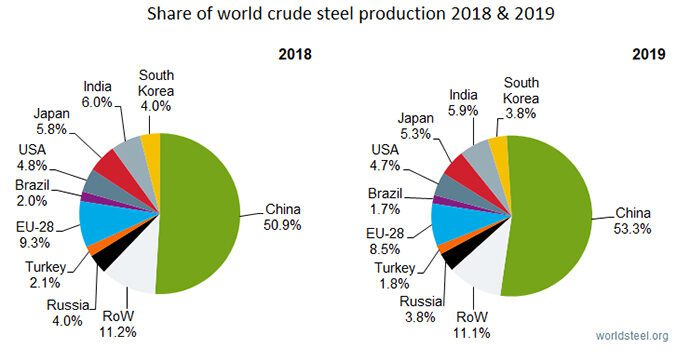

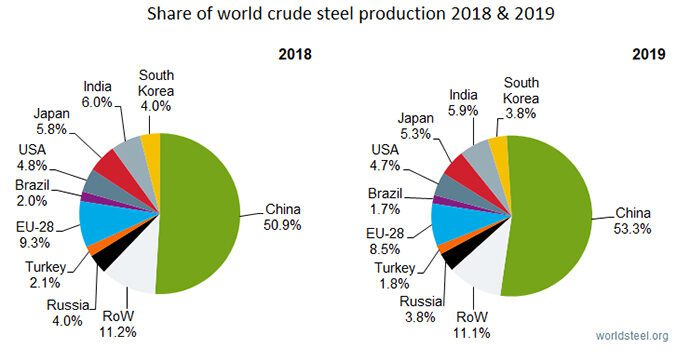

China is now in the position that the USA was after WW2: half the world's steel production, and a similar proportion of industrial goods.

His mistake is that he's too emotionally tied to gold and silver. There's nothing wrong with commodities, but it's a very small segment of finance.

The US dollar is too strong in the opinion of many - including President Trump.

This issue is debt-based money - not precious metals.

That is what is enslaving the citizens of the world.

China is now in the position that the USA was after WW2: half the world's steel production, and a similar proportion of industrial goods.

I don’t know. Whatever.

Every time I read one of these “ancient foresight” pieces, I receive the same enlightenment:

HANG ON TO YOUR WEAPONS AND AMMUNITION.

;-)

Consider the 1869 Gold Panic engineered by the Gold Ring composed of Jay Gould, James Fisk, and Abel Corbin, a brother in law to the new President, U.S. Grant. With the US was on the gold standard, they cornered the gold market and drove up the price in dollar terms, which then triggered a financial panic as gold denominated debts began to come due -- with President Grant unavailable because he was on vacation.

The panic broke only when a US Treasury official acting on his own authority approved the sale of gold bullion from US Treasury, which Grant wisely approved as soon as he was informed. Speculators had been recruited to the scheme on the false basis that with Grant's brother in law involved, Grant himself was in on it as well.

With a gold standard, bad policy decisions can also disorder the money supply, with catastrophic effects on prices. That was a key cause for the Great Depression. In the 1920s and 30s, the US and France adopted a policy of gold accumulation in which the government bought and held gold without issuing new money reflecting those gold holdings.

This deprived other countries of access to the normal flow of newly mined gold that added to the global base money for national currencies. In effect, as with the Gold Ring, the result was a gold shortage that led to a shortage of currency to run national and global economies.

This caused a worldwide deflation that crushed banks, ruined debtors and businesses, and impoverished hundreds of millions who had been employed, productive, and prosperous. The ensuing poverty and discontent brought down governments and disordered societies around the world. The Second World War followed.

If a return to the gold standard is no answer to our financial problems, what is? Spending restraint leading to balanced budgets and stable monetary value for the dollar. More is required, but that is the essential remedy.

[Does Schiff think if he says something for enough years (decades in his case) that it will eventually become true?

His mistake is that he’s too emotionally tied to gold and silver. There’s nothing wrong with commodities, but it’s a very small segment of finance.

The US dollar is too strong in the opinion of many - including President Trump.

This issue is debt-based money - not precious metals.

That is what is enslaving the citizens of the world.]

The drive-by conclusions about the Roman empire are silly. The issue they ran into was mutual adaptation and rivals who were as intelligent as the Romans themselves, so capable of matching, then surpassing their innovations. Everything that gave the Roman military an edge, its rivals adopted. But those rivals also came up with new approaches the Romans failed to keep up with.

In other words, Rome fell to its enemies for the same reason the remnants of the Greek empire fell to Rome - an inability to permanently stay ahead of the opposition. There is a measure of luck and circumstance involved in getting to and staying at the top. That serendipity eventually shifted to its rivals, and then to the rivals of those rivals and so on.