Skip to comments.

JPM Eligible Gold Plummets By 66% In One Day To Just Over 1 Tonne, Total Gold At Fresh All Time Low

Zero Hedge ^

| 19 July, 2013

| Tyler Durden

Posted on 07/19/2013 2:15:15 PM PDT by Errant

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61 next last

To: politicket

China is seeing their outstanding loans begin to decrease. This means that their money supply is decreasing - deflationary.Ah, but that isn't for lack of trying. The Bank of China is still cranking up the [figurative] printing presses, but the Chinese people just don't want to borrow. Ditto the Europeans -- why borrow when there's such a low prospect of profits?.

Nonetheless, just as in the U.S., where business won't borrow, either, the inflation will show up in assets: stock market, land, housing, art, etc..

We're a ways off from deflation. And I say that with disappointment. Deflation is a good thing -- it means the value of the currency is rising.

41

posted on

07/20/2013 4:34:59 PM PDT

by

BfloGuy

(The imposition of a duty on the importation of a commodity burdens the consumers. --Ludwig Von Mises)

To: Errant

Wow, you can readily tell when the "Age of Obama" began in this chart. The following is not meant to defend Obama. He is a horrible president...

The Fed's ZIRP policies are not dictated by the US government. Instead, many of the government's actions are caused by the FED.

Also, don't forget that it was President Bush and the Republicans who partnered with the Demon-rats and got the first TARP bill passed.

What if you were president of the US and knew that you had two choices:

1) Keep debt levels somewhat low and see the nation go through a Greater Depression on your watch, or

2) Start creating new debt as fast as possible through all means at your disposal (after all, the US government is somewhat limited in its ability to create new debt, since it has to fund all loans that it originates). This would create the illusion that things are getting better, while making the entire citizenry even more debt slaves to the largest international banks.

Almost all politicians, Republic and Demon-rat alike will choose option 2. Bush did. Obama did. Remember "Cash for Clunkers"? Do you see all of the federally-subsidized road construction projects going on all over the US right now? How about all of the student loans that are being distributed like candy?

If I was president I would immediately seek to abolish the Fed, and have the currency of the US handled by the US Treasury - and not be debt-based. Currency would only be paid out and circulated based on the completion of underlying labor.

Of course, the international banks could respond to that by immediately shutting down their financial clearing houses and refusing to process any transactions. This would collapse the world economy overnight.

So...how much economic power does the president really have? The answer is: not much. The bankers control the game, and can take their ball and go home if we all refuse to play by their rules. That's a pretty bad place to be. We stopped being the "Land of the free" a long, long time ago - when we adopted debt-based currency.

42

posted on

07/20/2013 5:54:42 PM PDT

by

politicket

(1 1/2 million attended Obama's coronation - only 14 missed work!)

To: Errant

Thanks. Now, have a look at some nations with large populations per square miles that exist mostly on agricultural production and energy production without much manufacturing. Though some of those nations are communist/fascist, they don’t get enough revenues from those two sectors to support big governments. And the people of those nations live in squalor.

See where we’re going without a large manufacturing base? I don’t think many Americans are ready for that, even if the whole trip is a slow one. Most of those who appear to be ready for it are moving third world hordes into our country while complaining about overpopulation. We need new leadership, and the other end of the default process might be the way.

43

posted on

07/20/2013 5:55:52 PM PDT

by

familyop

(We Baby Boomers are croaking in an avalanche of rotten politics smelled around the planet.)

To: BfloGuy

Good thoughts, but I disagree with many of them...Ah, but that isn't for lack of trying. The Bank of China is still cranking up the [figurative] printing presses, but the Chinese people just don't want to borrow. Ditto the Europeans -- why borrow when there's such a low prospect of profits?.

There is always a market for people wanting to go into debt. The Bank of China does not issue new debt (and they don't print money) - they issue currency against Treasury securities.

The Europeans are in a very bad way. They're all stuck on the Euro - and yet there is no way to issue "federal level" Eurozone debt. They can only create new debt on an individual nation basis - and they don't trust each other to all work together in the seeking of that new debt. That's why we hear so much about the desire to create a "Eurobond" that simulates what we have with our Federal government issuing debt that promises the future labor of the individual citizens of the various states.

Nonetheless, just as in the U.S., where business won't borrow, either, the inflation will show up in assets: stock market, land, housing, art, etc..

How will this inflation produce itself? New debt issuance is struggling to stay ahead of the combination of debt repayment and bankruptcies. Monetary inflation is only possible through massive amounts of new debt. What happens when this stops? The equities market crashes and the US dollar index skyrockets - while gold and silver fall through the floor.

Many businesses aren't borrowing because they're scared and many of the rest can't qualify anymore.

We're a ways off from deflation. And I say that with disappointment. Deflation is a good thing -- it means the value of the currency is rising.

No, deflation is already here - being hidden by Federal debt at the level of 2 Trillion per year (even though they have instituted fancy bookkeeping in the last few years to pretend its not that high).

Deflation is a very, very bad thing. Buyers stop purchasing - knowing that the price on a widget will most likely drop some more in the coming days. Those with existing debt get slammed, as job losses mount, pay decreases, and work weeks shrink. They become trapped. Bankruptcies only add to the problem, by decreasing the money supply further. Everything feeds on itself - which is why it's known as a deflationary spiral. Japan has been trying to get out of theirs for 25 years...

Rising currency during deflation just means that the money supply is shrinking against a set of goods and services - making each unit of currency possibly purchase more. However, their can be segments of price inflation, as companies get to the point where they have cut everything to the bone - and can either raise prices in one last attempt at solvency - or go bankrupt.

44

posted on

07/20/2013 8:54:28 PM PDT

by

politicket

(1 1/2 million attended Obama's coronation - only 14 missed work!)

To: politicket

You are talking in circles. Central Banks DO create money. Not worth arguing that.

To: JustTheTruth

You are talking in circles. Central Banks DO create money. Not worth arguing that. You're just plain wrong. Tell me how the Fed does that - and please be specific. You might want to utilize the H.4.1 report in your response, since it contains their weekly balance sheet.

46

posted on

07/20/2013 9:46:46 PM PDT

by

politicket

(1 1/2 million attended Obama's coronation - only 14 missed work!)

To: JustTheTruth

P.S.: I’d also like to hear specifically how I’m talking in “circles”? I think my posts have been pretty straight to the point.

47

posted on

07/20/2013 9:47:55 PM PDT

by

politicket

(1 1/2 million attended Obama's coronation - only 14 missed work!)

To: Errant

48

posted on

07/21/2013 11:33:29 AM PDT

by

matt1234

(The NRA: Redefining "Too big to fail.")

To: MSF BU

but expecting food to last ten or fifteen years is not unreasonable. You might need it....

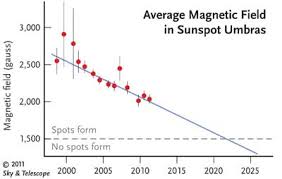

...Obama issues an Executive Order to the Sun...

....to increase it's magnetic field....

and make a good crop of sunspots before elections in 2016....

(PhysOrg.com) -- Sunspot formation is triggered by a magnetic field, which scientists say is steadily declining. They predict that by 2016 there may be no remaining sunspots, and the sun may stay spotless for several decades.

The last time the sunspots disappeared altogether was in the 17th and 18th century, and coincided with a lengthy cool period on the planet known as the Little Ice Age....and lasted 400 years.

Good luck surviving with no electricity and GE modified seeds.

Read more at: http://phys.org/news203746768.html#jCp

To: politicket

There is always a market for people wanting to go into debt.If the interest rate is low enough, yes.

The Bank of China does not issue new debt (and they don't print money) - they issue currency against Treasury securities.

Yes. That's called "making new money". Why the heck else would they do it?

That's why we hear so much about the desire to create a "Eurobond" that simulates what we have with our Federal government issuing debt that promises the future labor of the individual citizens of the various states.

When the bureaucrats in Brussels finally get the OK to issue Eurobonds, the last shreds of monetary discipline will be lost. That is, of course, what they want. The permission to print freely.

How will this inflation produce itself?

M1 has increased by 60% in the last three years. That's real money in circulation that the Fed has created or enabled to be created despite your insistence that it hasn't. Are you going to sit there and tell me that the stock markets aren't in a bubble?

Wish I'd had some real estate to sell you in 2007.

50

posted on

07/21/2013 2:52:33 PM PDT

by

BfloGuy

(The imposition of a duty on the importation of a commodity burdens the consumers. --Ludwig Von Mises)

To: BfloGuy

Yes. That's called "making new money". Why the heck else would they do it? They do it because currency is used for trade. However, that currency is backed by the securities (i.e. debt). "Money" and "Currency" are two different things in debt-based economics (even though they're treated the same almost everywhere. "Money" and "Currency" are only equal to each other in an economy were the currency is not issued against debt (none exist like that anymore).

Debt-based money is actually the verbal and physical promissory notes that are entered into within an economy. Some currency is issued against these notes and used to pay for things - however, that currency is not money - it is backed by money (debt). [Yes...I know...that definition would get me laughed out of the Ivy League schools...but it is how things work in reality]. You keep wanting to believe that central banks issue money. They don't. They issue currency.

When the bureaucrats in Brussels finally get the OK to issue Eurobonds, the last shreds of monetary discipline will be lost. That is, of course, what they want. The permission to print freely.

Actually, things would improve dramatically - for a time - in Western Europe if they issued Eurobonds. That would give the Eurozone the ability to create massive amounts of new debt in order to pretend they're not in a deflationary spiral.

M1 has increased by 60% in the last three years. That's real money in circulation that the Fed has created or enabled to be created despite your insistence that it hasn't. Are you going to sit there and tell me that the stock markets aren't in a bubble?

Take a look at the Fed's H.4.1 report for July 18, 2013. Go to section 8 and look at the Liabilities section of the balance sheet. You'll see that there is roughly $1.15 trillion outstanding in Federal Reserve notes (currency). You'll also see under the Assets in Section 8 that there is roughly $2 billion outstanding in coinage (as a side note - do you find it curious that coins are assets, while FRN's are liabilities?).

The latest M1 chart is shown to be roughly $2.6 trillion. In other words, there are a lot of bank deposits that are the same currency (physical and/or electronic) getting reused to fund new debt. I.e. - I sign a promissory note. You give me $100. I deposit that in my bank. My bank reuses some of that to fund a new loan, etc., etc. etc. The checking deposits are showing up due to new debt creation - not from the Fed pumping the currency supply.

Yes, the equities market is in a bubble. Companies are doing stock buybacks, which is lifting the price of their remaining shares outstanding. The market will correct when the Fed removes the heroin of QE.

Wish I'd had some real estate to sell you in 2007.

I wouldn't have bought it. I saw this coming (in fact, wrote about it). I went entirely to cash in December 2007.

51

posted on

07/21/2013 8:52:06 PM PDT

by

politicket

(1 1/2 million attended Obama's coronation - only 14 missed work!)

To: JustTheTruth

Anyone who sinks enormous amounts of savings to buy years' and years' worth of perishing food is not making a good investment. It only lasts so long....

It only takes one gold ounce, or maybe 1.5 oz now that the price has plummeted, to buy a year's worth of food. And wheat berries, rice, and beans packed correctly will last decades.

I think of it as insurance, just as PMs are for me.

To: politicket

“Exchanging treasuries for currency does not increase the money supply.”

Yes it does. Once treasuries are exchanged for FED created new currency that new currency is used to fund government operations and finds it’s way into the economy. It’s called debt monetization.

To: politicket

However, that currency is backed by the securities (i.e. debt).You can stop right there.

The American dollar is backed by nothing. Once upon a time, it was backed by gold. You could march up to the teller's window and redeem your paper dollars for their defined weight in gold.

Until I can do the same with these securities; to claim that my dollars [either of the "money" kind or the "currency" kind] are "backed" by them is untrue.

54

posted on

07/22/2013 2:31:12 PM PDT

by

BfloGuy

(The imposition of a duty on the importation of a commodity burdens the consumers. --Ludwig Von Mises)

To: ScottfromNJ

Yes it does. Once treasuries are exchanged for FED created new currency that new currency is used to fund government operations and finds it’s way into the economy. It’s called debt monetization. A few points here...the Fed only purchases Treasury securities from Primary Dealers (select large banks). They do not purchase anything directly from the US government. Therefore, any currency used in the purchase goes to banks - not the government.

A great majority of funds issued from Fed purchases of Primary Dealer securities stays in the Primary Dealer accounts at the Fed. It is not being circulated back in to the economy. This can be very easily seen by looking at Section 8 of the Fed's weekly H.4.1 report, which shows its balance sheet. You can look in the Liabilities area and see that "Term deposits held by depository institutions" is currently sitting at around $2.14 trillion dollars (from the 7/18/13 release).

Debt is "money" in a debt-based economy. "Currency" (both physical and electronic) is what is used to transact business - and is backed by debt.

55

posted on

07/22/2013 8:53:21 PM PDT

by

politicket

(1 1/2 million attended Obama's coronation - only 14 missed work!)

