Skip to comments.

A $600 Billion Failure

Townhall.com ^

| July 9, 2011

| Bob Beauprez

Posted on 07/09/2011 6:43:10 AM PDT by Kaslin

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-48 next last

To: sr4402; ScottinSacto

The real purpose of Quantitative Easing is to ease the debt in order to get more into debt.Seven Purposes for the Federal Reserve’s Quantitative Easing Program:

- Fund the deficit spending of the U.S. Federal Government

- Provide free cash for insolvent TBTF banks

- Fund the deficit spending of the U.S. Federal Government

- Create the inflation necessary to service existing debts

- Fund the deficit spending of the U.S. Federal Government

- Infuse cash into the Primary Dealers which they, in turn, can use to buy S&P futures and prop up the stock market (i.e. preserve the “Wealth Effect”)

- Fund the deficit spending of the U.S. Federal Government

And QE3 and its offspring are coming..... For the reasons listed above and stated in the article you refer to, among many others, there always be a QE of some form and fashion until the currency collapses.

21

posted on

07/09/2011 9:22:55 AM PDT

by

Zakeet

(The Wee Wee's real birth certificate got shredded with his Rezko mortgage records)

To: Golden Eagle

>>The problem as I understand it is the banks that got the money aren’t loaning it out, at least not to small businesses in the US.<<

My take on it is completely different. The money supply that I watch has grown at a tremendous clip and we are getting the inflation in commodities and stock prices that one would expect. If banks start to circulate the massive amount of excess reserves they hold, we’ll enter a hyperinflation that will make past South American inflation levels look good to us.

The main reason the economy is struggling is that Washington DC is aggressively regulating businesses across the board in an attempt to get as much done on the green agenda as possible in as short a period of time as possible.

Just look at the jobs actually lost in the Gulf drilling industry, not to mention those not created if sensible policies were in place. How much bigger would the coal industry be with energy prices at this level if we enabled clean coal technology? Instead, we’re aggressively CLOSING coal-fired plants. You could probably question the owners of any business in the U.S. today and find that expansion plans are being subdued by regulators.

Meanwhile, where we are expanding makes little economic sense...windmills and solar and ethanol, in the energy sphere. Sure, shale oil is booming, but liberals would love to stop it, so is it booming as fast as it would without their influence? Doubtful.

In essence, we’re getting the worst of both worlds right now: a looming inflation caused by excessive money growth accompanied by a struggling real economy tied down intentionally by regulators in DC. We already have one side of the misery index, unemployment, at excessive levels; the other side, inflation, is right around the corner. The result is stagflation, a la the late 1970’s under Carter.

Obama is the worst President in U.S. history, but he hasn’t yet topped Carter’s level of the misery index. By election day, he just might. One thing is certain. The next President will be fully justified in using the phrase “It’s Obama’s fault” for at least a year or so into his Presidency, and maybe longer depending upon just how huge a mess he leaves us.

22

posted on

07/09/2011 10:05:42 AM PDT

by

Norseman

(Term Limits: 8 years is enough!)

To: Norseman

The problem as I understand it is the banks that got the money aren’t loaning it out, at least not to small businesses in the US.

23

posted on

07/09/2011 10:16:52 AM PDT

by

gusopol3

To: Norseman

The problem as I understand it is the banks that got the money aren’t loaning it out, at least not to small businesses in the US. Haven't the banks from TARP until now had the opportunity to make more money passing money back and forth to the government than lending to the public? Isn't that beginning to change? That would break the inflation dam as well , maybe? Sorry, that's what happens when you put ". " instead of ">"

24

posted on

07/09/2011 10:18:58 AM PDT

by

gusopol3

To: ngat

OK. So what is the reason to get people into debt? What is the reason to get our nation into overwhelming debt?

Answer: A revolution in Government: Socialist or Communist.

25

posted on

07/09/2011 10:32:52 AM PDT

by

sr4402

To: gusopol3

Yes, the big banks have no doubt made billions on a positive carry trade (borrow at short term rates, lend at higher long term rates) in the last two years. They love a gently rising yield curve and the longer it persists, the more they make.

And Geitner and Bernanke are no doubt aware that the QE’s are helping the big banks get healthy again. What I think they’ve been hoping though is that they could put enough downward pressure on longer interest rates to get markets like housing going again. It just didn’t work out like they hoped it would.

In the meantime, individuals living on the interest income of their investments (and there are a whole bunch of those) have been spending their capital for the past four to five years instead, because they’re earning less than peanuts on their CD’s, etc. That is the real reason the small banks are shrinking. People are spending their deposits on food and lodging instead of spending the interest they used to earn.

I heard an elderly person ask quite innocently the other day, “Do you suppose Obama just doesn’t like old people?”

Even leaving aside the implications of ObamaCare, which many older people have yet to realize is a near certain sentence of an earlier death for them, many seniors are starting to wonder about the answer to that same question.

Being forced to spend one’s lifelong accumulation of capital at an unexpectedly fast pace is disturbing far more seniors than Obama imagines. This is a very under-reported issue because the MSM isn’t going to go there, and it’s a bit too boring for Fox and talk radio. And now prices are starting to rise rapidly as well, but Soc. Sec. payments didn’t go up (went down actually) because the government sees no inflation. I suspect Obama is slowly losing many of his senior supporters as a result.

26

posted on

07/09/2011 10:35:18 AM PDT

by

Norseman

(Term Limits: 8 years is enough!)

To: gusopol3

I think you're right, the press will deem him re-elected Yes, the Lamestream Press has already started that claiming an uninteresting Republican bunch. IE: Obama is the only one of interest to them.

27

posted on

07/09/2011 10:36:03 AM PDT

by

sr4402

To: Norseman

Thanks for the detailed post. While inflation may very well skyrocket when the banks stop hoarding all the money, until they do many businesses are completely frozen. Not quite as bad as 2008 when banks wouldn’t even loan to one another but close. I think the banks are choking Obama off for all the new regulations he wants, icluding Obamacare. His new FHA loan reprieve for the unemployed is him attempting to fire back. It’s going to be class warfare to the extreme for the next year and a half and unfortunately most of us are caught in the middle.

To: Golden Eagle

>>until they do many businesses are completely frozen...<

I doubt this is the case. If a business is “frozen” out of the current credit markets it’s more likely because the current economic environment is so unfavorable to a lot of small businesses that they can’t get a bank officer to sign off on a loan. Just because a business needs money doesn’t mean it makes sense for a bank to lend it.

In fact, a lot of businesses are sitting on piles of cash. They just don’t want to invest in ventures that will run afoul of Obama and the Green Machine of regulation that he’s installed in DC since he took office.

One of the bigger problems a Republican President is going to face in 2012 is how to unwind everything the Fed has done to bank reserves at the same time the economy is starting to fly due to a reversal of most of Obama’s economic policies. We could see a monster inflation rate if it’s not handled properly.

It’s important to understand that with current money growth we should be experience significant economic growth, on the scale of 6-8% per year by now, especially coming out of a recession. The money is there. What’s missing is the will to expand among business owners large and small.

The stagnation is due to policies Obama has put in place, or threatens to put in place (EPA CO2 regs, ObamaCare, etc.) and not Fed policy. Fed policy has been extremely expansive, as indicated by the strong stock and bond markets, excessively low interest rates and surging commodity prices. None of that happens when the Fed is tight with money. Quite the opposite in fact.

29

posted on

07/09/2011 10:57:47 AM PDT

by

Norseman

(Term Limits: 8 years is enough!)

To: Norseman

Thanks, I appreciate your careful answer.

30

posted on

07/09/2011 11:00:05 AM PDT

by

gusopol3

To: Norseman

My opinion is easy money from the Fed is what got us into this mess in the first place, going back to Greenspan’s low rates under Clinton. He raised them a bit on Bush at first but then lowered them right back down and the economy eventually overheated. Lots of that money has now left the country, along with many jobs, maybe to never be seen again. Giving out even more money at even lower rates to banks who are now just sitting on it hasn’t helped at all, things are actually worse than ever, and if inflation now hits hard most savings that are left are ruined too. Changing rates is far too blunt an instrument that is far overused. Leave it to banks that earned their money to decide how and when to lend, not up to those that simply print it, then we’d have far fewer of these ridiculous swings both up and down.

To: Golden Eagle

Ironically, low rates don’t always mean easy money. I was worried about the Fed causing a deflation, even with low rates, in the 2001-2005 time frame. Since the 1970’s the Fed has never really goosed the money supply sufficiently to cause a significant inflation, until very recently.

If you look at the crash, it wasn’t a total economic crash as much as it was a housing crash, and housing definitely had access to “easy money” during Bush’s presidency. But it wasn’t “easy money” via the Fed, but rather “easy money” via lax lending standards foisted on us by Fannie Mae and Freddie Mac, abetted by both the Democrats and a lot of Republicans, including Bush.

The main reason the housing decline was so huge is that it was only house prices that were out of line at the time. Overall inflation was minimal, so every 10% increase in housing prices each year drove them farther and farther above equilibrium. We are only now approaching that equilibrium with housing prices falling 30-60% and the general price level also rising more rapidly up to meet the falling house prices.

I totally agree with you that “things are worse than ever” mainly because the Fed has created a mess that is going to be difficult to unwind safely, the Obama administration has created a regulatory morass that will also take years to unwind (if we have the sense to do it), and yes, savings could very well be wiped out by a significant rise in the inflation rate over the next decade.

However, if the Fed were ever to be managed the way I’d like to see it managed, short term rates would become more volatile because they would move up and down with every short term swing in the economy instead of being pegged by the Fed at whatever level they decide in committee meetings. They would become a true market-determined rate instead of a managed rate set by the Federal Reserve.

32

posted on

07/09/2011 1:46:41 PM PDT

by

Norseman

(Term Limits: 8 years is enough!)

To: All

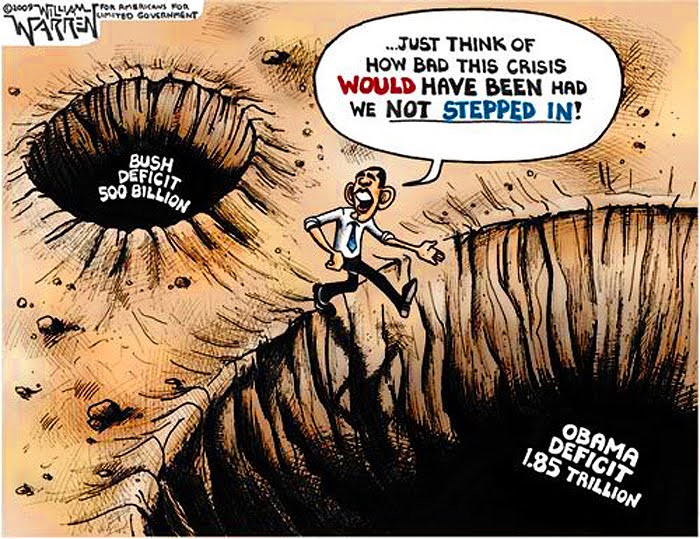

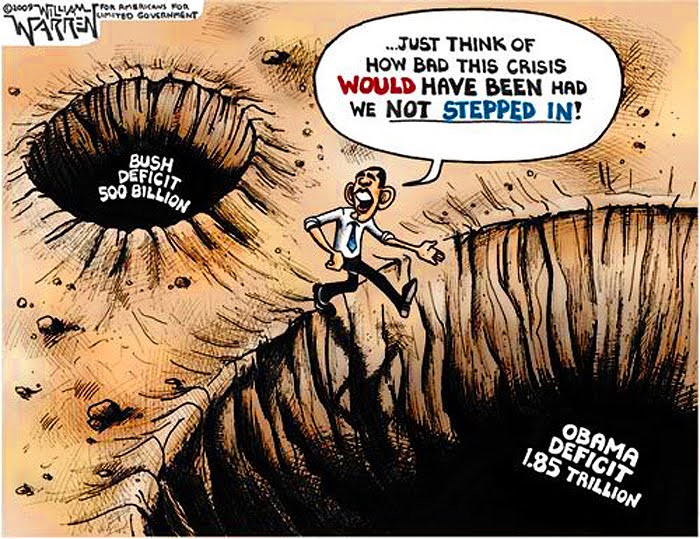

In Feb 2009, the newly-inaugurated Obama warned that without his $800B

stimulus, "an economy already in crisis will be faced with catastrophe."

Obama’s Deficit Avalanche isn’t Bush’s Fault / scottuystarnes.com / 2/9/2010

SOURCE http://scottystarnes.files.wordpress.com/2010/02/obama-deficit.jpg?w=400&h=308

Washington Times reports: Even more staggering than the mountains of snow in the capital are the deficits the Obama administration plans for the next decade. Huge spending increases will add about $12 trillion to the national debt for budget years 2009 to 2020.

The scariest part is that these deficits are based on unrealistic budgeting assumptions; the real fiscal outlook is much bleaker. In the proposed 2011 budget, the White House defensively attacks the “irresponsibility of past” deficits.

For example, the 2009 budget deficit of $1.4 trillion is blamed on the George W. Bush administration as if President Obama’s $862 billion stimulus package and more than $400 billion supplemental spending bill had nothing to do with it. Mr. Obama’s planned 2010 budget deficit rises to an even higher record level of $1.6 trillion.

By comparison, all of Mr. Bush’s deficits from 2002 to 2008 – the seven years during which his team had the most control over the budget – produced a combined deficit of $2.1 trillion.

Obama has spent more in 2 years than Bush did in 7 years. Obama’s BIOB (Blame it on Bush) defense just won’t work anymore.

33

posted on

07/09/2011 2:40:08 PM PDT

by

Liz

( A taxpayer voting for Obama is like a chicken voting for Col Sanders.)

To: All

Here's how Obama "Stimulated" the Economy------with run-away spending.

Now the US Treasury and HHS entries must be seen in this context. Ohaha's

then-COS---the power-mad Rahm Emanuel---took control of the US Treasury, took

over the census, and put his brother in charge of Medicare/Aid billions and O/Care

billions. Can you say offshore accounts? Govt fraud? Money laundering? Illegal

conversions of govt monies?

34

posted on

07/09/2011 2:40:43 PM PDT

by

Liz

( A taxpayer voting for Obama is like a chicken voting for Col Sanders.)

To: gusopol3; Norseman; Zakeet

Norseman’s list is a good one. Let’s remember to add that Federal inflationary finance is also intended to bail out (continue) the public sector bubble. Over-priced, low-skilled public-union workers in blue states like California.

In short, printing money, to give to the Democrat Party, via inflated state/local public-worker union dues. Also, private sector compulsory union bailouts-which-turn-into-Rat-Party-donations, too [read: GM].

4L

35

posted on

07/09/2011 4:01:30 PM PDT

by

4Liberty

(88% of Americans are NON-UNION. We value honest, peaceful Free trade-NOT protectionist CARTELS)

To: Kaslin

So that inexplicable run-up in the markets last week. That was QE2's last gasp? Should make for an interesting July.

To: Kaslin; Rapscallion; Quix; Joya; Whenifhow; stephenjohnbanker; TruthConquers; blam; M. Espinola

37

posted on

07/09/2011 6:01:15 PM PDT

by

ex-Texan

(Ecclesiastes 5:10 - 20)

To: Norseman

Ironically, low rates don’t always mean easy money. Maybe not always, but typically. Money to buy all kinds of things was more available in the last 15 years than anytime in US history, at extremely favorable terms, and the relation most draw is to the low rates initially set by Greenspan. And it seemed to work great, for a while, but like a drug we became addicted, and like a cake the economy eventually overcooked. Like the stock market when there's no one left to buy because everyone's already bought, then comes the crash.

If you look at the crash, it wasn’t a total economic crash as much as it was a housing crash, and housing definitely had access to “easy money” during Bush’s presidency. But it wasn’t “easy money” via the Fed, but rather “easy money” via lax lending standards...

The failure of housing was certainly the result a combination of things, but without the underlying money supply being so easily available, none of the rest would have been possible. There was a feeding frenzy underway, and very few were denied a seat at the trough. But we finally ran out of buyers, being those who were willing to take out new loans for any reason, which gave time for auditors to catch up and determine that too many loans had been made that would never be paid back, and the crash came.

The main reason the housing decline was so huge is that it was only house prices that were out of line at the time.

Energy prices were also at record highs, stocks at or near record highs, cost of luxury vehicles at record highs, and not just record highs achieved normally over long periods of time - the price per gallon of oil for example had tripled in just a few short years, cost of Cadillac Escalades up almost 50%, the cost of a college education doubling in 10 years, etc. Had the prices not gone up so quickly and so rapidly, people may have kept borrowing. But once the prices of houses got beyond what a normal family can afford in each neighborhood, the cost of gas too much for many to take a vacation, the cost of college too much for many to leave their homes after graduation, the party was over.

if the Fed were ever to be managed the way I’d like to see it managed, short term rates would become more volatile because they would move up and down with every short term swing in the economy instead of being pegged by the Fed at whatever level they decide in committee meetings. They would become a true market-determined rate instead of a managed rate set by the Federal Reserve.

While we may not agree completely on how we got here, we seem to agree across the board on what needs to be done now. I'd go so far as abolish the Federal Reserve, it's an unnecessary middleman that has no accountability to the American people. No private organization should be able to radically manipulate the currency of a country as they have been allowed. Simply too much power in a shadowy organization, that in many people's opinion is primarily responsible for this catastrophe we've seen, that very well may not be over yet.

To: ex-Texan

Because their Marxist/globalist cronies, colleagues, peers, old-boys club are in virtually ALL the key positions of power and they take very good care of one another.

39

posted on

07/09/2011 7:11:29 PM PDT

by

Quix

(Times are a changin' INSURE you have believed in your heart & confessed Jesus as Lord Come NtheFlesh)

To: Liz

” Obama has spent more in 2 years than Bush did in 7 years. Obama’s BIOB (Blame it on Bush) defense just won’t work anymore. “

Tell that to the MSM = Mainstream Marxists.

40

posted on

07/09/2011 7:14:09 PM PDT

by

stephenjohnbanker

(God, family, country, mom, apple pie, the girl next door and a Ford F250 to pull my boat.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-48 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson