To: Golden Eagle

Ironically, low rates don’t always mean easy money. I was worried about the Fed causing a deflation, even with low rates, in the 2001-2005 time frame. Since the 1970’s the Fed has never really goosed the money supply sufficiently to cause a significant inflation, until very recently.

If you look at the crash, it wasn’t a total economic crash as much as it was a housing crash, and housing definitely had access to “easy money” during Bush’s presidency. But it wasn’t “easy money” via the Fed, but rather “easy money” via lax lending standards foisted on us by Fannie Mae and Freddie Mac, abetted by both the Democrats and a lot of Republicans, including Bush.

The main reason the housing decline was so huge is that it was only house prices that were out of line at the time. Overall inflation was minimal, so every 10% increase in housing prices each year drove them farther and farther above equilibrium. We are only now approaching that equilibrium with housing prices falling 30-60% and the general price level also rising more rapidly up to meet the falling house prices.

I totally agree with you that “things are worse than ever” mainly because the Fed has created a mess that is going to be difficult to unwind safely, the Obama administration has created a regulatory morass that will also take years to unwind (if we have the sense to do it), and yes, savings could very well be wiped out by a significant rise in the inflation rate over the next decade.

However, if the Fed were ever to be managed the way I’d like to see it managed, short term rates would become more volatile because they would move up and down with every short term swing in the economy instead of being pegged by the Fed at whatever level they decide in committee meetings. They would become a true market-determined rate instead of a managed rate set by the Federal Reserve.

32 posted on

07/09/2011 1:46:41 PM PDT by

Norseman

(Term Limits: 8 years is enough!)

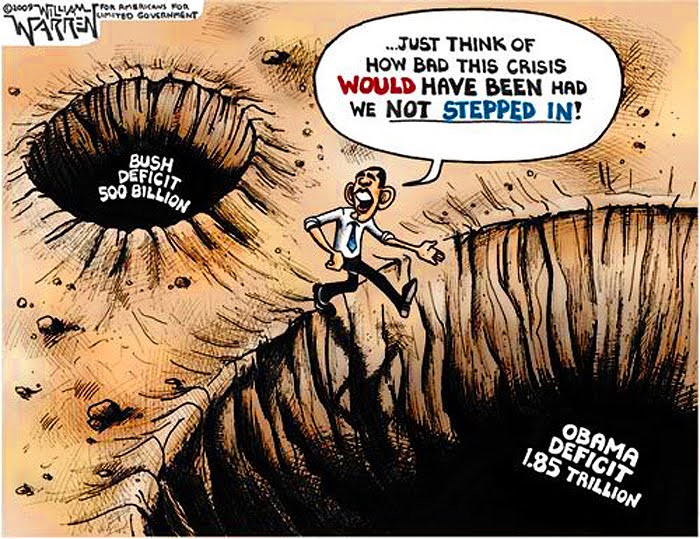

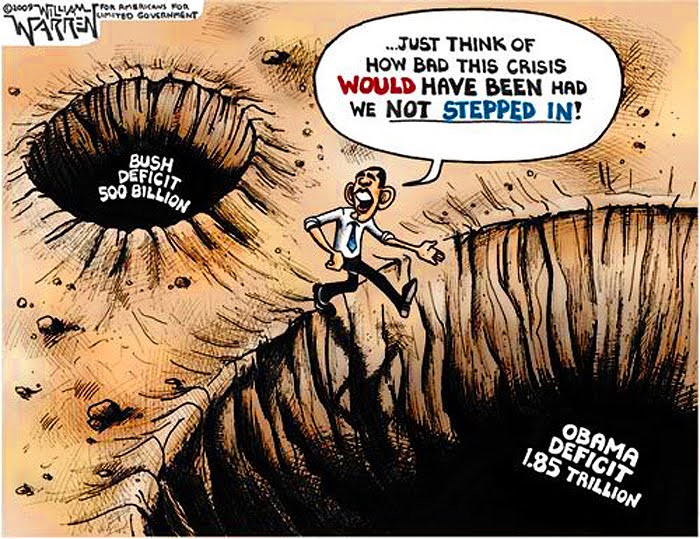

To: All

In Feb 2009, the newly-inaugurated Obama warned that without his $800B

stimulus, "an economy already in crisis will be faced with catastrophe."

