Investment & Finance Thread Market Rally Progress Report

Investment & Finance Thread Market Rally Progress ReportPosted on 11/02/2014 9:30:08 AM PST by expat_panama

Investment & Finance Thread Market Rally Progress Report

Investment & Finance Thread Market Rally Progress Report

Stocks are up and metals are down.

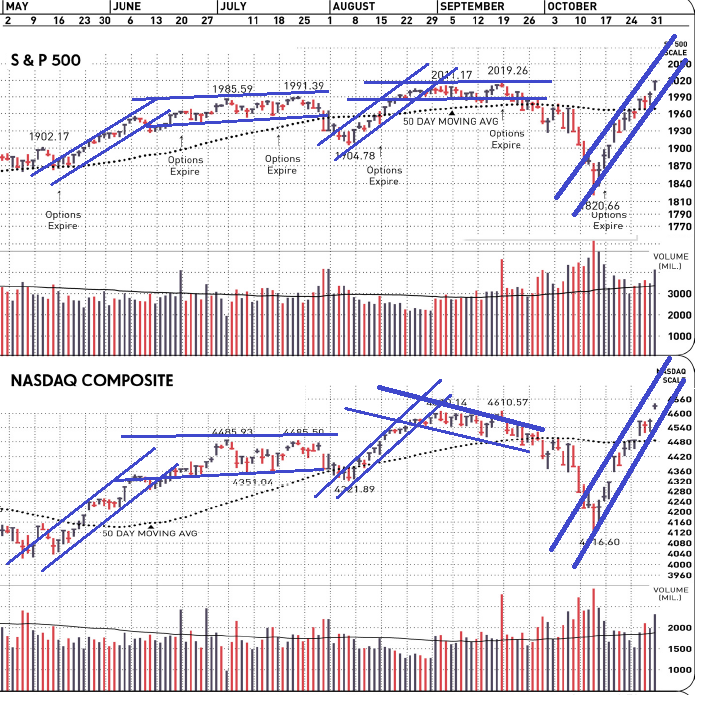

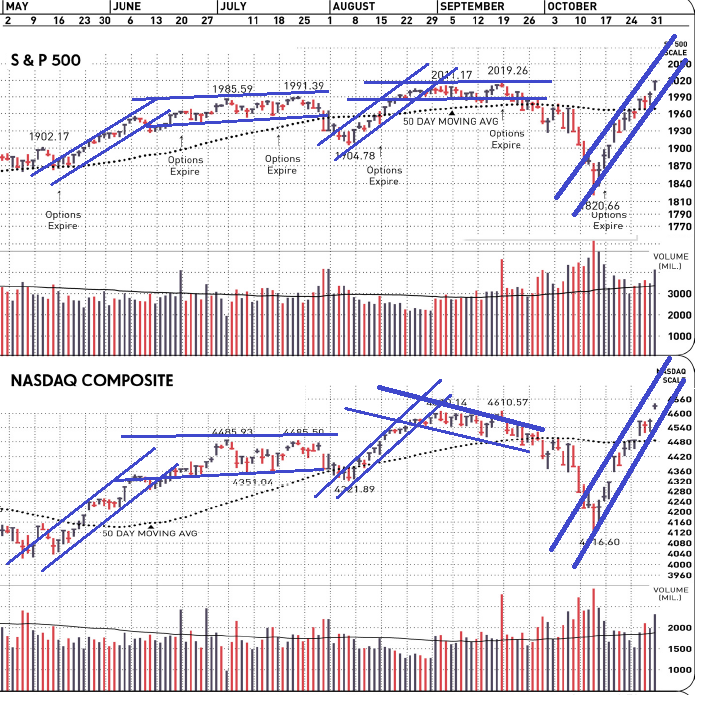

Details: major stock indexes have been showing a run up for the past three weeks --enough time to look at trading patterns. The past two uptrends (w/ both the NASDAQ and the S&P500) seemed to come in two parts, a 3-4 week burst followed by a month & a half stalling before the drop off. OK, so there's no law that says the current run-up has to follow suit but what we know is that for the next week prices within the trendlines are "business as usual".

Not much help from the pundits because they're taking all sides. Makes it difficult to get good input either in the form of sage advice or as a stupid-pundit contrarian indicator.

| Stocks Zoom, Confirming Morici’s Prediction I have written that the fundamentals of capital formation and stock market valuations have changed, and indicate stocks are capable of maintaining a much higher P/E ratio than that historical average going forward. U.S. Recovery Is the Envy Of the World - Chico Harlan, Washington Post Obama's Incompetence Explains The Poor Recovery - Editorial, Investor's Latest Rebound Says Bear Isn't In the Cards - Mark Hulbert, MarketWatch The World's Richest Are Bullish On the U.S. - Margaret Collins, Bloomberg |

As for metals the chaotic downtrends show few repeating patterns, so we're still looking at a decline that began at the 2011 top. If anyone sees a decent pattern they're sure welcome to MicrosoftPaint some trendlines and share.

In the mean time let's see what Tuesday's elections do --remembering that past Democrat surprise victories were followed by 10 - 20% stock losses.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

The storage figs, after 9:30 EST, are at eia.doe.gov/

On November 1st, the first European bank has passed along these negative interest rates to its retail customers.

So if you maintain a balance of more than 500,000 euros at Deutsche Skatbank of Germany, you now have the privilege of paying 0.25% per year… to the bank.

On November 1st, the first European bank has passed along these negative interest rates to its retail customers.

So if you maintain a balance of more than 500,000 euros at Deutsche Skatbank of Germany, you now have the privilege of paying 0.25% per year… to the bank.

|

Wedesday, November 5, 2014 |

||||

| Markets | yesterday | today | |||

| metals | Gold trading at $1,146.85 & silver to $15.31 | Futures @ 4 hrs. before opening -2.33% | |||

| stocks | Early hedging/profit taking --"Quiet losses in mixed volume" | Futures +0.31% | |||

--election's over and appeared to end well! This morning's reports: ADP Employment Change, ISM Services, and Crude Inventories. News:

Investors eye opportunities as Republicans take U.S. Senate

GOP seizes the Senate: Here's how it will impact investorsToyota raises full-year profit forecastBBC News - 42 minutes agoJapan's biggest car manufacturer, Toyota, has raised its full-year profit forecast by 12.4%, citing a weaker yen and cost cutting efforts.

FOREX-Dollar up after US elections, euro weakness to test SNB's floor Reuters - 1 hour ago ... * Yen falls as risk appetite grows after U.S. election results. * Euro at two-year lows against Swiss franc. * Dollar index up 0.2 percent.

U.K. Services Index Slumps to 17-Month Low as Economy Cools Bloomberg - an hour ago Growth at U.K. service companies slowed to the least in 17 months in October as demand cooled, preventing companies from raising prices.

It is not normal to get negative interest rates from a bank. YOU are telling me YOU would put $100 in a bank and and be OK with your account being worth only $99 a year later? IMHO no one would be banking.

What's been happening in the U.S. for years is that if I deposit enough money to buy $100 worth of food clothing & shelter one day, a year later the money in the account will buy one percent less. It has to do w/ inflation, and when inflation goes below a percent then banks have to charge negative interest.

You may have hit upon one more reason to fear deflation, that folks stop putting their money in the bank and banks have less money to loan out.

Unless of course you use your credit card and they pay you “bonuses” for using it. The retailers are forced to raise prices on everyone to pay the increased charges they incur for these bonuses.

Money deposited in banks gets a lot of benefits like safe storage, checks, statements, transfer privileges, but money that banks loan out has to be positive because borrowers don’t do any favors for the banks. The ‘real’ prime interest rate (prime - cpi) is usually 2-3% tho lately it’s been less.

For the past few decades average ‘real’ credit card interest rates have hung out around 12%.

http://www.bloomberg.com/video/what-s-behind-the-saudi-oil-price-cut-UvsjUNlkRR6BSO7_DJlUkw.html

Interest also has to cover the losses from deadbeats. And there are quite a few. I know first hand.

Yo! Yesterday's metals continued their drop while stock indexes closed mixed in lower volume, and now today's futures seeing more more of the same for both. Busy report list this morning:

Challenger Job Cuts

Initial Claims

Continuing Claims

Productivity-Prel

Unit Labor Costs

Natural Gas Inventories

fwiw: More jobs data, ECB loom on Wall Street

Tuesday’s minimum wage hikes could inspire more states

Oil Is Crashing Oil falls to new lows. Business Insider

Will We Get a Republican Bull Market Now? - Stephen Moore, Investor's

Initial claims 275K exp 285K

The NFP number tomorrow could be huge. >300K

aka "victims of predatory lenders" ;) Seriously, it's not that big of an issure --and it really never was. We had a nasty 3% spike at the end of '09 which meant fully 97% of borrowers were still making payments. Right now the charge off rate's back down to a super-low of just 0.49%

Big gap. The drop in claims is definately a leading indicator for unemployment rates —lending credence to the ‘paying-people-not-to-work’ meme. My suspicion is that we’re looking at a higher than average long term unemployment exceeding compensation limits. Also, iirc it was 2010-2011 when the duration got cut too.

1/2% is significant when your profit margin is in the low single digits.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.