To: BfloGuy

The American dollar is backed by nothing. Once upon a time, it was backed by gold. You could march up to the teller's window and redeem your paper dollars for their defined weight in gold. Respectfully, you're wrong. Every monetary unit that has ever existed has been backed by the same exact thing - and it's not gold. It's labor.

A biblical economy had currency issued (sometimes consisting of gold and silver) that was based on the completion of labor. You worked, and you got paid - where the currency you were paid was backed by the labor you just completed. Not all labor was equal - that's Socialism. But is was completed labor. This works great, since there is only so much labor that a society can complete in any given time period. Also, the work product tends to add to the overall economy so that it grows. The amount of currency may grow over time, but prices remain fairly stable, since the amount of goods and services grows along with it. Another interesting thing is that "money" and "currency" are synonymous in a "complete labor" economy.

A debt-based economy is centered around "money" being promissory notes. There is a disconnect with currency, since it is backed by those same debt instruments. "Currency" in a debt-based economy is backed by a claim on the promise of someone's future labor. "Currency" is a claim on "money" - but it is not "money".

What would happen if all debt in our nation either defaulted, or was paid off? Currency would cease to exist - since there would be no more claims on future labor. Do you now see why both Demon-rats and Republicans will always seek new debt? They have to in a debt-based economy - or the nation will face a far Greater Depression.

What is the solution? Is it to have currency backed by gold and silver? No. It's to have currency backed by the completion of labor instead of claims on the promise of future labor. I have no problem minting currency out of gold or silver - buts that's completely removed from the real issue.

Start focusing on what truly backs all currency throughout history - labor. It's just a matter of whether the currency is one of a free people - or one of slaves.

We are all implicit monetary slaves in this country - even if we are supposedly "debt free". The government has imputed claims on our future labor - and the labor of untold generations that will follow us.

Until I can do the same with these securities; to claim that my dollars [either of the "money" kind or the "currency" kind] are "backed" by them is untrue.

Again, I go back to my previous points. People are so fixated on precious metals that the miss the real point. England had a currency system called "tally sticks" that worked beautifully for over 600 years! These notched sticks of wood were not gold or silver - but they did represent labor that had been completed. They were not based on debt. Tally sticks were used by an economically free people. King William and Queen Mary (mainly William - who used Mary's claim to the throne) started debt-based money in the 1590's. Over time, England sought to force the same concept upon the American colonists. Our forefathers understood the danger. We no longer do.

56

posted on

07/22/2013 9:13:52 PM PDT

by

politicket

(1 1/2 million attended Obama's coronation - only 14 missed work!)

To: politicket

“A few points here...the Fed only purchases Treasury securities from Primary Dealers (select large banks). They do not purchase anything directly from the US government. Therefore, any currency used in the purchase goes to banks - not the government.”

The dealer gets a cut, and although the funds may temporarily sit in accounts, the funds are not permanently under the control of the banks. The funds are eventually spent as directed by law by the legislative branch

To: ScottfromNJ

The dealer gets a cut, and although the funds may temporarily sit in accounts, the funds are not permanently under the control of the banks. The funds are eventually spent as directed by law by the legislative branch The Primary Dealers by US securities outright during Treasury auctions. The Federal government receives currency from these auctions to use for its purposes. The Primary Dealers are then free to hold the securities and do whatever they want with them.

At certain periods, the Fed will purchase some of these securities from the Primary Dealers in order to 1) circulate more physical currency into the market - since banks need new dollar bills for their customers, and 2) to unethically prop up the big banks.

In case #2, the currency that the Primary Dealers are paid by the Fed mainly stays sitting in the Dealers accounts at the Fed. Look at the weekly H.4.1 Fed report - Section 8. It shows that there are over $2.14 trillion in deposits just sitting there - collecting 3% interest.

There is no governmental law telling the Primary Dealers how they must use their securities and interact with the Fed after an auction has taken place.

58

posted on

07/23/2013 8:35:10 AM PDT

by

politicket

(1 1/2 million attended Obama's coronation - only 14 missed work!)

To: politicket

Respectfully, you're wrong. Every monetary unit that has ever existed has been backed by the same exact thing - and it's not gold. It's labor.I cannot agree with that. To say that something is backed by something else, it must be redeemable on the spot for that something else.

Money is only valued for the goods that it can buy. It is a commodity differing only from other commodities in that it is not consumed but merely transferred. Future labor is immaterial. The labor theory of value was disproved over a century ago.

I fear you have become enamored of the New Monetarists [and their theories are seductive] and will go down a blind avenue. I encourage you to take a look at the Austrians. They have the only rational and logical theory of money that I've read. Cheers.

59

posted on

07/23/2013 3:04:02 PM PDT

by

BfloGuy

(The imposition of a duty on the importation of a commodity burdens the consumers. --Ludwig Von Mises)

To: BfloGuy

I cannot agree with that. To say that something is backed by something else, it must be redeemable on the spot for that something else. It's been a great debate, but I think we're both pretty set in our economic hypotheses.

There are a myriad of things that are backed by that which cannot be immediately redeemable. If you believe that currency is money (or even pretending that gold is money) then any type of loan would be but one example.

Money is only valued for the goods that it can buy.

"Money" is a debt-based economy cannot but anything - only "currency" can. The currency is backed by a claim on the promise of future labor. When you buy a loaf of bread from the grocery store you are giving some of the claims that you possess to the store. The same holds true for any purchase made with currency. Credit card purchases created new "money", since they create new debt.

It is a commodity differing only from other commodities in that it is not consumed but merely transferred.

"Currency" could loosely by thought of as a labor commodity. It is true that "currency" is just transferred, with the Fed being the only ones that can issue more "currency" (not "money") into the economic system. Issuing more currency does not increase the nation's debt money supply.

Future labor is immaterial.

Actually, it's very material. And if you understand what I'm writing then what's currently happening all over the economic world makes perfect sense. One example: why did the Japanese yen spike drastically upwards right after the tsunami that hit? With your economic theory it should have plummeted.

The yen spiked because the economic area affected by the nuclear fallout lost almost all of its potential for the promises of future labor that had been made against it. In effect, the area went bankrupt. This created a lot less overall debt in Japan, which meant the "money" supply shrank drastically. Less money against a level of goods and services cause each unit of money to be worth more. The yen "currency", which is backed by "money" spiked as a result.

The labor theory of value was disproved over a century ago.

My economic hypothesis has absolutely nothing to do with the traditional "labor theory of value". That belief held that things were worth more if more labor was put into producing them. That's ridiculous. There was also a belief that all labor was of equal value. That too is preposterous.

I'm simply teaching how debt-based money works, in a very systematic way, hopefully. :-)

I fear you have become enamored of the New Monetarists [and their theories are seductive] and will go down a blind avenue.

I've been writing about debt-based economics since 2008 - and many here on FR know that. My hypothesis has remained consistent. It was used in 2007 to see what was coming across the world. Because of that, I took my family completely to cash in 2007.

There were many then (and there still are) that keep preaching about the US dollar being "toilet paper" and going to zero - while gold and silver would skyrocket. I have consistently taught, based on the hypothesis that I've laid out, that the US dollar would actually strengthen over time and that gold and silver would come back down to minimal levels. This isn't because I believe in the US dollar. It's because of what it's backed by - and the fact that the world has entered a deflationary spiral.

Your economic theory has no support over the last five years - not trying to pick on you, but trying to make a point. There is no monetary inflation. Governments are doing absolutely everything they can to create new debt as quickly as possible. What do you think "Cash for cars" was all about? How about TARP? How about student loans given out to anybody still breathing? Don't you wonder why Republicans support every debt measure that comes down the pipe? Do they know something that most people don't?

I encourage you to take a look at the Austrians. They have the only rational and logical theory of money that I've read.

I actually like many things about Austrian economics - except for the fact that it's completely useless in analyzing a debt-based monetary system. It would be great if we had a system where money = currency.

The Austrian's believe that there must be a tremendous reduction in the amount of outstanding debt or the world will implode.

Let's take a giant leap and pretend that all debt were paid off. What would happen? Disaster in a debt-based economy. The "money" supply would drop to zero - since there would be no more promises of future labor - therefore no currency that can make claims on it.

What I've written is hard to get one's head around - because it's the exact opposite of what people have been told and taught.

I have written economic articles for quite some time, and have a readership that includes many high-level professionals in the financial community. I've been getting a lot more since the price of precious metals began dropping. They're beginning to see what I've been writing about. I would give the name of my newsletter, but don't believe in "pimping my blog" on FreeRepublic.

Think about what I've written. Think about what's happening in the world. Play a "what if" game with it. If it doesn't stand the test of time then discard - I would. Adhering to "Austrian" economics right now is going down the wrong path - in my opinion.

Cheers.

Thanks for the great discussion...

60

posted on

07/23/2013 8:15:51 PM PDT

by

politicket

(1 1/2 million attended Obama's coronation - only 14 missed work!)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson