All true.

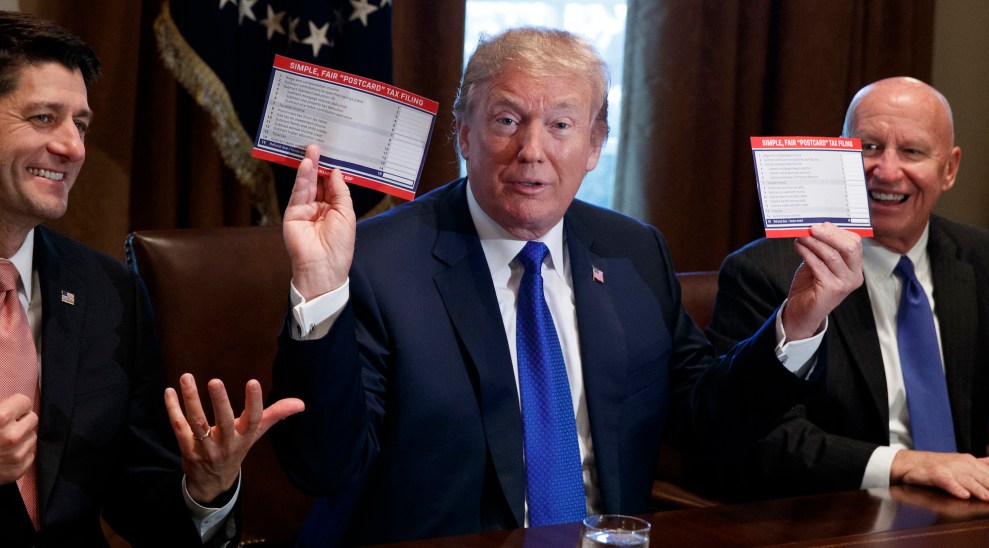

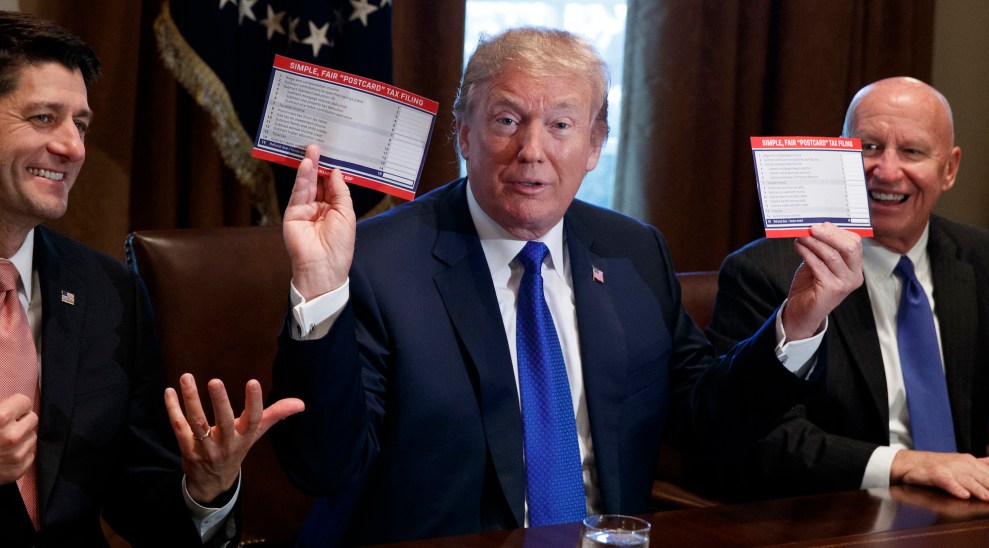

What I would like to know is: where is Donald Trump?

Is he really going to screw us all?

I want to believe that, in the end, he won't go along with all of this - but it looks like he will.

For those of you who think that all Californians are nut cases, there still are lots of middle and upper middle income conservatives living here, and I am one of them.

For folks in low or no state income tax states, if you itemize and think that either of these bills will not result in higher incomes taxes, then think again and try applying these proposed changes to your last year’s tax returns, both Federal and State.

Everyone will lose medical expenses, real property taxes, personal property taxes, sales taxes and some other tax deductions. Plus, if your state income taxes are calculated directly off of your Federal income tax form as is California’s, then your state itemized deductions will be significantly reduced, and your state income taxes will be significantly increased.

We need large and small business income tax reductions but we do not need this fraud of an individual tax increase for those of us middle and upper middle income earners.

All true.

What I would like to know is: where is Donald Trump?

Is he really going to screw us all?

I want to believe that, in the end, he won't go along with all of this - but it looks like he will.

True. Most states start with your federal AGI, then allow either federal itemized deductions, or a meager standard deduction (e.g. $2,300 for a single filer, $3,000 for a joint filer in Georgia). So, if after losing itemized deductions, you are forced to take the federal standard deduction, then you have to take the state standard deduction as well.

I will lose roughly $12K in itemized deductions making the federal standard deduction higher. And, if forced to use the federal standard deduction, then my state itemized deductions will go from $24K, and change, to the $2,300 Geordia standard deduction. That means I will owe $1,100 more in state taxes at 5% of $22K.

So, in my case, and many others I can name, I will be getting a federal and state tax hike. But, I'm sure Congress already thought about this. Right? Unless all 40 some-odd states with an income tax change their laws simultaneously, this hidden gem will negate any of the proclaimed tax savings Republicans in Congress are harping about.