boomer retirees.

This surplus – plus interest – is mostly the result of the larger number of baby boomers paying in than their parents drawing out. It is expected that this surplus will run out in 2042.

Currently, there are 3.3 persons paying for each retiree. In 2008, it is expected that there will be 2 persons paying for each retiree. The number of workers paying for each retiree continues to fall for as far as analysts can see.

The third great lie about Social Security is that general revenue tax cuts are creating a short fall in the ability to pay Social Security. The only way that this could possibly be true is if an appropriation from the general fund would be spent to bail out the Social Security System. This is not how the Social Security System is supposed to work.

It is also a given fact by most intelligent observers that over-taxation of an economy robs that economy of future growth. Hence, all government taxation should not be greater than 45 – 50 percent of GDP.

The truth is that the Social Security System is some $10 - 11 trillion short at the current taxation rate of approximately 12.4 percent for Old Age Social Disability Insurance (Social Security’s real name). The total FICA taxation with health insurance is approximately 15.3 percent.

The other truth that is constantly being obfuscated is that unless there are saving accounts for the generation working for their own retirement that the third option proposed by President Clinton is not possible. Then, President Clinton raised the alarm of the impending Social Security disaster by saying there were only three possible solutions to the Social Security problem: higher Social Security taxes; cut Social Security benefits; and the third option of getting a higher rate of return on Social Security taxes.

The only way this third option of getting a higher rate of return on Social Security taxes works is if the taxes collected are kept for the generation that is currently working, not paid out to those who are already retired. Those currently working would then have the earning potential of compound interest in higher yielding investments until they retired.

This third option requires a generational shift in Social Security. It requires the current retired generation no longer steal the income of the current working generation. This is difficult to do because the previous retired generation stole their earnings. It is difficult to do because the full un-funded liability to Social Security looms somewhere in the range of $26 trillion... and is currently $10 – 11 trillion short.

Probably the only way to implement this generational shift and ease the burden on our nation and future generations is to implement it gradually. As all of us baby boomers know, this means cutting benefits.

The problem with Social Security will not go away. Current retirees seem fond of the bumper sticker “I’m spending my children’s inheritance.” Nothing could be further from the truth. The current generation of retirees are not spending their children’s inheritance. They are spending their children’s current earnings.

Roger Wm. Hughes is a political consultant and Chairman of Iowa Presidential Watch, a conservative political website and unaffiliated PAC. [e-mail: sixstrategies@wmtel.net]