Posted on 06/26/2020 8:33:35 AM PDT by Red Badger

A $1 billion solar plant approved in 2011 never delivered what it promised and closed last year.

Solar farms are the new frontier in energy, with falling costs and myriad benefits.

A combination of terrible management and simple technological advancement turned the plant into a dinosaur.

=======================================================================

Bloomberg reports that a planned $1 billion solar plant was out of date and obsolete before it could even be completed. The Crescent Dunes plant opened outside of Las Vegas in 2015, when its technology was already behind, and the solar boom since then has completely eclipsed it. Now, the closed and abandoned plant is the subject of huge ongoing lawsuits.

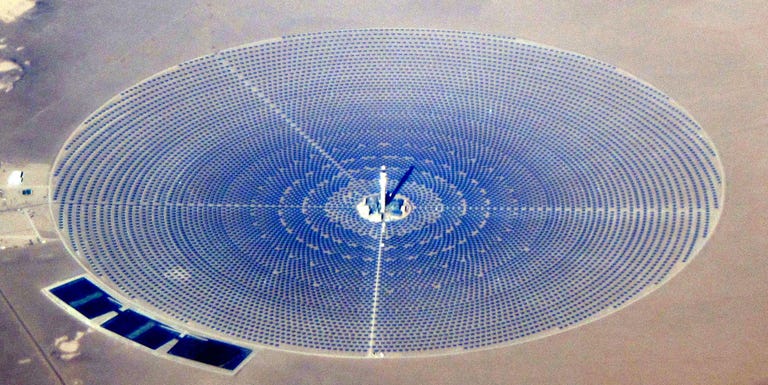

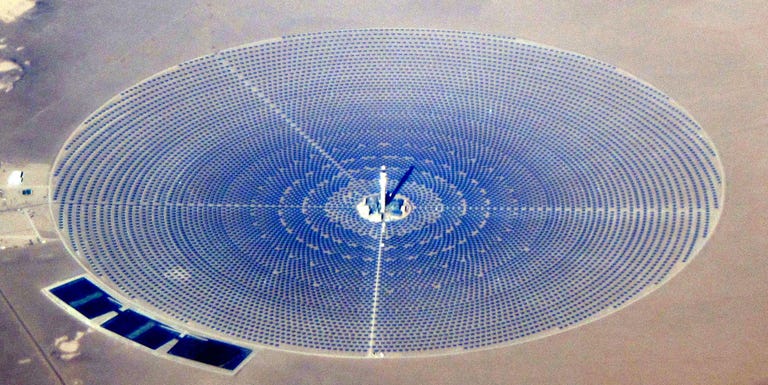

In a way, Crescent Dunes was like the Elon Musk dream solar farm of its heyday after construction was approved in 2011. It covers about 1,500 acres with thousands of mirrors that heat a central molten salt tower. In 2011, a handful of companies presented plans for the plant and received over $700 million in government loan guarantees.

The tower was the work of SolarReserve Inc., and the rest of the plant was designed and built by ACS Cobra. SolarReserve’s website isn’t online as I write this, and more than one of its projects has ended in the possibility of bankruptcy.

Even at peak operation, “[i]ts power cost [Nevada] about $135 per megawatt-hour, compared with less than $30 per MWh today at a new Nevada photovoltaic solar farm,” Bloomberg writes. That’s not necessarily a reflection on the structure or management at Crescent Dunes, but a reflection on how rapidly the price of solar technology has fallen.

The total cost of Crescent Dunes was $1 billion for a promised 110 megawatts on 1,500 acres. Now, the Trump administration is approving a $1 billion plant that will make 690 megawatts on over 7,000 acres. The solar dollar is going a lot further in 2020.

From the beginning, Crescent Dunes generated buzz and controversy alike. In 2011, solar had much less of a public profile than it does now, and approving ambitious solar projects could seem like tilting at windmills. But the Department of Energy (DoE), whose overall portfolio includes $38 billion in projects in the same vein as Crescent Dunes, invests in a variety of projects at all stages.

The Department of Defense has more of the government’s high-profile “moon shot”-type investments with DARPA, the Spruce Goose, and other famous weirdies—but in the short term, the government invests in cutting-edge science, too. The Air Force and NASA fund tons of university research. And as in any form of investment, there's risk involved.

And public money has another layer of trouble. Because of the way public contracts are bid for, won, and fulfilled, the companies chosen to complete projects are often the best at the application process, and not necessarily the best at the work the project really involves. Indeed, despite the $737 million taxpayer money and an additional $140 million from private investors, Crescent Dunes never reached the initial promises; the best-case scenarios were already outmoded by the 2015 opening.

Instead of 50 percent efficiency, the plant hovered at 20 percent. And the plant only ever secured one client, NV Energy, which couldn’t rely on the plant to do its part. Industry people and locals say the plant's heat-focusing mirrors killed local wildlife, maybe more efficiently than they ever generated electricity. Bloomberg reports that even though the plant shut down in April 2019, NV Energy wasn’t allowed to sever its agreement with the plant until late in 2019, after the DoE was forced to take over the shuttered plant in August. SolarReserve took the DoE to court.

Somebody got paid, though.

Solyndra filed for bankruptcy in 2011.

This stuff is such a scam.

and it keeps getting reset and going again and again.

To a liberal, history began at breakfast this morning —— Ann Coulter

If you don’t learn anything from history...........

I wonder how many desert tortoises that boondoggle killed? If I had wanted to drill some claims in that area, I would have had to comply with all sorts of tortoise mitigation restrictions.

Solyndra was a California solar power fabrication/re-selling venture, entirely set up to take taxpayer money and spend it funding democrat donor companies. Never really intended to make a product, generate or sell energy.

From the article,

“The total cost of Crescent Dunes was $1 billion for a promised 110 megawatts on 1,500 acres. Now, the Trump administration is approving a $1 billion plant that will make 690 megawatts on over 7,000 acres. The solar dollar is going a lot further in 2020.”

And it gets worse! This next 1 billion dollar solar plant is STILL BEING FUNDED by the Deep State from Washington! Despite Trump, despite what the repubbies claim, it is still being funded.

Yup, and it was the only purpose to begin with. Gee whiz liberals, just skip the middle man and just take all the money why don’t you...

yep...1970s ideas...chinese though are forging forward

https://www.solarpaces.org/shouhang-and-edf-first-to-test-s-co2-cycle-in-concentrated-solar-power/

$30 per megawatt-hour is 3¢ per kilowatt-hour. That's less than I'm paying and is getting in the range where widespread roof mounting of solar panels will at least aid in powering air conditioning during the day even without storage. If I were building a new house I would probably design it with solar built in, either on the roof or in the yard.

The price is finally getting to where it should be taken seriously. Especially if it allows people to get off the grid so their power can't be cut off by outside forces.

It looks pretty cool when you fly into Las Vegas. You can see it in the distance, intensely bright. Very sci-fi looking. Sad waste of money though. Should have built a nuclear plant instead, and of course (sorry Nevada) the Harry Reid Memorial Nuclear Waste Dump.

Nanzi Pelosi’s son or nephew or some other family member had ties to that thing. I don’t remember all the details.

I think I see the problem.

If taxpayers funded this constitutionally indefensible project, the purpose of the project irrelevant, the key question to ask is how many taxpayer dollars were contractors and post-17th Amendment ratification lawmakers able to pocket before project was scrapped?

Solyndra II?

Insights welcome.

Send "Orange Man Bad" federal and state government Democrats and RINOs home in November!

Supporting PDJT with new patriot federal and state government leaders that will promise to fully support his already excellent work for MAGA and stopping SARS-CoV-2 will effectively give fast-working Trump a "third term" in office imo.

“They asked me how well I understood theoretical physics. I said I had a theoretical degree in physics. They said ‘welcome aboard!’”

In 1970, after having developed one of the earliest solar cells, JPL competed for the the first solar power contract in response to a gov't RFP.

They were excluded "because they had an unfair advantage".

Dr. Roger Burke headed the JPL effort, and was later my professor in 3 of my graduate classes at USC.

Neither that original contract nor any since has ever met the cost/benefit targets set forth in the contract requirements.

Old noose. I mean news. But, for those of us that live in east cali (nevaDUH), our last legislative session put us on a fast track to have 50% of our energy by renewable sources by 2030. Yeah, those brilliant assclowns. SMDH! How many ‘buh-zillions’ (as foe-cah-hauntus would say) is this gonna cost us?

Never a hail storm around when you need it.

Wonder how many others on this board get the reference

ASK FACTCHECK

Ron Pelosi’s Connection to Tonopah Solar Energy

By FactCheck.org

Posted on December 8, 2011 | Corrected on February 2, 2012

Q: Did the Energy Department give a loan to an energy company connected to Nancy Pelosi’s brother-in-law?

A: Yes. The loan was awarded to Tonopah Solar Energy for a project in Nevada. Ron Pelosi was then a board member with a subsidiary of Pacific Corporate Group, an investment partner in Tonopah’s parent company.

FULL QUESTION

This came from a typically unreliable source, any truth to it?

The Solar thing just got a little more interesting…….REALLY!

The Tonopah Solar company in Harry Reid’s Nevada is getting a $737 million loan from Obama’s DOE.

The project will produce a 110 megawatt power system and employ 45 permanent workers.

That’s costing us just $16 million per job.

One of the investment partners in this endeavor is Pacific Corporate Group (PCG).

The PCG executive director is Ron Pelosi who is the brother to Nancy’s husband.

Just move along folks…..nuthin goin on here.

FULL ANSWER

Shortly after the solar energy company Solyndra filed for bankruptcy — after receiving a $535 million loan from the Department of Energy — we received several emails from readers asking us to look into the claims made in the chain email above. It gets some of the basic facts correct.

It’s true that Tonopah Solar Energy, a subsidiary of SolarReserve, received a $737 million loan from the government to build a new solar facility in Nevada.

It’s also true that the project is expected to create 45 permanent jobs. However, many construction jobs also would be supported. Furthermore, there’s no indication at present that the loan won’t be repaid. So it’s misleading to claim it is costing taxpayers $16 million per job.

And Ron Pelosi, Nancy Pelosi’s brother-in-law, had been the executive director with PCG Asset Management, a subsidiary of PCG, until April 2009. But he was only an “independent director” on the company’s board in September 2011 when the loan guarantee for Tonopah was finalized. As an independent director, Pelosi sat on the board of directors, but did not oversee day-to-day management of the company.

What we can’t say one way or the other is whether the loan the company received from the Energy Department had anything to do with Ron Pelosi, as the email suggests. We spoke to company officials for SolarReserve and PCG, and they denied that Pelosi had any influence on the loan. They also stated to us that Ron Pelosi’s compensation agreement does not allow him to benefit personally from the loan, a statement we are not in a position to confirm or dispute.

Update, Feb. 2, 2012: In a statement to FactCheck.org, Ron Pelosi also said that “the loan the company received had nothing to do with me.” He added that he “knew nothing regarding their proposed or actual transactions,” and “did not speak with any person in connection with their plans.” He said that “those who say I did are attempting to smear Nancy Pelosi and me for their own political purposes.”

Pelosi also provided us with email correspondence between him and David Fann, the former president and CEO of PCG Asset Management, indicating that he was only to receive $25,000 annually as a member of the company’s board of directors.

The Loan

The Department of Energy announced on Sept. 28 that it had “finalized a $737 million loan guarantee to Tonopah Solar Energy LLC to develop the Crescent Dunes Solar Energy Project” in Nevada. The 110 megawatt solar power tower will be the “first of its kind in the United States and the tallest molten salt tower in the world,” according to a press release from the department.

The project, which had the backing of Democratic Senate Majority Leader Harry Reid of Nevada and the state’s former Republican Gov. Jim Gibbons, is expected to generate enough renewable electricity to power up to 75,000 homes at peak hours.

The email claims that the project will “employ 45 permanent workers … costing us just $16 million per job.” But that math is misleading. The project is expected to create 45 permanent jobs, according to figures available on the website of the Energy Department’s Loan Programs Office. But in addition to those permanent positions, the project could create as many as 600 construction jobs over a 30-month period and “more than 4,300 direct, indirect and induced jobs” throughout the country, according to Kevin Smith, the chief executive officer of SolarReserve.

More important, if things go according to plan, the government might actually make money on the deal. SolarReserve anticipates paying back the government’s loan with interest, Smith said.

Smith, Nov. 4: It’s important to stress that this is a loan that earns the government an approximately 4% annual interest rate. This is not an ‘expenditure’ by the government, but rather a loan that has to be fully paid back with interest so it should not cost the tax payers any money at all.

