Posted on 01/16/2016 10:19:48 AM PST by SkyPilot

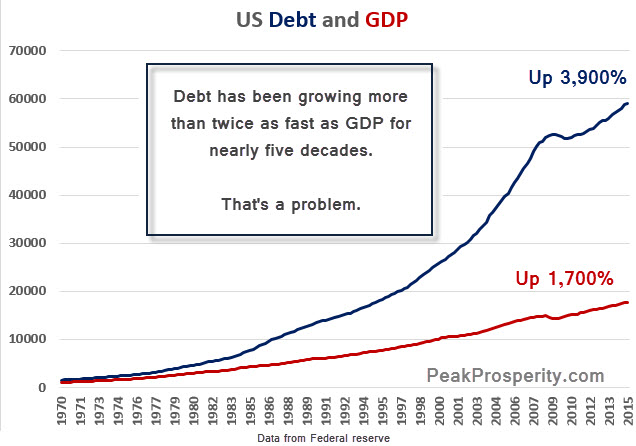

As we’ve been warning for quite a while (too long for my taste): the world’s grand experiment with debt has come to an end. And it’s now unraveling.

Just in the two weeks since the start of 2016, the US equity markets are down almost 10%. Their worst start to the year in history. Many other markets across the world are suffering worse.

If you watched stock prices today, you likely had flashbacks to the financial crisis of 2008. At one point the Dow was down over 500 points, the S&P cracked below key support at 1,900, and the price of oil dropped below $30/barrel. Scared investors are wondering: What the heck is happening? Many are also fearfully asking: Are we re-entering another crisis?

Sadly, we think so. While there may be a market rescue that provide some relief in the near term, looking at the next few years, we will experience this as a time of unprecedented financial market turmoil, political upheaval and social unrest. The losses will be staggering. Markets are going to crash, wealth will be transferred from the unwary to the well-connected, and life for most people will get harder as measured against the recent past.

It’s nothing personal; it’s just math. This is simply the way things go when a prolonged series of very bad decisions have been made. Not by you or me, mind you. Most of the bad decisions that will haunt our future were made by the Federal Reserve in its ridiculous attempts to sustain the unsustainable.

(Excerpt) Read more at zerohedge.com ...

Who gave money to the banks? TARP had some pretty high interest rates attached. Overnight loans from the Fed weren't gifts either.

The Treasury made big profits on bank TARP. The Fed loans were repaid long ago.

Obviously puffing up bank balance sheets and income statements has only made the banks richer. Nobody else besides a very tiny and already wealthy minority has really benefited.

The only people who benefited were those who owned stocks or bonds or houses. Or anyone who refinanced their mortgage at a crazy low rate.

And everyone who likes a functioning banking system.

Nope. $95 to one guy.

Voila, the "money supply" has just expanded by close to 6X...

Nope. Expanded by 95%.

In a free market there will be cycles of inflation and deflation. The FED intervention just kicked the can down the road.

Nope, dept is not a zero sum game. Countries, especially larger ones whose dept is in their own currency, can always devalue. They borrow dollars worth 100 yen and pay back in dollars worth 80 yen. You didn’t see it but the loan was devalued, therefore the debt was devalued.

As long as people believe in the dollar or Yen or Euro, this macro economy game can continue. It’s when their countries don’t play it very well that they feel the pain. The US does not play it perfectly but, we play it better than the rest of the world on average. And that is all we have to do.

The US, for now and the foreseeable future, owns the board. We are a huge importer and exporter and we have gobs of raw materials. And best of all, we have a growing productive population. You may say that Germany or Japan have more productive populations and, that may be true. But in both cases their populations are shrinking and they have few raw materials. China is in the same situation. That is why they dropped the one baby rule.

And its why the German government is okay letting a million young men into the country. Someone there had the bright idea of opening the flood gates to emigrant cheap labour. They have been getting Turkish emigrants for years. But they need more so, don’t think they are bringing in the emigrants because they are nice. Charity has little to do with it.

The money supply is like the universe. Its growing all the time and nobody notices. The reason we don’t notice is because we are the biggest. And because almost every other large country is increasing their debt faster than we are. If Germany was not held back by the debt of Spain, Italy, France and the rest, we might have an issue. The US debt is not a problem as long as there is no other currency or equivalent to measure the value against. It looked like gold or oil would be that bench mark. But as you can see, both are also expanding in supply so as to keep the value of each relatively low. (Governments, especially the US, control the supply of both gold and Oil.)

The Fed may or may not do the right thing. But increasing the money supply is not a problem affecting the stock market. If it were, the price of oil and gold would be going up, not down. The problem is not our debt. But it is our dependence on Government spending. This is different. Because its Congress, and not the Fed, who controls the crack.

Our free market is increasingly dependent on the spending of governments. When the government starts to save money we go into a recession. This causes taxes to go down. So the government spends its way into more debt and pulls forward lots of spending, sowing the seeds of the next recession. Additionally, it fosters cronyism and unnecessary or unproductive spending and an increasingly larger government workforce which produces an increasingly more expensive government retirement population. If we could control our government spending so it did not grow, we could slow this spiral. And the fed would not need to act as much.

“Banks can’t lend out more than they take in.”

On what planet?

“Fractional-reserve banking (or FRB) is the widespread banking practice in which only a fraction of a bank’s demand deposits are kept in reserve and available for immediate withdrawal (as cash and other highly liquid assets), whilst the remaining cash is lent out to borrowers (and so is never actually available for immediate withdrawal to legitimate deposit-holders).[1][2][3][4] The bank in effect lends out most or even all of the funds it receives in demand deposits, whilst at the same time guaranteeing that all deposits are available for immediate withdrawal upon demand. Fractional reserve banking is currently legal and practiced by all commercial banks.

The practice of fractional reserve banking expands credit and therefore also expands the money supply (demand deposits and cash) beyond what it would otherwise be in a stable money system. Due to the prevalence of fractional reserve banking, the broad money supply (deposits created via the issuance of loans plus cash) is a much larger multiple than the amount of “real” paper currency created by the country’s central bank. That multiple (called the money multiplier) is determined by the reserve requirement or other financial ratio requirements imposed by financial regulators, and by the excess reserves kept by commercial banks.

In legal terms, instead of a deposit being considered a bailment contract with the bank being the custodian of the funds deposited as trustee for the depositor with fiduciary duties not to embezzle or misappropriate the funds, banks since the 19th century have been allowed to consider the deposit (available for immediate withdrawal) “their money”, and they are able to do with the money as they wish, provided they recognize the deposit as a general liability on their books of account.[5] In the current legal regime, the depositor no longer “owns” any money when the deposit is made. The depositor is merely an unsecured creditor, relying on the central bank to bail out the bank should a bank run occur, with no further recourse against the bank.”

http://wiki.mises.org/wiki/Fractional_reserve_banking

A pretty wise fellow that taught some strict business law said inflation was the cruelest tax of all.

On what planet?

Earth. If you open a bank and try to lend $500 with only $100 in deposits, you're going to fail. Possibly end up in jail.

Fractional-reserve banking (or FRB) is the widespread banking practice in which only a fraction of a bank's demand deposits are kept in reserve

Thanks. As your own link shows, "deposits kept in reserve" means money available for loans is less than deposits. Just as I said.

And the country will still be 100 trillion + dollars in debt. Cure that.

A lot of debt does also.

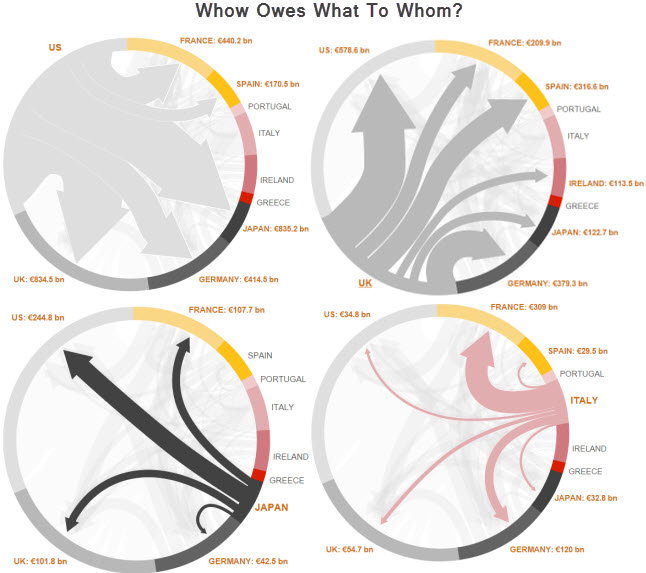

So that who owes who chart actually has been on my mind for a while - like years.

I don’t understand why the various treasury secretary’s can’t get together with chips on the table and say ok I owe you two you owe me one - let’s cancel out one and just have me owe you one, etc and vice versa. This would start with the highest interest debt and work down until there are no more exchanges that can be made between two countries.

Then if there are 3 countries with debt between they agree to trade off between the 3. britain owes france one us owes britain one france owes use one - in the end they cancel out the circle - poof annnnnd it’s gone. Why not they do it with the taxpayers money all the time. It goes on in order to retire the most debt between all the countries.

I get Time value of money too - so the chips should be appropriately calculated to the appropriate value based on interest etc prior to starting.

In the end there will still be some countries that still owe. But at least then it would be an amount that the world could look at and make a true effort to address. Maybe I’m just crazy...

Banks can and do borrow to lend. Its just cheaper to lend using deposits.

These are not single entities. Some French institution owes some money to some English institution. Its not all federal debt to federal reserves.

Absolutely. When I'm trying to stomp out the "Banks lend multiples of deposits" meme, I try to keep it simple.

That's why I originally said, " Banks can't lend out more than they take in"

You should show this chart starting with zero so it does not appear so extreme. Also, show world population growth. And then show currency growth as a percent of population. It actually decreases.

It’s funny how ‘taming’ the business cycle results in moral hazards and selective bonanzas. I’m thinking of the dairy subsidies, Sam Donaldson’s mohair wool subsidies, sugar quotas, and all manner of corporate cronyism. Prices inevitably go up, competition is stymied, and barriers are erected to entry of many fields.

And we prattle on about how free we are.

(”Even so Lord Jesus, come quickly”)

Amen to that!

In bank accounting, deposits are liabilities and loans are assets. So if a banks deposits equal $500 and they loan on a house valued at $400,they have liabilities at $500, assets at $400 plus $100 in reserves. The loan defaults and the house is devalued to $100. Now they only have assets at $100 (the house) and $100 in reserves. The depositors demand their money back, all $500. How much can they give them? Only $100, and if they manage to sell the house it will cover some of their losses.

So they did loan out more money than they have for demand deposits.

I must be missing something- On that “who owes what to who” chart, I don’t see China anywhere. What’s with that?

then the graph is a misrepresentation attempting to put it on the government and reserve banks when they aren’t the ones creating the debt.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.