Posted on 04/16/2013 3:20:08 PM PDT by blam

Is Bernanke’s Worst Nightmare Just Around The Corner?

Economics / Deflation

Apr 16, 2013 - 09:17 PM GMT

By: Graham Summers

First off I want to say that all of us here at Phoenix Capital Research are sending our prayers to the victims of the Boston Terror Attacks. We sincerely hope none of you, our readers, or your loved ones were injured or harmed by these events.

The markets today are snapping back from yesterday’s sharp drop. However, in the bigger picture we believe that Ben Bernanke must be terrified.

The Fed and other Central banks of the world have done their darnedest to inflate away the debts of the developed world. These folks wanted more than anything to create inflation… because it meant it was easier to service their debt loads provided interest rates stayed low.

It is beginning to look like they failed. The Fed has announced QE 3 and QE 4, the Bank of Japan just announced a $1.2 trillion stimulus, the European Central Bank has promised unlimited bond buying… and yet deflation looks to be rearing its head again.

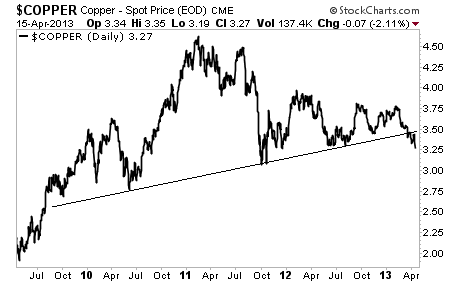

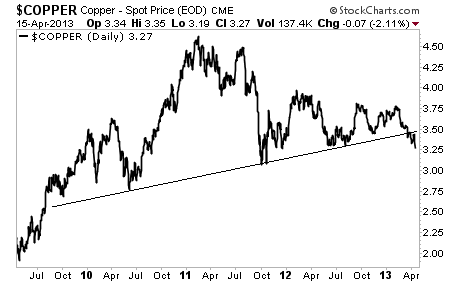

Copper has taken out its “recovery’ trendline.

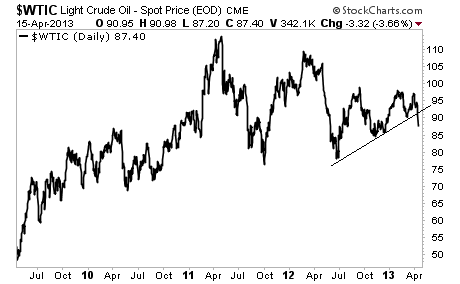

Oil is breaking down:

So is Gold:

These are all signs of rising deflation. If deflation IS back then Bernanke’s efforts to create inflation will have failed. IF this is the case, the Fed is literally out of bullets.

Investors take note, the global economy appears to be contracting again. China’s recent GDP miss is the just the latest in a series of economic surprises to the downside.

And stocks are always the last asset class to realize this.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash?

We seem to be sliding further into a deflationary depression, delayed slightly by the previous stimulus efforts.(?)

ping

“....Ben Bernanke must be terrified.”

.

Now why should Bernanke be terrified?

He is a wealthy man without a financial worry in sight and no one will ever accuse him of mismanaging the economy. And if someone did, he would just give him the finger. Our politicians are never held responsible for their actions.

If the SHTF nothing of it will splatter on him. I’ll take his place any day and I will continue to coolly drink my scotch and never be terrified.

If we are headed for deflation, they’re definitely coming after the 401k and IRA plans.

My theory is the money is coming out of commodities and into real estate, which looks like it is bubbling again.

That is what I would do if I was younger. Quality rentals that I could sell as primary residences in a few years.

Deflation never left...

Dougie Kass is right we have "Screwflation".... All our large captial assets have gone down and maybe stabilized, while cereal boxes get smaller to hide the inflation of a week dollar as they sell them at the same price.

Go out and if you got cash and want to buy a boat, collector car, airplane, you can get them for a song, they have deflated and people need the cash..

The question begs, when does Bernake slight of hand to try to make us feel like inflation fails entirely and we snap to Hyper-Inflation with his worthless dollars flooding the system..

The amount of liquidity that has been pumped into the markets over the past 5 years makes the few trillion hanging out in retirement accounts look like chump change. A complete seizure of retirement accounts would yield $3t from 401k's and $3 to $5 t from IRA accounts. The total dumped into the markets since 2008 is approaching $10t. The Fed is out of bullets, I have been saying that for a while now. The percentage of the markets that are 'owned' by the fed and PD's now is beyond comprehension.

What happens next?

Default on sovereign debt. Seizure of private assets—the GM thing and Stockton where bondholders are screwed over in favor of connected groups. Its going to hurt. That’s why they’re going after the guns. They should probably go after rope as well. The only spike in employment would probably be things like professional food tasters for government officials.

I love what one smart Freeper said...

“One day closer to street justice.”

May they all enjoy their adult beverages while they can.

Out of bullets? The Fed can create trillions with a handful of electrons. Out of bullets.....LOL!

What happens next?

Well, that is not exactly a soup question.

I wish I knew. None of the scenarios that I play out are very appealing. A lot of people are going to suffer, necessarily, as the system collapses upon itself.

to what benefit? With that line of thinking, why not just print up a billion for each citizen and call it a recovery? It has been attempted before - it never ends well. Spare me the logic that our military preserves the value of the dollar. When it comes down to it, our volunteer military will not be on the front lines while their families starve because their paycheck only buys two slices of bread for the month.

Who said anything about benefit? Just mocking the idea that the Fed is out of bullets.

Spare me the logic that our military preserves the value of the dollar.

..........

The dollar is floating upwards because the US has pumped about 800,000 barrels a day more for each of the last three years. The USA is on track to increase production by the same amount for each of the next 6-7 years. That means the US becomes not just oil independent but an oil exporter.

This also means that the dollar floats upwards and kills both the price of oil and gold. If you were around during the OPEC embargoes of the 1970’s —what we’re experiencing is that decade in reverse.

Only two other countries have experienced this kind of massive growth: the saudis between 1968-1975 and the Russians between 2002 and 2007.

What if the Feds attack the market in the same way that they attacked gold? The US could start things off by liquidating positions in certain banks. Then when the rout accelerates, they could clean up by shorting across the board. This would redistribute wealth from the private sector to the government sector.

When the dust settles, and martial is declared, the Feds would have lots of gold, a strong dollar, and the ability to buy up what’s left.

Why would they attack the market? Or gold?

The US could start things off by liquidating positions in certain banks.

I don't think they hold any positions to liquidate.

Then when the rout accelerates, they could clean up by shorting across the board.

But why?

When the dust settles, and martial is declared, the Feds would have lots of gold, a strong dollar, and the ability to buy up what’s left.

Right. Geez.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.