Posted on 12/27/2014 5:36:48 AM PST by Kaslin

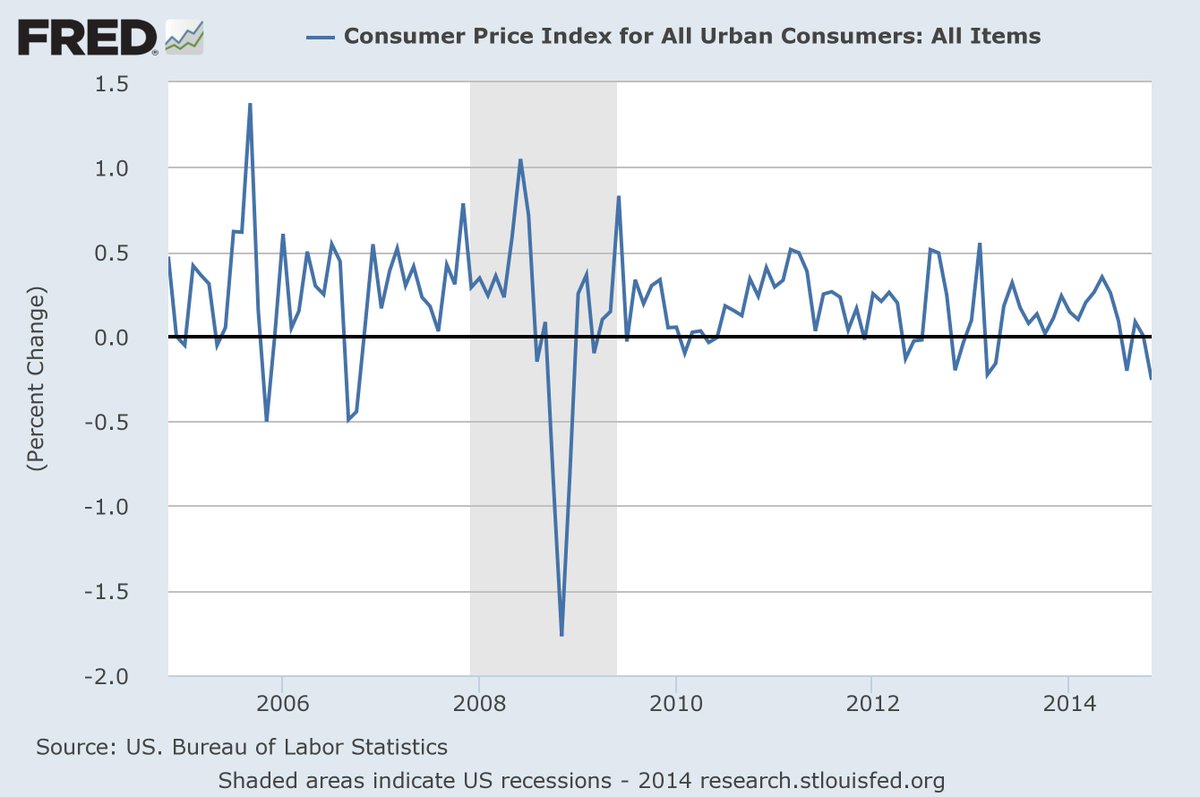

Could we be entering into a golden period where inflation is not only not an issue, but prices are falling in so many key areas of day to day life that it amplifies income even though wages aren't rising?

The short answer is “yes,” and it's what the Fed has been working toward for years. The other question is “has this reward been worth the risk?”

That answer remains to be seen. Critics, including myself, frown upon the way money printing makes the dollar weak and eventually leads to major inflation. But, today the dollar is strong and prices are in free fall. It's not just crude, but things like apparel and used cars. Only electricity, which the White House warned would necessarily move higher as a consequence of killing the coal industry, is still edging higher. And while plenty of homemakers will point to things like higher beef prices, it's hard to deny cheap gas and other things aren't having an impact.

Last month, consumers spent money faster than they earned it and dipped into savings to make it happen. Blind confidence? Certainly it’s disturbing, but it's what the architects of money printing have been seeking.

I'm only going to remind everyone there is a threat of deflation even as the dynamics of oil and gasoline used has changed from the past. We aren't going to base any investments on it because I'm not sure it's different this time, but right now it looks different.

Right now, we're basing investment strategy on this window in time a burgeoning golden period that needs one key ingredient of higher wages to move into the next level. Maybe we dodge deflation and later in 2015, the worry is too much money is chasing too few goods. In such a scenario, it feels real good and lots of money can be made in the market. For those that think Fed policy got the market to this level- wait until it goes into overdrive and the S&P is trading at a PE of 23 or more.

So, we ride the wave for now and into 2015.

Could we be entering into a golden period where inflation is not only not an issue, but prices are falling in so many key areas of day to day life that it amplifies income even though wages aren't rising? The short answer is "yes," and it's what the Fed has been working toward for years.Ludicrous -- prices are falling because the price of energy has dropped by half. We've had falling interest rates since the Reagan years.\

‘Less food’ ... yep, ‘less food’ statistics.

I don't know if there will be true Deflation, but there is no question: Deflation is worse than Inflation. Falling prices destroys production.

1. CPI is a poor measure of inflation since the government continuously redefines it. In other words - we are being lied to about inflation.

2. The cost of groceries is my way of measuring inflation. And, by that measure, inflation is moving along quite rapidly.

3. What is going to happen to all that money printed by the Fed? Do we really expect them to "un-print" it at some point? I don't think so.

4. If the Fed raised interest rates what would happen to the U.S. government debt payments? Payments would go out of sight and more money would have to be "borrowed/printed" to support the ever increasing debt. I think that is called "positive feedback" or "death spiral".

I know. I do like Charles a lot, but everything is about the reduction in energy prices.

At face value that may be true, but income is a relative term, the more important question is what is the "value" or "buying power" of that income?

Even with a 2 % raise each year from my employer I can certainly tell you it is not keeping up with inflation on food goods and consumer goods because of the weakening dollar..

Whenever someone says this time it's different, worry.

Clothes are cheaper because they’re being made more cheaply. A good, well made suit costs more than it did a few years ago, so does a good pair of pants. You can go into Walmart and get cheap pants on sale. If you don’t shop for food, you shouldn’t even be talking about inflation because beef is bordering on unaffordable, milk is close to double in cost from five years ago as are eggs and butter. Even fresh veggies are higher in price. Forget bread, it’s usually $3.99 a loaf for anything other than plain ole white bread. If you want anything other than a macintosh, apples are up about 25%. I can’t even afford Campbell’s soup anymore. It used to be .75 per can and now you’re lucky to find it at $1.50 per.

What world are these people living in?

In a way the Fed can un-print the money, they will just "re-value" it at some point...

Small adjustment at a time to erase the 18 trillion debt over time...

Anybody who thinks the Fed doesn't know what it's doing, is not paying attention, the USA is the golden gooses, they will not let it fall apart monetarily, they manipulate the currency since it's a fiat currency to their ends to protect themselves ...

American citizen is just along for the ride, they try to make it as less bumpy as possible so we don't actually pay attention to their manipulations ...

“What world are these people living in?”

One in which some people, the author included, put inordinate and IMHO unjustified faith in the ability of economists and the fed to ‘guide’ the economy (e.g. “...and it’s what the Fed has been working toward for years”).

A good, well made suit can be had for the price of a one ounce gold coin. That hasn't changed at all.

Agreed.

And the reason for that is captured in one word: fraccing.

Something that developed IN SPITE OF the gov. and the Fed.

Secondly, rising interest rates are bad for the feral gubbamints debt repayment for certain, but really good for the average joe getting close to retirement. Just so happens to be tens of millions scared stiff to invest hard earned savings in this market. Pop goes the weasel, magically a third or more of the nest egg evaporates.

The feds are in real trouble and they know it. China, technically our enemy, an enemy of freedom owns close to four trillion in U.S. debt, could very well dump bonds causing tremors throughout the world, specifically our financial system. Government agencies quake in their boots when the Chicoms refuse to purchase bonds or dump a mere twenty billion. Imagine four hundred billion......all at once!

Cost of eggs is going up with the new CA law on chicken coops....chickens now have more room to turn around, flap their wings and scratch their behinds.

10%+ is not edging.

What's up in this deflationary period?

Car insurance, homeowners insurance

All food, not just beef

Health insurance, health care

Prescription drugs (20% last week on my thyroid meds)

Electricity

Cable TV

Property taxes

A slew of taxes related to ObamaCare

We're their #1 market. It wouldn't make sense to kill it. There are advantages to economic interdependence.

Meanwhile, I've come to the conclusion that our politicians are

Yesterday, somewhere around here, someone pointed out that fracking is cheaper and quicker to develop than the offshore wells, and can be discontinued more cheaply when they’re played out (which is good, because that happens somewhat quickly). The Kenyan has done everything he could to destroy the US economy, but his pulling the plug on offshore drilling (by US companies) led to unintended consequences. So, while the demand for oil has declined in the US because of the worldwide Obama Recession, production has risen in the face of the former higher crude price.

I suspect the reason why inflation hasn’t had much of an effect as yet is that the money is being absorbed globally, whereas in the past it was more a national phenomenon. Which means we can “just do it until we need glasses” for a bit longer than before, and the rest of the world will pay along with us.

Decreased production does hurt the economy, the Chinese economy.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.