Obama’s Deficit Avalanche isn’t Bush’s Fault / scottuystarnes.com / 2/9/2010

SOURCE http://scottystarnes.files.wordpress.com/2010/02/obama-deficit.jpg?w=400&h=308

Washington Times reports: Even more staggering than the mountains of snow in the capital are the deficits the Obama administration plans for the next decade. Huge spending increases will add about $12 trillion to the national debt for budget years 2009 to 2020.

The scariest part is that these deficits are based on unrealistic budgeting assumptions; the real fiscal outlook is much bleaker. In the proposed 2011 budget, the White House defensively attacks the “irresponsibility of past” deficits.

For example, the 2009 budget deficit of $1.4 trillion is blamed on the George W. Bush administration as if President Obama’s $862 billion stimulus package and more than $400 billion supplemental spending bill had nothing to do with it. Mr. Obama’s planned 2010 budget deficit rises to an even higher record level of $1.6 trillion.

By comparison, all of Mr. Bush’s deficits from 2002 to 2008 – the seven years during which his team had the most control over the budget – produced a combined deficit of $2.1 trillion.

Obama has spent more in 2 years than Bush did in 7 years. Obama’s BIOB (Blame it on Bush) defense just won’t work anymore.

33 posted on

07/09/2011 2:40:08 PM PDT by

Liz

( A taxpayer voting for Obama is like a chicken voting for Col Sanders.)

To: Norseman

Ironically, low rates don’t always mean easy money. Maybe not always, but typically. Money to buy all kinds of things was more available in the last 15 years than anytime in US history, at extremely favorable terms, and the relation most draw is to the low rates initially set by Greenspan. And it seemed to work great, for a while, but like a drug we became addicted, and like a cake the economy eventually overcooked. Like the stock market when there's no one left to buy because everyone's already bought, then comes the crash.

If you look at the crash, it wasn’t a total economic crash as much as it was a housing crash, and housing definitely had access to “easy money” during Bush’s presidency. But it wasn’t “easy money” via the Fed, but rather “easy money” via lax lending standards...

The failure of housing was certainly the result a combination of things, but without the underlying money supply being so easily available, none of the rest would have been possible. There was a feeding frenzy underway, and very few were denied a seat at the trough. But we finally ran out of buyers, being those who were willing to take out new loans for any reason, which gave time for auditors to catch up and determine that too many loans had been made that would never be paid back, and the crash came.

The main reason the housing decline was so huge is that it was only house prices that were out of line at the time.

Energy prices were also at record highs, stocks at or near record highs, cost of luxury vehicles at record highs, and not just record highs achieved normally over long periods of time - the price per gallon of oil for example had tripled in just a few short years, cost of Cadillac Escalades up almost 50%, the cost of a college education doubling in 10 years, etc. Had the prices not gone up so quickly and so rapidly, people may have kept borrowing. But once the prices of houses got beyond what a normal family can afford in each neighborhood, the cost of gas too much for many to take a vacation, the cost of college too much for many to leave their homes after graduation, the party was over.

if the Fed were ever to be managed the way I’d like to see it managed, short term rates would become more volatile because they would move up and down with every short term swing in the economy instead of being pegged by the Fed at whatever level they decide in committee meetings. They would become a true market-determined rate instead of a managed rate set by the Federal Reserve.

While we may not agree completely on how we got here, we seem to agree across the board on what needs to be done now. I'd go so far as abolish the Federal Reserve, it's an unnecessary middleman that has no accountability to the American people. No private organization should be able to radically manipulate the currency of a country as they have been allowed. Simply too much power in a shadowy organization, that in many people's opinion is primarily responsible for this catastrophe we've seen, that very well may not be over yet.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson