Posted on 12/15/2015 3:41:27 AM PST by expat_panama

I have felt that demographics of the boomer retirements, low birth numbers of millennials and bad conditions for gen X in their prime years have put us on the track for deflation. The succeeding generations don’t want or can’t afford the homes of the boomers, boomers will spend less and have less to spend in retirement etc.

It all adds up to a falling market. Deflation.

Consider this please:

A fellow came by the office today. I’ll tell you what he is selling but also tell you some things he believes are headed our way. One of you may know him. In ‘13 he did a pretty fair job of predicting the end of the oil boom based on charting the trends. He is a technical / chart trader in just about anything that is traded. Not a big fan on analysis of fundamentals since the events usually have passed by the time the analysis has been done. He has been trading for about 40 years.

Here are some facts and what he thinks:

Fact, 75 million baby boomers are leaving the consumption market and their spending patterns are not replacing those of Gen X and the Millennials

Fact, Japan is deep in a demographic hole with an aged population and Europe is following in close step to Japan and the U.S.

Fact, not enough workers to support debt promises to retirees

Fact, too many lucrative pensions have been given to public employees who retire far too early for us to afford to pay them. Again, not enough workers to support these pensions.

Fact, we are not creating enough well paying jobs because we are not making enough value added products.

Observation, There are long and short term patterns in everything. E.g. a trend of boom and bust is suggested starting with 1902 when new technologies came on the scene creating a major shift in the economy. They were the car, the airplane, communications etc. The boom lasted until 1928. The bust lasted until 1942 or so with the onset of the World War. The good times lasted until about 1968 when Vietnam became so costly and the markets stalled. That bust lasted until some sea change came along, the computer technology boom in about 1982. The dot com bust came and went, then 9/11 then the Great Recession in 2008. The pattern conveniently suggests 26 years of growth and 14 years of bust.

Observation, per the Fourth Turning, we are in the fourth period of an 80 year cycle. The fourth period, for the last 500 years studied, commences with an economic down turn followed by a global war. The last 20 year period of the 80 year cycle is called the Crisis.

Conditions suggest we are firmly in the grip of the Crisis phase of the 80 year cycle.

He suggests that the market has been propped up by 4 trillion of QE and that it is a house of cards owing to the facts and observations noted and that the trend is for deflation as people consume less. The FED seems hell bent for leather to declare victory and raise interest rates. I’d say this will not go well and QE will resume very quickly in the election year but probably not quickly enough. The economy does not turn that fast but the market does turn very fast to the downside and it probably will.

He suggests that the debt is, as most of us probably concur, unsustainable. A default must take place because it can’t be paid back.

Politicians will do all they can to sustain their power including even more aggressive confiscation to prop up their power as the crisis deepens and grows old.

He forecasts gold to less than 400 as it is not the haven some have suggested since it is a hedge against inflation, not deflation

He forecasts the Euro to go up to about $1.15 to the euro and then collapse to about $0.88 as it becomes apparent that the game of QE there is not working.

He expects the EU to eventually fail within only a “few” years.

He forecasts oil must fall to the previous troughs low before it can begin recovery. The charts suggest low 30s notwithstanding some geopolitical outbreak.

He forecasts an even worse fall in housing than we have seen as there are too few buyers for downsizing and dying boomers homes.

He makes two suggestions: Cash and learning how to make money in a declining market by shorting the market.

If you have a paid for house keep it but if it is not paid for realize it may go upside down again.

Now for the punch line of what he does. A disclaimer. He is an unregistered trader, meaning he is a boutique trader only able to manage the money of a limited number of persons. He trades and markets himself as an investment coach teaching people how to read charts and thereby achieve his fantastic, so he shows, results.

What he does, does not make the facts untrue though he is very motivated for you to buy his service, the observations invalid or the forecasts necessarily tainted. Obviously though one wonders why, if he is such a successful trader would he bother with selling his services as an investment coach at $2,700 for a three month engagement? Certainly not altruism.

Notwithstanding this disclaimer I don’t count this evaluation as wrong nor what appears to me as the risky proposition to deal with it.

“Low inflation-and low prices-sound beneficial but can stall growth in wages and profits. Debts are harder to pay off without inflation shrinking their burden.”

Talk about mumbo-jumbo. Inflation shrinks the value of all assets, across the board, which is much worse economically than having debts NOT shrink. Anyone who racked up a debt should have secured the means to pay it off before incurring it, they should not be counting on inflation to shrink it.

Of course, the real debt they are worried about is the GOVERNMENT debt, not our loans and mortgages. They know the only chance they have of paying that off is by devaluing our currency to some extent.

“Take a look at the figures for the debt: The debt stayed unchanged until the congress, under the “leadership(?)” of Paul Ryno (Closet Muzzie, Wisconsin), raised it and then it jumped over $339 Billion overnight.”

Yes, they are playing games with the debt. It stayed frozen because they had hit the “debt limit” and didn’t want to raise it again so soon. Of course the government didn’t stop spending money, they were just moving shells around so that whatever they were spending wasn’t counted towards the debt limit. As soon as the limit was raised, as you saw, they transferred that spending back to “debt” with a simple accounting trick.

So what everyone here's saying is basically "nyah nyah nyah".

The way the free market works is that when someone starts a business he raises capital and hires folks. Only after the business gets moving can he start getting money coming in so he can pay off the bonds/loans. If deflation hits the money coming in is less than planned, the busines folds, the folks get laid off, they starve and die, and folks on the FR say "nyah nyah nyah".

That's now what we really want to do.

Inflation is great if you have existing home and mortgage, you are paying it off with dollars worth less. Incomes go up during inflation, but your mortgage payment stays the same.

I would LOVE to be still paying on my first house- at $350 a month (including taxes)

Does the Fed actually believe all the BS numbers the Department of Lies, ah, Labor is shoveling and raise interest rates or look at reality and keep them where they are? Either way the country is screwed because the law doesn’t apply and there is no longer an attempt at a referee, government and business are one in the same and the people just get the bill.

Inflation as has been posted is alive and well at the grocery store, smaller packages, higher prices. Lower energy prices should help but with all the taxes and BS green energy crap that monthly power bill remains artificially high.

All the money from the numerous QE’s is still in the banks or in the stock market, little has reached main street.

When the country is “officially” in another recession what does the Fed have left in the cupboard? Not much, wouldn’t surprise me to see Helicopter Ben’s mocking comments actually come to fruition, the Fed handing out money to the government and it being openly deposited in bank accounts, a helicopter drop electronically.

The world is so far in debt the only way to repair it is a debt jubilee world wide, governments and private people alike.

That all makes sense and that you mention it, old people are being replaced by something / someone who should buy stuff. Bottom line is people are not buying stuff because they are not able. People without work don’t buy much. Any other reason people don’t buy much?

Too few dollars chasing too many goods. Many years ago that is how my Dad explained the Great Depression. Not there now but could be.

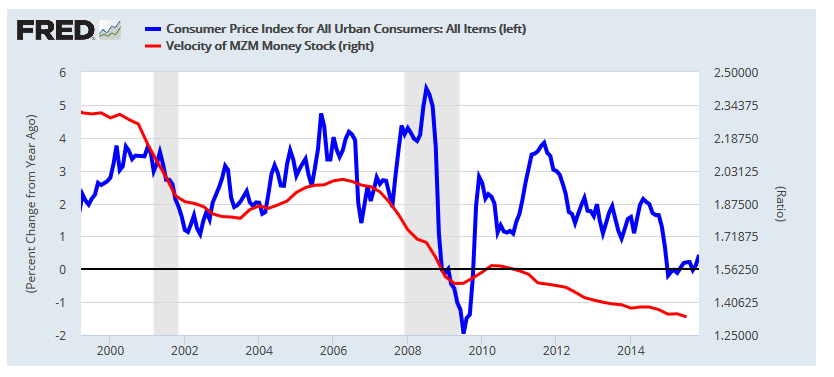

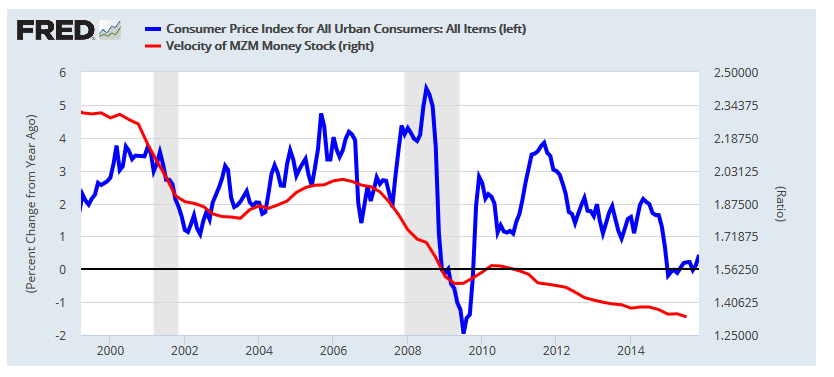

Like so many things, the answer from the FRED is in plain sight.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.