Posted on 02/24/2024 5:59:01 AM PST by SpeedyInTexas

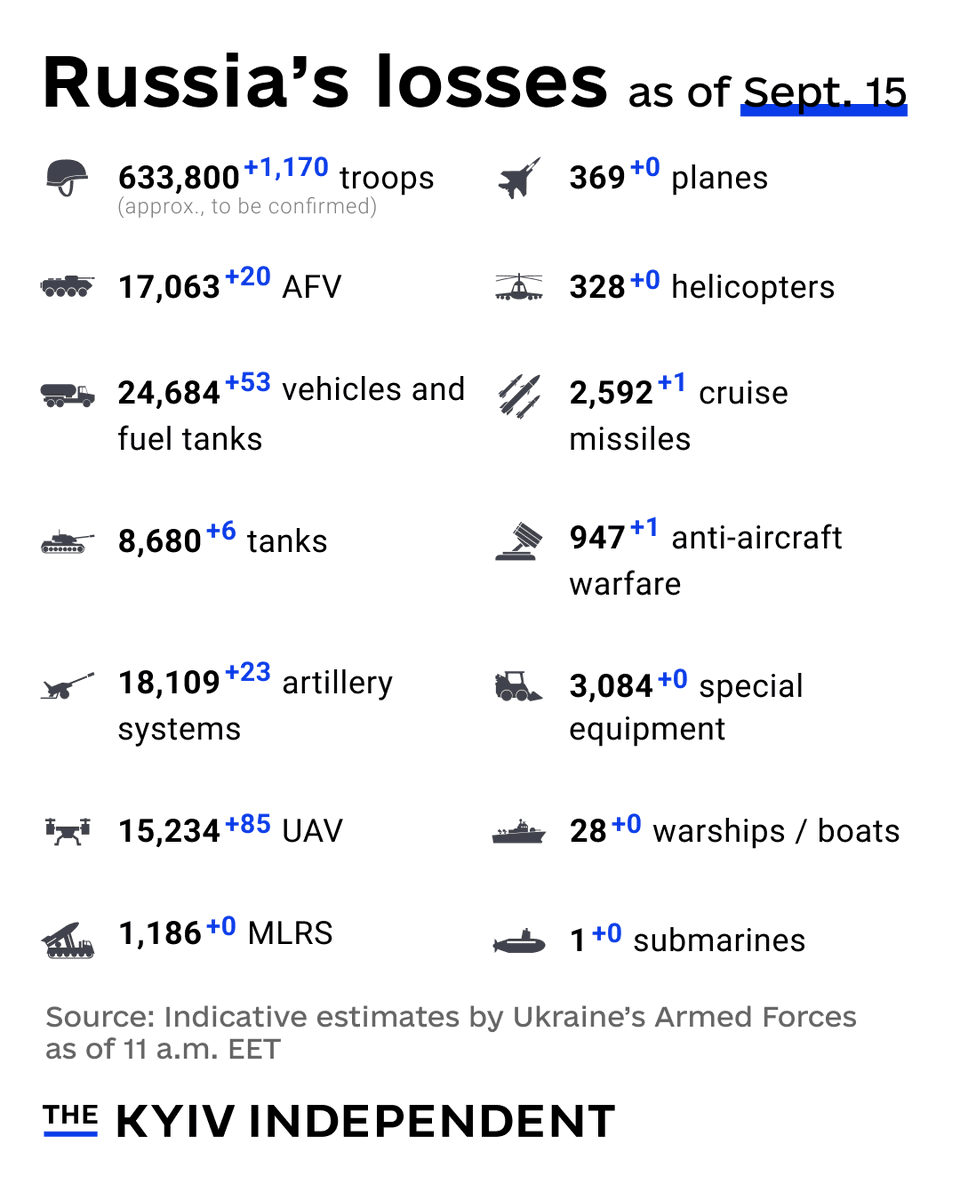

This list only includes destroyed vehicles and equipment of which photo or videographic evidence is available. Therefore, the amount of equipment destroyed is significantly higher than recorded here. Loitering munitions, drones used as unmanned bait, civilian vehicles and derelict equipment are not included in this list. All possible effort has gone into avoiding duplicate entries and discerning the status of equipment between captured or abandoned. Many of the entries listed as 'abandoned' will likely end up captured or destroyed. Similarly, some of the captured equipment might be destroyed if it can't be recovered. When a vehicle is captured and then lost in service with its new owners, it is only added as a loss of the original operator to avoid double listings. When the origin of a piece of equipment can't be established, it's not included in the list. The Soviet flag is used when the equipment in question was produced prior to 1991. This list is constantly updated as additional footage becomes available.

(Excerpt) Read more at oryxspioenkop.com ...

Iranian Ambassador to Russia Kazem Jalali told TASS about this on the sidelines of the BRICS Media Summit. “We are currently trying to connect the Mir and Shetab payment systems. Shetab is currently working at a test level. I believe that in about six months the Mir payment system will also start working in Iran,” the diplomat said.

Ask not for whom the bell tolls, it tolls for Russia. They sink or swim on the price of oil. If that price drops significantly next year, Russia won’t have much financial buffer remaining to withstand it.

OilPrice.com reports:

Macquarie Sees “Heavy Surplus” for Oil in 2025, Cuts Oil Price Forecast

By Charles Kennedy - Sep 13, 2024,

“- Macquarie: “our balances contemplate heavy oversupply across the next five quarters”

- This week, both OPEC and the International Energy Agency lowered their global oil demand growth forecasts.

Weaker-than-expected demand is set to tip the oil market into a surplus over the next five quarters, Macquarie said in a Friday note as it lowered its Brent and WTI oil forecasts for the rest of the year.

“As we enter shoulder and turnaround season, the ‘last hurrah’ for oil in the form of Q3 tightness is quickly fading as our balances contemplate heavy oversupply across the next five quarters,” according to the Macquarie note cited by BOEreport.com.

The bank revised down its forecast for Brent Crude price by $2 per barrel to $80 for the rest of 2024. Macquarie cut by the same amount its estimate for the WTI Crude price, expecting it to average $75 a barrel for the remainder of the year.

The market is set to tip into a “heavy surplus” in 2025 as non-OPEC+ supply is set to increase amid tepid demand growth. This expected heavy surplus could limit the need for the OPEC+ group to begin unwinding their production cuts, according to the bank.

This week, both OPEC and the International Energy Agency (IEA) lowered their global oil demand growth forecasts, citing weaker Chinese consumption so far this year.

Despite the second consecutive downward revision of its demand growth estimate, OPEC is still much more optimistic than the IEA on Chinese and global oil consumption growth this year.

Other Wall Street banks have also recently lowered their oil price estimates.

Weaker Chinese oil demand, high inventories, and rising U.S. shale production have prompted Goldman Sachs to reduce its expected range for Brent oil prices by $5 to $70-$85 per barrel.

Just two weeks after lowering its Brent estimate to $80 per barrel for the fourth quarter, Morgan Stanley cut again its forecast, now expecting the international benchmark to average $75 a barrel in the last quarter of the year. Analysts at Morgan Stanley see rising headwinds on the demand side, which has been their key reason for cutting their Q4 oil price forecast.”

Another indicator of lower oil prices next year - as Russian financial reserves are depleted.

OilPrice.com reports:

Oil Net Short For First Time in History

By Julianne Geiger - Sep 13, 2024

“According to energy investor and market commentator Eric Nuttall, the financial demand for oil, known as “net length,” has dropped to its lowest point in history.

Essentially, “net length” refers to the difference between the number of investors betting oil prices will rise (long positions) versus those betting they will fall (short positions). When net length is low, it means there is a reduced belief that prices will increase.

What’s even more striking is that, for the first time ever, the paper market for Brent crude is “net short.” This means there are now more investors betting that oil prices will fall than those expecting them to rise.”

The train wreck in the Russian natural gas industry continues to compound, as Europeans are now finally banned from participating in Russia’s export sales or project development.

OilPrice.com reports:

“Back in June, the EU approved sanctions on Russian gas, the first time it has done so. According to the Belgian EU presidency, the EU will hit Russia with unprecedented sanctions against its lucrative gas sector–a move that could potentially drain hundreds of millions from Moscow’s war chest.

However, the proposed penalties won’t hit the majority of Russia’s liquid natural gas (LNG) exports to the EU; instead, the sanctions would prevent EU countries from re-exporting Russian LNG after receiving it and also ban EU involvement in upcoming LNG projects in Russia. The sanctions will also prohibit the use of EU ports, finance and services to re-export Russian LNG, essentially meaning that Russia would have to overhaul its LNG export model. Currently, Russia supplies LNG to Asia through Europe, with Belgium, Spain and France being major hubs.

“If they can’t transship in Europe, they might have to take their ice-class tankers on longer journeys,” Laura Page, a gas expert at the Kpler data analytics firm, has told Politico, adding that Russia “may not be able to get out as many loadings from Yamal because their vessels can’t get back as quickly.”

Norway and the U.S. have replaced Russia as Europe’s biggest gas supplier: Last year, Norway supplied 87.8 bcm (billion cubic meters) of gas to Europe, good for 30.3% of total imports while the U.S. supplied 56.2 bcm, accounting for 19.4% of the total.”

https://x.com/Maks_NAFO_FELLA/status/1835257749413707920

The GBU-39/B Small Diameter Bomb (SDB) is a 250-pound (110 kg) precision-guided glide bomb.

The video shows a lot of destruction for a 250-pound warhead.

“GBU-39 bomb strike on a building with Russian personnel in the Kursk region… a lot of destruction for a 250-pound warhead.”

American weapons striking into Russia?

Call it a GBU-39, to maintain some surprise?

Post Peak China.

“SINGAPORE, Sept 10 (Reuters) - Oil products demand in China, long the driver of global crude consumption, peaked in 2023 and is forecast to decrease by 1.1% annually between 2023 and 2025, with the drop accelerating in subsequent years, a China oil researcher said on Tuesday.

Declining Chinese oil demand from the growing adoption of liquefied natural gas (LNG) trucks and electric vehicles (EV), as well as China’s slowing economic growth following the COVID-19 pandemic, has been a drag on global oil consumption and prices.”

“The train wreck in the Russian natural gas industry continues”

Come Dec 31, Ukraine will stop overland shipping of nat gas to Europe.

Severing ties between RuZZia and Europe is a benefit of this war.

Chinese used home prices fell another 1% month over month in August. That means home prices are still falling - 12% annualized.

In a year, Chinese home prices will have fallen 40% from their high.

“Chinese Stock Traders Ponder Just How Bad the Economy Can Get”

“A slew of poor economic data from China is deepening pessimism among equities traders wondering what it’d take for authorities to initiate forceful stimulus.

Figures released Saturday showed Chinese factory output, consumption and investment all slowed more than forecast for August, and the jobless rate unexpectedly rose to a six-month high. Home prices declined from the previous month.

“The fear is that the authorities are losing control of the economy and they won’t admit it,” said Gary Dugan, chief executive officer of the Global CIO Office. “The market looks set to go to significantly lower levels in the absence of real, substantial new policies.”

Concern that Beijing doesn’t have the stomach to turn things around has weighed on the nation’s equities. The CSI 300 Index fell to its lowest since early 2019 last week. In Hong Kong, the Hang Seng China Enterprises Index has dropped 13% from a high in May.”

$6.8 trillion here and $6.8 trillion there, pretty soon you have $13.6 trillion.

“The result has been an exodus from the nation’s equity markets. In all, some $6.8 trillion has been wiped out from the market value of Chinese and Hong Kong stocks since a peak reached in 2021.”

Interesting interview

https://m.youtube.com/watch?v=s4mFH6PNwsk

BRICS, RICKS, DICKS

“China Slowdown Spurs Calls for Stimulus Before It’s Too Late”

‘Production, consumption and investment cool more than expected

5% GDP growth impossible without ‘bazooka’ stimulus: economist”

“China’s economy lost momentum in August as activity cooled across the board, pointing to mounting risks to achieving the government’s annual growth target.

Measures of factory output, consumption and investment all slowed more than economists had forecast, while the jobless rate unexpectedly rose to a six-month high, official figures showed Saturday.

The broad weakening darkened the growth outlook for the world’s second-largest economy, fueling calls for a more aggressive policy response with just a few months left before the end of the year.

“The August data basically rules out the chance to attain the official target of 5% growth in 2024, unless the top leadership is willing to launch a bazooka stimulus package,” said Raymond Yeung, chief economist for greater China at Australia & New Zealand Banking Group Ltd”

The east is rising, the west is falling”... or something like that.

“Home prices fell at the fastest pace since 2014, reflecting weak confidence that’s weighing on demand and threatening to draw China into a deflationary spiral. A string of rate cuts has done little to stimulate borrowing, indicating anemic consumer and business sentiment.”

At least they have power plants to power EV, don’t think out unicorn fart production is quite up to speed😎

“Video showing the naval raid on the Krym-2 drilling platform by Ukrainian GUR’s Timur Group 13, and other units. “ [Ukraine’s GUR says the Su-30SM was shot down by a MANPADS during an operation in the Black Sea. ]

https://x.com/RALee85/status/1835110373462032849

Maybe use up the $6 billion that expires at the end of the month?

“Jake Sullivan, the White House National Security Advisor, announced that the U.S. is working on a significant assistance package for Ukraine, which may be revealed by the end of September. This package will include various capabilities to support Ukraine.”

https://x.com/NOELreports/status/1835223061857001492

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.