Posted on 08/05/2024 6:07:24 AM PDT by John Robinson

Stock markets around the world are crashing right now, but why?

The answer to this question is the Yen carry trade, a term you'll probably hear many times this week.

So what exactly is the Yen carry trade and why did it cause a market downturn?

It all started after the Bank of Japan (BOJ) decided to raise rates at their most recent meeting. The BOJ raised rates to ~0.25% in their second rate hike since 2007, effectively ending negative rate policy. For years, traders took advantage of these ultra low rates.

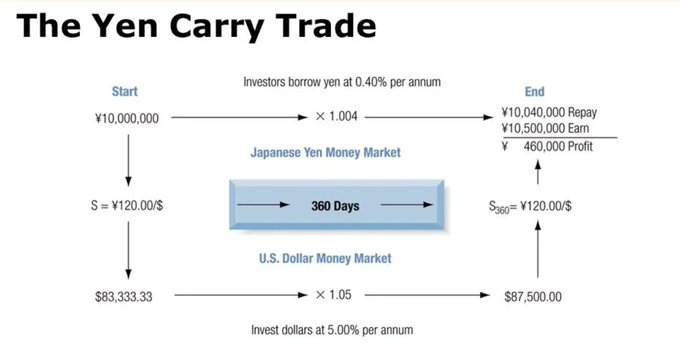

The Yen Carry trade explained:

For years, investors would borrow Yen at ultra low rates, such as ~0.4%, and use these Yen as a form of leverage. Investors could convert these Yen to US Dollars or other currencies and get *almost* free margin. Low rates made this possible.

The wide spread between rapidly rising rates in the US and other countries and negative rates in Japan made it possible. However, as the BOJ began raising rates, this resulted in an unwinding of the carry trade. Especially as rate cuts are beginning in the US and EU. As a result, the Japanese Yen strengthened and the USD/JPY currency pair just hit its lowest level since December 2023. You now receive 142 Yen for every US Dollar compared to 160 Yen for every US Dollar a few weeks ago.

But here's why this is the key point:

As the Yen strengthens, many of these Yen carry trades are being "margin called." Suddenly, the era of "free" Yen loans is coming to an end. As these margin loans are called, the underlying assets are being sold and crashing equity markets.

The carry trade is unwinding.

The solution to this problem is not as simple as it may seem and may require a separate thread. This is a vastly different situation than previous market downturns.

For now, we are trading the volatility.

Very helpful explanation thanks.

Not to worry, we have Joe Biden and Kamala on guard. And as long as we all use correct pronouns, continue to de-sex our young, and pledge fidelity to wokeness, we will be shielded from trouble.

Just a thought.

It has dawned on investors that the possibility of a Kommie-La Harris regime is becoming real and the total destruction in EVERY aspect that would entail!

I guess all the dem memes on look at your 401k will need revised now.

FEAR OF KAMALA

Nailed it. And the riots in the UK simply add to the Kamala problem.

The UK is a tinderbox... Illegal Migrants living free of charge in luxury hotels, and being given spending money monthly by the government while they work under the table for untaxed cash... Tends to grate on those living in the borderline of poverty, formerly referred to as the ‘Middleclass’.

The same thing is happening in Democratic countries worldwide including the United States... So it’s only a matter of time.

would love to all of our employees (regime keepers) that sold off stock last week...

The market P/E ratio still seems high, even by 21st century standards.

https://www.multpl.com/s-p-500-pe-ratio

Very helpful explanation thanks.

***********

I second that.

They tried to take out Trump every way possible, and so far, they’ve failed in every attempt.

So now, they’re going directly for the heart of middle-class America instead.

Whadda bunch of evil arseholes.....

It’s only 9:37 EST and Yahoo finance is DOWN due to technical difficulties.

Warren Buffett is bailing out today. That is a strong indication.

Basically ALL the market gains over the past 3 1/2 years are about to be wiped away - isn’t Kamala great.

Black Monday

Indian/Jamaican Monday.

Yeah, I can’t seem to login to my investment account site either.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.