Posted on 01/29/2023 9:19:11 PM PST by SeekAndFind

On January 10, the French government announced plans to raise the retirement age from 62 to 64.

The change would mean that after 2027, workers in France would have to work 43 years to qualify for a government pension, instead of 42 years. French workers promptly took to the street in protest decrying even this very small reduction government welfare.

Like many countries in Western Europe and North America, France faces a major demographic problem in that its population is aging and demanding ever larger amounts of public pension funds.

Meanwhile, the younger working-age population is shrinking as birth rates continue to fall. So, the French state is looking for ways to stay relatively solvent.

For Americans who follow our own old-age social benefits systems, this problem will seem quite familiar. Although the US regime is not in as dire fiscal straits as the French one, the US's federal government nonetheless faces huge and growing obligations to current and future pensioners. This will only grow more urgent as the population continues to age and as the numbers of prime-age workers stagnates.

Indeed, the Social Security scheme is an excellent example of how government programs, once established, gradually become far more costly—in real per capita terms, not just aggregate terms—as time goes by. Many recipients now spend decades collecting benefits on a program that had been sold as a program only for people who were too old, exhausted, and injured to work at all. Meanwhile, fewer and fewer workers are called upon to foot the inflated bill.

At the center of this mission creep for Social Security is the fact that Social Security benefits originally began at age 65. Yet, at that same time, the life expectancy at birth was below 65. (It's much higher now.) Many people lived well past 60 back then, of course, but not nearly as many as do today. In other words, a far smaller fraction of the work force collected Social Security, and for a shorter period. Today, however, more workers live long enough to collect Social Security, and they now receive payments for longer. That's a sure way to inflate the cost to taxpayers of old-age benefits. (It's also a sure way to encourage able-bodied workers to leave the workforce, thus tilting the economy more toward consumption rather than production.)

Even if we ignore the moral problems presented by transferring huge amounts of income from current workers to pensioners, the realities of demographics in the twenty-first century mean the minimum "retirement age" should really be at least 75. Too long has a shrinking pool of workers been forced to fund pensioners who start collecting government benefits in their 60s and can now expect to be on the dole for 20 years or more. Moreover, this phenomenon is growing. Social Security increasingly forces today's workers to shoulder an ever-greater burden on their ability to earn a living and support their families. The days of subsidized extended vacations for able-bodied 65-year olds must come to an end, but until that day comes, the damage can at least be limited by raising the age of eligibility.

When it was being sold to the public in 1935, those promoting Social Security took advantage of sentiments that people over age 65 were essentially too old to work, and thus would soon fall into poverty. This certainly would have seemed plausible at the time. Most jobs in 1935 involved significant amounts of physical labor whether we're talking about cleaning laundry, waiting tables, farming, mining coal, or building houses. Work was also more dangerous—as historical work injury data makes clear—and workers were more likely to sustain injuries that would render one unable to work. For example, a 65-year-old simply could not safely perform much of the work required at a steel mill. (As shown in this 1944 video on the steel industry.)

Especially important to efforts at presenting Social Security as fiscally prudent was the fact that with a minimum age of 65, the number of Social Security beneficiaries would also be limited by the realities of life expectancy. In 1940, for example—the first year that pensioners could receive benefits—life expectancy at birth was only 61 for men and 65 for women. Indeed, even if we eliminate the toll of childhood diseases on life expectancy, the numbers do not change dramatically. In 1940, total life expectancy for persons over 15 years of age was 68. Moreover, in 1940 the percentage of the population surviving from age 21 to 65 was only 54 percent for males and 61 percent for females. But what about those who actually made it to age 65? In 1940, a male at age 65 would, on average live another 13 years. A female would live another 15 years. So, when looking at the work force in 1940, we can eliminate nearly half of the men and about 40 percent of the women as likely future Social Security recipients. About half of those who actually made it to 65 would then collect benefits for no more than 15 years.

Now let's contrast that with life expectancy realities in our own time.

Life expectancy at birth today is 78 years, and for those who reach age 15, it is 80. for both men and women, more than 75 percent of the population reaching 21 will survive to age 65. That's an increase of 50 percent for men, and around 30 percent for women. For those reaching age 65 in 2022, males will live another 18 years on average, while females will live another 20 years.

