Posted on 07/05/2012 3:40:07 PM PDT by blam

Silver, Gold And The Coming Deflation

Commodities / Gold and Silver 2012

Jul 05, 2012 - 02:03 PM

By: Hubert Moolman

Historically gold has made its significant gains, relative to other assets (as well as nominally), not during inflation, but during deflation (Note: I am using the terms inflation and deflation very loosely in this case). These significant gold rallies historically occur when value flees instruments such as stocks and certain commodities.

Since the 1920s there have been three major gold rallies (1930s, 1970s and the current rally).

All three major gold rallies came after a significant top in the Dow and the Dow/Gold ratio (1929, 1966 and 1999). A great portion of the 1930s and 1970s rallies occurred when the Dow was falling significantly. In fact, the biggest rise in the gold price occurred when the Dow was falling or was trading closer to the bottom of its trading range during that period.

The current gold rally (since 2001) has mostly been during the time when the Dow has also been rising, with the exception of a short period in both 2002 and the end of 2008 to Feb 2009. The best of the current gold rally, since 2001, has been during a time when the Dow was rising as well.

With the Dow still relatively close to all-time highs; I believe the current gold rally has not yet had its best period - it is still to come, and will be during the time that the Dow is falling just like in the 1930s and 1970s. It is my believe that if gold goes on to rally from here, then we will have financial turmoil like there has never been. The word depression might not be adequate to describe what is coming. The Great Tribulation might be the proper term. More details on this in my next updates.

Gold/Silver Ratio Suggests Silver Will Outperform Gold

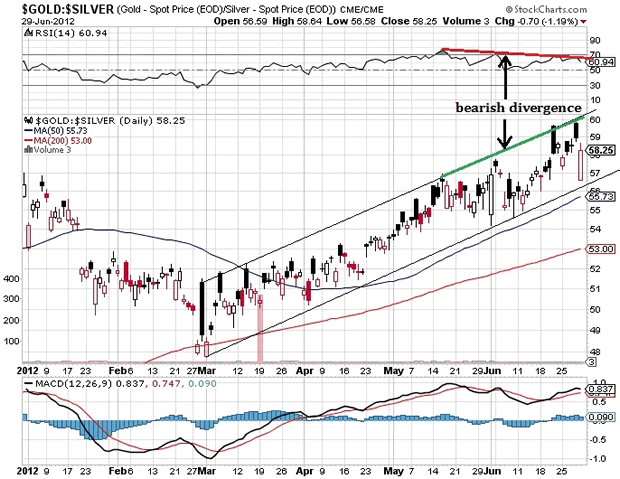

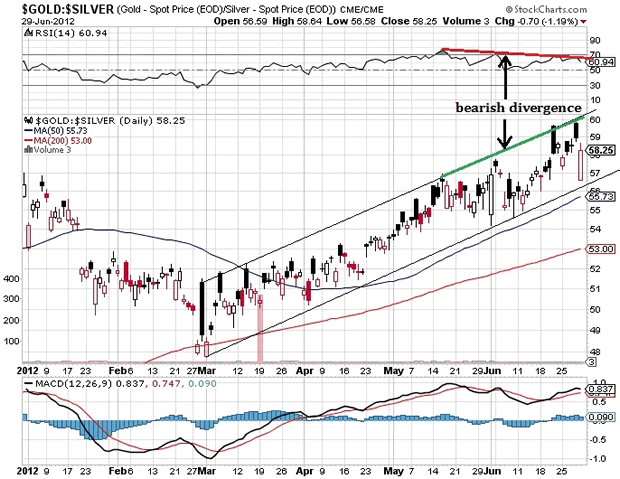

In my last update, I covered the Gold/Silver ratio, and explained why I think the Gold/Silver ratio will soon fall straight down. Below is a Gold/Silver ratio chart (from stockcharts.com), which shows some more evidence to suggest that it could indeed fall soon:

On the chart I have indicated a trading channel in which the ratio has been moving for the last four months. On Thursday, 28 June, it hit the top of that channel and was smacked down immediately. When price goes out of this channel, it could be a sign of where this ratio, as well as the gold and silver price is going.

More importantly, there is a bearish divergence, between the ratio and the RSI. The RSI has been making lower highs, whereas the ratio has been making higher highs. This could be a signal that the ratio will soon fall significantly, confirming higher prices for gold and silver.

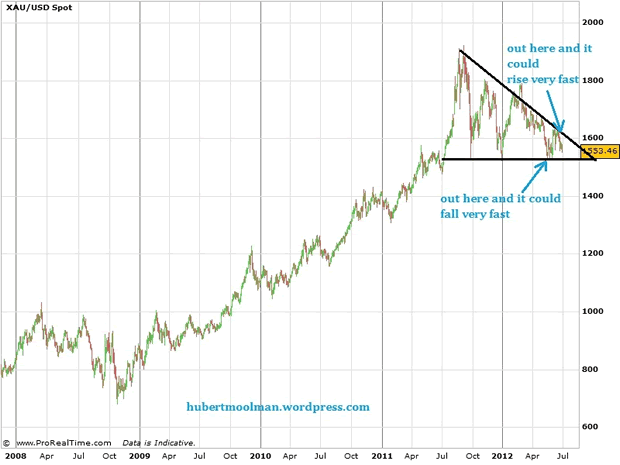

Below is a chart for gold (from fxstreet.com):

On the chart, I have indicated a big triangle. When the price moves out of this triangle, it is very likely to fall or rise very fast (a very long way). It really could go either way, and nobody can be 100% certain which way it will go.

However, before price makes a big move, there is almost certainly going to be signs and evidence of that big move. Based on the evidence that I have collected, analysing gold and silver, I am convinced that the big move will be higher.

So, $3.30-3.50 is relatively close to $3.50 per lb.

I did not look up the price.

It has been near $4.00 per lb. before. (not sure that is a spot market price)

I lived in the copper mining district in NM in the 1972-1986 time frame. When I left copper was $.47 per lb.

That is quite a run up.

Why not a little of all?

Farm land is good.

Historically before & during major wars copper, lead and cotton prices are very high.

Financial collapses are breeding ground for wars.

Hungry people do desperate things.

Gold is gold and silver is silver (bullion, that is). Land is many things, more variables to factor in. Do you mean purchasing land that you "own" but the bank holds the mortgage? Or land that you *own*?

Personally, and I am believer in a coming crash, so you must factor that into my outlook, I would like to get a little land out of the way somewhat so I could fix it up as a getaway option. I can't afford to pay cash for what I want, so I don't see it as a good move for that reason.

Hungry people do desperate things.

Precisely why I disagree with those that believe the military will not go along with subjugating the civilian population of this country, including firing upon us.

Hungry, angry, disenfranchised, maladjusted types are prime recruits for the military in a crash, especially when the country's leadership is despotically oriented. Which I think ours obviously is. Good and moral men won't participate in that, so they either leave or are forced out.

My opinion for those here that think the military will side with the civilian population. It won't be that simple.

This is my opinion on “junk” Morgans. (I probably own 250 or so)

They are kinda neat coins, but once you’ve seen however many dozens, you’ve pretty much seen them.

You MUST go a coin show and wander around one weekend afternoon for a few hours (www.coinshows.com) and see how many silver dollars there are. Gargantuan numbers. Giant, enormous numbers of them. Many many years had 10 million minted. Even after so many millions were melted down over the years.

I classify a year/mint of SDs as “sort of rare” if there were about 1.7 million or fewer minted. Google “morgan dollar mintage” for a table. Something under 20 diff dates/mints fall into this category. The next stratum is about 400K-800K minted. Rough numbers. These are substantially rarer and are the so-called “key dates”. There are maybe ten dates/mints of these. Then there are the cats’ meows, the CC mints, and a few dates down in the 200K minted. I don’t have them memorized because I don’t care that much, but 1893-S is one.

98.5% of all you will see are very common dates. And of those dates, rather surprising numbers are in quite good condition. But they are not worth more than their silver content. By the way, SDs contain something like 1.06 times the silver in two half dollars, which is different than halves containing *exactly* double the silver of two quarters or exactly 5 times the Ag in 2 dimes. So SDs, because they are “neat” coins, typically sell for extra premium over junk quarters and dimes and halves. Justifiably. But I generally find them to be overpriced, and not as good a form as one might imagine.

There are large numbers of counterfeit Morgans that were made in China. And because of that, I like them less. People know this. Are they detectable? Yeah, pretty much, but now this places an obligation to examine them carefully, making transacting them a tad more difficult or at least time consuming. So where and how are you going to get one of those stinkers? In a bag of 100? Hmmm.

My own preferred form of silver is 10 oz bars, J-M or Englehard if possible, but the 3-4 better secondary mints are fine. APMEX, Amark, Silvertown, Wall St mint, NTR, these names come to mind and carry less premium than J-M or Engle. But that is just my opinion. I like Eagles, but they carry a fat premium I’d rather not pay. And they are NOT .999 silver, they are like 23.3 or 23.7 karat. There is a skosh of copper in there to toughen up the coin.

So, I only buy SDs when I can buy them for 2x the market price of two halves. And that is rare. I like to buy 10 oz bars (or, 1 oz rounds) when they’re having a 99 cents over spot sale.

Despots if not removed will recruit those who will. That is not an instant change.

The citizens are armed. They will not relinquish those weapons quietly. FACT.

There is a lot riding on November.

I am a boomer, born in 1947. BUT I have never been a part of the 60’s culture. Grew up on a farm, worked for independent businesses for 35 years. Not a leftie tendency anywhere in my body.

We shall see.

I am thinking of buying land and paying cash for it. I am looking at it as an investment along with having a getaway place if needed.

We still need to have cash, gold or silver. Cash is probably the worst option based on the ease of devaluing cash from the govt stance. Course bullets are a great bargaining tool also....

I agree on both points.

Addressing the second, the change has not happened. But it is and has been a work in progress whenever the Dems have the upper hand. The Clintons drove out some of the good career officers, Obama is doing the same now as well. Their goal is a gradual rotting from within the military. IMO, that is their desired and defined goal, not an unplanned result of misguided policies.

It is analogous to salt water seeping into a freshwater aquifer. One day you go to the well and it is no longer potable. It happens slowly.

Agreed

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.