Meanwhile, since Beijing has tipped its hand that it will not temper any housing price speculation, the local population has been happy to chase home price to the upside, and after a decade of rapid home-sales growth, fueled by borrowing, China’s household leverage ratio hit a record high of 57.7% in the first quarter. It was, according to the WSJ, the biggest quarterly jump in the ratio since the first quarter of 2010.

Indeed, as noted above, the WSJ confirms that "the central problem in China is that buyers have figured out the government doesn’t appear to be willing to let the market fall. If home prices did drop significantly, it would wipe out most citizens’ primary source of wealth and potentially trigger unrest", something we have been saying for more than half a decade.

That gives Chinese citizens who have enough money an incentive to keep buying because they believe property in large cities will remain the safest investment in China, regardless of the health of the broader economy.

"Property has hijacked China’s economy, so the government wouldn’t dare to push for a plunge in housing prices, even if that’s the most effective way to deflate the bubble,” said Chen Zhiyu, who works for an American retailer and is looking to purchase a property in Shenzhen. He could as well be talking about the US stock market, which is serving a similar wealth effect function half a world away in the US.

“You gotta follow the money,” said the 37-year-old, adding that he has raised his budget for spending on property since the coronavirus pandemic helped drive up prices. "Whenever governments start printing money, asset prices will go up. In the U.S., you have a bull stock market, but in China, only housing prices will keep surging."

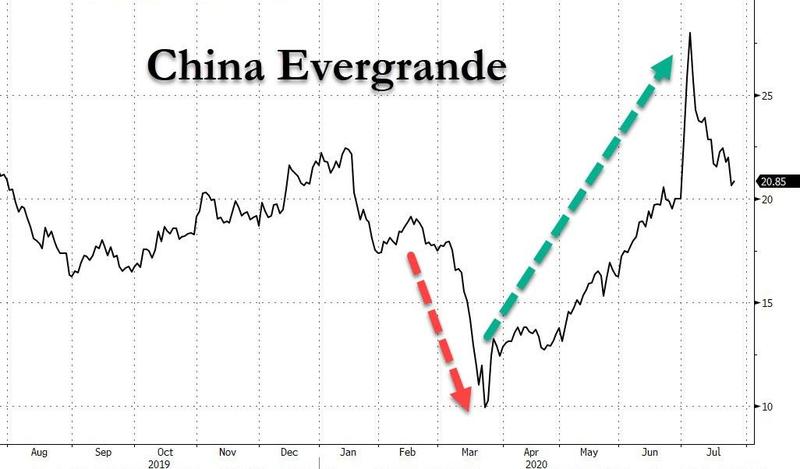

Bingo, and for the reason why to China the housing market is as stocks are to the US, see the top chart above.

Meanwhile as the bubble grows bigger, an ever greater portion of the economy becomes reliant on its continued expansion and viability. Sales activity, for one, is being driven by cash-strapped developers and the local governments that sell them land. And both need to gin up revenue to pay down debts or offset other problems, and are cooking up more incentives to move properties. The bottom line: everyone is targeting higher home prices which in turn drive much of the rest of the economy.

The problem, as China has found out the hard way on so many occasions, is that every bubble eventually bursts, and when it comes time for the housing bubble - which is now arguably even bigger than the US stock bubble, let along the US housing bubble of 2007 which was amateur hour by comparison - no one has any idea how Chinese officials can manage the problem without destabilizing the broader economy. Even if the market stays strong, it creates headaches for policy makers, who have had to hold off on more aggressive economic stimulus this year—which some analysts say is needed—partly because of fears it will inflate housing further.

Meanwhile, the bubble is only getting worse:

Polling conducted by the China Household Finance Survey, based in the Southwestern University of Finance and Economics in Chengdu, suggests the coronavirus pandemic has encouraged the kind of buying Beijing worries about, with demand for property rising among people who already own multiple properties, even as it has dropped among those who don’t yet own any.

That is a telltale sign of speculative investment, according to Gan Li, a professor of economics at Texas A&M University and an expert in Chinese household finance.

"Speculative demand is on the rise because [people] view housing as a safer asset than the stock market or overseas assets,” he said. “They think it’s guaranteed. Because of the pandemic they’re actually consuming less, and saving more. So they’ll actually have more money available to invest. That will create an even larger housing problem."

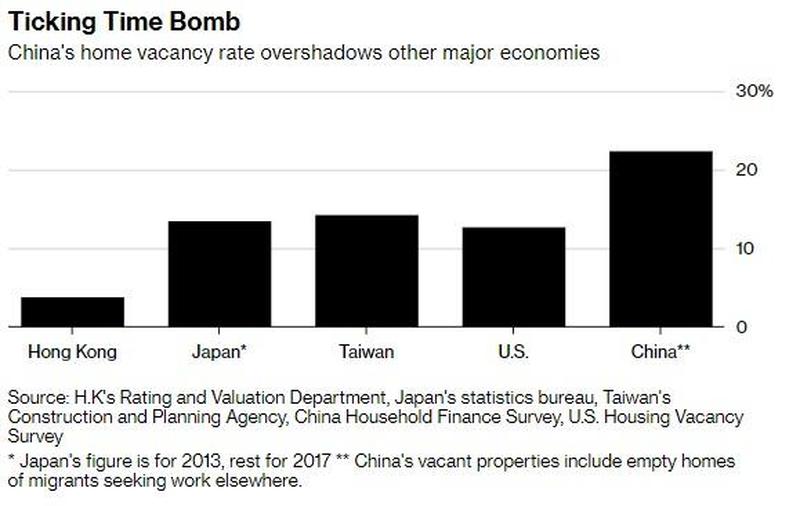

There are other problems too, one is that instead of actually living in them, many Chinese use local apartments as nothing more than an investment asset. Back in late 2018 we observed that for Beijing, a "nightmare scenario" was unfolding as more than 50 million apartments were vacant, about 21% of all homes in urban China.

