It is good for home prices to come down off its previous trajectory.

Posted on 02/13/2023 7:44:35 AM PST by Kaiser8408a

Black Knights December Mortgage Report is out and the house price graphs show the west is a mess.

While much of the US is down from 2022 peaks in home price. but it is The West where home prices are down the most (just like 2008 where the Inland Empire of California, Phoenix and Las Vegas crashed in term of home prices).

At least Columbus Ohio is down only -2.1% from the 2022 peak. While Austin TX is down almost -10% from 2022 peak.

US inflation numbers are out tomorrow. Let’s check on home price and rent growth tomorrow.

(Excerpt) Read more at confoundedinterest.net ...

They should come down.

$3M for a 3/2 built in 1961 in Mountain View that sold new for $20K is absurd. And non-competitive: the H1Bs who live in them aren’t worth anywhere near what Their stock options make them look like they’re worth.

Here in Phoenix, the prices went up 40% before they went down 10%. We had to buy near peak in 2021, but we got a great interest rate. If we have to move in the future, I will try to keep the house and rent it out.

There was a 20 percent markup during covid for no reason in many places. Needs to come down.

1. The prices were inflated to begin with.

2. That the prices may be coming down is not necessarily bad for staying put homeowners and is good for home buyers.

I remeber during the last housing bubble, when a California friend of mine noted that the highger house valuations looked good for them and other home owners ON PAPER, but it was also the reason her two college graduate working children were still living with her and her husband.

It is good for home prices to come down off its previous trajectory.

As they should. Insanity needs treatment.

Why is affordable housing and less property tax a bad thing again?

Basically, those are cuts in the increase of prices.

IOW, prices are still up from during and after the pandemic and before and after the inflationary prices.

Nobody is getting a deal from the ‘decrease’ in prices.

50 million illegals have to live somewhere.

That's probably a contributing factor to the decline in home value...

I did not know I bought my last home in 2015 until Aug 2022. Since 2020 at 3% and 17 years left the expense of any changes is not worth it. If I want to be someplace else, Ill rent for the month or live on a boat or rent an RV for a week. Moving 300k+ of cash between assets on a frail market depending on school districts and local governments not being scumbags, seems like a really big trap.

I got a place to “pile my stuff” as George Calin said.

