Skip to comments.

The Dow Just Goes Up

Self

| February 24, 2021

| Barnacle

Posted on 02/24/2021 6:27:57 PM PST by Barnacle

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-117 last

To: LS

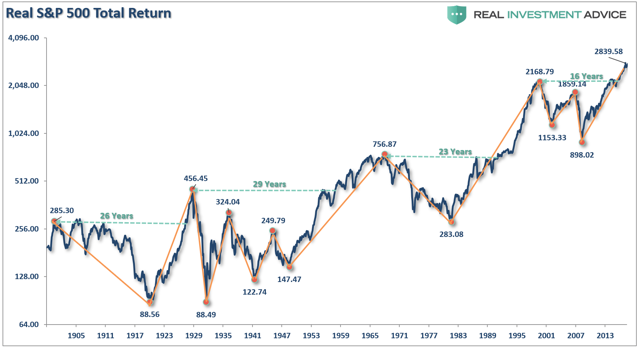

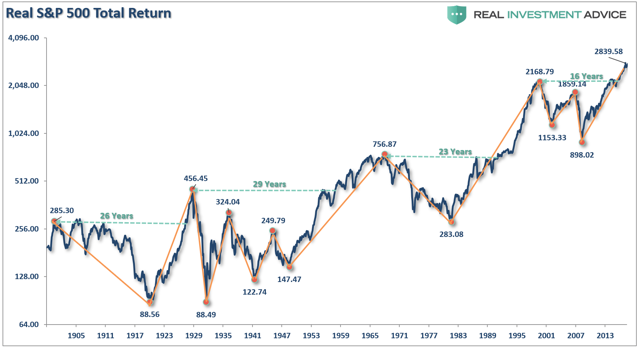

If I'm not mistaken, it took ~25 years for the DJIA to recover from the crash of 1929.

There are multiple periods throughout US history where the markets dropped and stayed down for lengthy periods of time. Consider this chart, for example:

It's often said "don't have any money in the market that you need within 10 years". That's IMHO very good advice. (Just look at the market returns from peak to recovery in the 2000s. There were two big drops during that decade: the dot com crash of March 2000 through Oct 2002 (-44.11%) and the Subprime Crisis of Nov 2007 through March 2009 (-50.89%). A $1M portfolio of 100% US equities on 1/1/2000 would have only recovered to $1,150,588 at the end of that decade, for a CAGR of 1.2% or inflation adjusted CAGR of -1.21%..worse, the investor would have spent 5 years and 8 months "underwater" (ie: value less than what they started with) from Sep 2000 until April 2006..

Generally speaking, it seems many people think that recoveries from bear markets happen 'quickly'. 2020 was, of course, an extreme instance of that but a once in a lifetime anomaly that was happened primarily due to stimulus. But taking more 'normal' market volatility into account (like the period from 2000-2010), it's quite possible to be "underwater" on total equity returns for 5-10 (or more) years. 1-2 year recoveries are definitely not the norm.

Now, for anyone with 10+ year investing horizons..that's a different scenario than those in retirement or with shorter time horizons where access to $$ is needed within that window..

To: jstolzen

I still am not good at posting images. But look at the market over 100 years. You can’t even see the 1929 crash.

102

posted on

02/25/2021 8:00:43 AM PST

by

LS

("Castles made of sand, fall in the sea . . . eventually" (Hendrix) )

To: Barnacle

I’ve seen this before. If you remember way back when Obama won election the market got scared and lost several hundred points the day after his election. Then when he was inaugurated the dow lost several hundred points two days in a row. The market at that time was scared to death of dimocrats, Obama, and socialism, and started on a downward spiral over the next couple of years.

All this was in response to Obama and dimocrat policies. Then it bottomed out at 7,200 in March 09. From there it just went up and behaved irrationally. It was no longer scared of Obama’s policies but loved them. Each time Obama did something that should have scared the hell out of the market it just kept going up.

Fast forward to Nov 2020. I honestly thought the market would tank if the dimocrats won the house, the senate, and the presidency. After all, the market, under Trump, behaved as it did before Obama and it seemed things were back to normal. BUT the markets skyrocketed with the news that the dimocrats, with all of their freedom and economy killing policies, were in full control.

I think the Obama admin figured a way to manipulate the market so it would rise and now the biden admin is doing the same. I think it will continue to go up due to whatever it is that the dimocrats are doing behind the scenes.

To: wgmalabama

When interest rates are lower the lump sum is higher. I never had any question about taking the lump sum. I’ll be managing it myself like a 401K.

104

posted on

02/25/2021 8:22:08 AM PST

by

dynoman

(Objectivity is the essence of intelligence. - Marilyn vos Savant)

To: Big Red Badger

105

posted on

02/25/2021 8:26:02 AM PST

by

dynoman

(Objectivity is the essence of intelligence. - Marilyn vos Savant)

To: Barnacle

Yeah the markets and crypto, the crypto market cap is up 1.25 billion over the last year. Flush with cash is the right word, it’s frothing, it’s inflated.

106

posted on

02/25/2021 8:32:10 AM PST

by

dynoman

(Objectivity is the essence of intelligence. - Marilyn vos Savant)

To: Barnacle

Bond obliteration continues.....

To: MrRelevant

Many people don’t get that. The markets will follow the economy - eventually. Not enough of a positive change in the economy to support what the markets have done in the last year, especially true in the crypto market with it’s 1.25 trillion rise in value.

108

posted on

02/25/2021 8:39:00 AM PST

by

dynoman

(Objectivity is the essence of intelligence. - Marilyn vos Savant)

To: Barnacle

Wrong about the crypto market cap, it’s up 1.25 TRILLION over the last year.

109

posted on

02/25/2021 8:42:00 AM PST

by

dynoman

(Objectivity is the essence of intelligence. - Marilyn vos Savant)

To: Barnacle

I think we are at or very near how much bonds can be destroyed before something breaks.

To: Barnacle

111

posted on

02/25/2021 9:58:07 AM PST

by

dfwgator

(Endut! Hoch Hech!)

To: LS

Understood..but the point I was trying to make, regardless of whether you can see the 1929 crash relative to the growth of the market over the past 100 years is that markets can, and do, drop and stay “underwater” for very long periods of time - often 10+ years or more.

The 1929 crash took 25 years for the DJIA to get back to the same level - ie: to “recover” from the crash.

Some may have 25 years to recover from the next crash. Others, especially those in retirement with shorter timeframes should be aware of the risk that equities involve..and it’s been my experience that there’s pretty widespread expectations out there that markets “always come back quickly” (as in, a year or three at most) - and that is most definitely not the case..

US equity markets do seem extremely jittery at the moment..just look at today. A small uptick (literally less than 1/10th of 1%) in the 10-year T-Bill, and we dropped 500 points on the Dow, 2+% on the S&P and 3+% on the NAS.

Might be time (especially for those with a need to reduce risk or shorter investment timelines) to lock in some profits. US markets are massively over-priced by any measure, and the balloon IMHO is eventually going to pop. Whether today is the start of it or it starts in 2021 or 2022 is hard to say..but it’s almost certainly coming, especially with the lunatics “in charge” of the US economy at present.

To: jstolzen

Well I was wrong. It was 2.5 in 2019. 1.9 in 2020. So my mistake.

113

posted on

02/26/2021 5:50:30 AM PST

by

wgmalabama

(Tag line for rent. )

To: jstolzen

Agree, but again 1929 is an exception because FDR’s policies utterly destroyed any chance for business recovery. A better example would be 1987.

114

posted on

02/26/2021 8:04:06 AM PST

by

LS

("Castles made of sand, fall in the sea . . . eventually" (Hendrix) )

To: LS

Sure..but the odds that Biden’s policies are going to be just as bad as FDRs, if not WORSE are IMHO quite high / almost certain. Just look at the insane spending ($1.9T stimulus that’s mostly not needed and which only ~9% actually has anything to do with COVID..$2-3T infrastructure bill..$12T [!!!] “reparations”)..that’s gonna be a disaster if even a third or quarter of all that passes.

Let’s face it..we’re in an environment with the current regime that none of us have ever, ever seen before in US history. All bets are off at this point and I don’t think any of us can count on a “normal” investment climate until we get to a new administration in 2024.

To: jstolzen

Agree but not for reasons you think.

I think we are STILL digging out of a huge deflation due to tech productivity.

116

posted on

02/26/2021 3:22:00 PM PST

by

LS

("Castles made of sand, fall in the sea . . . eventually" (Hendrix) )

To: Barnacle

Since 2008 take this

to the $7.1 trillionth power and then you will know why the market is heated (Mainly for retirements/pensions which is why younger generations are trying to economically troll the theft).

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-117 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson