Skip to comments.

A Sure-Fire Case for Deflation

Townhall.com ^

| June 27, 2012

| Mike Shedlock

Posted on 06/27/2012 5:20:26 PM PDT by Kaslin

Zero Hedge, citing a Federal Reserve Bank of New York report on Shadow Banking, makes (without even realizing it) a sure-fire case for deflation.

I encourage you to visit the link shown above, but also take a look at On The Verge Of A Historic Inversion In Shadow Banking by Zero Hedge.

Here is the introduction by ZH.

While everyone's attention was focused on details surrounding the household sector in the recently released Q1 Flow of Funds report (ours included), something much more important happened in the US economy from a flow perspective, something which, in fact, has not happened since December of 1995, when liabilities in the deposit-free US Shadow Banking system for the first time ever became larger than liabilities held by traditional financial institutions, or those whose funding comes primarily from deposits.

As a reminder, Zero Hedge has been covering the topic of Shadow Banking for over two years, as it is our contention that this massive, and virtually undiscussed component of the US real economy (that which is never covered by hobby economists' three letter economic theories used to validate socialism, or even any version of (neo-)Keynesianism as shadow banking in its proper, virulent form did not exist until the late 1990s and yet is the same size as total US GDP!), is, on the margin, the most important one: in fact one that defines, or at least should, monetary policy more than most imagine, and also explains why despite trillions in new money having been created out of thin air, the flow through into the general economy has been negligible.

Empirical Proof of Deflation

Here are the pertinent charts and commentary.

That chart is from the NY Fed.

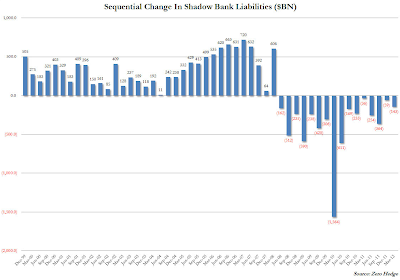

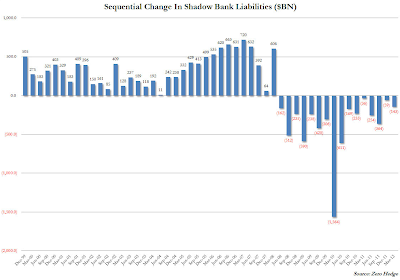

On a similar chart ZH commented ... "As another reminder, US Shadow Banking liabilities - a combination of Money Market funds, GSE and Agency paper, Asset-Backed paper, Funding Corporations, Open market paper and of course, Repos - hit a gargantuan $21 trillion in March 2008. They have tumbled ever since, printing at just under $15 trillion at the end of March 2012, the lowest number since March 2005 when shadow banking liabilities were soaring. This is an epic $6 trillion in flow being taken out of credit-money circulation, with a $143 billion drop in Q1 alone!"

Sequential Change in Shadow Bank Liabilities

click on chart for sharper image

The chart immediately above is from ZH, not the NY Fed article.

ZH comments ... "It is precisely this ongoing contraction that the Fed does all it can, via traditional financial means, to plug as continued declines in Shadow Banking notionals lead to precisely where we are now - a sideways "Austrian" market, in which no new credit-money money comes in or leaves."

Emphasis in bold by ZH.

Deflation It Is

There is nothing "sideways" about it. The charts clearly show credit money is indeed leaving (contracting) to the tune of a whopping $6 trillion since March 2008.

Interestingly, Zero Hedge did not mention "deflation" once in his post.

Yet, those charts, without a doubt, depict deflation if one accurately describes inflation and deflation as measures of credit, not prices.

Based on real-world experience of what is most important, here is my definition: Inflation is a net increase of money supply and credit with credit marked to market.

Deflation is the opposite, a net decrease of money supply and credit with credit marked to market.

If one woodenly sticks to the view that inflation and deflation are about prices (while ignoring a devastating collapse in housing), then yes, the US is still in a period of inflation.

Likewise, if one foolishly sticks to measures of money supply like M1, M2, or TMS (true money supply) by Michael Pollaro, then the US is also in a period of inflation.

Real World Viewpoint

Neither money supply nor the CPI can adequately explain interest rates, housing prices, lack of jobs, and numerous other real-world phenomena.

In the real-world, in a credit-based economy, it is credit that matters.

The above charts show the real story. That story explains 10-year treasury yields at 1.61% and 2-year yields at .29% even though the CPI is 1.7% year-over-year.

Those charts also show why hyperinflationists are in an alternate universe and why proponents of "huge inflation but not hyperinflation" are on Mars.

TOPICS: Business/Economy; Editorial

KEYWORDS: deflation

Navigation: use the links below to view more comments.

first 1-20, 21-25 next last

1

posted on

06/27/2012 5:20:30 PM PDT

by

Kaslin

To: Kaslin

Inflation now (just bought quite a bit of ranch hardware). Deflation after the political/regulator class falls with its debt regime.

2

posted on

06/27/2012 5:30:29 PM PDT

by

familyop

("Wanna cigarette? You're never too young to start." --Deacon, "Waterworld")

To: Kaslin

So investing in paper currency is a smart idea?

3

posted on

06/27/2012 5:38:13 PM PDT

by

JimWayne

To: Kaslin

4

posted on

06/27/2012 5:57:19 PM PDT

by

Pelham

(Amnesty for Illegals, a bipartisan goal of the Stupid Party and the Evil Party)

To: Kaslin

I understand that defining inflation as credit rather than prices is his point. Not sure I agree.

However, he needs to be a little more precise about the realities of the BLS horse manure they call the CPI.

That story explains 10-year treasury yields at 1.61% and 2-year yields at .29% even though the CPI is 1.7% year-over-year.

1.7% CPI my Lilly white posterior. Closer to 10% but no one has the stones to admit the methodology is bogus, not fit for a freshman statistics class. Does his point stay the same with a figure of 8-10% increase in consumer prices?

5

posted on

06/27/2012 6:05:25 PM PDT

by

ChildOfThe60s

(If you can remember the 60s....you weren't really there)

To: JimWayne

Who knows? This is uncharted territory.

During the Great Depression the money supply was shrinking dramatically and paper money actually increased in value.

But the Fed wasn’t fighting that deflation by creating vast quantities of new money like they are this time. So this time will be different. Maybe. Somehow.

6

posted on

06/27/2012 6:11:41 PM PDT

by

Pelham

(Amnesty for Illegals, a bipartisan goal of the Stupid Party and the Evil Party)

To: ChildOfThe60s

Don't you just love “deflation” where the price of food, insurance, health care, college tuition, car repairs, and everything else is going up like crazy? Oh, and wages are going down or are stagnant.

7

posted on

06/27/2012 6:17:23 PM PDT

by

SkyPilot

To: SkyPilot

What you must purchase on a daily basis to live goes up in price, while the value of your assets goes down.

In the Looking Glass Land reasoning of the federal government, they cancel each other out. Hence, no inflation.

Feel better now?

8

posted on

06/27/2012 6:28:23 PM PDT

by

ChildOfThe60s

(If you can remember the 60s....you weren't really there)

To: Kaslin

Good Article.

Zero Hedge’s hyperinflation forecasts have been wrong so far and completely ignored the reduction in credit assets in the banking system, much less shadow banking.

I suspect that the current drought that is affecting 2/3rds of our country will drive food prices up some. No doubt Zero Hedge will be back blaming the FED.

The thing that gets me about Zero Hedge is their constant blaming of the FED, which has only done exactly what they are supposed to, distracts from the real problem which is congressional spending.

9

posted on

06/27/2012 6:35:52 PM PDT

by

DannyTN

To: ChildOfThe60s

Yes, this is very crazy times. One other factor not getting a lot of press, is the amount of retirees who are not getting any supplemental investment interest, and are having to sustain on principal.

Seems the monster is consuming itself so to speak.

10

posted on

06/27/2012 6:36:30 PM PDT

by

catfish1957

(My dream for hope and change is to see the punk POTUS in prison for treason)

To: Kaslin

There is nothing "sideways" about it. The charts clearly show credit money is indeed leaving (contracting) to the tune of a whopping $6 trillion since March 2008. Give me $6 trillion and I'll fix the entire economy. The first thing I'll do is payoff politicians to make dramatic cuts in regulations and to hold government size at its current level. I'll make the rest available for small business loans and investments.

11

posted on

06/27/2012 6:38:16 PM PDT

by

Moonman62

(The US has become a government with a country, rather than a country with a government.)

To: ChildOfThe60s

This thing is like watching a train wreck in slow motion. And worse the leaders of our country are fiddling, while this tinderbox of an economy is about to flash.,p>I guess the biggest question now, is what event is going to topple the house of cards?????... Euro crash???, Another soverign debt downgrade???? A war?????

12

posted on

06/27/2012 6:46:05 PM PDT

by

catfish1957

(My dream for hope and change is to see the punk POTUS in prison for treason)

To: catfish1957

One other factor not getting a lot of press, is the amount of retirees who are not getting any supplemental investment interest, and are having to sustain on principal. Government manipulation of interest rates is just another hidden tax. I went from $1,700 in annual interest on CDs at the credit union to almost nothing.

My nephew, with mediocre credit and debt up to his eyeballs is getting a $135,000 mortgage with 3% down and 3.8% interest. 30 year fixed. Thank you Dodd-Frank.

13

posted on

06/27/2012 6:47:08 PM PDT

by

ChildOfThe60s

(If you can remember the 60s....you weren't really there)

To: JimWayne

In deflationary times CASH IS KING...

14

posted on

06/27/2012 7:01:42 PM PDT

by

Hotlanta Mike

(Resurrect the House Committee on Un-American Activities (HUAC)...before there is no America!)

To: Southack

15

posted on

06/27/2012 7:01:42 PM PDT

by

Sawdring

To: familyop

Inflation now (just bought quite a bit of ranch hardware). Deflation after the political/regulator class falls with its debt regime.I think the instabilities will run in reverse order. Deflation, or at least low inflation for the next couple of years, with the low monetary velocity and shrinking M2, and inflation later as the money printing takes effect and confidence in the stability of the monetary unit wanes.

To: Pearls Before Swine

"I think the instabilities will run in reverse order. Deflation, or at least low inflation for the next couple of years, with the low monetary velocity and shrinking M2, and inflation later as the money printing takes effect and confidence in the stability of the monetary unit wanes."

Well said, and I left out the second likelihood. Then after the inflation trend my describe, maybe a more severe deflation (for lack of sustainable economic activity before rebuilding). Many imported products might even be an exception to that latter stage of the process, if Asia manages to continue much productive activity at all (products from Asia traded for natural resources--commodities--from other countries, resuming inflation in Asia relative to the dollar).

17

posted on

06/27/2012 8:50:44 PM PDT

by

familyop

("Wanna cigarette? You're never too young to start." --Deacon, "Waterworld")

To: Pearls Before Swine

"Then after the inflation trend you describe,"

Well done, and thanks.

18

posted on

06/27/2012 8:52:04 PM PDT

by

familyop

("Wanna cigarette? You're never too young to start." --Deacon, "Waterworld")

To: Kaslin

Kaslin,

Thanks for posting the link to the long (28 page) Federal Reserve essay.

This is the first time in 4 years I feel like I see the full picture on the financial collapse in 2008.

To: Kaslin

Bi-flation.

We will have simultaneous inflation and deflation.

It will depend upon asset classes.

Home and automobile prices will deflate as buyers evaporate and credit continues its transition from easily available to virtually unobtainable.

Assets commonly purchased with credit will deflate.

Everything else will inflate as the currency loses its value. Expect rising food prices, energy prices and eventually even the prices of heavily deflated assets mentioned above.

20

posted on

06/28/2012 5:43:01 AM PDT

by

Bon mots

("When seconds count, the police are just minutes away...")

Navigation: use the links below to view more comments.

first 1-20, 21-25 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson