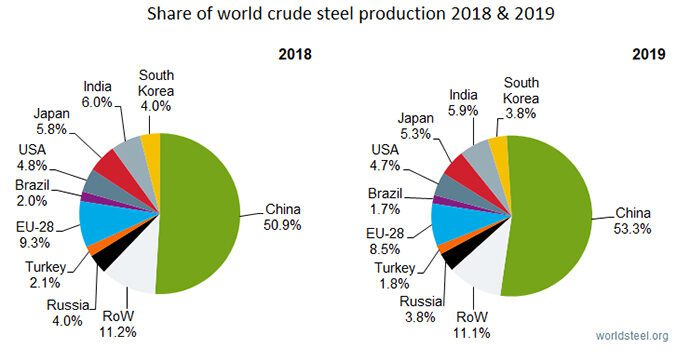

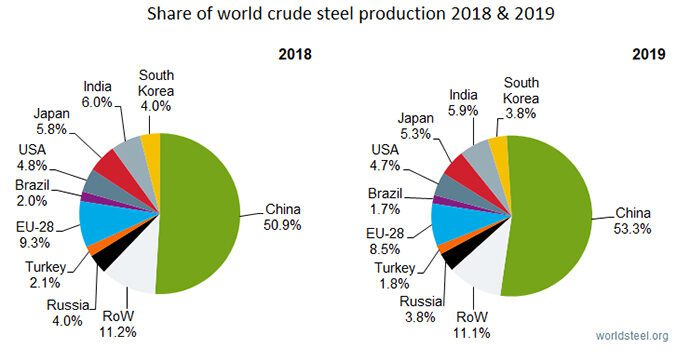

China is now in the position that the USA was after WW2: half the world's steel production, and a similar proportion of industrial goods.

Posted on 05/17/2024 9:18:27 PM PDT by SeekAndFind

His mistake is that he's too emotionally tied to gold and silver. There's nothing wrong with commodities, but it's a very small segment of finance.

The US dollar is too strong in the opinion of many - including President Trump.

This issue is debt-based money - not precious metals.

That is what is enslaving the citizens of the world.

China is now in the position that the USA was after WW2: half the world's steel production, and a similar proportion of industrial goods.

China is a factory nation who's economy is utterly cratering - leading the rest of the world into the abyss of a very long-lasting recession that could turn into a depression for some.

” China is a factory nation who’s economy is utterly cratering - leading the rest of the world into the abyss of a very long-lasting recession that could turn into a depression for some. “

So like the USA in 1929, then ?

We are so screwed.

I don’t know. Whatever.

Every time I read one of these “ancient foresight” pieces, I receive the same enlightenment:

HANG ON TO YOUR WEAPONS AND AMMUNITION.

;-)

>> China is now in the position that the USA was after WW2: half the world’s steel production, and a similar proportion of industrial goods.

Yeah, but who’s #1 in moviemaking, music videos, sports, and pr0n? Huh?

I would think the present course of countries selling Treasuries is a pretty good indicator - but it would take something else, like, say, disclosure that there is no gold in Ft. Knox might do the trick.

Very much so.

The international bankers control the future actions and labor of the world, through debt-based currency.

This with "money" simply own "claims on the future labor of others". Money is a claim on debt.

Right now there is an enormous shortage of US dollars (Eurodollars) internationally to settle trade between nations.

That's why the nations of the world are doing everything they can to create new debt - including the US.

It's why student loans went from $300 billion outstanding in 2000 to over $1.8 trillion now.

It's why the government attempted to have people take out new debt in 2007/08 through their "Cash for Clunkers" program - instead of telling people to be wise with their spending and become debt free.

If all debt were paid off then there would be no money. There would be zero claims on debt - therefore zero money.

The roaring 20's were a means to have the servants take out large amounts of debt through speculation. People like Groucho Marx did heavy real-estate speculation in Florida.

Then the banksters pulled the rug in 1929. It was the largest transfer of wealth at the time. Those making the loans tooks the underlying assets from the slaves.

2007/08 wasn't an accident. It was planned. There are signs to look for that show when the banksters are getting ready to steal wealth again - I was writing about it in late 2006 into 2007.

We're at a much worse point now. The bubble pop will be ginormous.

Look at the equities market in 2007. It was reaching new highs every day. A "soft landing" was talked about often.

This go around I see numbers showing a downturn that will easily last 10 years or more.

People think it can't happen. Those same people need to study the economy of Japan - and the generations who had their lives stolen from them in the aftermath.

One problem? Most Republicans don't understand economics any better than the Demonrats.

Japan is selling US Treasuries because the yen is closing in on 160 again - levels not seen in over 30 years. Their people are suffering.

They're selling US Treasuries and buying yen with result, in a failing effort to prop up their currency.

It's not because they hate the US.

That is going to be many families with jobs crash even more and the housing bubble pops - with loans higher than the new value of the house.

It won't be pretty.

People should be watching the price of oil. It's an easy general indicator. Two wars going on, OPEC reducing inventory, and they still can't keep WTI above $80.

“It’s not because they hate the US.”

I don’t think selling Treasuries or pulling away from the Dollar as a Reserve Currency means a country “hates the US”.

Do you?

They're not going to establish a new reserve currency. The banksters won't allow it.

Besides, anyone thinking BRICS and their cohorts would be successful at it when they're all simply factory nations - at best - doesn't understand international trade settlement. Everybody, and I mean everybody, is clamoring for Eurodollars (US dollars in the foreign markets). There just isn't any to easily be had.

Nice old V8 automobile! Does it run?

>> This is an actual photo of me and my family.

Which one are you, Laz? :-)

I’m the one that looks like they’re living in poverty.

I think he’s the cute lil’ guy in the overalls.

>> That’s why the nations of the world are doing everything they can to create new debt - including the US.

>> It’s why student loans went from $300 billion outstanding in 2000 to over $1.8 trillion now.

Bullshit. Your screed is sounding a lot like a support group for Modern Monetary Theory.

Which itself is bullshit upon bullshit.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.