Posted on 02/24/2024 5:59:01 AM PST by SpeedyInTexas

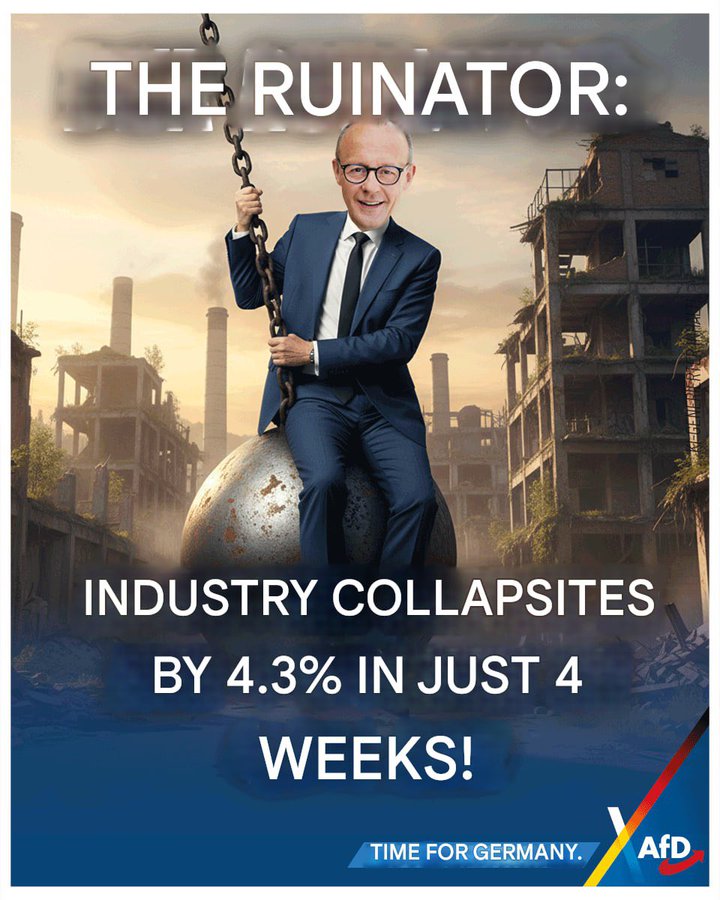

The so-called “engine of Europe” is coughing up smoke. Germany’s economy isn’t just slowing - it’s unraveling.

The hospitality sector, once the soft cushion of the Mittelstand, just posted catastrophic summer numbers: real turnover down 3.5% in August, even in peak holiday season.

The party’s over - restaurants, hotels, caterers all sinking in unison.

Behind the scenes, the industrial heart that powered postwar Germany has lost a quarter of its output since 2018.

Factories closing, firms fleeing, 270,000 manufacturing jobs gone in just over a year. The private sector shrinks; the bureaucracy swells by 50,000 new state jobs.

1.3 million private-sector jobs erased. Insolvencies up 27% in hospitality alone. The country’s on track for 25,000 corporate collapses this year - €60 billion in economic wreckage.

Berlin’s fix? Cut restaurant VAT back to 7%. A symbolic band-aid on a corpse.

Germany’s problem isn’t inflation - it’s exhaustion. Too many taxes, too much red tape, too little faith.

The beer’s still cold, but the optimism’s gone flat.

“Major PRC state oil companies — including PetroChina, SinoPec, CNOOC, and Zhenhua Oil — suspended purchases of seaborne Russian oil “at least in the short term” following the October 22 US sanctions”

BONE-CRUSHING SANCTIONS!

But wait, that’s not all...

Interesting how the usual has not posted any data of Russian GDP and industrial collapse, almost as if “he” is biased 😎

Stampede to replace Russian oil goes Global!

BONE-CRUSHING, now underway...

OilPrice.com (24 Oct):

Supertanker Rates Soar as Buyers Scramble to Replace Russian Oil

“The supertanker freight futures surged on Thursday and Friday after the U.S. sanctions against Russia’s biggest oil firms created a rush to replace Russian barrels.

The front-month supertanker contracts on the route Middle East to China, the benchmark route, jumped by 16% on Thursday, to the highest level in nearly two years, according to data from the Baltic Exchange data cited by Bloomberg.

“We anticipate the rush for replacement crudes will be larger and more sustained because of the exhaustive list of Russian producers under OFAC sanctions,” Anoop Singh, global head of shipping research at Oil Brokerage, told Bloomberg...

...(These sanctions) “are a major shock to refiners in India, which are already scrambling for alternatives.

Oil prices surged on Thursday after the U.S. sanctions were announced. Early on Friday oil was on track to post a weekly gain following Thursday’s 6% rally.

Supertanker rates were already rising earlier this month due to the latest tit-for-tat fees on port callings in the U.S.-China trade spat. The port fees threaten to create additional vortexes in global oil flows.

In those early days of the port fee escalation last week, the oil tanker market was in chaos as freight rates were rising on expectations of millions of U.S. dollars in additional costs per voyage, and cargoes were being delayed or canceled.

The U.S. sanctions could have a more sustained effect on global trade flows and tanker demand as buyers found themselves in a hectic search of additional supply from the Middle East, Africa, or the Americas to offset the expected plunge in Russian crude shipments.”

Must agree with the melon, President Trump has his eyes wide open esp to Russian mir and pitin😀🇺🇸

That explains Russia’s position, but not Ukraine’s

—

That’s easy: there is no way that Belarusian troops can cross into Ukraine because of the terrain and the fortifications. Plus, the Belarusian troops do not want to attack Ukraine - they resisted all attempts early in the war, so why should Ukraine attack them and make them mad?

Кремлевская табакерка

Some of the military at the front are outraged that Russia does not announce a serious mobilization

We were informed about such sentiments by several officers who are fighting in different areas in the NVO zone. “The guys who were mobilized in 2022 hope for demobilization. And they want justice. They have been fighting for a long time, they have not received payments, like many current contract soldiers, while honestly paying their debt to the Motherland. And they were very tired. More and more often I hear conversations from the guys: when there is already a serious mobilization, we will be replaced, we will rest, and someone who is sitting in the rear will fight instead of us? I understand that I am saying unpleasant things. And that during the NWO, maybe it is not worth saying so. But it is wrong to hide the truth,” said the channel's interlocutor, who is now in the Zaporizhzhia region.

Another officer who liberates the DPR noted that the situation is exacerbated by the mobilization of reservists, which should soon begin in Russia. “Someone was sent to the front, and someone will shoot down drones in the rear. Somehow unfair. The guys are worried, they ask if the reservists can replace them? And they will protect the refineries, I think this will suit them after the NWO,” the source said.

Our interlocutors in the Kremlin and the Ministry of Defense, in response to these words, asked the military to “be patient a little.” “I won't be able to rest yet. But we are working to find people who will replace our mobilized at the front. You just need to be patient a little, a few months,” said a source close to Andrei Belousov. What will change in a few months and whether this is somehow related to mobilization processes (among reservists and in general), he refused to say. He referred to the secrecy of information.

Fair points, but Belarus is one of the main ways Russian are staying in business and avoiding sanctions.

Belarus knows what they are doing, allowing drones and missiles through their air space, supplying food, fuel, ammunition and equipment.🤔

“Make them mad”, much like making Russian citizens “mad” bring war home to them

“Working to find people….”

But Russia has “unlimited “ manpower and all are ready to sacrifice for Dear Leader, right?😎

Russian damper payments (Federal subsidies to refineries, to keep domestic fuel costs low), have grown from $15 Billion/year, in 2021 (before the war), to $40 billion currently (equal to more than half their pre-war Defense budget of $70 Billion).

To reduce their deficits, they had planned to eliminate that expensive subsidy from their 2026 budget, but have recently decided to not only keep paying them, but to increase them further.

Going broke quicker.

Cheap gas is very expensive for the Kremlin.

Germany races to secure US sanctions exemption for Rosneft refineries

http://www.ft.com/content/0d9a5946-1cb6-4c0b-aa5b-7f5383dedef7

OilPrice.com - OilPrice

Blend Flag Futures & Indexes

Last Change % Change

today [10/24/2025]:

WTI Crude 61.53 -0.27 -0.44%

Brent Crude 65.90 -0.09 -0.14%

[10/22/2025]:

WTI Crude 59.82 +1.32 +2.26%

Brent Crude 62.59 +1.27 +2.07%

yesterday [10/23/2025]:

WTI Crude 61.79 +3.29 +5.62%

Brent Crude 65.98 +3.39 +5.42%

Can you tell us what countries might profit from having their tankers earning higher rental fees? I seem to recall that some decades ago, Greece used to have a lot of that kind of ships. Are these what have been called Tramp Steemers

Regarding border between Belarus and Ukraine, I read a while ago that beavers had done a mighty labor in the wetlands between the two countries converting them into serious barriers of water, dams, and downed trees. Try crossing that with motorcycles, golf carts, or bicycles. I suspect those beavers have been free to build these defenses since around 2014. All hail the mighty Beaver Brigade. ;-)

“Can you tell us what countries might profit from having their tankers earning higher rental fees?”

Yes, you are right that many tankers are Greek (privately/corporately owned). Most tankers are not State-owned, so the profits are more for corporations than countries. The big companies are mostly headquartered in Greece, or Bermuda.

BDA and analysis on the recent strike on Rosneft’s big Ryazan refinery, near Moscow.

OilPrice.com (24 Oct):

“Russia’s Ryazan oil refinery—its fourth-largest and a key Rosneft asset southeast of Moscow—was forced to halt a major crude distillation unit after a Ukrainian drone attack set part of the facility ablaze this week, industry sources told Reuters.

The targeted unit, CDU-4, handles roughly 4 million metric tons of crude per year, or about 80,000 bpd—nearly a quarter of the refinery’s total capacity. The stoppage, combined with secondary unit shutdowns including a reformer, vacuum gasoil hydrotreater, and catalytic cracker, has sharply reduced output. Rosneft has not commented, but sources say the plant continues limited operations.

Ukraine said it hit the Ryazan refinery, one of a growing number of strikes on Russian fuel sites as U.S.-led peace efforts drag on. Kyiv’s drones have been taking aim at the infrastructure feeding Russia’s war machine, and the Kremlin has been pointing to those same attacks to explain gasoline and diesel shortages at home.

Ryazan processed 13.1 million tons of crude last year, yielding 2.3 million tons of gasoline, 3.4 million tons of diesel, and 4.2 million tons of fuel oil. A prolonged outage could pressure domestic fuel availability further just as Russia heads into winter, when heating demand peaks and logistical networks tighten.

For global markets, the direct supply hit is small, but the symbolism isn’t. Every successful strike deep inside Russia adds to the risk premium baked into oil prices and tests the Kremlin’s ability to protect the infrastructure that underpins its export revenues.”

“Putin said. “But they will not significantly affect our economic well-being.””

President Trump’s Bone-Crushing new sanctions are making many diverse and serious impacts - despite Russian assertations to the contrary. (Pro Tip: Putin lies)

Sanctions Halt Oil Flows to Serbia as Russian-Owned NIS Faces Refinery Shutdown

OilPrice.com (24 Oct):

“Russia-owned Naftna Industrija Srbije (NIS) has halted crude processing as U.S. sanctions choke oil flows to Serbia, triggering fears of a fuel shortage ahead of winter. A shipment of roughly one million barrels of Kazakh KEBCO crude that arrived at Croatia’s Omisalj terminal on 9 October remains blocked after deliveries through the JANAF pipeline were suspended on 8 October, according to multiple industry sources cited by Reuters on Friday.

The U.S. Treasury’s Office of Foreign Assets Control (OFAC) allowed a sanctions waiver on NIS to expire on 9 October, formally cutting the company off from international crude purchases. NIS, 56 percent owned by Gazprom Neft, runs Serbia’s only refinery at Pancevo, which processes about 4.8 million tonnes of crude per year and supplies over 80 percent of the country’s gasoline and diesel demand. Without new cargoes, refining operations could stop by early November, officials and traders said.

Serbia’s government has downplayed the immediate risk. President Aleksandar Vucic said current inventories are sufficient through the end of the year, but analysts warned that prolonged disruption would force the country to depend on product imports through neighboring EU states.

The JANAF pipeline from Croatia had been Serbia’s primary supply line for Russian and Kazakh crude since 2022. Its closure underscores the limited flexibility of Balkan energy logistics, where few alternative routes exist and domestic storage capacity remains constrained.

Earlier this month, regional analysts said the U.S. measures were likely to hit Serbia’s downstream sector hard, calling NIS’s exposure “a critical vulnerability” for the Balkan state.

Serbia is now seeking replacement cargoes via Hungary and exploring temporary swaps through regional refiners. Whether those can arrive fast enough to keep Pancevo running will determine if Serbia avoids a full-blown fuel crunch.”

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.