Posted on 01/30/2011 8:21:27 AM PST by SeekAndFind

I'll show you all. I'm investing in suits. Then, one day, (to paraphrase) all your gold are belong to me.

#8 You Cannot Eat Precious Metals

A well-tilled garden plot and a cache of seeds is also recommended. Planting fruit trees and berry bushes can also be a nice long-term investment on staving off hunger...

If I was planning on buying gold (which I am not) where should I keep it? Planted in my garden?

Hypothetically, all of your precious metals except silver could go in the same storage safe. Gold, lead, brass, etc. All in the gun safe.

Ditter wrote:

If I was planning on buying gold (which I am not) where should I keep it? Planted in my garden?

Silver needs to be kept elsewhere. Silver + sulfur = tarnish and corrosion damage.

Not saying that I would actually own any silver, gold, lead, brass or guns.

>>>not saying I would actually own any etc. etc. etc

Of course not, me neither. We are a gun free zone and our dogs are all pussy cats. snort*

bttt

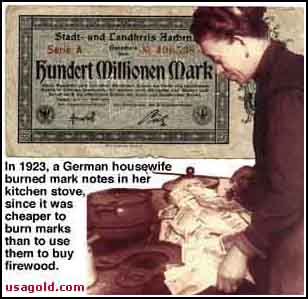

#8 You Cannot Eat Precious Metals

Investing in precious metals should be done only after you have gathered together an adequate emergency food supply. If the global economy completely shatters, having gold and silver is not going to be good enough. You are going to need lots of food for you and your family. So be sure to take care of the necessities before you invest in precious metals.

Most important point in the whole article.

You can’t eat savings bonds or stock certificates either. That’s just about the dumbest thing anyone can say about gold, with honorable mention going to “it’s heavy” or possibly “assay is required.”

Without regard to whether owning gold makes sense, gold is not an “investment”. By definition an investment is something other than money, and something that provides a return or dividend on that investment. Stocks are an investment. Gold is a form of currency speculation, sort of like buying swiss francs or australian dollars.

Nowhere did the article mention taxes - which are currently 28% on gold and silver. That’s not a good way to “invest” - the underlying measurement in currency loses value, one has merely preserved purchasing power, and the government comes along and wants nearly a third of the “gains”. Nice.

Amen!

And for the record, I buy gold - just to tick off the local LDS pawn shop broker ...cause he only pays a fraction of its worth.

Right now I'm paying 28% more than him, and still make money.

mark

It’s a relevant point when you’re talking about severe economic disruption to the point of degrading to a barter economy. Gold or silver won’t help you much in that situation. If you have extra cash after getting yourself to the level of being able to survive, then as a store of value gold or silver makes sense.

Preferably in the back of a well secured gun safe.

Ever try to access your safe deposit box after the bank has been closed?

In those extremes, maybe gold and silver would be priceless. Historically in third world countries, hard currencies were utilized in lieu of the local money, typically US dollars, German marks, Swiss francs.

In terms of paper currency yes, they will be. More accurately, paper currency will be worthless.

If you have a local network that’s willing to take gold and/or silver, more than likely in terms of real goods, gold and silver will settle down to a certain value, probably not all that different than what it has been historically.

In severe economic disruption, people may not be willing to take precious metal and will stick to barter if they don’t feel they can exchange gold/silver for goods with the next guy.

Even so, it’s better to not let the value of extra cash waste away. Once you can survive, convert the rest to precious metal and wait for better times.

Provided we’re discussing a “barter economy” - No, I mean in absolute terms, practically speaking. Set aside for the moment the likelihood of that scenario.

Anything that needs to be imported would be pretty much unobtanium without an accepted medium of exchange. “Imported” would take on a new meaning, but particularly things not grown or produced in the US.

It seems unlikely that if paper currencies aren’t for some reason accepted

locally then forget things like coffee and chocolate, which can’t be grown here. My view is that such a scenario seems pretty unlikely but if that were to happen, that’s what we’d be looking at, no way around it. Thankfully most of our wealth outside the house is held in T-bills and Savings Bonds. Hm.

bookmark

Plant a Garden...you can’t eat gold.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.