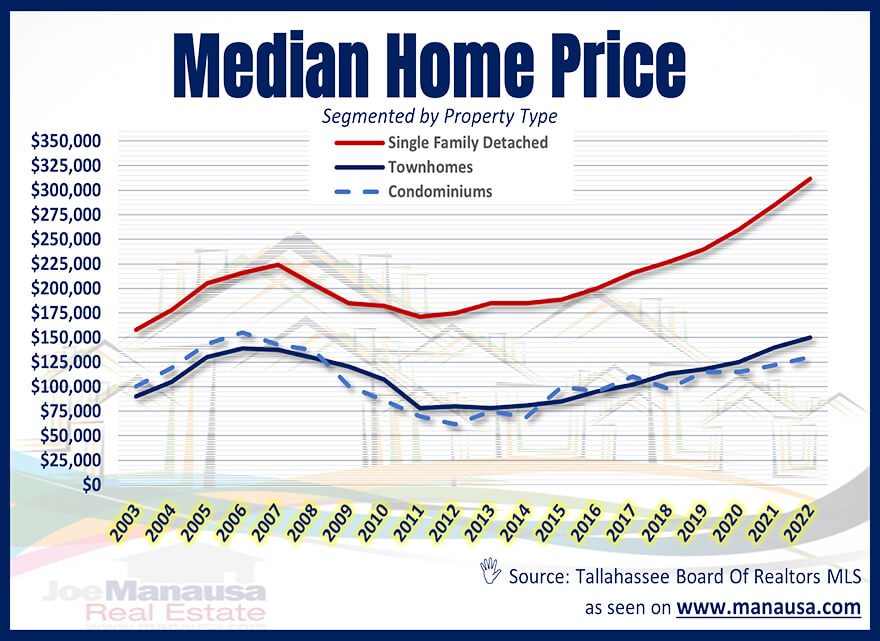

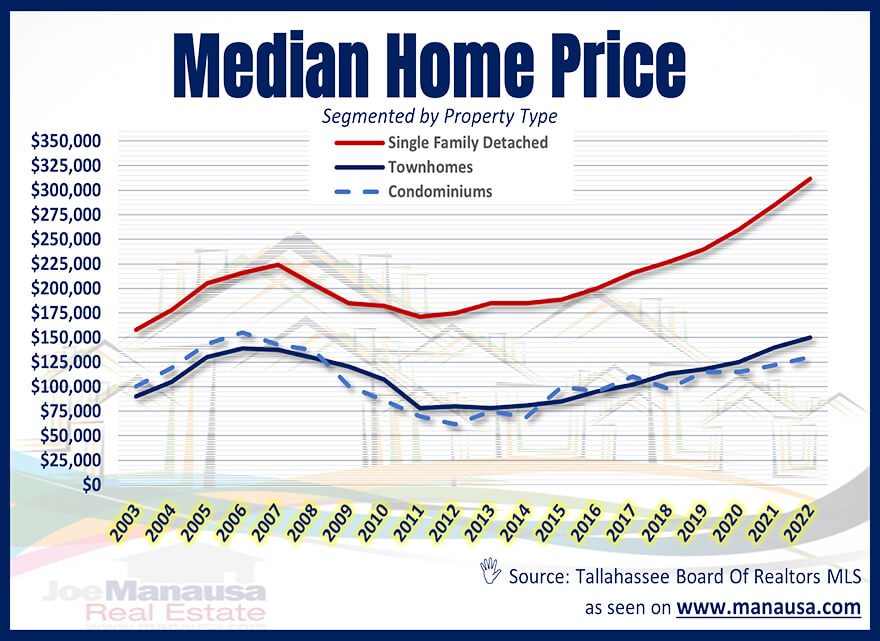

Holy smokes! Those numbers can’t possibly be correct. About $125k-$150k for a condo or town home?

I live in one of the poorest cities in the United States and a one bedroom, one bath condo starts at $250k. And that’s in a neighborhood with bad schools.

Builders won’t even bother with constructing a house for less than $1 million.

These numbers are from Florida?! Where everyone is moving? And I live where nobody wants to move! This can’t be correct.

It would make sense that this headline would be legitimate. Almost weirdly the headline is based on a statistical anomaly that is not as meaningful as it would appear... That is mostly because the “peak” at least in the Seattle area where my wife and I live was a frothy over the top buying frenzy that lasted only a very short period last Spring and Summer before prices retreated sharply to where they were earlier in the year.

“What is the housing market like in Seattle today?

In December 2022, Seattle home prices were up 0.6% compared to last year, selling for a median price of $775K. On average, homes in Seattle sell after 31 days on the market compared to 13 days last year. There were 515 homes sold in December this year, down from 979 last year.”

https://www.redfin.com/city/16163/WA/Seattle/housing-market

Any information about real estate should always be considered suspect. There is not a more dishonest bunch of “professionals” than realtors. Even lawyers take a back seat. The vast majority of realtors that I have met in my lifetime have always hoped to make a bunch of money without really working for it. Their hope is always to find people who will sell for less than market value and others who will pay for more than market value a short time later.

I thought the internet and increased information availability would improve the situation but like just about everything else... the misinformation has increased far more than legitimate information. Realtors know that if they can keep the public confused that they can profit from the situation.

There are a lot of self-correcting factors at play currently. It is not that I do not believe that the Biden administration is not capable of crashing any segment of the economy. It is just that despite more than doubling interest rates from historic lows... demand remains high in many segments of the real estate market.

What’s next, a headline in CAPITAL LETTERS telling us nights are now colder than days??!

It’s not a “mess” when something overpriced by 300% drops in value by 13%.

Idiotic histrionics, of “the sky is falling” variety.

We moved into our home here in Alabama after moving from Bremerton, WA (the greater Seattle market). Bremerton for those who do not know is directly across Puget Sound. About an hour on the Ferry ride. It costs much less to live over on the West Side of the Sound than in Seattle itself. When we left in 2006, we sold our house for twice what we paid for it 14 years before. We had done a lot of remodeling and landscaping and it was a nicer home than before. The Seattle market is crazy. In the hot market of 2003-06, when a house in Seattle went on the market, there would be 20-30 people BIDDING on the danged houses!! Crazy prices over there back then.

“Idiotic histrionics, of “the sky is falling” variety.”

Yes.

“It’s not a “mess” when something overpriced by 300% drops in value by 13%.”

Seller just set asking prices. Buyers set sale prices.

My house dropped 250 kilobucks from its peak in 2020. It is still supposedly valued at triple what I paid for it though.

Today’s real estate market is incredibly confusing—even if folks are “playing it straight”.

A few factors:

—There is a two tiered real estate market—the higher end where buyers can pay cash and the lower end where the buyers have to pay (relatively) high interest rate mortgages. The cash market remains strong, while the lower end is starting to feel the pain.

—Everything is local—totally dependent on the economy and whether new employers and retirees are moving in.

—Many potential sellers with mortgages are “locked in” to their current home with interest rates that are much lower than they would get if they moved. This means a lower supply on the market which raises prices on those houses that are for sale.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.