Posted on 02/24/2024 5:59:01 AM PST by SpeedyInTexas

“Ukrainian drone strike on Russian refinery in Krasnodar”

Krasnodar is (was?) Russia’s oldest refinery.

Very realistic appraisal

The oil market is swimming in so much supply, that analysts are projecting $50 Brent, and suppliers having to cut back production next year.

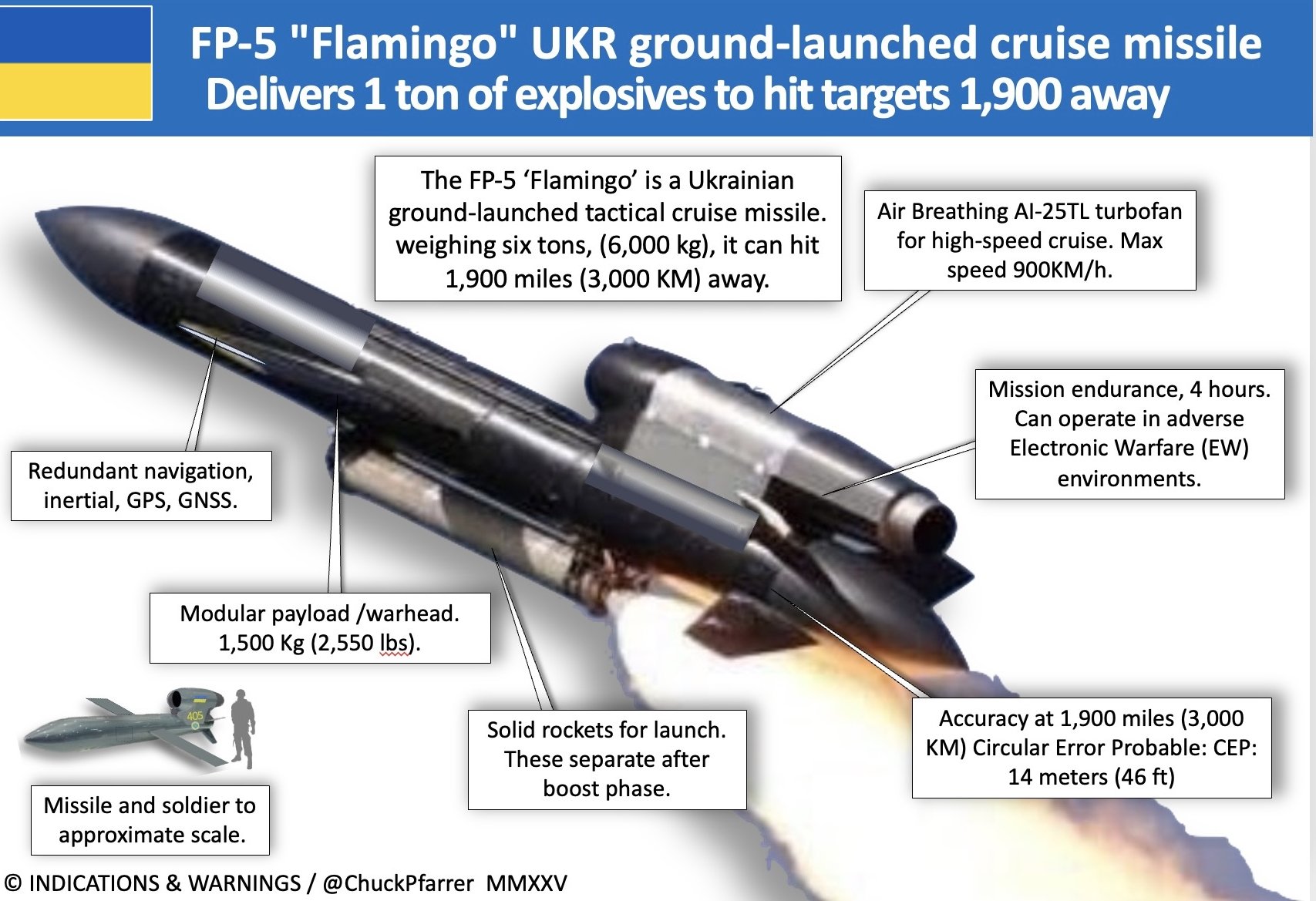

Conditions are set, to force those production cuts on Russia, without market prices having to rise too high. That is what all the new Ukrainian long range strike weapons are for.

Bone-Crushing.

OilPrice.com (31 Aug):

Wall Street Forecasts Oil in the $50s Next Year

“The market consensus appears to be that the strong summer demand is at its peak, and come the fourth quarter, global oil consumption will slow, and rising supply will overwhelm the market.

Growing supply from OPEC+ and higher output from South America will tip the market balance into oversupply toward the end of the year, analysts say.

Despite geopolitical risks, Wall Street banks have lowered their oil price forecasts for later this year and the first quarter of 2026, expecting the glut to depress prices...

...The glut will diminish by the third quarter of 2026, the banks reckon, as excess supply shocks are absorbed during next summer’s peak demand period.

But banks, analysts, and market participants expect oil supply to outstrip demand over the next six months, putting additional downward pressure on prices...

...The U.S. Energy Information Administration (EIA) is even more bearish than major banks in oil price projections.

The EIA expects in its latest Short-Term Energy Outlook (STEO) Brent to slump in the coming months, falling from $71 per barrel in July to average just $58 in the fourth quarter of 2025 and around $50 per barrel in early 2026...

...Due to the OPEC+ supply hikes, global oil inventory builds will average more than 2 million barrels per day (bpd) in late 2025 and early 2026, which is 800,000 bpd more than in last month’s STEO.

“Low oil prices in early 2026 will lead to a reduction in supply by both OPEC+ and some non-OPEC producers, which we expect will help moderate inventory builds later in 2026,” the EIA said.”

The Kremlin is pursuing a multi-pronged informational effort aimed at deterring Western support for Ukraine and undermining European participation in the peace process. The Kremlin has recently been intensifying three rhetorical lines aimed at influencing Western decision-making in the Kremlin's favor: accusing European states of prolonging the war in Ukraine, levying nuclear threats against Western states, and claiming that Russian victory in Ukraine is inevitable. Kremlin officials, most notably Kremlin Spokesperson Dmitry Peskov and CEO of the Russian Direct Investment Fund (RDIF) Kirill Dmitriev, implied that European states seek to prolong the war in Ukraine in an effort to reinject this long-held Russian narrative back into the Western information space to undermine US trust in European governments.[1] The Kremlin often leverages Dmitriev to advocate for Russia's interests in the West, particularly involving the peace process in Ukraine and sanctions, on English-language platforms and media outlets.[2] Russian Security Council Chairperson Dmitry Medvedev criticized French President Emmanuel Macron and German Chancellor Friedrich Merz on his English-language X (formerly Twitter) account on August 31, regarding France's and Germany's involvement in US efforts to end the war in Ukraine.[3] Medvedev claimed that Merz and Macron have “forgotten the lessons” of the Second World War and that “things could end up like they did in 1945 – [Macron and Merz] too may end up being identified by their teeth.” Medvedev is evoking the memory of US atomic bombs to threaten France and Germany for supporting Ukraine in the peace process. Medvedev also claimed that Russian advances are “bad news” for Macron and Merz. These various rhetorical lines seek to bolster the Russian Ministry of Defense (MoD)’s recently intensified effort to falsely portray Russian victory in Ukraine as inevitable.[4] The MoD attempted to use large amounts of qualitative data to make claims about Russian advances – data and claims which ISW assesses are inflated.

Russian milbloggers criticized the Russian Ministry of Defense (MoD) for exaggerating its battlefield successes. Russian milbloggers heavily criticized Russian Chief of the General Staff Army General Valery Gerasimov’s August 30 claims that Russian forces seized 3,500 square kilometers of territory and 149 settlements since March 2025 and rejected Gerasimov’s claim that Russian forces have seized half of Kupyansk.[5] The milbloggers characterized Gerasimov’s figures as a “very big exaggeration” and asked which elements of the Russian military command structure are feeding false reports to the Russian high command. ISW has observed evidence to assess that Russian forces had gained only roughly 2,346 square kilometers of Ukrainian territory and seized 130 settlements between March 1 and August 30.[6]

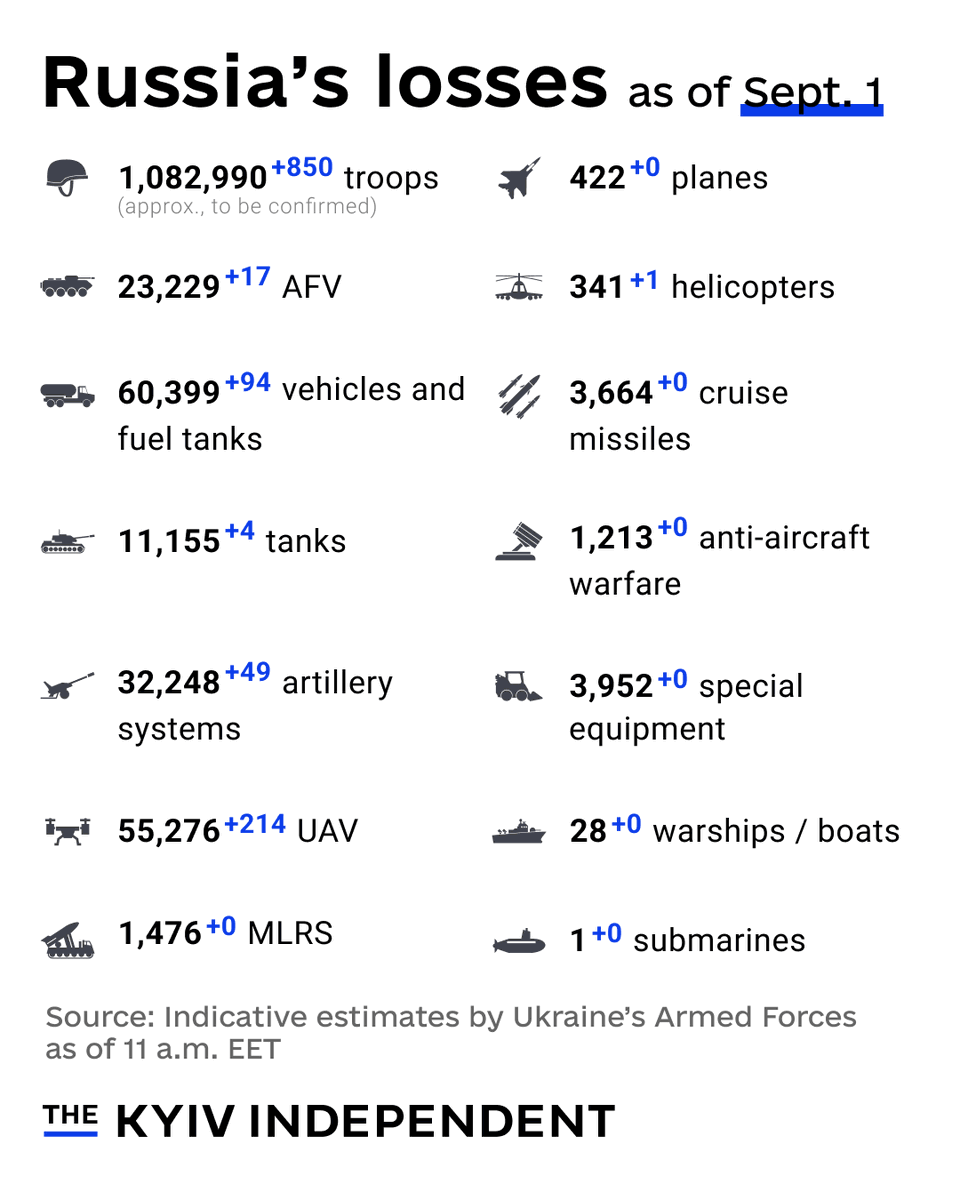

The Kremlin is intensifying these information efforts because its territorial gains remain disproportionately limited and slow relative to the high losses incurred. The Ukrainian General Staff reported on August 30 that Russian forces incurred 210,000 personnel casualties in Kharkiv, Luhansk, and Donetsk oblasts from January to August 2025, an average of 26,250 casualties per month.[7] The Ukrainian General Staff reported that Russian forces suffered a total of 290,000 personnel casualties throughout the entire theater from January to August 2025, an average of 36,250 casualties per month. Russian opposition outlets Meduza and Mediazona reported on August 29 that data from the Russian Register of Inheritance Cases (RND) suggests that at least 93,000 Russian military personnel died in 2024 — almost twice as many as in 2023 (about 50,000), and estimated using a predictive model that at least 56,000 Russian soldiers have died since the start of 2025.[8] Russia's gains have been largely gradual and creeping for many months, and Russia's rate of advance is incredibly slow under the norms of modern mechanized warfare.[9] Any assessment of Russia's battlefield performance and strength must examine both the tempo of advance and the resulting losses to make those gains.

