Posted on 01/29/2021 6:25:20 AM PST by NOBO2012

If you don’t understand hedge funds here’s a Cliff’s Notes version:

If you understand this then you understand everything that’s wrong with capitalism today: we’ve removed capitalists from capitalism and replaced them with financiers – there is nothing being made aside from money; there is no product being made, no service being provided, only money changing hands. We’ve replaced the wheels of industry with the wheels of finance.

What happened last week, forcing a couple of hedge funds to liquidate was the result of a proletariat uprising. Retail traders -i.e. ‘day traders’ - generally with a portfolio between $500 to $2,500 - took down two billionaire hedge funds by buying the GameStops shares the hedge funds were shorting. Now when huge funds short a stock they not only hope it will go down, but they are instrumental in driving it down by triggering momentum buyers. What the retail traders on Reddit did was change the game by creating momentum in the opposite direction by buying up all the stock that the hedge funds dumped (that they don’t own remember, they ‘borrowed’ it to sell short) on the market.

They manipulated the market on the same stock the hedge funds were trying to manipulate only in the opposite direction, thereby bankrupting the funds as they had to buy the stocks they had already sold for $4(remember, they didn’t own them, they ‘borrowed’ them) at $400 a share. Ouch!

I posted this last night, but it still has me chuckling this morning:

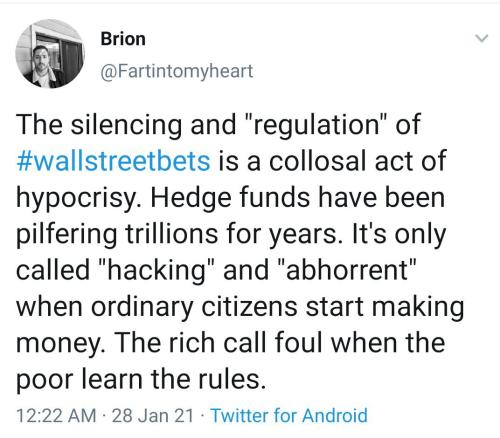

Of course the elitists immediately sprung into action:

But oddly enough, this is how free market capitalism in suppose to work, the little guys banding together to keep the big guys in check, using the same rules of the system everybody plays by. No laws were broken, nothing was rigged.

Ironic, isn’t it, that the stock that brought down a couple of billionaire market gamers was “GameStoppers.”

Posted from: MOTUS A.D.

I like Don Jr. a lot.

Nothing like a run on the “Bank” to FreeQ out the elites!

No one from Wall Street ever paid for the market manipulations that led directly to the 2008 crash. So seeing what is happening now seems lije delayed justice at some level.

GME is a $15 stock and it will trade back near that level in month or so. But it’s not practical to to make any bets otherwise I’d be shorting the hell out it. Mar 21 at the money puts are going for ~$210 so it would have trade at $100 or lower to start making any money. Not a good bet. With the insane volatility premiums now priced into puts, you have to just walk away. No practical way to control risk on the trade.

Neophyte journalist warning. Most people who write about finance have problems balancing their own check books and have zero experience in actual trading.

Let's get somethings straight here. 1.) All investments involve risk. 2.) Risk is not a bad thing. 3.) Risk is required for return. 4.) Leverage can be safely used with a risk and money management plan. 5.) Most derivatives are not evil and have been part of capitalism for hundreds of years. 6.) True hedging involves taking opposite positions in two or more related financial instruments to offset risk. 7.) There is absolutely nothing wrong in taking short positions. It has long been a vital part of financial markets and is only misused when big banks collude in conjunction with more perfect information about position disposition that all investors do not have access.

I write these things because I make my living as a small investor. My investments require leverage for me to turn a decent profit. I only trade derivatives. I take both long and short positions. And I hedge. The critical part of my success is risk and money management. I would have to say my investments are less risky than what most people do by blindly putting money into equities in a 401k.

My fear in all of this is that people who do not understand finance will call for regulations that actually hurts small investors. Every time there is some financial crisis a bunch of legislators are hoodwinked by lobbyists and Big Banks into creating regulations that hurt small investors and provide a competitive advantage to Big Banks. Dodd Frank was one of the most recent examples of this. It created one of the most restrictive laws in the world making it more difficult or impossible for small investors to even enter markets. In short, it allows Big Banks to abuse small investors and it allows only highly capitalized Big Banks to invest in some markets. It is the poster child crony capitalism where government gets to picks winners and losers - not the marketplace.

The Community Reinvestment Act incentivized Hedge Funds. Government enabled the 2008 fiasco. As it does today...

So true. If they really knew what they were talking about they would be making serious money trading and investing, not making some small hourly wage or salary at some periodical.

As far as rules and regulations on leverage - take the little guy can selling covered calls or puts and banking the insurance premium that others want to pay. Restrict that and then only the big guys can collect those insurance premiums.

“My fear in all this...”

_______________

You speak as if there is some possibility that this will NOT happen. Isn’t it inevitable?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.