Oh yeah! Things are REALLY looking up.

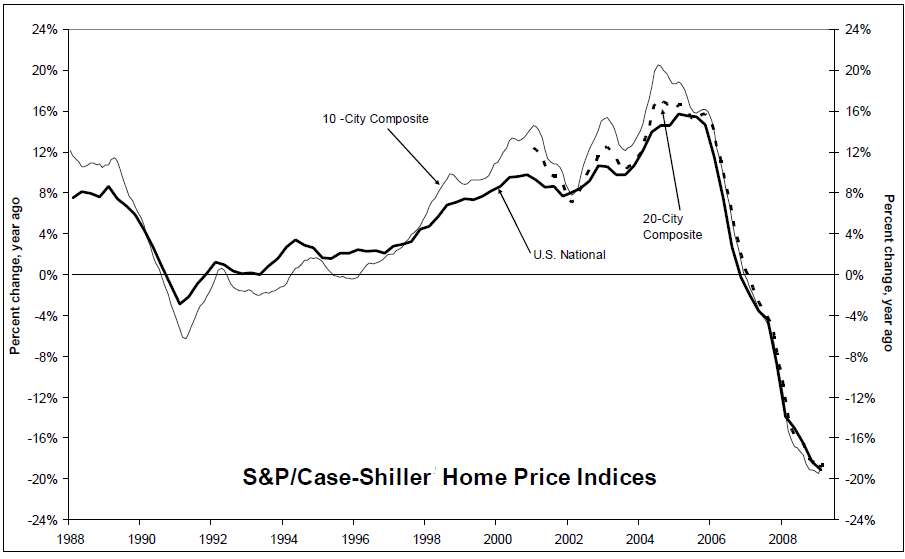

Last Hurrah for Housing

Case-Shiller is a backward looking index. The increasing number of foreclosures, the complete collapse in new home sales, a massive increase in inventory, and the end of tax credits all suggest we are near the end of the line for this bounce in home prices.

Interestingly, even the home builders are against another home tax credit. Is that reflective of the massive distortions caused by the credit, the realization the tax credit was useless, or the fact that homebuilders recognize there is little chance Congress will back another tax credit?

Regardless, here's the deal: New Home Sales Consensus 330K, Actual 276K, a Record Low. As a followup please see How Many New Home Sales Was That?

Expect to see new all time low prices in some cities later this year or next year as pent-up demand dries up along with incentives that merely brought that demand forward.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com