The Russian-led Collective Security Treaty Organization (CSTO) began its annual military exercises in Belarus on August 31. The Belarusian Ministry of Defense (MoD) announced the start of the “Interaction-2025,” “Search-2025,” and “Echelon-2025” exercises at the Lepelsky training ground in Vitebsk, Belarus.[73] Forces from Kyrgyzstan, Kazakhstan, Russia, Tajikistan, and Belarus are participating in the exercises.[74] The exercises will continue until September 6 and reportedly include more than 2,000 military personnel; 450 pieces of weapons and equipment, including nine aircraft and helicopters; and over 70 drones.[75] Belarusian Chief of the General Staff Major General Pavel Muraveiko stated on August 31 that the ongoing CSTO multilateral exercises and the upcoming Zapad-2025 bilateral Russian-Belarusian military exercises will plan and practice the use of nuclear weapons, including tactical nuclear weapons.[76]

https://www.understandingwar.org/backgrounder/russian-offensive-campaign-assessment-august-31-2025

The coming days are extremely important for strengthening the Russian-Chinese partnership. Vladimir Putin is on a visit to China, there are many meetings, a lot of work. Can the SCO summit be called historic? In part, yes. But today we are talking about something else.

There are three important points about the talks between Putin and Xi Jinping.

First, the partnership between Russia and China is much more important for the Kremlin than attempts to build friendship with the United States. “China is building an economically strong empire, and the Americans are weakening. There is no clarity with Trump at all,” a source in the AP said. The interlocutor stressed that it is important for Russia to show its role as a mediator in the dialogue between Beijing and Washington. Although both sides still prefer bilateral contacts.

Secondly, negotiations with the American side have reached an impasse. Russia does not intend to stop the NWO [war in Ukraine] until complete victory is achieved. And during this visit, the president needs to convince the Chinese leader to continue further cooperation. In particular, the supply of technology and important components is vital for the war. For sure, Vladimir Vladimirovich will succeed.

Thirdly, it is very important to show not only the unity of partners, but also our key role in the triangle - Russia, India, China. India has suffered from short-sighted policies and the introduction of secondary duties by the United States. It is important to emphasize the need for strategic partnership with all key capitals as opposed to the United States. Many people think that China is the key in this triangle, but without our energy resources, Beijing would have to look for an alternative. And it would be significantly more expensive.

Parubii, 54, was shot dead in Lviv on Aug. 30 by an assailant disguised as a courier, prompting a nationwide manhunt. During a press briefing in Lviv, police officials said that Parubii was shot at eight times with a short-barreled firearm. Seven shell casings were found at the crime scene.

“The crime was carefully prepared: the attacker studied the victim's movements, mapped out the route, and planned the escape,” Klymenko added. “Once again, police officers and employees of the Security Service of Ukraine have demonstrated a high level of professionalism. Within 24 hours of the murder, they were already on the direct trail of the shooter, and within 36 hours — they detained him. More details will be provided later by the police.”

❗️"Nazi woman": this is how Ursula von der Leyen was greeted in Bulgaria

Ursula von der Leyen planned to visit a military factory in Sopot today, but the entrance was blocked by concerned citizens. The country's authorities kept the exact time of her visit to the military… pic.twitter.com/6UoKKCrNsI— Zlatti71 (@Zlatti_71) August 31, 2025

"Nazi woman": this is how Ursula von der Leyen was greeted in Bulgaria

Ursula von der Leyen planned to visit a military factory in Sopot today, but the entrance was blocked by concerned citizens. The country's authorities kept the exact time of her visit to the military factory in Sopot strictly secret.

"If the European Union is preparing for war with Russia, let Ursula come and say so here. More than 80% of Bulgarians do not consider Russia an enemy, but 'they see the enemy in the EU's policies, they see the enemy in Ursula, they see the enemy in NATO's policies,'" said Kostadin Kostadinov, leader of the "Vazrazhdane" party.

- SMI

The complete transcript.

—

[ Ukrainian Bombs Rip Through Strategic Russian Base, Producing up to 9,000 Drones/Month! ]

Today [ Apr 25, 8 pm ], there are a lot of interesting updates from the Russian Federation. Here, flying deep behind enemy lines, Ukrainian long-range drones delivered a devastating blow to the only Russian Shahed production facility. Long-range drones loaded with 250 kilogram bombs tore through the final assembly line, throwing all Russian strike plans into disarray.