And Smith said that the project, which is just starting the construction phase, already has a 25-year purchase agreement to sell 100 percent of the electricity generated to NV Energy, the largest utility company in Nevada. “This essentially ensures the project has the revenue stream necessary to pay back the loan,” he said.

The Pelosi Connection

On Sept. 29, the conservative Weekly Standard called the loan an example of “crony capitalism” in a blog post, citing, in part, Ron Pelosi’s connection to SolarReserve through PCG. That blog item was then featured temporarily on the Drudge Report under the heading: “Crony Capitalism: Massive Solar Loan Benefits Pelosi’s Kin.”

Ron Pelosi worked for PCG Asset Management as the executive director from March 2008 until April 2009, when he resigned. SolarReserve’s CEO said the company didn’t apply for the loan guarantee until the fall of 2009. And when the loan for the project was finalized in September 2011, Pelosi was only serving as an “independent director” on the board of PCG Asset Management. But did he have anything to do with the loan going through?

Fortune.com called this “the next fake solar scandal” on its website. And the San Francisco Chronicle labeled the claims of “crony capitalism” erroneous, reporting that the Energy Department officials and Rep. Nancy Pelosi had called the claims “absurd.”

We can’t say definitively whether Ron Pelosi had anything to do with the loan or not. But, for what it’s worth, officials for SolarReserve and PCG deny that he did.

Smith, SolarReserve’s CEO, told FactCheck.org in an email that PCG “does not have a seat on our Board and have had no direct activity in any project and have done no lobbying on our behalf.” He even went so far as to say that he “never met or talked to Ron Pelosi and did not even know he existed” until after the project’s final financing was announced in September.

Smith also said that PCG has just a 2 percent investment in SolarReserve (through some New York pension funds). He didn’t provide us with any documentation to that effect, however.

PCG spokesman Brian Maddox also denied that Pelosi, or anyone else from the company, had lobbied for the Energy Department to make the loan to SolarReserve. In an exchange of emails with FactCheck.org, Maddox said that Pelosi was employed at the time the loan was finalized, but that PCG’s investment in SolarReserve “substantially antecedes” the time when Pelosi joined the company.

More to the point, he also said that Pelosi “is not compensated on the performance” of that investment. But even though we asked, Maddox didn’t provide us with any documentation of the basis for Pelosi’s compensation.

Update, Feb. 2, 2012: As we previously noted, Ron Pelosi was not actually “employed” by PCG at the time the loan guarantee was finalized. He was on the board of a subsidiary of the company. And Pelosi provided us with email correspondence between him and the former president and CEO of PCG Asset Management, indicating that he was only to receive $25,000 annually as a member of the company’s board of directors.

— Dave Bloom, with D’Angelo Gore

Correction, Feb. 2, 2012: The original Ask FactCheck incorrectly stated that “Ron Pelosi is an executive with Pacific Corporate Group” and that he had been employed there when the loan was finalized. Pelosi was the executive director with PCG Asset Management, a subsidiary of Pacific Corporate Group, from March 31, 2008, until April 13, 2009. And he was an “independent director” on that company’s board from March 16, 2011, until November 10, 2011. The Energy Department finally approved the loan guarantee for Tonopah Solar Energy’s project in September 2011. We have corrected this article accordingly.

Sources

Smith, Kevin, CEO SolarReserve. Email Sent to FactCheck.org. 4 Nov 2011.

Maddox, Brian, PCG Spokesman. Email Sent to FactCheck.org. 9 Nov 2011.

Department of Energy. “DOE Finalizes $737 Million Loan Guarantee to Tonopah Solar Energy for Nevada Project.” Press release. 28 Sep 2011.

SolarReserve. “SolarReserve Completes Financing for Advanced Technology Solar Power Project in Nevada.” Press release. 28 Sep 2011.

SolarReserve. “SolarReserve Signs Power Contract with NV Energy for Utility Scale Solar Power Project in Nevada.” Press release. 22 Dec 2009.

Hemingway, Mark. “Crony Capitalism: $737 Million Green Jobs Loan Given to Nancy Pelosi’s Brother-In-Law.” WeeklyStandard.com. 29 Sep 2011.

Garofoli, Joe. “Pelosi brother-in-law not tied to solar project.” San Francisco Chronicle. 30 Sep 2011.

Primack, Dan. “The next fake solar scandal.” Fortune.com. 29 Sep 2011.

CategoriesAsk FactCheck

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.