:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/3969046/food_spending__select_countries_2014.0.png)

Posted on 10/02/2019 8:48:41 AM PDT by SeekAndFind

Americans on average spent more on taxes in 2018 than they did on the basic necessities of food, clothing and health care combined, according to the Bureau of Labor Statistics Consumer Expenditure Survey.

The survey's recently published Table R-1 for 2018 lists the average "detailed expenditure" of what the BLS calls "consumer units."

"Consumer units," says BLS, "include families, single persons living alone or sharing a household with others but who are financially independent, or two or more persons living together who share major expenses."

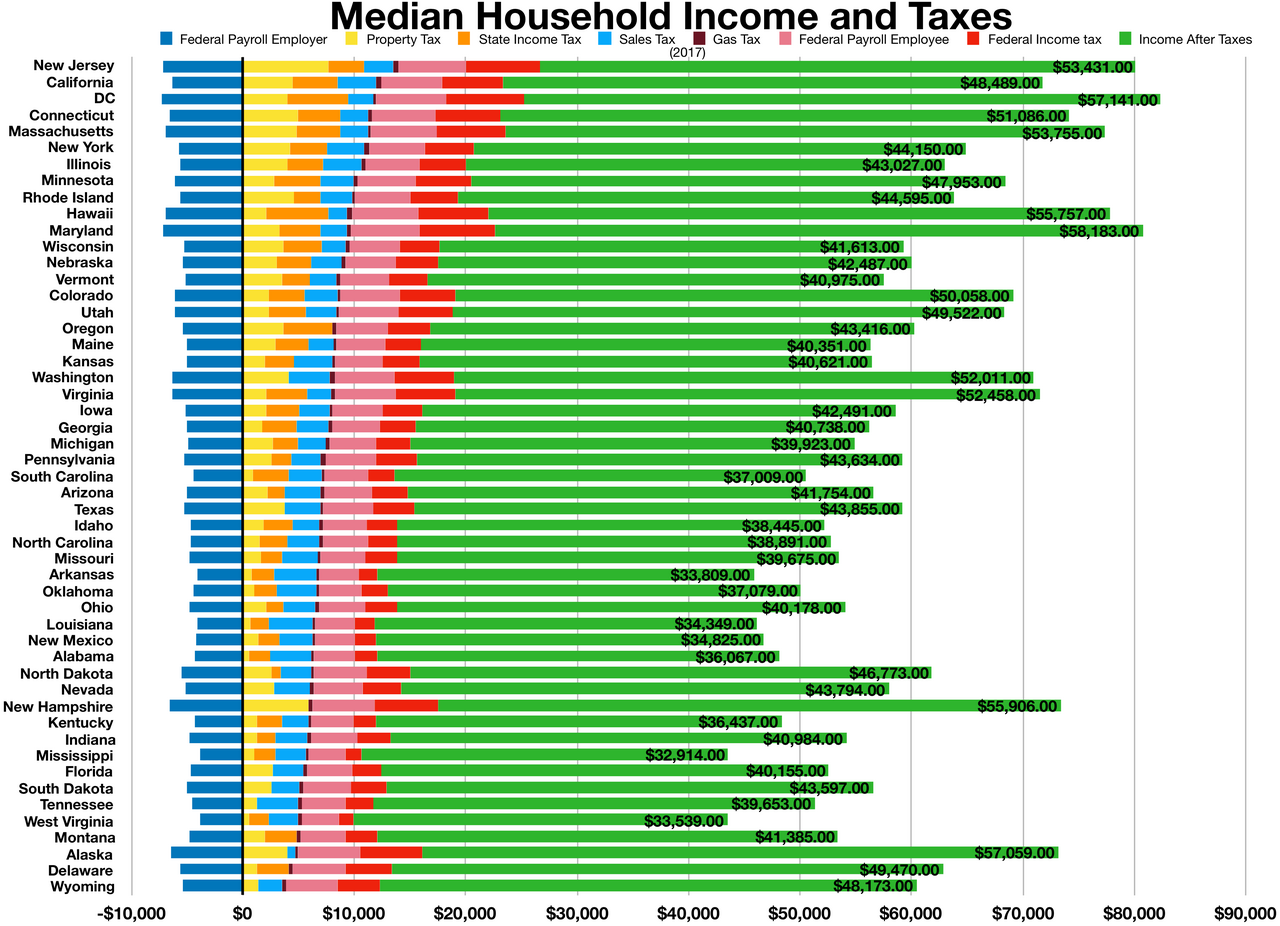

In 2018, according to Table R-1, American consumer units spent an average of $9,031.93 on federal income taxes; $5,023.73 on Social Security taxes (which the table calls "deductions"); $2,284.62 on state and local income taxes; $2,199.80 on property taxes; and $77.85 on what BLS calls "other taxes."

The combined payments the average American consumer unit made for these five categories of taxes was $18,617.93.

At the same time the average American consumer unit was paying these taxes, it was spending $7,923.19 on food; $4,968.44 on health care; and $1,866.48 on "apparel and services."

These combined expenditures equaled $14,758.11.

So, the $14,758.11 that the average American consumer unit paid for food, clothing and health care was $3,859.82 less than the $18,617.93 it paid in federal, state and local income taxes, property taxes, Social Security taxes and "other taxes."

I asked the BLS to confirm these numbers, which it did while noting that the "Pensions and Social Security" section of its Table R-1 included four other types of payments (that many people are not required to make or that do not go to the government) in addition to the average of $5,023.73 in Social Security taxes that 77.21% of respondents reported paying.

"You asked us to verify the amounts for the total taxes and expenditures on food, apparel/services, and healthcare," said BLS. "Based on table R-1 for 2018, your definition for food, apparel, and healthcare matches the BLS definition and the total dollars. Your dollar amounts for federal, state, and local income taxes and for property taxes are correct, as is the amount for Social Security deductions. For the combined pension amount ($6,830.71) that we publish however, in addition to the $5,023.73 for Social Security, there is an additional amount for government retirement deductions ($135.11), railroad retirement deductions ($2.85), private pension deductions ($608.22), and non-payroll deposits for pensions ($1,060.79)."

That Americans are forced to pay more for government than they pay for food, clothing and health care combined has become an enduring fact of life.

A review of the BLS Table R-1s for the last six years on record shows that in every one of those years, the average American consumer unit paid more in taxes than it paid for food, clothing and health care combined.

In 2013, the average American consumer unit paid a combined $13,327.22 for the same five categories of taxes cited above for 2018, while paying a combined $11,836.80 for food, clothing and health care.

In 2014, the average American consumer unit paid $14,664.13 for those same taxes and $12,834.34 for those same necessities.

In 2015, it was $15,548.36 versus $13,210.83. In 2016, it was $17,153.30 versus $13,617.60. And, in 2017, it was $16,750.20 versus $14,489.54.

Even when all the numbers for the last six years are converted into constant December 2018 dollars (using the BLS inflation calculator), the largest annual margin between the amount paid in taxes and the amount paid for food, clothing and health care was last year's $3,859.82.

The margin was so great last year that you can add the $3,225.55 Table R-1 says the average consumer unit paid for entertainment to the $14,758.11 it paid for food, clothing and health care, and the combined $17,983.66 is still less than the $18,617.93 it paid for the five categories of taxes.

You get a similar result if you add what the average consumer unit paid in 2018 for electricity ($1,496.14) and telephone services ($1,407.36) to a combined $2,903.50.

Yes, Americans on average paid more in taxes last year than they paid for food, clothing, health care, electricity and telephone services combined.

Was the government you got worth it?

Americans Spent More on Taxes in 2018 Than on Food, Clothing and Health Care Combined

...

Somebody has to pay the food, clothing and healthcare bills for all the illegal aliens and other government dependents who sell their votes to the Dems.

Democrats think our problem is we don’t pay enough taxes. Go figure.

It’s probably higher than that. Unless they only calculated those who pay income taxes, their data is skewed by the almost 50% of “consumer units” who don’t pay income taxes, and may, through EIC, get more back than they paid in.

No counting housing, car payments, utilities, boat, 5 kids, college tuition...

The Monster must be fed.

Not sure you “spend” on taxes given it’s mainly involuntary (provided you are law abiding).

But the numbers are surprising nonetheless.

Thanks SeekAndFind.

Trump should be rubbing peoples’ noses in this data during the campaign.

“and $77.85 on what BLS calls “other taxes.” “

Way low!

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/3969046/food_spending__select_countries_2014.0.png)

RE: Last I read, Americans spend about 6-7% of their income on food.

Great, let’s tax Americans some more so that we can at least reach Canadian levels.

bfl

Most of us native Americans are spending close to half our income on one tax or another. Meanwhile, millions of people are coming in here getting free health care, free education, free welfare and all kinds of other benefits native born citizens never get (but pay for).

My property taxes in Connecticut are now over $1,000 a month. For much of my life, my mortgage or rent payment was never that high.

RE: My property taxes in Connecticut are now over $1,000 a month. For much of my life, my mortgage or rent payment was never that high.

This means that IN EFFECT, you don’t really own your property. You are paying rent to the local government. Try being behind on your property taxes and see whether you can still live at home.

Maybe some illegal aliens will squat there.

It is not clear, but probably what the article calls social security tax includes the medicare tax.

In any event, I believe this is counting only the "employee's half" of the social security tax. An equal amount is paid by the employer, and it actually comes out of the employee's compensation, as one can see when converting from employee to self-employed status. The self-employment (social security and medicare) tax is 15.3%, double the so-called "employee's share."

If you add the extra $5,023.73 in SS tax to $18,617.93 which the BLS claims as total taxes paid, the result is $23,641.66. Outrageous.

Note: In 2019 the taxable SS wage base is $132,900. Total SS and medicare tax paid directly and indirectly by an employee earning $132,900 is $20,333.70.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.