Posted on 05/03/2013 7:05:30 AM PDT by SeekAndFind

One of the darkest risks facing America is that so few of us are prepared for retirement.

It's shocking, really. According to ConvergEx Group, "Only 58% of us are even saving for retirement in the first place. Of that group, 60% have less than $25,000 put away ... a full 30% have less than $1,000." According to Nielsen Claritas, Americans age 55 to 64 have a median net worth of $180,000 -- less than they'll likely need for health care spending alone during retirement.

I recently asked Joseph Dear, chief investment officer of CalPERS, one of the world's largest pension funds, whether America was ready for retirement. Without delay, he snapped: "No!"

We have a retirement problem. A very serious one that shouldn't be discounted.

But it is nothing new.

Same as it ever was

The notion that these challenges are new -- that there was some golden era when Americans were prepared to kick up their feet and enjoy retirement in financial security -- is a myth. By some measures, retirees are in a better position today than at any other time in modern history.

Let's start with something simple. The entire concept of retirement is unique to the late-20th century. Before World War II, most Americans worked until they died.

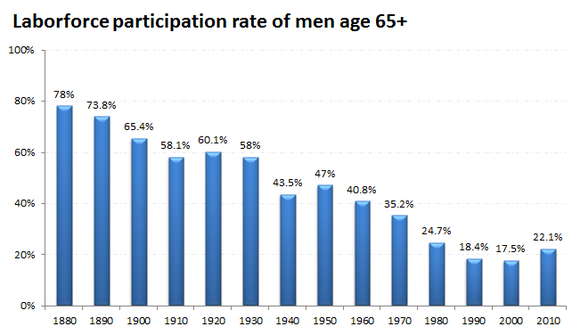

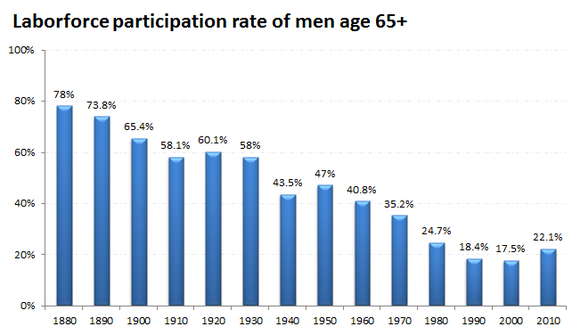

The best way to show this is the labor force participation rate for men age 65 and up:

Source: Economic History Association, Bureau of Labor Statistics.

For most of us, I think the nostalgic sense of America's golden era of retirement is set between the 1950s and the 1990s. That, we often hear, is when workers had pensions and were able to retire with security. But as much as twice the percentage of men were still working into their elderly years back then compared with today.

The truth is, that 20th century was brutal for most elderly. As Frederick Lewis Allen writes in his 1950 book The Big Change: "One out of every four families dependent on elderly people and two out of every three single elderly men and women had to get along in 1948 on less than $20 per week [$193 in today's dollars]."

There are a couple of reasons for this. First, those retiring in the 1940s, 1950s and 1960s, were in their prime earning years during the Great Depression. Not exactly fertile ground for saving.

More importantly, Social Security used to pay out much smaller benefits, even adjusted for inflation.

When Ida Mae Fuller cashed the first Social Security check in 1940, it was for $22.54, or $374 in current dollars. Today, the average monthly benefit in real (inflation-adjusted) terms is more than three times larger. Since payouts are set with a calculation based on wage growth, not just price inflation, real Social Security benefits have risen consistently over the last half-century:

Sources: Annual Statistical Supplement to the Social Security Bulletin, 2012; Bureau of Labor Statistics.

But hold on, I hear you say. Didn't workers have private pensions to rely on in previous decades?

Some did, yes. But only a minority. There has never been a time in American history when the majority of retirees took in income from either a private or public pension (outside of Social Security). Nothing close to it, in fact.

Nevin Adams of the Employee Benefit Research Institute tells the story: "Only a quarter of those age 65 or older had pension income in 1975 ... The highest level ever was the early 1990s, when fewer than 4 in 10 (both public- and private-sector workers) reported pension income."

Mr. Adams continues: "In other words, even in the 'good old days' when 'everybody' supposedly had a pension, the reality is that most workers in the private sector did not."

Here's what's really interesting. In 1975, 15% of all income reported by those 65 and older came from pensions, according to Adams. By 2010, that figure actually increased, to 20%.

The bottom line, Adams writes, is that "even when defined benefit pensions were more prevalent than they are today, most Americans still had to worry about retirement income shortfalls."

As a matter of fact, retirees had a lot more to worry about in past decades than they do today.

The Census Bureau's measure of poverty -- based largely on how much of a household's income is devoted to basic food necessities -- for those age 65 and up has plunged since the 1960s, continuing to fall even during the financial crisis:

Source: Census Bureau.

By this metric -- and I struggle to think of a more complete measure of financial wellbeing than poverty -- those age 65 and up have never been in better financial shape.

What about age?

The most common rebuttal to what I've presented so far is likely that we're living longer today than we were in the past. So, even if retirees have higher incomes and more security today, they need it because they have to finance a longer retirement.

There is some truth to this, but probably less than many assume.

While there has been tremendous progress in life expectancy over the last century, most of the gains have come to the young.

According to the Centers for Disease Control's actuary tables, someone born in 1950 could expect to live to age 68.2, while someone born in 2010 could expect to live to 78.7.

That's extraordinary: An extra decade of life expectancy gained inside of two generations.

But the gains have been much smaller for those who survive into their retirement years. A 65-year-old in 1950 could expect to live 14 more years, while a 65-year-old in 2010 could expect to live another 19 years. The gains continue to diminish from there. A 75-year-old in 1980 (the earliest we have data on for that age group) could expect 10.4 more years of life. Today, they can expect another 12 years -- a gain of a mere 1.6 years.

Just like the good old days

Let me clearly state what these statistics do not show. They do not show that Americans are prepared for retirement, or that there is no retirement crisis.

There is a retirement crisis.

But there always has been one.

The lack of savings is a grim problem that will affect millions of Americans for decades to come.

But that's nothing new.

Most retirees will have to cut back on their standard of living.

But they always have.

Many will be reliant on Social Security.

But that's been the case for decades.

"When all is said and done," Adams writes, "we're all still challenged to find the combination of funding -- Social Security, personal savings, and employment-based retirement programs -- to provide for a financially satisfying retirement."

"Just like in the 'good old days.'"

Divorce lawyer here and more and more of my cases involve older people (55+) with no retirement or maybe no more than $30K and they plan to spend that soon. Sad. Oh, and usually with lots of debt and the house not paid off. Calling Dave Ramsey.

Even with a very nice IRA and savings, I’m already looking for a large refrigerator’s empty box which I can live in, in a vacant lot, away from the city. After the coming train wreck and SHTF. Stop by sometime, and we’ll split a Big Mac & Fries. Heh.

I will work until I cannot. That said, it is awful hard to put away the millions they advise when you get hit from every angle with taxes and rising prices, low investment returns, all the while salaries stay basically static.

The one thing my ex father-in-law said that I agreed with was you will never get rich working for somebody else. I have just never been in a place to make that jump without enormous risk (that I cannot take with my kiddos).

I look at retirement like the false premise of home ownership. Buy a house, pay it off, but stop paying taxes and see how long you own it. The federal beast is in a catch 22. On one hand they need you to work forever and pay taxes and on the other they need you to retire and make room for other workforce acquisitions.

It’s even harder to put away the amount they say you should, when you don’t make enough to do that in the first place.

RE: it is awful hard to put away the millions they advise when you get hit from every angle with taxes and rising prices,

Heads up, according to Obama’s recent budget proposal, you cannot save too much. He is proposing to cap your 401K and IRA to a max. of $3 Million.

Of course most people will shrug and say — Hey, it doesn’t affect me, I don’t have that much money for retirement.

But note — IT ALWAYS STARTS WITH A HIGH NUMBER, and then slowly, but surely as the government runs out of money, the number goes DOWN.

The Saul Alinsky playbook is always GRADUAL, not a big bang. Get people complacent and used to tiny oppressions until they become pliable.

Obama majored in this in college and he is applying what he learned. That is why he does not want his college records released.

You are so correct, we never really own an thing as long as the tax monster lives.

As for retirement, unless one saves about 25% of gross at a RoR of at least 6% per year from age 20 or so until age 60 or so and has no debt at that time... forget about it. Retirement is not going to happen.

Your F-I-L was right, you are most likely never going to get rich working for someone else. Not so sure that it is possible very often even now with the tax monster we have.

Thanks, sfl.

Work till you die. It is immoral for capable people not to work.

RE: Work till you die.

Assuming businesses will hire you when you’re of Social Security age.

Why didn’t you link to the actual article?

This link is to something else on Real Clear Markets.

It’s never too late to start.

I did when I started my current job in 1985, my wife did in 1994 when she accepted a postion in a Corp. HQ. We started low. I had 25 bucks a pay (bi-weekly) deposited in a TSA (403b). The wife had more put in hers because her company matched hers with 50%. You will Never find investments that will constantly earn you that rate.

Every year or two based on our monthly bills we talked about how much should be increase that amount.

We Have taken a few vacations over the last 30 years but even they are on the cheap. Tent to the Big Lake, camp out and fish, a hunting trip out west or Canada. But not every year.

We also rarely eat out. Nor do we do the Movies. Maybe once or twice a year. We raise a garden, chickens and a few hogs. Sell a couple to friends to cover part of the cost.

You may never get “rich” working for someone else, however I think a more appropriate saying is “It is not how much you make it’s how much you spend”.

My personal opinion is that Way to many people think life consists of eating out every night, trips to the bar and or Movies and other forms of costly entertainment over the weekend. Same with Phone, internet and cable TV costs.

The other biggy to me is what people spend on Vehicles. Maybe it’s my age but spending 35-50k on a vehicle that most can’t afford and then full coverage Insurance is like getting your paycheck cashed into twenties then piling it up and burning it.

We drive used vehicles. When we buy they are 2-4 years old low milage vehicles. We drive them until the fall apart. Usually get 10-12 years out them.

Start small and pay attention to all the small stuff that you spend money on. Cut some of the non essential out and stick it away. After a few years you will see what a small amount can turn into.

/rant

That. One of the best posts I’ve ever seen in any personal finance related thread in the twelve years I’ve been a FReeper. I would add to the “it’s how much you spend” part of the plan by saying “it’s not how much you make, it’s how much you keep.”

The plan you describe works nearly every time it’s tried.

sarcasm

I know of some elderly who are happily married and enjoying retirement, except that they would retain more of their retirement if they were divorced and living togther. Any truth to this?

Thanks. Most of what I wrote is based on todays lifestyles and knowledge my Grand Parents (lived thru the depression)passed on to me.

Correct link.

But thanks for the article posted, enjoyed it more than the link you provided!

The same with my parents. They both lived through the depression, and raised a family of four by making do with what they had. None of us never went hungry, unclothed, or uneducated.

The same type planning has served Mrs. abb and I quite well as we now enter into retirement.

They’ll have to go waaaay down to get to the amount I’m able to save. I’m not going to worry unless I win a lotto.

YEP...what YOU said.

HA...I think Mercat will say YES!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.