Investment & Finance Thread Market Rally Progress Report

Investment & Finance Thread Market Rally Progress ReportPosted on 11/02/2014 9:30:08 AM PST by expat_panama

Investment & Finance Thread Market Rally Progress Report

Investment & Finance Thread Market Rally Progress Report

Stocks are up and metals are down.

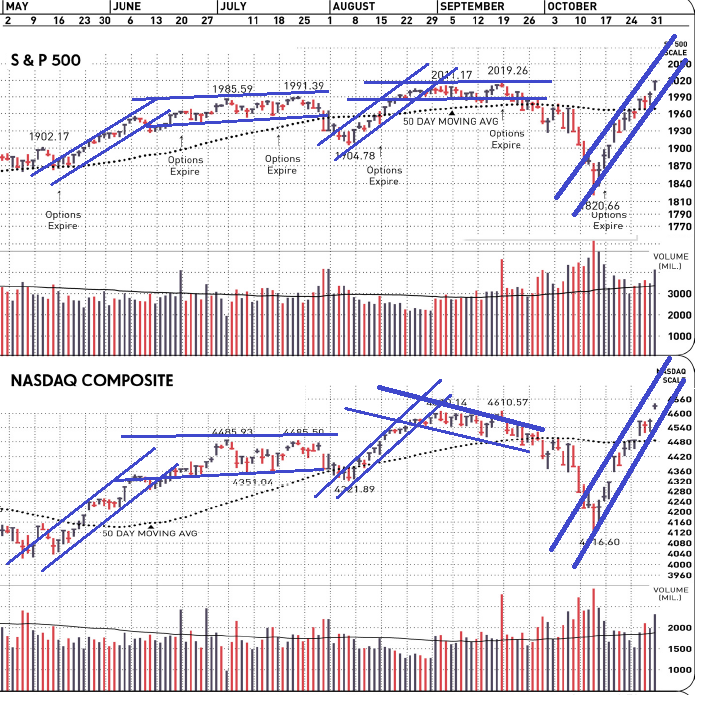

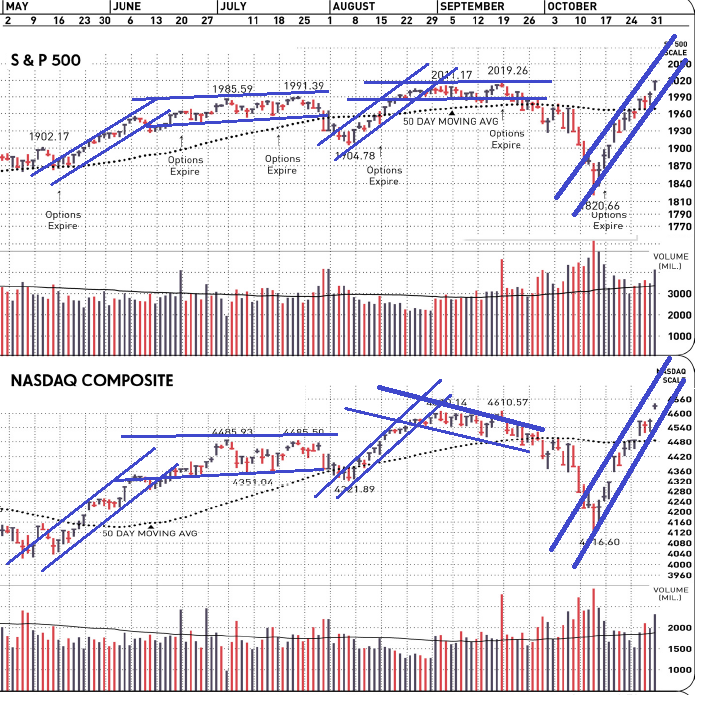

Details: major stock indexes have been showing a run up for the past three weeks --enough time to look at trading patterns. The past two uptrends (w/ both the NASDAQ and the S&P500) seemed to come in two parts, a 3-4 week burst followed by a month & a half stalling before the drop off. OK, so there's no law that says the current run-up has to follow suit but what we know is that for the next week prices within the trendlines are "business as usual".

Not much help from the pundits because they're taking all sides. Makes it difficult to get good input either in the form of sage advice or as a stupid-pundit contrarian indicator.

| Stocks Zoom, Confirming Morici’s Prediction I have written that the fundamentals of capital formation and stock market valuations have changed, and indicate stocks are capable of maintaining a much higher P/E ratio than that historical average going forward. U.S. Recovery Is the Envy Of the World - Chico Harlan, Washington Post Obama's Incompetence Explains The Poor Recovery - Editorial, Investor's Latest Rebound Says Bear Isn't In the Cards - Mark Hulbert, MarketWatch The World's Richest Are Bullish On the U.S. - Margaret Collins, Bloomberg |

As for metals the chaotic downtrends show few repeating patterns, so we're still looking at a decline that began at the 2011 top. If anyone sees a decent pattern they're sure welcome to MicrosoftPaint some trendlines and share.

In the mean time let's see what Tuesday's elections do --remembering that past Democrat surprise victories were followed by 10 - 20% stock losses.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

Havin' fun while it lasts ping.

To trade around Election Day, I think it's useful to study what happened in 2010:

You’re absolutely right —wish I’d have thought of that but I’m glad to see it now. That makes election day a perfect day for a top, it’s the 3 week rally plus the election day slough off.

Agreed- Election Day give or take a day.

It will be a good time to get hedges on, to hold until early December.

The recent rally has been sharper than what was experienced in 2010, so I expect the pullback to be faster and more gut-wrenching.

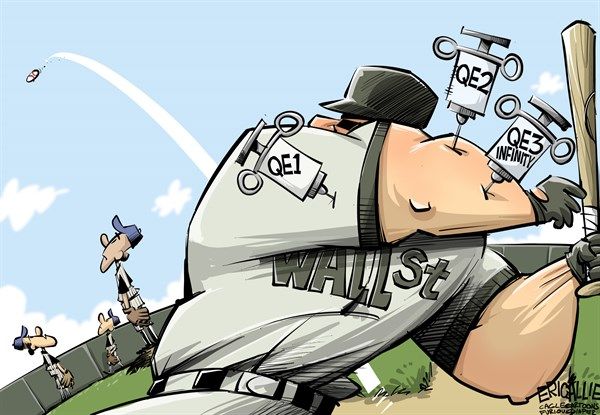

The rally isn’t mindless, as some contrarians are saying. Global markets are pricing in an unwinding of the “covered call” that Obama’s policies have imposed on the economy (an analogy of the Bernanke/Yellen put).

That said, I would never expect a market to go straight up, or down.

Good morning and a happy new week & new month! Traders are starting out uncertain w/ metals mixed up and stock indexes mixed/off. Reports this morning: ISM Index, Construction Spending and in the afternoon Auto and Truck Sales. Morning reading:

“World Trade Center reopens for business”

As I recall we set out to show how resilient we were. 13 years later.....

What I remember is that building the new one didn’t take as long as arguing about it.

Absolutely. That is the way we do everything now. We used to decide to do something and then we did it. Now we debate it forever.

Hmmm...

Gold Slumps to Multiyear Low

By APARNA NARAYANAN, INVESTOR’S BUSINESS DAILY

Please help me out here, I'm having a hard enough time just keeping up w/ daylight saving time. You mean "Natty Investments"?

Sponsoring FReepers are contributing

$10 Each time a New Monthly Donor signs up!

Get more bang for your FR buck!

Click Here To Sign Up Now!

Huh. We were just talking at http://www.freerepublic.com/focus/news/3222397/posts?page=6#6 about how gold was supposed to be at $3K/oz today...

We're going to have another 80+ build in supply this week (Thursday am) which will/should take the wind out of the sails of these premature bulls. For the season, we're about 200B cuft under the 5yr avg, so that is somewhat bullish.

Continued colder-than avg temps in the NE (because that is the only area that "counts" to the NYMEX boys) will ultimately BE bullish, and I will join the crowd...but NOW?? First week in Nov?? Somebody's jacking the mkt around.

Helpful, I hope?

|

Tuesday, November 4, 2014 |

||||

| Markets | yesterday | today | |||

| metals | Gold trading at $1,169.5 & silver to $16.13 | Futures @ 4 hrs. before opening -0.75% | |||

| stocks | Flat in higher volume. | Futures +0.12% | |||

--w/ the only reports this morning being Trade Balance and Factory Orders. Welcome to hold-your-breath Tuesday!

Global shares gain ground as oil prices extend fall European shares gained ground and core bond yields dipped on Tuesday following a raft of company trading updates, bucking a more muted trend in Asia and the United States as oil prices extended their fall and economic growth fears lingered. The after-effects of the Bank of Japan's surprise stimulus move last week were also still being felt, with the dollar taking a breather but still..

hey guy, I’m up at the CR border wishing you were here! OK, you’re glad ur not, but I still haven’t gotten the NATTY info so if u got links it wud be nice.

cheers!

Anyway, what I was noticing was that it was the inverse of the classic "buy point" that IBD's always raving about. I've heard that buy signals can often be inverted and used as sell signals.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.