Skip to comments.

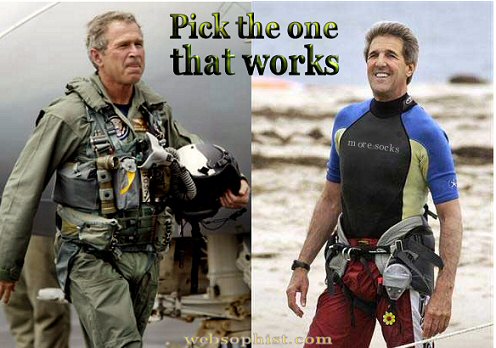

FReeper Canteen ~ The Left Vs The Right

Which one is looking out for America? ~ July 19 2004

MoJo2001, Fawnn, Kathy in Alaska and FRiends of the Canteen

Posted on 07/18/2004 8:00:07 PM PDT by 68-69TonkinGulfYachtClub

click here to read article

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 401-407 next last

If you are a servicemember stationed in CONUS or overseas, you can register to vote absentee.

If you are a servicemember stationed in CONUS or overseas, you can register to vote absentee. The UOCAVA (Uniformed and Overseas Citizens Absentee Voting Act)

requires that the states and territories allow certain U.S. citizens, as defined below,

to register and vote absentee in elections for Federal office.

These groups include:

Members of the Uniformed Services (including Army, Navy, Air Force, Marine Corps, Coast Guard)

Merchant Marines

Eligible family members of the above

Commissioned Corps of the Public Health Service,

and Commissioned Corps of the National Oceanic and Atmospheric Administration

U.S. citizens employed by the Federal Government residing outside the U.S.,

and All other private U.S. citizens residing outside the U.S.

If you are eligible to register under UOCAVA, CLICK HERE and follow the instructions.

For state-by-state voting deadlines and calendar CLICK HERE

General Election Date: Tuesday, November 2, 2004

IMPORTANT DATA

Military Voting for 2004

YOUR VOTE will count!

Military Voter Registration Info

Just Click on a flag to Visit that Branch of Service Voting Info

Originally posted by MoJo2001 and The Sailor

| *IMPORTANT MILITARY VOTE INFORMATION* |

Having gone through the process of ensuring that The Sailor can vote, I found out that there is another easy way to ensure that our military can receive their ballots. If you are stressing out trying to figure out how to get an application, you can click on the Sample to find out how to do it.

You will need to open up the ballot with Adobe Acrobat Reader. If you don't know how to open up .pdf files, don't worry. You can easily visit their site to get a free installation of Adobe's Acrobat reader.

Click the above link to get Adobe Reader

We must all work together to ensure that our Troops have the right to vote. This is the least we can do for them. If you know anyone overseas or stationed away from their "home of records", please send them this link. It is important.

|

To: MoJo2001; Fawnn; Kathy in Alaska; LaDivaLoca; Bethbg79; bentfeather; Ragtime Cowgirl; ...

To: 68-69TonkinGulfYachtClub; All

To: The Sailor; kjfine; Old Sarge; USAF_TSgt; darkwing104; txradioguy; Long Cut; Jet Jaguar; armyboy; ..

FYI : Look in upper right corner of "My Comments" page.

FYI : Look in upper right corner of "My Comments" page.

Set it for "Brief" instead of Full.

You only will get title of thread and who pinged you.

No graphics will load.

To: Kathy in Alaska; MoJo2001; LaDivaLoca; bentfeather; beachn4fun; Fawnn; Ragtime Cowgirl; ...

From the men in the Military and the Canteen

To: 68-69TonkinGulfYachtClub

6

posted on

07/18/2004 8:11:01 PM PDT

by

Lady Jag

(Used to be sciencediet (AKA Tad Rad) but found the solution)

To: Bob J; All

To: bentfeather

Radiant of smile...

8

posted on

07/18/2004 8:12:57 PM PDT

by

Lady Jag

(Used to be sciencediet (AKA Tad Rad) but found the solution)

To: 68-69TonkinGulfYachtClub; All

Good morning Troops, Veterans and Canteeners . . . Wakey Wakey Cubevillians . . . it's Monday.

9

posted on

07/18/2004 8:13:28 PM PDT

by

HopeandGlory

(Hey, Liberals . . . PC died on 9/11 . . . GET USED TO IT!!!)

To: Interesting Times; All

KERRY LIED . . . while good men died

A gathering of Vietnam veterans from across America

Where: The West Front of the U.S. Capitol Building

Washington, DC

When: Sunday, Sept 12, 2004 2:00-4:00 PM (EDT)

Why: To tell the truth about Vietnam veterans.

To counter the lies told about Vietnam veterans by John Kerry

All Vietnam veterans and their families and supporters are asked to attend.

Other veterans are invited as honored guests.

Printable flyer Click Here

(pdf file)

To: Lady Jag

To: 68-69TonkinGulfYachtClub

Moving to the right!!

Moving to the right!!

To: All

Photograph of Hanoi Kerry meeting with Comrade Do Muoi,

Photograph of Hanoi Kerry meeting with Comrade Do Muoi,

General Secretary of the Communist Party of Vietnam.

Photo is displayed in the War Remnants Museum

(formerly the "War Crimes Museum") in Saigon.

CLICK ON PHOTO for proof that Hanoi Kerry is a traitor!

To: 68-69TonkinGulfYachtClub

14

posted on

07/18/2004 8:19:58 PM PDT

by

Delta 21

(MKC USCG -ret)

To: 68-69TonkinGulfYachtClub

To: Delta 21; All

June '04 US Budget surplus $19 billion higher than $16 billion Wall Street expected

http://www.nypost.com/postopinion/opedcolumnists/27358.htm

By LAWRENCE KUDLOW

July 18, 2004 -- IF it's not bad enough that rapid economic recovery has neutered Sen. John Kerry's principal domestic criticism of President Bush, now comes even worse news for the Democratic campaign: The budget deficit is starting to substantially shrink.

The latest budget numbers show a $19.1 billion surplus for June, $3 billion higher than the $16 billion Wall Street expectation. It seems that a flood of new tax collections, spurred by fatter employment payrolls and corporate profits, is rapidly reducing the federal budget gap. Tax receipts from businesses rose an astonishing 38 percent over the past 12 months, and personal income-tax collections increased almost 9 percent.

What's happening? Could it be that stronger economic growth from lower tax rates is producing more tax receipts? I believe it's called . . . supply-side economics.

Just as the 1.5 million new jobs created since last August has terminated talk of a jobless recovery, the chatter over widening budget deficits will end. The fiscal-year 2004 budget deficit now looks to come in around $435 billion, less than 4 percent of GDP. This would be almost $100 billion below estimates early in the year from the Office of Management and Budget and about $50 billion less than Congressional Budget Office forecasts.

The administration is also getting its arms around federal spending. Fiscal year to date, growth in spending on domestic discretionary programs has slowed to 2.7 percent from 6.8 percent a year ago.

As the tax-cut-led recovery continues, deficits will rapidly wane over the coming years.

Former Clinton economic officials Robert Rubin, Gene Sperling and Bowman Cutter — all now advising Kerry — continue to obsess over the alleged economic consequences of budget deficits. But there is virtually no evidence that the budget gap (two-thirds of which emanated from the Clinton recession) has had any negative effect on U.S. recovery prospects. In fact, even with the fastest economic growth in 20 years, long-term Treasury rates remain at 4.5 percent, the cheapest money in over 40 years.

All this is why Kerry's proposal to raise tax rates on upper-income individuals, small businesses and key investment categories like capital gains and dividends is so completely out of touch. The Kerry tax hikes will blunt the good news on growth and deficits, exactly the reverse of what the pessimistic Kerryites are predicting.

Like the modern Democratic Party, the Kerryites neither understand nor acknowledge the tax-incentive model of economic growth that simply restates an old truism: Individuals produce and invest more if it is more profitable after-tax to do so.

Ironically, by placing his $900 billion government-funded health-care plan at the center of his economic policy, Kerry has dropped any pretense of deficit reduction. He may take great pains to position himself as a Clinton-type moderate Democrat, but his policies are pure tax-and-spend liberal.

Oddly, the Kerryites talk about a middle-class "squeeze." This is counter-factual. Over the first five months of this election year, after-tax incomes (adjusted for inflation) have jumped 4.3 percent compared with the same period a year ago. That's why retail spending over the first six months of 2004 has increased 7.7 percent compared with the year-ago period.

The middle class wouldn't be spending quite so rapidly if it was squeezed in the way the Kerry complainers allege.

In other words, the Kerry campaign's dark picture of American economic life is simply untrue. And in the areas where improvements are necessary — including the Social Security system — a big-spending, overarching government-regulatory scheme is not the answer. What is? Greater individual responsibility and personal choice in the context of our free-enterprise market system. It's what will make this thriving nation even more prosperous.

To: 68-69TonkinGulfYachtClub

John Kerry is a worthless piece of slime.

redrock

17

posted on

07/18/2004 8:28:54 PM PDT

by

redrock

("Better a Shack in Heaven....than a Mansion in Hell"---My Grandma)

To: 68-69TonkinGulfYachtClub; All

Well Kathy you might get that news story everybody waiting Hareetz wire reporting that witnesses are claim they seeing part of Arafat Ramallah HQ under siege at this hour

And gun fire has broken out small fire just got put out near HQ

Also report off AP wire French is not amused of course not they run smack chat over Ariel Sharon suggestion that French Jews should come to Israel

Maybe that good idea since French cops wont' do anything on solving wave of Anti Semtric crimes

18

posted on

07/18/2004 8:30:08 PM PDT

by

SevenofNine

("Not everybody , in it, for truth, justice, and the American way,"=Det Lennie Briscoe)

To: Lady Jag; MoJo2001; bentfeather; StarCMC; Brad's Gramma; Fawnn

Does anyone remember which FReeper was looking for a Babushka?

19

posted on

07/18/2004 8:34:49 PM PDT

by

HiJinx

("Air Force Brat, Army Vet")

To: 68-69TonkinGulfYachtClub

Evening Tonk .. I'm sitting here watching a show on the Discovery Channel about Alaska Crab Fishing and the Coast Guard rescuing a crew when their ship started to roll over

All I can say is WOW!!!

20

posted on

07/18/2004 8:38:41 PM PDT

by

Mo1

(50 States .... I want all 50 States come November!)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 401-407 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson