Posted on 12/23/2012 6:15:04 AM PST by blam

GERALD CELENTE: The Financial Collapse Of 2013 Will Be Worse Than The Great Depression

Sam Ro

Dec. 23, 2012, 5:07 AM

Forget the Mayan Apocalypse.

Gerald Celente, the popular trends forecaster of Trends Research, cites the work of a former Treasury official and warns that the bonds are in a massive bubble that will burst in 2013 in what will be a financial collapse like nothing we've seen before.

He recently spoke about it in an interview with King World News:

This piece is being penned by Dr. Paul Craig Roberts, the former Assistant Treasury Secretary under Ronald Reagan. And he is convinced that the bond bubble is about to burst. This cannot continue to go on the way it is. Everyone knows that the whole game is rigged, and so is this....

The whole game is rigged. It’s ready to go down, and Dr. Paul Craig Roberts believes it’s ‘Bonds Away’ in 2013 as the bond bubble explodes and brings about a financial disaster even worse than the Great Depression. ... Because the whole world is being propped up by these phony bonds and it’s going to collapse. It has to happen. Interest rates are going to start going up, and when they do the bond bubble explodes. You cannot keep interest rates at zero for this amount of time and expect anything other than disaster to follow.

Speaking of the the recent sell-off in gold prices, Celente is convinced that the metals market is being manipulated.

Read more at KingWorldNews.com.

(Excerpt) Read more at businessinsider.com ...

How can anyone doubt that the U.S. will be a significantly different, and much worse, country AFTER the Obama tax increases take effect, AFTER the costly and euthanasia-promoting ObamaCare system starts meddling in everyone’s lives; AFTER the continued printing of dollars cheapens them to Weimar proportions?

After the Bush tax cuts went into effect, the Gross Domestic Product rose by more than five percent almost immediately. So when the Bush tax cuts end after the first of next year, what will prevent the GDP from going down a similar amount? A five-percent drop will mean a Depression, with a capital D, and that will mean trouble in River City.

Obama’s re-election assures us of at least a decade long economic depression. Better start rolling out the old WPA and CCC to give people government jobs raking leaves in the forest or painting murals on government buildings...that worked so well during the last Great Depression. I expect Obama will soon be using a cigarette holder and giving us fireside chats on the radio.

My internal projection, ~2015

GDP multiplier is dangerously close to 1

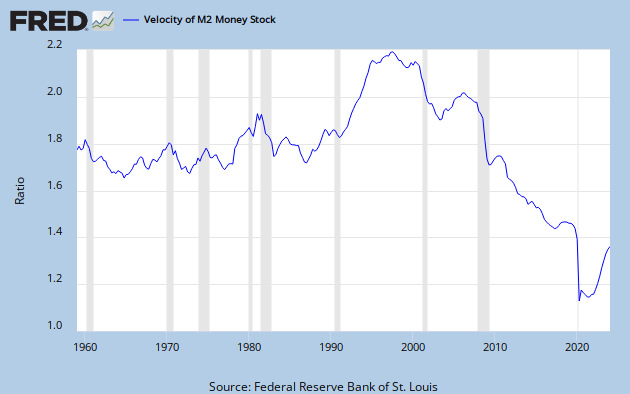

And M2 velocity,

The best single indicator of economic activity,

is still dropping

Anyone who thinks this is healthy is

They are building up resentments in other countries that will last for generations. I guess that's all right with them, as long as they keep profiting now.

Ultimately, the value of our bonds will be determined by the strength of our military. As long as we remain able to crush all opposition into dust, they will retain some value. When and if we lose the ability to directly influence world affairs, then some catalyst will occur - like the Fall of Taiwan - that will show the world once and for all that we are a paper tiger. Then, Obama will feel his "revenge" - many times over.

Like you, I think this is quite a few years off yet. Japan-style deflation without Japanese societal cohesiveness is our immediate future. Things will just keep gradually getting worse, as they have since 2006.

didn’t this prophet of doom lose his own gold at MF Global?

No truer words were ever put down. That said, at least it gives the rest of us an opportunity to plan ahead and try to minimize the damage for us and our famiies. It's going to be ugly and we need to know this and make sure we don't get caught napping.

A flamethrower might help,or some cratering charges dropped on the top of the pile.

Brad Pitt has been in a bunch of good movies. Fight Club, Seven, Kalifornia, Snatch, True Romance, 12 Monkeys, and Inglorious Bastards.

Nonsense.

America needs to shift to a pro-American stance. 100%.

Bring back American jobs. Or operate elsewhere. As in, the American market is closed to you.

Ever heard of Kyle Bass? If not, Google him. He has actually MADE $$ from these various bubbles, and as such has more credibility than some others (like Peter Schiff or Rick Santelli). In any case, I urge you to give this video a watch. Its long, but extremely educational and compelling.

http://www.youtube.com/watch?v=JUc8-GUC1hY

Ha, Ha, Ha, Ha

See my post #33

You got it. That's why some previous posters are not buying into the article as much as they should. There is no question that the government bond bubble (along with mortgage bonds) is going to collapse. The problem with zero rates is that they hollow out the economy and push money into speculative carry trade or commodities. The carry trade and commodity bubbles expand and contract with psychological factors and reaction from the Fed. When the final contraction comes, the Fed will be boxed in.

We have yet to see any real deflation or corresponding "money printing" for stimulating demand. All contraction so far has been in assets and money printing up to now is to buy bonds. The money printing buys government bonds and the politicians spend money to stimulate demand indirectly. But the politicians can also transfer money directly to people to buy votes. We have probably passed the point where we can fundamentally cut back the payments by greatly expanding the economy. But there will be minor expansions while politicians kick the can on reform.

:D

You see sending our jobs to China as a good thing.

I see, bringing them back to America as a good thing.

I really don’t think anyone is smart enough to know when the collapse will come. But, yes, the farce will keep going for quite some time because ALL the Central Banks are playing the same game. The Powers-That-Wannabe all have the same fundamental goal: stave off social upheaval.

• For the West (including Japan): Too much debt, too many promises, and too high a standard of living. Aside from Germany and Japan, there is not enough industry to provide a living for everyone. So the Government has a bigger and bigger role in employment and entitlements keep the rest of the population fed & docile. They play along because if there will be massive social upheaval if Government spending is actually cut to sustainable levels.

• For the East (particularly China): They need to grow, so they need to export. They play along because the alternative is massive unemployment and, likewise, social upheaval. Also, even while its Monopoly $$, it helps them catch up with the West from a military/technological standpoint.

• For the Oil Producers: They are in the same boat. The minute the petrol dollars stop, they will have to contend with their own restive poulations

The fundamental problem is that the Human race now produces enough to survive without everyone taking part in the workforce. While this is good in many ways, it also renders a lot of people….redundant. At the same time, we are also busy offshoring jobs so the necessities of life can be produced even more cheaply. All countries are trying to export excess goods to each other now in a race to the bottom. Improvements in technology and foreign education/work ethic have made this possible. As value-added jobs, Government has picked up the slack by employing more people and handing out ever increasing transfer payments to poor people. After all, we Westerners demand high living standards and we don’t let people starve. While our credit was good, this created an illusion of normalcy (prosperity) for a long time, but illusions have limits. People are slowly waking up to the fact that Government can’t deliver all it promised. And, at this point, all but the stupidest politians will admit to themselves that its not working. Deficit spending is giving us increasingly diminishing returns, buying less & less stability today at the expense of anarchy tomorrow.

But they feel they have no choice. So, they all play along and accept increasing worthless currency to keep the Status Quo going—because no one can fathom what will happen when the music stops. Certainly riots—cities will burn and people will die. Perhaps even the start of a new Dark Age. So, we have condemned ourselves to a Zombie economy as long as our leaders will go to extraordinary lengths to maintain the facade.

Of course, the same people warned us to sell all our bonds and stocks in 2008, promising a 10-year collapse of the market. Took the market just four years to come almost all the way back. People who sold lost 2/3 of their money.

I’m thinking sometime around 15April2014 When all these Obamacare taxes kick in and must be paid.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.