The Ukrainian strike happened at Yelabuga, located over 1,200 km away from the frontline. The Ukrainians used 6 drones for the strike on the main Shahed assembly facility, of which 5 Ukrainian drones managed to reach and directly strike their target despite Russian air defenses being present.

The strike led to severe damage to the final assembly line of the drone production facility, creating a bottleneck and disrupting the entire production process within the factory. This assembly is the most technologically complex segment, without which the rest of the drone production process cannot be completed. Targeting this facility hampers Russia’s ability to produce new Shaheds, thereby severely impacting its ability to continue its daily drone strikes on Ukraine.

For the strike, Ukrainians used small A-22 light training planes repurposed as drones to strike critical Russian military and economic infrastructure far beyond the frontline. These drones have a maximum flight range of over 1,500 km, with integrated GPS inertial guidance to conduct precision strikes. Each of these drones has an integrated payload of 250 kg, able to collapse the facility’s roof, already damaging production machinery, which was then followed by the next drone striking the factory floor itself, finishing the job.

The destruction of the assembly line at the Alabuga facility throws a massive wrench into Russian plans, as the Russians are exerting considerable effort to scale up production and increase the number of Shahed drone strikes. Since the launch of this factory, which produced 300 Shahed drones daily before the Ukrainians hit it, Russia has steadily increased the number of Shahed strikes each month.

Following the completion of the Alabuga drone production complex, the Russians continued to increase their production output, launching a massively increased number of Shahed drone strikes in the past 6 months. This number could have risen to 9,000 by the end of April, prompting the Ukrainians to urgently develop a plan to strike the Russian Shahed production facility.

The strike on the Alabuga plant was additionally prompted by the recent Russian development of an analogue to Ukraine’s Palianytsia jet-propelled drone. The upgraded Shahed, called the Geranium-3, features a turbojet engine for increased speed, raising from 200 kph to 600. This enhancement makes it much harder for Ukrainian mobile air defense units to intercept them, primarily relying on truck-mounted machine guns and autocannons to take down the Shaheds.

Western sources report that the Alabuga factory was a key producer of these new Russian jet-powered Shahed drones. With the new drones being significantly more difficult to intercept for conventional Ukrainian mobile air defense units, Ukraine would have had to rely on more expensive and very limited missile defense systems to protect its cities.

Destroying Russian production capabilities before these drones could be produced and implemented on a larger scale was a strategic play to prevent the Russians from exploiting weak spots in Ukrainian air defense, while the laser air defense is still in the early stages. This also shows that Ukrainians know the locations of these critical Russian factories, and can continue to target them, if they struggle to intercept the new Shaheds.

While Ukrainians have many potential targets to hit, they must choose wisely, due to the amount of time needed to plan and set conditions for such complex aerial operations, making it impossible to strike every location simultaneously.

Overall, the Ukrainians conducted a precision strike on the largest and most important Russian drone production facility, over a 1,000 km away from the frontline, causing massive damage to its production capabilities and greatly diminishing the number of drones available for further Russian strikes. The effects of the Ukrainian strike will be evident, with the planned Russian increase of Shahed strikes not becoming a reality.

Lastly, the strike demonstrates Ukraine’s constant awareness of potential Russian threats, making educated decisions on which facilities to hit with the most urgency, to achieve the most significant effect.

https://www.youtube.com/watch?v=-Tr9_gR1_6w

Reporting From Ukraine:

https://www.youtube.com/@RFU/videos

The complete transcript.

—

[ Russians Lost Air Superiority. Biggest Swedish Military Aid Package Changes The Game! ]

Today [ Apr 28, 8 pm ], there is an interesting update concerning the defense of Ukrainian skies. Here, the Ukrainian air defense got one of the biggest boosts as reports emerged that a new powerful flying radar from Sweden had probably already arrived in Ukraine. This system will help the Ukrainian air defenses not only in their offensive operations but will also significantly support their ability to defend the Ukrainian rear from constant Russian missile and drone attacks.

Sweden has pledged to deliver two ASC-890 airborne warning and control system planes to Ukraine as part of its largest military aid package to date, valued at approximately 1.16 billion euros. Sweden’s decision marks a significant enhancement in Ukraine’s air defense capabilities.

These aircraft, equipped with advanced Erieye radar systems, are designed to provide long-range surveillance and target identification. While official confirmation is pending, there are reports that a calibration aircraft was flying over western Ukraine, which might indicate Ukrainians are making final preparations, recalibrating and fine-tuning ground-based radars for the arrival of the new Swedish planes.

The ASC-890, based on the Saab 340 airframe, is an airborne early warning and control aircraft. It features the Erieye radar, a fixed, active electronically scanned array mounted atop the fuselage. This radar system offers a detection range of up to 450 km and can track multiple targets simultaneously, including aircraft, missiles, and drones.

By operating at high altitudes of 6,000 meters, the ASC-890 can monitor vast areas, providing real-time data to command centers and enhancing situational awareness. Essentially, aircraft like the ASC-890 serve as flying radar stations and command centers, coordinating air and ground operations effectively, with its compact size and reliability making it ideal for rapid deployment.

In the context of Ukraine’s current defense infrastructure, the ASC-890 represents a substantial upgrade. Ukraine’s existing radar systems are primarily ground-based, and even though some of them have a range of around 350 to 400 km, their immobility limits their range and makes them vulnerable to terrain obstructions. The ASC 890’s airborne platform overcomes these limitations, offering a broader and more flexible surveillance capability. This enhancement is crucial for the early detection of incoming threats, more accurate tracking of them, and a better response time that would allow Ukrainian air defense to intercept air threats more successfully.

The integration of the ASC-890 is particularly significant in light of Ukraine’s acquisition of Western fighter jets, notably the F-16s. After the manufacturer, SAAB, made some updates to improve the interoperability between the 2 systems, the ASC-890 can now provide these aircraft with comprehensive situational awareness, guiding them to targets and alerting them to potential threats.

As a result, these awacs will significantly improve the engagement range of the F-16s, allowing them to use their modern air-to-air missiles at their maximum ranges, as well as providing a significant improvement to the limited radar detection range of the F-16.

This synergy enhances the operational effectiveness of fighter jets, enabling more precise and coordinated missions. Additionally, the ASC-890’s data can even support Soviet-era Ukrainian fighter jets, extending their operational capabilities despite technological disparities. Sharing real-time radar data and threat information with ground-based command centers, Ukrainians can then relay targeting and situational awareness updates to the pilots via secure radio or datalink.

This allows older aircraft, despite lacking modern onboard radars, to operate more effectively by flying with external guidance and warning support.

Contrastingly, Russia’s equivalent platform, the Beriev A-50, has faced significant challenges. Since early 2024, Ukraine has successfully targeted and destroyed at least two A-50 aircraft, utilizing systems like the Patriot missile defense. These losses have compelled Russia to operate its remaining A-50 fleet even further from the front lines, diminishing its surveillance effectiveness over Ukrainian territory. [ Now grounded ]

The reduced presence of A-50s near Ukraine hampers Russia’s ability to conduct continuous airborne surveillance and coordinate air operations effectively.

Overall, the arrival of Sweden’s ASC-890 aircraft is a strategic boon for Ukraine, especially amid uncertainties regarding continued American intelligence support. These aircraft not only bolster Ukraine’s air defense and surveillance capabilities but also ensure greater autonomy in operational planning and threat response.

As the war continues the ASC890 will fill in gaps as a critical asset in safeguarding Ukrainian airspace and enhancing the effectiveness of its aerial operations.

https://x.com/NOELreports/status/1962479531706495435

Seen here, Ukrainian drones hunt down and slam into a pair of Russian Mi-8/17 helicopters.

https://x.com/Osinttechnical/status/1962434829649088622

Supposedly, the drones are transported via USV and controlled through Starlink.

Some Ukrainian observers had earlier suggested the footage was of a live strike.

https://x.com/wartranslated/status/1962183979135623325

Probably operational test (OT) to determine missile accuracy.

Target selection based on ability to get satellite imagery or ISR overflight.

https://x.com/Maks_NAFO_FELLA/status/1962504526411272490

Multiple Ukrainian drones successfully struck an electrical substation supplying power to a major Russian railroad junction in Krasnodar Krai, reportedly causing significant damage.

https://x.com/Osinttechnical/status/1962366273947312318

Fire at the substation visible via NASA's FIRMS.

“Multiple Ukrainian drones successfully struck an electrical substation supplying power to a major Russian railroad junction in Krasnodar Krai”

Perhaps to cut railroad supply of fuel to some facilities in Krasnodar Krai, that had previously been supplied from the refinery there.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.