Since then the number was only increased, and according to the WSJ which cites recent data from China Household Finance Survey, there are now 65 million empty units. Among families who owned two properties, the vacancy rate reached 39.4%, and among those that owned three or more, 48.2% were empty.

The record number in vacant units has meant little upward pressure on rents; in fact, Chinese rental yields are below 2% in major cities like Beijing, Shanghai, Shenzhen and Chengdu, less than can be made buying Chinese government bonds. Even so, Shannon Bi, a 42-year-old English teacher, told the Journal that the pandemic has pushed her to invest in a second home in Shenzhen sooner than she planned, because she worries about inflation. "You have to invest the money somewhere, or it will only depreciate," she said, and she is not wrong.

* * *

What is so worrisome to some economists is the speed at which China’s property boom - just like the US stock market rebound in the past four months - has grown so large, and its tendency to keep climbing even during times of economic stress. As recently as the 1990s, it was illegal under China’s communist system for most people to own homes.

A State Council decision in 1998 abandoned the country’s system of employer-allocated housing, and homeownership took off. By late last year, about 96% of China’s urban households owned at least one home, according to a Chinese central bank survey released in April, far exceeding the 65% homeownership rate in the U.S. Needless to say, mortgage debt in China has absolutely exploded.

In some ways, the boom accomplished Beijing’s goals. It has boosted economic growth and created wealth for millions of middle-class Chinese families (even if it is all dependent on nothing more than money printing and cheap credit, and like every other bubble, it will eventually crash). It also gave local governments, which must turn over a major part of income-tax revenue to the central government, additional revenue from land sales to developers.

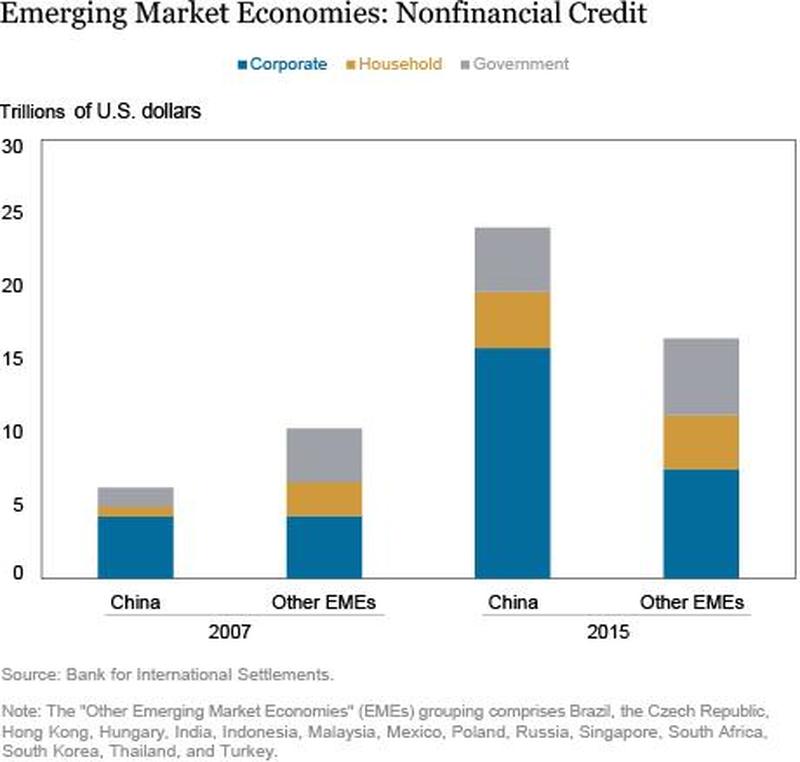

But the boom has taken investment dollars away from other industries competing with real-estate borrowers for bank funding. It also has saddled many families with debt. Globally, China accounted for around 57% of the $11.6 trillion increase in household borrowing over the decade through 2019, according to Bank for International Settlements data, or roughly half of all global debt created since 2005! The U.S. accounted for about 19%.

Home prices in some Chinese cities have reached levels comparable with some of the world’s most expensive urban areas. Average home prices across China reached 9.3 times average income in 2018, according to the Chinese Academy of Social Sciences, compared with 8.4 in San Francisco.

In Tianjin, a city of 15 million southeast of Beijing, apartments in upscale areas sell for around $9,000 a square meter, or about $836 a square foot, according to real-estate services company Savills PLC. That is roughly the price an average buyer would pay in some of the most expensive parts of London, even though disposable incomes are seven times as high in London as in Tianjin.

The bottom line is that, for better or worse, just as Americans have gone all in on stocks, urban Chinese have bet everything on their homes. And picking up on the chart that we first showed years ago, the WSJ notes that the Chinese "now have nearly 78% of their wealth tied up in residential property, versus 35% in the U.S."