Posted on 04/16/2013 3:20:08 PM PDT by blam

Is Bernanke’s Worst Nightmare Just Around The Corner?

Economics / Deflation

Apr 16, 2013 - 09:17 PM GMT

By: Graham Summers

First off I want to say that all of us here at Phoenix Capital Research are sending our prayers to the victims of the Boston Terror Attacks. We sincerely hope none of you, our readers, or your loved ones were injured or harmed by these events.

The markets today are snapping back from yesterday’s sharp drop. However, in the bigger picture we believe that Ben Bernanke must be terrified.

The Fed and other Central banks of the world have done their darnedest to inflate away the debts of the developed world. These folks wanted more than anything to create inflation… because it meant it was easier to service their debt loads provided interest rates stayed low.

It is beginning to look like they failed. The Fed has announced QE 3 and QE 4, the Bank of Japan just announced a $1.2 trillion stimulus, the European Central Bank has promised unlimited bond buying… and yet deflation looks to be rearing its head again.

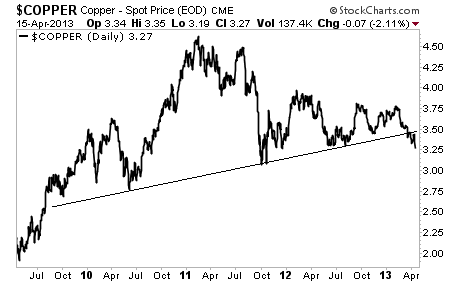

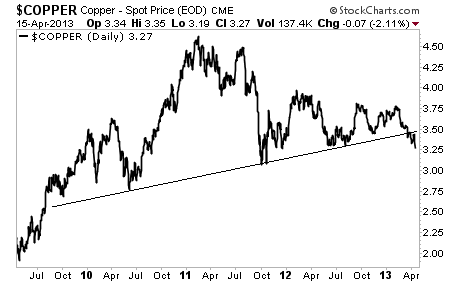

Copper has taken out its “recovery’ trendline.

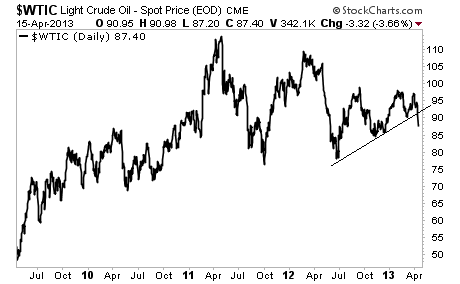

Oil is breaking down:

So is Gold:

These are all signs of rising deflation. If deflation IS back then Bernanke’s efforts to create inflation will have failed. IF this is the case, the Fed is literally out of bullets.

Investors take note, the global economy appears to be contracting again. China’s recent GDP miss is the just the latest in a series of economic surprises to the downside.

And stocks are always the last asset class to realize this.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash?

Right, I always trust the Feds to do the right thing. Tell me, what has the Fed done to the dollar since 1913?

Sounds like you are going to support Bernanke for another term, and you probably wish Obama could get another term too. Being a patriot shouldn’t mean being a slave to the Fed or the government.

I'll wait for proof of your claim.

Sounds like you are going to support Bernanke for another term

Compared to anyone Obama picks, Bernanke is probably better.

and you probably wish Obama could get another term too.

Still beating your wife?

Being a patriot shouldn’t mean being a slave to the Fed or the government.

It means not repeating silly claims.

Try a little social policy with some sanity and reversing business smothering regulation that Obama has dumped on our backs and we will start recovering and create that inflation in short order. Printing money is not necessarily a magic potion after you have raised the risk of capital investment several multiples with poor tax policy, Obamacare and overbearing regulation. The Commie demoncRats are economic morons.

Good question, a look back at History tells us that a Large scale WAR is the most likely answer.

Yours is the only correct post on this thread. It is our new Oil and Natural Gas finds that has prevented and MAY STILL prevent this things from going all sideways in a bad way. Oil and Gas are as rock solid of assets as Gold and Silver. We would have already been broken by now without this boom. The Wehrmacht Republic did not have such resources. If Oil and Gas can double or triple, if the Keystone Pipeline can be built, then we could sustain the unimaginable 25 trillion in real debt. Not forever, not much above that. And a contraction via inflation will STILL happen. It just will not be the SHTF most believe it will be.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.