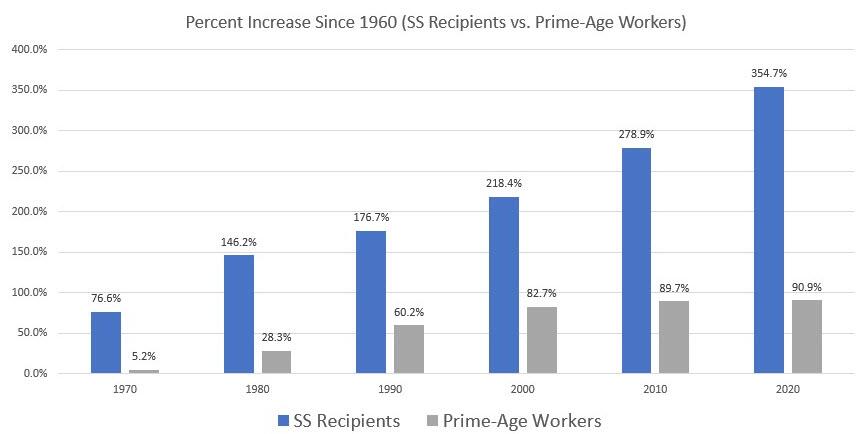

These growing commitments from Social Security are further aggravated by the fact that while the retiree population is growing, growth in the work force is stagnating. Since 1960, the total number of Social Security recipients has increased by 364 percent. Meanwhile, the prime age population (age 25-54) has grown by only 90 percent. Put another way, in 1960, there were 4.6 prime age workers per Social Security recipient. In 2020, that number was 1.9.

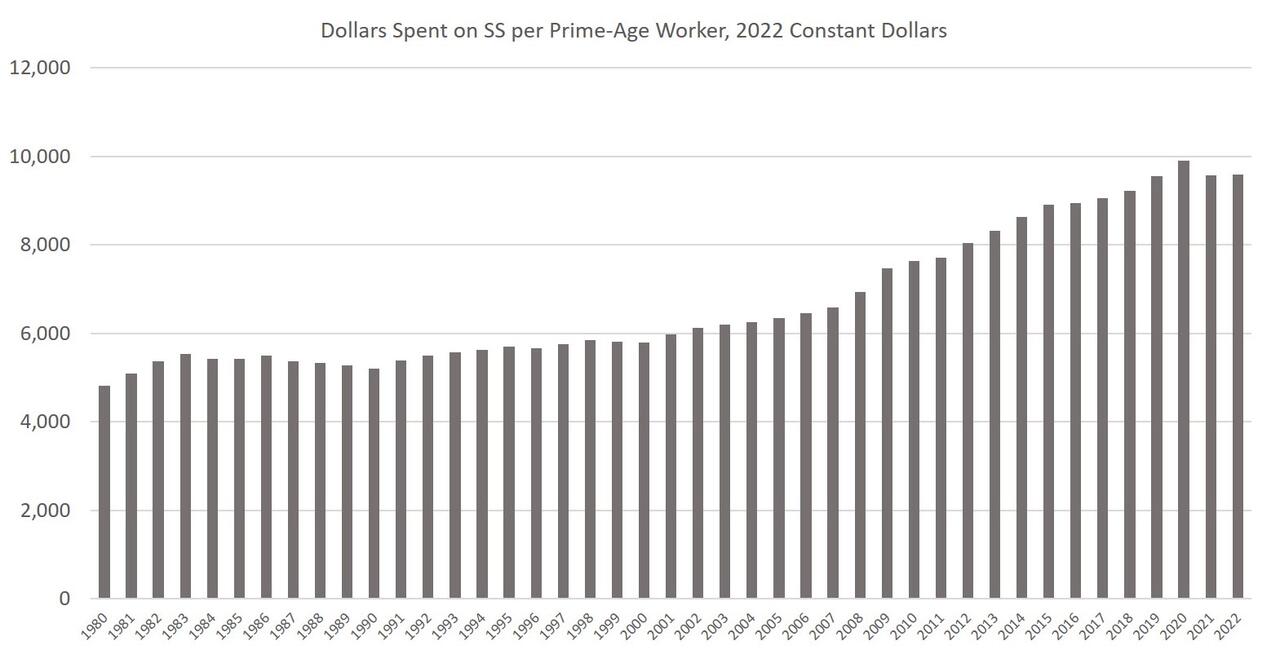

Now let's look at this in dollar terms. Per prime-age worker, inflation-adjusted dollars spent on SS amounted to $9,590 in 2022. That's up from $4,814 in 1980, or an increase of 99 percent over the period. During the same period, inflation-adjusted weekly earnings for workers increased 16 percent. Part of this discrepancy is due to the fact SS payments are consistently—as mandated by law—bumped up by cost-of-living adjustments to account for price inflation. Wage workers enjoy no such guarantees.

Social Security benefits are rapidly outpacing both population growth and earnings growth. In the aggregate, the program is more generous (toward pensioners) than ever.

To stanch some of the bleeding from today's workers who get an increasingly raw deal on this, the time has come to stop the ever-upward creep in how much Social Security recipients collect.

As noted above, we see that, on average, men and women collect Social Security for a period that has grown by five years since 1940—an increase of 38 percent for men, and 33 percent for women. To even put a dent in this, the minimum age for SS needs to rise to 70. Yet, even this is much too low given how turning 65 in 2022 is nothing like what it was in 1940. Ever since it was first put forward, Social Security has assumed that reaching the age of 65 is also closely associated with disability. That may have been a good assumption in 1935 when work was more often dangerous, likely to produce disability, and medical care was much less adept at addressing these disabilities.

In 2022, however, the word "disabled" hardly describes the majority of Americans in the 65-74 age range. Indeed, only one quarter of this population reports having any disability at all. The share of Americans from 65-74 who report poor health has been declining, as has the proportion of workers in physically demanding jobs. It's unclear why 100% of these workers would require government income subsidies. In any case, workers who are actually disabled would qualify for disability benefits even if the age is raised. Moreover, a male worker today who reaches age 75 can still expect to live another 11 years. A female can expect to live even longer. Raising the age to 75 still wouldn't eliminate a taxpayer-subsidized "official" retirement, but the change certainly would reduce the length of time today's workers toil in a state of indentured servitude to today's pensioners.

One thing raising the age has going for it is that it's been done before. A 1983 change very gradually increased the full-benefits age from 65 to 67. That's much too little, and even an increase to age 75 would be a mild reform. Other reforms, up to and including abolition, should include means-testing pensions and totally defederalizing and decentralizing the program. But it's also easy to imagine the tidal wave of opposition from activists who vehemently oppose even a very mild reduction in Social Security payouts. Raising the age won't make Social Security just, prudent, or wise. But cutting federal spending is always the right thing to do.

If my “contributions” had not been pilfered they would easily pay for my “benefits”.

SSI has been used for everything. No wonder it is broke.

How about starting with taking everyone off of it that never worked and never paid in? That would be a great start. Obama made it permanent welfare for millions.

Fine. Who is going to hire people in their 60s and 70s so they can earn a living until the Mises Libertarians think they should be eligible for Social Security?

What companies are hiring - as opposed to firing - people in their 60s and 70s?

If one sits on his butt all day, fine, but I did manual labor. No way I could see myself doing my job until I was 75

Many people won’t live that long.

I guess that’s the idea. lol

Since they won’t be able to get Social Security till they’re 75 , under the Mises libertarian plan, people will have to work until that age (unless they’re fortunate to have government job pensions or inheritances from wealthy parents). So, who is going to hire them? What companies are hiring - as opposed to firing - people in their 60s and 70s?

No way I could see myself doing my job until I was 75

Managers in their 20s, 30s and 40s aren’t going to want employees staying around into their 60s and 70s. And they definitely aren’t going to fill open positions with senior citizens

When they start talking about reducing welfare benefits and support to illegals maybe ill pay attention.

Is the Von Mises Institute determined to make sure the Democrats win every national election?!

Since you posted this article, what’s your reply to my question: what companies are hiring people in their 70s?

🔝🔝🔝

Details....

But many US presidents are seniors.

.

Tax the illegal immigrant laborers to the max so that they can pay for the country’s senior citizens. They need to learn how socialism works.

Nope. I am 51 and headed to retirement very soon. I joined AARP for one reason only: their militant defense of social security. I know that it all other matters AARP actually works against their own members.

In sum, Progressives purposely established a benefit based on a tax - with the knowledge that most people would not collect it

That's a ponzi-scheme

Life Expectancy in the U.S. Dropped for the Second Year in a Row in 2021

https://www.cdc.gov/nchs/pressroom/nchs_press_releases/2022/20220831.htm

“Non-Hispanic white people in the United States had the second biggest decline in life expectancy in 2021 – one full year from 77.4 in 2020 to 76.4 in 2021. Non-Hispanic Black people had the third biggest decline, a 0.7 year drop from 71.5 years in 2020 to 70.8 in 2021. Life expectancy at birth in 2021 was the lowest for both groups since 1995. After a large (4.0 year) drop in life expectancy from 2019 to 2020, Hispanic people in the U.S. had a slight decline in 2021 of 0.2 years to 77.6 years. Life expectancy for non-Hispanic Asian people also dropped slightly in 2021 – 0.1 years – to 83.5 years, the highest life expectancy of any race/ethnic group included in this analysis.”

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.